by Calculated Risk on 7/26/2018 02:35:00 PM

Thursday, July 26, 2018

Chemical Activity Barometer Increased in July

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Continues to Signal Gains in U.S. Commercial and Industrial Activity

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 0.1 percent in July on a three-month moving average (3MMA) basis, improving upon June and May performances which were essentially flat. The barometer is up 3.9 percent year-over-year (Y/Y/), a slower pace than of that earlier in the year. The unadjusted CAB also increased, notching a 0.2 percent gain, up from a 0.1 percent gain in June. July readings indicate a continued expansion of U.S. commercial and industrial activity well into the first quarter 2019.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has been solid over the last year, suggesting further gains in industrial production in 2018 and early 2019.

Kansas City Fed: Regional Manufacturing Activity "Continued to Expand Solidly" in July

by Calculated Risk on 7/26/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Expand Solidly

The Federal Reserve Bank of Kansas City released the July Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand solidly, and expectations for future growth remained strong.All of the regional surveys for July have been solid so far.

“Our composite index came down slightly from record highs in recent months,” said Wilkerson. “Many firms remain concerned about labor availability and tariffs, but optimism is still high.”

...

The month-over-month composite index was 23 in July, down from readings of 28 in June and 29 in May. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased solidly at durable and nondurable goods plants, particularly for petroleum and coal products, minerals, fabricated metal, computers and electronics, and transportation equipment. Month-over-month indexes were mixed compared with the previous month, but most indexes remained at high levels. The employment index inched up while the order backlog and new orders for exports indexes were virtually unchanged. The production and shipments indexes fell moderately, and the new orders index eased somewhat. The raw materials index fell modestly and the finished goods inventory index also dipped slightly.

emphasis added

HVS: Q2 2018 Homeownership and Vacancy Rates

by Calculated Risk on 7/26/2018 10:06:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q2 2018.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate increased to 64.3% in Q2, from 64.2% in Q1.

I'd put more weight on the decennial Census numbers - given changing demographics, the homeownership rate has probably bottomed.

Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Overall this suggests that vacancies have declined significantly, and my guess is the homeownership rate has bottomed - and that the rental vacancy rate has bottomed for this cycle.

Weekly Initial Unemployment Claims increased to 217,000

by Calculated Risk on 7/26/2018 08:37:00 AM

The DOL reported:

In the week ending July 21, the advance figure for seasonally adjusted initial claims was 217,000, an increase of 9,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 207,000 to 208,000. The 4-week moving average was 218,000, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 220,500 to 220,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 218,000.

This was at the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, July 25, 2018

Thursday: Unemployment Claims, Durable Goods, Housing Vacancies and Homeownership

by Calculated Risk on 7/25/2018 08:38:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 207 thousand the previous week.

• At 8:30 AM, Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.2% increase in durable goods orders.

• At 10:00 AM, the Q2 2018 Housing Vacancies and Homeownership from the Census Bureau.

• At 11:00 AM, the Kansas City Fed manufacturing survey for July.

NMHC: Apartment Market Tightness Index remained negative for Eleventh Consecutive Quarter

by Calculated Risk on 7/25/2018 04:02:00 PM

From the National Multifamily Housing Council (NMHC): July Apartment Market Conditions Show Improvement

Apartment market conditions improved across three of the four indexes measured by the July National Multifamily Housing Council (NMHC) Quarterly Survey of Apartment Market Conditions. The Sales Volume (55), Equity Financing (56) and Debt Financing Indexes (55) all increased to above the breakeven level of 50, while the Market Tightness Index came in at 46.

“The apartment industry is showing small, but unmistakable signs of improvement,” said NMHC Chief Economist Mark Obrinsky, “The Market Tightness Index continues to show some weakening. However, the number of respondents who reported looser conditions fell to 29 percent, the lowest share since January of 2016.”

“Of greater concern is that the demand for construction labor has been growing faster than supply, driving up costs and delaying some projects. In fact, the majority of firms reported that the availability of construction labor has declined over the past year, even accounting for increased compensation,” said Obrinsky.

...

At 46, the Market Tightness Index was the only index to remain below 50, marking the eleventh consecutive quarter of overall declining conditions. One-fifth of respondents reported tighter market conditions than three months prior, compared to 29 percent who reported looser conditions. Half of respondents felt that conditions were no different from last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

This is the eleventh consecutive quarterly survey indicating looser conditions - it appears supply has caught up with demand - and I expect rent growth to continue to slow.

Technical Note: GDP Release and Revisions

by Calculated Risk on 7/25/2018 02:38:00 PM

With the GDP release on Friday, the BEA will release the 2018 Comprehensive Update. This will include changes in how GDP is calculated, revisions to previous years, and the third phase of removing residual seasonality.

A few key points:

1. The entire series of GDP (annually all the way back to 1929, and quarterly back to 1947) will be updated with new seasonal adjustments.

2. Forecasts of Q2 GDP could be off significantly.

3. The BEA will now release GDP Not Seasonally Adjusted (every year GDP NSA declines in Q1).

From the BEA: Preview of the 2018 Comprehensive Update of the National Income and Product Accounts

In July, the Bureau of Economic Analysis (BEA) will release the initial results of the 15th comprehensive, or benchmark, update of the national income and product accounts (NIPAs). Comprehensive updates are usually conducted at 5-year intervals that correspond with the integration of updated statistics from BEA’s quinquennial benchmark input-output accounts; the last comprehensive update was released in July 2013.And from the BEA: BEA on Track to Implement Third Phase to Combat Potential for Residual Seasonality in GDP

Comprehensive updates and, to a lesser extent, annual updates, provide the opportunity to introduce major improvements to maintain and to improve the NIPAs as outlined in BEA’s strategic plan. The changes are generally of three major types: (1) statistical changes to introduce new and improved methodologies and to incorporate newly available and revised source data, (2) changes in definitions to more accurately portray the evolving U.S. economy and to provide consistent comparisons with data for other national economies, and (3) changes in presentations to reflect the definitional and statistical changes, where necessary, or to provide additional data or perspectives for users.

This article describes the major changes that will be introduced in the NIPAs as part of the upcoming comprehensive update.

The U.S. Bureau of Economic Analysis is on track to soon implement the third phase of a three-pronged plan to mitigate any potential for residual seasonality in gross domestic product. That’s when seasonal patterns remain in the data even after they are adjusted for seasonal variations.

BEA laid out the plan in 2016, after conducting a painstaking component-by-component review of some 2,000 nominal data series included in GDP to look for possible sources of residual seasonality.

...

Applying seasonal adjustment improvements to the entire GDP times series. (Annual figures stretch back to 1929 and quarterly figures back to 1947).

Publicly releasing estimates for GDP (and gross domestic income) that are not seasonally adjusted, including major components, for the years 2002 and forward.

emphasis added

A few Comments on June New Home Sales

by Calculated Risk on 7/25/2018 12:34:00 PM

New home sales for June were reported at 631,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months, combined, were revised down.

Sales in June were up 2.4% year-over-year compared to June 2017. This was weak YoY growth, especially since was a fairly easy comparison since new home sales were soft in mid-year 2017.

There have been several articles recently about a weaker housing market (see: Has the Housing Market Peaked? (Part 2)). However I expect new home sales and single family starts will increase further over the next couple of years.

If new home sales weaken further this year, I'd be a more concerned. But so far, the growth in new home sales in 2018 is about what I expected.

Earlier: New Home Sales decrease to 631,000 Annual Rate in June.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 6.9% through June compared to the same period in 2017. Decent growth so far, and the next two months will be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decrease to 631,000 Annual Rate in June

by Calculated Risk on 7/25/2018 10:11:00 AM

The Census Bureau reports New Home Sales in June were at a seasonally adjusted annual rate (SAAR) of 631 thousand.

The previous three months were revised down, combined.

"Sales of new single-family houses in June 2018 were at a seasonally adjusted annual rate of 631,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.3 percent below the revised May rate of 666,000, but is 2.4 percent above the June 2017 estimate of 616,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in June to 5.7 months from 5.3 months in May.

The months of supply increased in June to 5.7 months from 5.3 months in May. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of June was 301,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

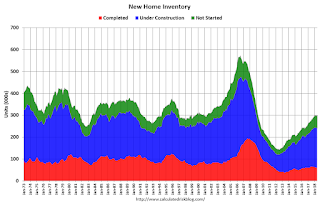

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is also somewhat low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In June 2018 (red column), 57 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in June.

The all time high for June was 115 thousand in 2005, and the all time low for June was 28 thousand in 2010 and in 2011.

This was below expectations of 669,000 sales SAAR, and the previous months were revised down, combined. I'll have more later today.

MBA: Mortgage Applications Decreased Slightly in Latest Weekly Survey

by Calculated Risk on 7/25/2018 07:00:00 AM

From the MBA: Mortgage Application Activity and Rates Nearly Flat in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 20, 2018.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 2 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.77 percent, with points decreasing to 0.45 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.