by Calculated Risk on 7/04/2018 07:00:00 AM

Wednesday, July 04, 2018

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 29, 2018.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index remained unchanged from the previous week and was 1 percent lower than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.79 percent from 4.84 percent, with points decreasing to 0.41 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 1% year-over-year.

Tuesday, July 03, 2018

U.S. Light Vehicle Sales increase to 17.5 million annual rate in June

by Calculated Risk on 7/03/2018 04:55:00 PM

Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.47 million SAAR in June.

That is up 5% year-over-year from June 2017, and up 4% from last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 17.47 million SAAR from AutoData).

This was above the consensus forecast for June.

Note that the increase in sales at the end of 2017 was due to buying following the hurricanes.

Sales will probably move sideways or decline in 2018 after setting new sales records in both 2015 and 2016.

Note: dashed line is current estimated sales rate.

This was the highest sales rate this year.

Reis: Mall Vacancy Rate increased in Q2 2018, "Worst quarter in nine years"

by Calculated Risk on 7/03/2018 09:36:00 AM

"The retail sector suffered its worst quarter in nine years with net absorption of negative 3.8 million square feet."

Reis reported that the vacancy rate for regional malls was 8.6% in Q2 2018, up from 8.4% in Q1 2018, and up from 8.1% in Q2 2017. This is down from a cycle peak of 9.4% in Q3 2011, and up from the cycle low of 7.8% in Q1 2016.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.2% in Q2, up from 10.0% in Q1, and up from 10.0% in Q2 2017. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011, and the low was 9.8% in Q2 2016.

Comments from Reis:

With 3.8 million square feet of negative net absorption brought on by the Toys “R” Us store closings, the U.S. Retail Vacancy Rate climbed 0.2% to 10.2% in the second quarter. Rent growth was positive at 0.2%.

The Regional Mall vacancy rate also increased 0.2% to 8.6% in the quarter, the average Mall rent increased 0.3%. The Mall vacancy rate has climbed 0.8% from a low of 7.8% at the end of 2016.

After withstanding the hundreds if not thousands of store closings over the last 18 months, the neighborhood and community shopping center industry suffered its worst quarter in nine years with negative net absorption of 3.8 million square feet. This pushed the overall vacancy rate to 10.2% from 10.0 percent where it had held steady for the four previous quarters.

The national average asking rent increased 0.2% in the second quarter as did the effective rent which nets out landlord concessions. At $21.01 per square foot (market) and $18.39 per square foot (effective), the average rents have increased 1.7% and 1.8%, respectively, since the second quarter of 2017.

…

Conclusion

The Toys “R” Us store closings impacted the second quarter statistics more than any other retailer has in any quarter over the last nine years. In the Reis property inventory, we tracked more than 80 total Toys “R” Us store closings in 40+ different metros in the quarter. Moreover, other retailers continued to shut down operations in the quarter including Winn-Dixie with eight closed stores in our inventory, Kmart with seven stores and Harvey with five closed stores. Very few metros saw significant positive net absorption, but a few gyms and trampoline parks opened in some metros along with TJ Maxx, Target, Aldi’s, Gabe’s and Bob Mills.

That said, we believe most of the Toys “R” Us stores are now closed and that most of the negative net absorption is behind us. Although we do not expect the vacancy rate to improve in the near future, it will not increase that much more in the coming quarters.

Oddly, rent growth has remained positive despite the higher vacancy. We suspect that rents will stay flat for some time. Finally, we have a few new construction projects in the pipeline, but have seen a number of older and obsolete shopping centers sold as development sites. We expect any new completions will be few and far between and could get offset by conversions or demolitions.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

CoreLogic: House Prices up 7.1% Year-over-year in May

by Calculated Risk on 7/03/2018 08:00:00 AM

Notes: This CoreLogic House Price Index report is for May. The recent Case-Shiller index release was for April. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic Reports May Home Prices Increased by 7.1 Percent, Consumers Express Desire to Buy Despite High Prices

CoreLogic® ... today released the CoreLogic Home Price Index (HPI™) and HPI Forecast for May 2018, which shows home prices rose both year over year and month over month. Home prices increased nationally by 7.1 percent year over year from May 2017 to May 2018. On a month-over-month basis, prices increased by 1.1 percent in May 2018 – compared with April 2018 – according to the CoreLogic HPI.CR Note: The CoreLogic YoY increase has been in the 5% to 7% range for the last few years. This is at the top end of that range. The year-over-year comparison has been positive for over six consecutive years since turning positive year-over-year in February 2012.

Looking ahead, the CoreLogic HPI Forecast indicates that the national home-price index is projected to continue to increase by 5.1 percent on a year-over-year basis from May 2018 to May 2019. On a month-over-month basis, home prices are expected to rise 0.3 percent in June 2018. The CoreLogic HPI Forecast is a projection of home prices that is calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

“The lean supply of homes for sale is leading to higher sales prices and fewer days on market, and the supply shortage is more acute for entry-level homes,” said Dr. Frank Nothaft, chief economist for CoreLogic. “During the first quarter, we found that about 50 percent of all existing homeowners had a mortgage rate of 3.75 percent or less. May’s mortgage rates averaged a seven-year high of 4.6 percent, with an increasing number of homeowners keeping the low-rate loans they currently have, rather than sell and buy another home that would carry a higher interest rate.”

emphasis added

Monday, July 02, 2018

Tuesday: Vehicle Sales

by Calculated Risk on 7/02/2018 06:54:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Slightly Higher After Mid-Day Change

Mortgage rates began the day in decent shape relative to last week. The average lender's rate/fee combo was at least as low as it had been on Friday. As the day progressed, however, underlying bond markets continued to weaken. For many lenders, it was enough to make mid-day changes to rate sheets. Affected lenders ended up slightly worse off compared to last Friday. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 8:00 AM ET, Corelogic House Price index for May.

• Early: Reis Q2 2018 Mall Survey of rents and vacancy rates.

• All day: Light vehicle sales for June. The consensus is for light vehicle sales to be 17.0 million SAAR in June, up from 16.8 million in May (Seasonally Adjusted Annual Rate).

Update: Framing Lumber Prices Up Sharply Year-over-year

by Calculated Risk on 7/02/2018 01:21:00 PM

Here is another monthly update on framing lumber prices. Current prices are well above the bubble highs.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through June 15, 2018 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 44% from a year ago, and CME futures are up about 52% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Tariffs on lumber, steel and aluminum are impacting housing costs. And rising costs - both material and labor - will be headwinds for the building industry this year.

Construction Spending increased 0.4% in May

by Calculated Risk on 7/02/2018 11:58:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in May:

Construction spending during May 2018 was estimated at a seasonally adjusted annual rate of $1,309.5 billion, 0.4 percent above the revised April estimate of $1,304.5 billion. The May figure is 4.5 percent above the May 2017 estimate of $1,253.6 billion.Both Private and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $1,005.4 billion, 0.3 percent above the revised April estimate of $1,002.3 billion. ...

In May, the estimated seasonally adjusted annual rate of public construction spending was $304.1 billion, 0.7 percent above the revised April estimate of $302.1 billion.

emphasis added

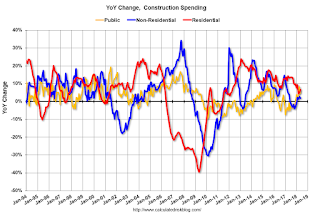

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is still 18% below the bubble peak.

Non-residential spending is 9% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 7% below the peak in March 2009, and 16% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 7%. Non-residential spending is up 2% year-over-year. Public spending is up 5% year-over-year.

This was below the consensus forecast of a 0.6% increase for May.

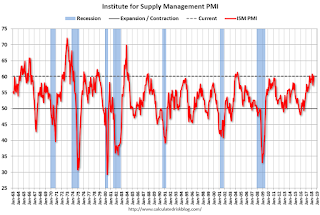

ISM Manufacturing index increased to 60.2 in June, Concern about Tariffs

by Calculated Risk on 7/02/2018 10:05:00 AM

The ISM manufacturing index indicated expansion in June. The PMI was at 60.2% in June, up from 58.7% in May. The employment index was at 56.0%, down from 56.3% last month, and the new orders index was at 63.5%, down from 63.7%.

From the Institute for Supply Management: June 2018 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in June, and the overall economy grew for the 110th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee: “The June PMI® registered 60.2 percent, an increase of 1.5 percentage points from the May reading of 58.7 percent. The New Orders Index registered 63.5 percent, a decrease of 0.2 percentage point from the May reading of 63.7 percent. The Production Index registered 62.3 percent, a 0.8 percentage point increase compared to the May reading of 61.5 percent. The Employment Index registered 56 percent, a decrease of 0.3 percentage point from the May reading of 56.3 percent. The Supplier Deliveries Index registered 68.2 percent, a 6.2 percentage point increase from the May reading of 62 percent. The Inventories Index registered 50.8 percent, an increase of 0.6 percentage point from the May reading of 50.2 percent. The Prices Index registered 76.8 percent in June, a 2.7 percentage point decrease from the May reading of 79.5 percent, indicating higher raw materials prices for the 28th consecutive month.

…

Respondents are overwhelmingly concerned about how tariff related activity is and will continue to affect their business

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 58.3%, and suggests manufacturing expanded at a faster pace in June than in May.

A solid report.

Sunday, July 01, 2018

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 7/01/2018 09:17:00 PM

Weekend:

• Schedule for Week of July 1, 2018

Monday:

• At 10:00 AM ET, ISM Manufacturing Index for June. The consensus is for the ISM to be at 58.3, down from 58.7 in May. The PMI was at 58.7% in May, the employment index was at 56.3%, and the new orders index was at 63.7%.

• Also at 10:00 AM, Construction Spending for May. The consensus is for a 0.6% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 4, and DOW futures are up 55 (fair value).

Oil prices were up over the last week with WTI futures at $73.40 per barrel and Brent at $78.39 per barrel. A year ago, WTI was at $46, and Brent was at $47 - so oil prices are up more than 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $2.22 per gallon - so gasoline prices are up 63 cents per gallon year-over-year.

June 2018: Unofficial Problem Bank list unchanged at 92 Institutions, Q2 2018 Transition Matrix

by Calculated Risk on 7/01/2018 01:05:00 PM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for June 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for June 2018. During the month, the list count was unchanged on a net basis after one removal and one addition. However, assets increased by a substantial $42.0 billion during the month to $60.0 billion. A year ago, the list held 137 institutions with assets of $35.2 billion.

This month, the action against Legacy State Bank, Loganville, GA ($92 million) was terminated.

The large jump in assets this month results from the addition of Deutsche Bank Trust Company Americas, New York, NY ($42.1 billion) to the list. In our last post on the list at the end of May, we noted the large increase in assets on the FDIC’s Official Problem Bank List they disclosed on May25th. At that time we suspected the large increase resulted from the FDIC adding a domestically charted bank with foreign ownership. A few days after our post, several major media outlets confirmed our suspicions. Interestingly, however, is that the Federal Reserve issued the enforcement action to Deutsche Bank Trust Company Americas back in May 2017. It makes us wonder why the bank did not make it onto FDIC’s official list until March 2018.

With it being the end of the second quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,731 institutions have appeared on a weekly or monthly list at some point. Only 5.3 percent of the banks that have appeared on a list remain today. In all, there have been 1,639 institutions that have transitioned through the list. Departure methods include 960 action terminations, 406 failures, 256 mergers, and 17 voluntary liquidations. Of the 389 institutions on the first published list, only 9 or 2.3 percent still remain in a designated troubled status more than eight years later. The 406 failures represent 23.5 percent of the 1,731 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 178 | (65,500,762) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 158 | (186,397,337) | |

| Asset Change | (449,522) | ||

| Still on List at 6/30/2018 | 9 | 3,563,255 | |

| Additions after 8/7/2009 | 83 | 56,456,770 | |

| End (6/30/2018) | 92 | 60,020,025 | |

| Intraperiod Removals1 | |||

| Action Terminated | 782 | 320,707,101 | |

| Unassisted Merger | 216 | 82,115,858 | |

| Voluntary Liquidation | 13 | 2,515,855 | |

| Failures | 248 | 125,152,210 | |

| Total | 1,259 | 530,491,024 | |

| 1Institution not on 8/7/2009 or 6/30/2018 list but appeared on a weekly list. | |||