by Calculated Risk on 3/31/2018 08:11:00 AM

Saturday, March 31, 2018

Schedule for Week of Apr 1, 2018

The key report this week is the March employment report on Friday.

Other key indicators include the February Trade deficit, March ISM manufacturing and non-manufacturing indexes, March auto sales, and the March ADP employment report.

Fed Chair, Jerome Powell, will speak on the Economic Outlook on Friday.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February.

10:00 AM: ISM Manufacturing Index for March. The consensus is for the ISM to be at 60.0, down from 60.8 in February.Here is a long term graph of the ISM manufacturing index.

The PMI was at 60.8% in February, the employment index was at 59.7%, and the new orders index was at 64.2%.

10:00 AM: Construction Spending for February. The consensus is for a 0.5% increase in construction spending.

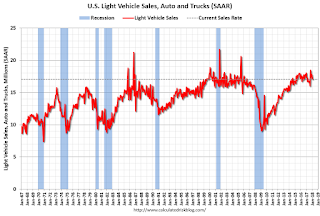

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for March. The consensus is for light vehicle sales to be 17.0 million SAAR in March, down from 17.1 million in February (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

10:00 AM: Corelogic House Price index for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in March, down from 235,000 added in February.

10:00 AM: the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 59.0 from 59.5 in February.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 215 thousand the previous week.

8:30 AM: Trade Balance report for February from the Census Bureau.

8:30 AM: Trade Balance report for February from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through December. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $56.8 billion in February from $56.8 billion in January.

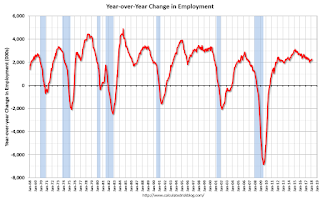

8:30 AM: Employment Report for March. The consensus is for an increase of 167,000 non-farm payroll jobs added in March, down from the 313,000 non-farm payroll jobs added in February.

The consensus is for the unemployment rate to decrease to 4.0%.

The consensus is for the unemployment rate to decrease to 4.0%.This graph shows the year-over-year change in total non-farm employment since 1968.

In February the year-over-year change was 2.281 million jobs.

A key will be the change in wages.

1:30 PM: Speech by Fed Chair Jerome Powell, Economic Outlook, At the Economic Club of Chicago, Chicago, Illinois

3:00 PM: Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $15.0 billion in February.

Friday, March 30, 2018

Fannie Mae: Mortgage Serious Delinquency rate decreased slightly in February

by Calculated Risk on 3/30/2018 04:23:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 1.22% in February, down from 1.23% in January. The serious delinquency rate is up from 1.19% in February 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 3.35% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.49% are seriously delinquent, For recent loans, originated in 2009 through 2017 (91% of portfolio), only 0.53% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Q1 GDP Forecasts

by Calculated Risk on 3/30/2018 03:32:00 PM

Here are few Q1 GDP forecast.

From Merrill Lynch:

The data sliced 0.3pp from 1Q GDP tracking, bringing it down to 1.6%. [March 29 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.4 percent on March 29, up from 1.8 percent on March 23. The forecast of the contribution of inventory investment to first-quarter real GDP growth increased from 0.66 percentage points to 1.21 percentage points after yesterday’s advance releases of wholesale and retail inventories by the U.S. Census Bureau, yesterday's GDP release by the U.S. Bureau of Economic Analysis (BEA), and this morning's release of the revised underlying detail tables for the National Income and Product Accounts by the BEA.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.7% for 2018:Q1 and 2.9% for 2018:Q2. [March 30 estimate]CR Note: It looks like another quarter around 2% or so, although there might still be some residual seasonality in the first quarter.

Hotels: Occupancy Rate Up Year-over-Year

by Calculated Risk on 3/30/2018 12:53:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 24 March

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 18-24 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 19-25 March 2017, the industry recorded the following:

• Occupancy: +1.0 at 69.4%

• Average daily rate (ADR): +4.4% to US$133.42

• Revenue per available room (RevPAR): +5.4% to US$92.53

STR analysts note that performance in many major markets was boosted by strong group business, which moved out of the week of 25-31 March due to an earlier Easter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is third overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Reis: Mall Vacancy Rate increased slightly in Q1 2018

by Calculated Risk on 3/30/2018 09:47:00 AM

Reis reported that the vacancy rate for regional malls was 8.4% in Q1 2018, up from 8.3% in Q4 2017, and up from 7.9% in Q1 2017. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate was 10.0% in Q1, unchanged from 10.0% in Q4, and up from 9.9% in Q1 2017. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis:

Despite continued announcements of store closures, the Neighborhood and Community Shopping Center vacancy rate remained at 10% for the fourth consecutive quarter, up from 9.9% in the first quarter of 2017. The vacancy rate has increased 20 basis points from a low of 9.8% in Q2 2016.

On the national level, both asking and effective rents increased 0.4% in the first quarter. At $20.96 and $18.34 per square foot, the average market and effective rents have increase 1.9% and 2.1% year-over-year, respectively.

Net absorption was 453,000 square feet, the lowest quarterly total in more than five years. Construction was also much lower than average: 712,000 square feet, well below the 3.1 million square feet quarterly average in 2017. The first quarter tends to see the lowest activity; however, this was an unusually slow quarter for retail leasing and construction.

The mall vacancy rate increased to 8.4% in the quarter, up 50 basis points from 7.9% in the first quarter of 2017. The quarterly rent increase of 0.5% shrouds the gap between the higher-end malls, which are thriving, and the increasingly vacant lower-end malls.

...

Although the retail real estate market survived the tsunami of closures in 2017, the closures expected in the second quarter from Toys “R” Us, BI-LO and others will be a true test of the retail sector’s ability to weather the ongoing storm.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

Recently both the strip mall and regional mall vacancy rates have increased from an already elevated level.

Mall vacancy data courtesy of Reis

Thursday, March 29, 2018

"Mortgage Rates Unchanged Despite Market Improvements"

by Calculated Risk on 3/29/2018 06:36:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged Despite Market Improvements

Mortgage rates were generally unchanged today, although a few lenders offered slight improvements. This stands in contrast to the noticeable improvements in underlying bond markets. As we discussed yesterday, Treasury yields are leading the charge toward lower rates, and while the bonds that underlie mortgages are definitely lagging that move, they're improving nonetheless. But again, you wouldn't really know it based on today's rate sheets. [30YR FIXED - 4.5%]Here is a table from Mortgage News Daily:

emphasis added

Merrill and Nomura Forecasts for March Employment Report

by Calculated Risk on 3/29/2018 04:06:00 PM

Here are some excepts from two research reports ... first from Merrill Lynch:

We expect nonfarm payrolls to increase by 195k and private payrolls to increase by 200k in March ...From Nomura:

We expect to see employment activity return back closer to trend after last month’s unexpected gain of 313k which was likely boosted by warmer weather conditions. As such, we could see some softening in goods-producing jobs, such as construction, which were particularly strong in February. Elsewhere, we expect negative payback in government payrolls in March after an outsized gain in February due to strong hiring activity in local government education payrolls. Therefore, we expect the gains in private payrolls to outpace the gains in nonfarm payrolls.

We look for the unemployment rate ... to remain unchanged at 4.1%, which would mark the sixth consecutive month at that level. ...

... note that while the inclement weather likely reduced hours worked in March, it’s unlikely to impact payrolls growth noticeably as the BLS counts the number workers on payroll during the pay period capturing the 12th of the month. The decline in hours worked should result in an upward bias to wage growth, leading us to forecast average hourly earnings to increase by 0.3% mom, pushing up the yoy comparison to 2.8% from 2.6%.

We expect nonfarm payroll employment in March to increase by 115k, a below-trend reading primarily due to negative payback from February’s weather-related boost. ... According to the San Francisco Fed’s weather payroll model, warmer weather biased up February payroll employment by roughly 90k, largely accounting for the above-consensus print of 313k in February. ...I'll write an employment report preview next week after more data for March is released.

We forecast a 0.2% m-o-m increase in average hourly earnings (AHE), corresponding to 2.7% on a 12-month basis. ... Finally, we expect the unemployment rate to decline 0.1pp to 4.0% ... However, there is some risk that the unemployment rate declines below 4.0% given an unusual increase in labor force inflows in February

Earlier: Chicago PMI Declines in March

by Calculated Risk on 3/29/2018 01:59:00 PM

From the Chicago PMI: March Chicago Business Barometer Eases to 57.4

The MNI Chicago Business Barometer fell 4.5 points to 57.4 in March, down from 61.9 in February, hitting the lowest level in exactly one year.This was well below the consensus forecast of 63.2, but still a decent reading.

Firms’ operations continued to expand in March, but the pace of expansion moderated for a third straight month. Three of the five Barometer components receded on the month, with only Employment and Supplier Deliveries expanding.

...

“The Chicago Business Barometer calendar quarter average had increased for six straight quarters until Q1 2018, with the halt largely due to the recent downward trajectory of orders and output,” said Jamie Satchi, Economist at MNI Indicators.

“Troubles higher up in firms’ supply chains are restraining their productive capacity and higher prices are being passed on to consumers. On a more positive note, firms remain keen to expand their workforce,” he added.

emphasis added

Reis: Office Vacancy Rate increased in Q1 to 16.5%

by Calculated Risk on 3/29/2018 11:25:00 AM

Reis released their Q1 2018 Office Vacancy survey this morning. Reis reported that the office vacancy rate increased to 16.5% in Q1, from 16.4% in Q4 2017. This is up from 16.3% in Q1 2017, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

Defying a healthy job market, the office vacancy rate increased in the first quarter to 16.5%, up from 16.4% at year-end 2017 and 16.3% in the first quarter of 2017. The vacancy rate has increased 30 basis points from a low of 16.2% in Q4 2016.

The national average asking rent increased 0.8% in the first quarter while effective rents, which net out landlord concessions, increased 0.9%. At $32.87 and $26.67 per square foot, respectively, the average market and effective rents have both increased 2.2% from the first quarter of 2017.

Net absorption was 6.2 million square feet, which was above the average quarterly absorption level of 2017: 5.9 million square feet. Construction was also higher than average: 10.9 million square feet, above 10.6 million square feet per quarter in 2017. Moreover, the first quarter tends to see the lowest activity; thus, this was a relatively strong quarter given the Nor’easters that plagued the Northeast.

...

Moreover, the market seemed to have stagnated in 2017 as companies had put off making office leasing decisions until a fiscal stimulus was passed. The passing of the Tax Reform and Jobs Act should deliver higher profits and stronger business confidence which should spur stronger office leasing this year.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.5% in Q1. The office vacancy rate has been mostly moving sideways at an elevated level, but has increased a little recently.

Office vacancy data courtesy of Reis.

Personal Income increased 0.4% in February, Spending increased 0.2%

by Calculated Risk on 3/29/2018 08:48:00 AM

The BEA released the Personal Income and Outlays report for February:

Personal income increased $67.3 billion (0.4 percent) in February according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $53.9 billion (0.4 percent) and personal consumption expenditures (PCE) increased $27.7 billion (0.2 percent).The February PCE price index increased 1.8 percent year-over-year (up from 1.7 percent YoY in January) and the February PCE price index, excluding food and energy, increased 1.6 percent year-over-year (up from 1.5 percent YoY in January).

Real DPI increased 0.2 percent in February and Real PCE increased less than 0.1 percent. The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent.

The following graph shows real Personal Consumption Expenditures (PCE) through February 2018 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

The increase in personal income was slightly below expectations, and the increase in PCE was slightly above expectations.

Using the two-month method to estimate Q4 PCE growth, PCE was increasing at a 1.4% annual rate in Q1 2018. (using the mid-month method, PCE was increasing 0.4%). This suggests weak PCE growth in Q1.