by Calculated Risk on 3/19/2018 08:31:00 AM

Monday, March 19, 2018

FOMC Preview

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week, and the tone might be a bit more "hawkish".

Assuming the expected happens, the focus will be on the wording of the statement, the projections, and Fed Chair Jerome Powell's first press conference to try to determine how many rate hikes to expect in 2018 and in 2019.

Here are the December FOMC projections.

Current projections for Q1 GDP range from 1.8% to 2.7%. There is probably some residual seasonality in the Q1 GDP numbers (pulling down GDP). So it is too early to revise down 2018 GDP.

At this point, as far as the impact of fiscal stimulus, the Fed has probably incorporated the estimated impact of the tax cuts in their projections for 2018 and beyond. So the FOMC might increase their projections a little.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Dec 2017 | 2.2 to 2.6 | 1.9 to 2.3 | 1.7 to 2.0 |

| Sept 2017 | 2.0 to 2.3 | 1.7 to 2.1 | 1.6 to 2.0 |

The unemployment rate was at 4.1% again in February. So the unemployment rate for 2018 will probably be unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Dec 2017 | 3.7 to 4.0 | 3.6 to 4.0 | 3.6 to 4.2 |

| Sept 2017 | 4.0 to 4.2 | 3.9 to 4.4 | 4.0 to 4.5 |

As of January, PCE inflation was up 1.65% from January 2017. Based on recent PCE readings, PCE inflation might be revised up slightly for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Dec 2017 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

| Sept 2017 | 1.8 to 2.0 | 2.0 | 2.0 to 2.1 |

PCE core inflation was up 1.5% in January year-over-year. Core PCE inflation might be revised up slightly for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Dec 2017 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

| Sept 2017 | 1.8 to 2.0 | 2.0 | 2.0 to 2.1 |

In general the data has been consistent with the FOMC's December projections, so any revision will probably be related to the FOMC's view of the impact of policy.

Sunday, March 18, 2018

Sunday Night Futures

by Calculated Risk on 3/18/2018 07:37:00 PM

Weekend:

• Schedule for Week of Mar 18, 2018

• Goldman: FOMC Preview

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 2, and DOW futures are down 20 (fair value).

Oil prices were mixed over the last week with WTI futures at $62.16 per barrel and Brent at $66.02 per barrel. A year ago, WTI was at $48, and Brent was at $51 - so oil prices are up solidly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.54 per gallon. A year ago prices were at $2.29 per gallon - so gasoline prices are up 25 cents per gallon year-over-year.

Goldman: FOMC Preview

by Calculated Risk on 3/18/2018 11:59:00 AM

A few brief excerpts from a note by Goldman Sachs economists Jan Hatzius and Spencer Hill: FOMC Preview: A Fast Start for the Powell Fed

The FOMC looks very likely to raise rates at next week’s meeting, the first with Chairman Powell at the helm ... we expect a slightly hawkish tone to next week’s meeting.

...

[We] expect the post-meeting statement to retain January’s upbeat tone ... but we expect the Committee’s optimism to come across more clearly in the SEP and the dots ... we do think the statement will acknowledge recent housing weakness.

...

The SEP is likely to show higher GDP growth projections for 2018, 2019, and longer-run, as well as a lower unemployment path and a modest inflation overshoot in 2020.

...

Public remarks by Fed officials suggest a broad shift in the committee’s outlook towards a potentially faster pace of tightening, and we expect the median dot to show four hikes in 2018, up from three at the December meeting.

Hotels: Occupancy Rate Up Year-over-Year

by Calculated Risk on 3/18/2018 08:41:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 10 March

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 4-10 March 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 5-11 March 2017, the industry recorded the following:

• Occupancy: +1.1 at 68.1%

• Average daily rate (ADR): +2.0% to US$131.46

• Revenue per available room (RevPAR): +3.1% to US$89.53

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is fifth overall - and slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, March 17, 2018

Schedule for Week of Mar 18, 2018

by Calculated Risk on 3/17/2018 08:11:00 AM

The key economic reports this week are February new home sales and existing home sales.

The FOMC meets this week and is expected to announce a 25bps increase in the Fed Funds rate.

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, up from 5.38 million in January.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, up from 5.38 million in January.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler will probably release his estimate on Monday. His preliminary estimate is 5.43 million SAAR for February.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 226 thousand the previous week.

9:00 AM: FHFA House Price Index for January 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 ET AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.1.72% increase in durable goods orders.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for 626 thousand SAAR, up from 593 thousand in January.

10:00 AM: State Employment and Unemployment (Monthly) for February 2018

Friday, March 16, 2018

Sacramento Housing in February: Sales up 10% YoY, Active Inventory up 17% YoY

by Calculated Risk on 3/16/2018 08:52:00 PM

From SacRealtor.org: Flat February: median sales price, sales volume stagnant

February closed with 1,131 sales, up just .2% from January’s 1,129 sales. Compared with one year ago (1,028), the current figure is a 10% increase. Of the 1,131 sales this month, 171 (15.1%) cash financing, 651 (57.6%) used conventional, 203 (17.9%) used FHA, 59 (5.2%) used VA and 47 (4.2%) used Other types of financing.CR Note: Inventory is still low, but now increasing year-over-year in Sacramento.

Active Listing Inventory increased 2.8% from 1,677 to 1,724. The Months of Inventory, however, remained at 1.5 Months. A year ago the Months of inventory was 1.4 and Active Listing Inventory stood at 1,469 listings (17.4% below the current figure).

The Average DOM (days on market) remained at 31 from month to month. The Median DOM dropped from 17 to 13.

“Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” 66.9% of all homes sold this month (757) were on the market for 30 days or less and 81.8% (925) of all homes sold in 60 days or less. Compare this to February 2016 where 78.8% of all homes sold (1,082) sold in 60 days or less.

emphasis added

The statistics for February are here.

Comments on February Housing Starts

by Calculated Risk on 3/16/2018 03:40:00 PM

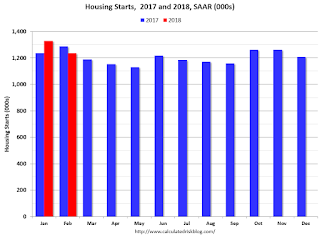

Earlier: Housing Starts decreased to 1.236 Million Annual Rate in February

The housing starts report released this morning showed starts were down 7.0% in February compared to January, and starts were down 4.0% year-over-year compared to February 2017.

The decline in starts was due to the volatile multi-family sector. Single family starts were up 2.9% year.

This first graph shows the month to month comparison between 2017 (blue) and 2017 (red).

Starts were down 4.0% in February compared to February 2017.

Note that February 2016 was a pretty strong month for housing starts, so this was a difficult comparison. The next three months will be easier.

Through two months, starts are up 1.6% year-to-date compared to the same period in 2017.

Single family starts were up 2.9% year-over-year, and also up 2.9% compared to January.

Multi-family starts were down 18.7% year-over-year, and down 26.1% compared to January (multi-family is volatile month-to-month).

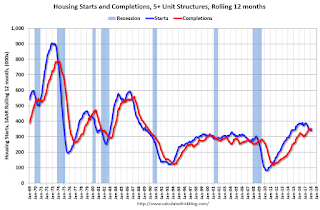

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in a year or so.

As I've been noting for a few years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

"CBO’s Projection of Labor Force Participation Rates"

by Calculated Risk on 3/16/2018 12:22:00 PM

CR Note: I've written extensively about the Labor Force Participation Rate (LFPR). This is a very detailed analysis and model from the CBO.

Here is the new paper from Joshua Montes at the Congressional Budget Office: CBO’s Projection of Labor Force Participation Rates

From the Conclusion:

This paper details CBO’s methodology for estimating and projecting labor force participation rates. CBO constructs a birth-year cohort model of the labor force participation rate that estimates labor force participation rates by age-sex-education-race subgroups. Using the estimated model to project rates over the next decade, CBO expects the overall rate to decline by 2.7 percentage points, reaching 60.1 percent by 2028.

Most (2.5 percentage points, or about 80 percent) of the 3.2 percentage-point decline since the 2007–2009 recession in the labor force participation rate for the population at least 16 years old is the result of aging. That decline continued a trend that began in the late 1990s and early 2000s as the early baby-boom cohorts began to turn 50 years old, the age at which individuals tend to start reducing their participation in the labor force. CBO projects that the continued aging of the population will further reduce the overall participation rate over the next 11 years by an additional 2.8 percentage points, as most baby boomers age into retirement.

Although aging is the primary driver of the falling labor force participation rate, it is not the only driver, as other structural factors are driving down some group-specific participation rates. First, the members of younger birth cohorts, who are replacing baby boomers in the labor force, have participated in the labor force at lower rates, and CBO projects that this trend will continue to weigh down the participation rate over the next decade. Second, the share of people receiving disability insurance benefits is generally projected to continue rising, and people who receive such benefits are less likely to participate in the labor force. Third, the marriage rate has declined and is projected to continue decreasing, especially among men, and unmarried men tend to participate in the labor force at lower rates than married men. Finally, elements of fiscal policy, including various provisions of the ACA, have increased effective marginal tax rates and reduced the incentive for individuals to supply labor in recent years. The effects of many of these structural factors have been concentrated among the less educated, contributing greatly to the decline in the participation rates of these groups.

Cyclical weakness was also an important factor weighing down the labor force participation rate over much of the previous decade, even as that rate has had much cyclical improvement in recent years. CBO’s estimates show that the drag on the overall participation rate from discouraged job seekers leaving the labor force was as much as 1.2 percentage points in 2014. Since then, many discouraged workers have reentered the labor force, and that cyclical weakness has diminished considerably. CBO estimates that the labor force participation rate remained only 0.4 percentage points below its potential rate in 2017, and that gap will close entirely in the coming years. Increases in populationwide educational attainment have helped boost the participation rate since 2007, on the other hand, as more of the population now holds a bachelor’s degree. CBO estimates that increases in educational attainment have increased the observed labor force participation rate by nearly a full percentage point over the past decade, all else being equal, highlighting the importance of modeling educational attainment in projections of the labor force participation rate. CBO projects these trends to continue over the next decade, boosting the participation rate by almost another full percentage point.

Although most of the decline in the overall labor force participation rate comes from the aging of the baby-boom generation, the decline in the prime-age labor force participation rate over the past decade is entirely unrelated to aging. Instead, other structural factors, including the declining propensity of successive cohorts to participate in the labor market, the increase in disability insurance incidence, the declining male marriage rate, and fiscal policy, have contributed most to the decline in that rate. The contribution of most of those factors to the declining prime-age labor force participation rate has been concentrated among the less educated. CBO expects the contribution of some of those factors to dissipate over the next decade—namely the declining male marriage rate and fiscal policy—whereas others will continue to weigh down the prime-age rate over the next decade.

Furthermore, CBO finds that the effects of the 2007–2009 recession reduced the prime-age labor force participation rate considerably and that lingering cyclical weakness from the aftermath of that recession still lowers that rate some. The agency estimates that cyclical weakness reduced the prime-age rate by as much as 1.3 percentage points in 2014 and 2015. Although the improving economy and labor market have pulled some discouraged prime-age workers back into the labor market, CBO estimates that the prime-age labor force participation rate was still 0.4 percentage points below its potential in 2017. As was the case for the overall participation rate, part of the decline in recent history of the prime-age rate has been offset by the evolving educational attainment distribution. Because individuals with higher levels of educational attainment participate at higher rates, the shift toward more education in the population results in higher rates of participation. The changing educational attainment distribution contributed to an increase in the prime-age potential labor force participation rate of more than a percentage point since the end of 2007. That increase, however, is not enough to offset the decline resulting from other variables. Over the next decade, as the downward pressure from other structural factors on the prime-age labor force participation rate is expected to dissipate, CBO projects that increases in educational attainment will fully offset downward pressure on that rate from those other factors. In addition to the upward pressure from continued increases in educational attainment, CBO expects further cyclical improvement to draw more individuals who had been discouraged from seeking work back into the labor market. As a result, CBO expects those factors to drive an increase in the observed prime-age labor force participation rate over the next decade, from 81.7 percent in 2017 to 82.1 percent in 2028.

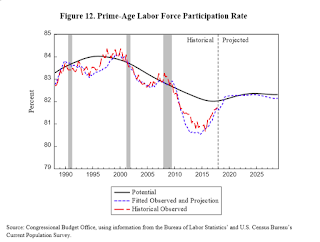

Click on graph for larger image.

Click on graph for larger image.This graph from the CBO paper shows the CBO projections for the overall Labor Force Participation Rate (LFPR). After a few year of a relatively stable LFPR (as the economy recovered), the CBO expects the LFPR to begin declining again by 2020.

The CBO projection is the LFPR will decline to 61.5% in 2024, and to 60.1% in 2028.

The second graphs shows the CBO projection for the prime age LFPR (people aged 25 to 54).

From the CBO:

From the CBO: The potential prime-age labor force participation rate follows a pattern similar to that of the potential aggregate labor force participation rate over history: It increases through the 1980s and early 1990s, peaks in the middle of the 1990s, and then starts a continuous decline in the late 1990s that persists through about 2017. The magnitudes of the changes in rates giving rise to that pattern, though, are much smaller than the changes in the aggregate rate. In particular, the potential prime-age labor force participation rate fell by 2.0 percentage points over the past roughly two decades, from its peak of 84.0 percent in the middle of the 1990s to 82.0 percent by the end of 2017. However, that decline is entirely unrelated to aging. Interestingly, that downward trend stops over the projection period, when CBO expects that the net change in the potential prime-age participation rate will be slightly positive at about 0.3 percentage points.A key point: The overall LFPR declined from a high of just over 67% in the year 2000, to the current level of 63%. The CBO expects that the LFPR will start declining again, and will be close to 60% in 2028 (this is close to my earlier projections).

BLS: Job Openings Increased in January

by Calculated Risk on 3/16/2018 10:10:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to 6.3 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.6 million and 5.4 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.3 million in January. The quits rate was little changed at 2.2 percent. Over the month, the number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 6.312 million from 5.667 in December.

The number of job openings (yellow) are up 15.9% year-over-year.

Quits are up 3.2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at the highest level since this series started, and quits are increasing year-over-year. This is a strong report.

Industrial Production Increased 1.1% in February

by Calculated Risk on 3/16/2018 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 1.1 percent in February following a decline of 0.3 percent in January. Manufacturing production increased 1.2 percent in February, its largest gain since October. Mining output jumped 4.3 percent, mostly reflecting strong gains in oil and gas extraction. The index for utilities fell 4.7 percent, as warmer-than-normal temperatures last month reduced the demand for heating. At 108.2 percent of its 2012 average, total industrial production in February was 4.4 percent higher than it was a year earlier. Capacity utilization for the industrial sector climbed 0.7 percentage point in February to 78.1 percent, its highest reading since January 2015 but still 1.7 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is 1.7% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 108.2. This is 24% above the recession low, and 3% above the pre-recession peak.