by Calculated Risk on 8/22/2017 05:39:00 PM

Tuesday, August 22, 2017

Wednesday: New Home Sales

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, New Home Sales for July from the Census Bureau. The consensus is for 610 thousand SAAR, unchanged from 610 thousand in June.

• During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

Chemical Activity Barometer Shows Modest Slowing in August

by Calculated Risk on 8/22/2017 11:45:00 AM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Shows Modest Slowing

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), remained unchanged from July, continuing a modest deceleration of growth. The flat reading follows a 0.1 percent increase in July and a flat reading in June. Compared to a year earlier, the CAB is up 3.2 percent year-over-year, an easing from recent year-over-year gains. All data is measured on a three-month moving average (3MMA).

On a year-over-year basis, the unadjusted CAB is up 3.0 percent, also an easing from the previous six months.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB increased solidly in early 2017 suggesting an increase in Industrial Production, however, the year-over-year increase in the CAB has slowed recently.

Richmond Fed: "Manufacturing Activity in August Remained Little Changed from July"

by Calculated Risk on 8/22/2017 10:04:00 AM

From the Richmond Fed: Reports on Fifth District Manufacturing Activity in August Remained Little Changed from July

Reports on Fifth District manufacturing activity were largely unchanged in August, according to the latest survey by the Federal Reserve Bank of Richmond. The composite index remained at 14 in August, with an increase in the employment index offsetting a decrease in the shipments index and a very slight decline in the new orders metric. Although the employment index rose from 10 to 17 in August, other measures of labor market activity — wages and average workweek — were largely unchanged.This suggests solid growth in August.

emphasis added

Monday, August 21, 2017

"Mortgage Rates Steady at 2017 Lows"

by Calculated Risk on 8/21/2017 05:11:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Steady at 2017 Lows

Mortgage rates held steady to start the new week. This keeps them in line with the best levels since November 2016. There were no interesting developments in financial markets or in terms of economic data today. ...Tuesday:

3.875% remains the most prevalently-quoted conventional 30yr fixed rate for top tier scenarios, although quite a few lenders remain at 4.00%.

• At 9:00 AM ET, FHFA House Price Index for June 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for August.

• Also expected at 10:00 AM (not confirmed), Q2 MBA National Delinquency Survey.

Existing Home Sales: Take the Under on Thursday

by Calculated Risk on 8/21/2017 11:55:00 AM

The NAR is scheduled to report July Existing Home Sales on Thursday, August 24th at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.57 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.38 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.52 million SAAR in June.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 145 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | --- |

| 1NAR initially reported before revisions. | |||

Chicago Fed "Index Points to Growth near Historical Trend in July"

by Calculated Risk on 8/21/2017 09:50:00 AM

From the Chicago Fed: Index Points to Growth near Historical Trend in July

The Chicago Fed National Activity Index (CFNAI) moved down to –0.01 in July from +0.16 in June. Three of the four broad categories of indicators that make up the index decreased from June, and three of the four categories made negative contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved down to –0.05 in July from +0.09 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 20, 2017

Sunday Night Futures

by Calculated Risk on 8/20/2017 08:59:00 PM

Weekend:

• Schedule for Week of Aug 20, 2017

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 futures are up 2, and DOW futures are up 32 (fair value).

Oil prices were mixed over the last week with WTI futures at $48.48 per barrel and Brent at $52.66 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.32 per gallon - a year ago prices were at $2.16 per gallon - so gasoline prices are up 16 cents per gallon year-over-year.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 8/20/2017 08:11:00 AM

Note: This is a repeat of a June post with updated statistics and graph.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

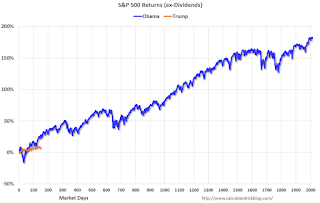

For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 6.8% under Mr. Trump compared to up 22.9% under Mr. Obama for the same number of market days.

Saturday, August 19, 2017

Schedule for Week of Aug 20, 2017

by Calculated Risk on 8/19/2017 08:09:00 AM

The key economic reports this week are New and Existing Home sales for July.

Fed Chair Janet Yellen will speak at the Jackson Hole Economic Symposium on Friday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

9:00 AM ET: FHFA House Price Index for June 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

10:00 AM, Expected: Q2 MBA National Delinquency Survey.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: New Home Sales for July from the Census Bureau.

10:00 AM ET: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for 610 thousand SAAR, unchanged from 610 thousand in June.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 232 thousand the previous week.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.52 million in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.52 million in June.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.38 million SAAR for July.

Three days (Thursday, Friday and Saturday): The 2017 Jackson Hole Economic Symposium, "Fostering a Dynamic Global Economy, will take place Aug. 24-26, 2017. (The program will be available at 6 p.m., MT, Aug. 24, 2017)."

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.7% decrease in durable goods orders.

10:00 AM, Speech by Fed Chair Janet L. Yellen, Financial Stability, At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming

Friday, August 18, 2017

Oil Rigs "Rigs counts are now off the peak"

by Calculated Risk on 8/18/2017 05:03:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Aug 18, 2017:

• Rigs counts are now off the peak

• Total US oil rigs were down 5 to 763

• Horizontal oil rigs were down 4 at 650

...

• Expect rigs counts to roll off for the next three months or so, with oil prices languishing in the $46-49 range typically.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.