by Calculated Risk on 5/20/2017 08:11:00 AM

Saturday, May 20, 2017

Schedule for Week of May 21, 2017

The key economic reports this week are April New and Existing Home sales, and the second estimate of Q1 GDP.

8:30 AM: Chicago Fed National Activity Index for April. This is a composite index of other data.

10:00 AM ET: New Home Sales for April from the Census Bureau.

10:00 AM ET: New Home Sales for April from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the March sales rate.

The consensus is for a decrease in sales to 604 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 621 thousand in March.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for March 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.67 million SAAR, down from 5.71 million in March.

10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.67 million SAAR, down from 5.71 million in March.Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million SAAR for April.

During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

2:00 PM: FOMC Minutes for the Meeting of May 2 - 3, 2017

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 237 thousand initial claims, up from 232 thousand the previous week.

11:00 AM: the Kansas City Fed manufacturing survey for May.

8:30 AM: Durable Goods Orders for April from the Census Bureau. The consensus is for a 0.9% decrease in durable goods orders.

8:30 AM: Gross Domestic Product, 1st quarter 2017 (Second estimate). The consensus is that real GDP increased 0.8% annualized in Q1, up from the advance estimate of 0.7%.

10:00 AM: University of Michigan's Consumer sentiment index (final for May). The consensus is for a reading of 97.6, down from the preliminary reading 97.7.

Friday, May 19, 2017

Oil: "Another Surge" in Rig Count

by Calculated Risk on 5/19/2017 05:06:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 19, 2017:

• Another smokin’ week for the rig count

• Total US oil rigs were up 8 to 720

• US horizontal oil rigs added 14 to 621

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Merrill: "Will it be a summer break for the Fed?"

by Calculated Risk on 5/19/2017 01:14:00 PM

A few excerpts from a Merrill Lynch research piece: Will it be a summer break for the Fed?

The US stock market witnessed its biggest sell-off of the year on Wednesday while Treasuries rallied and the market priced in a shallower path for rate hikes. The expectation for a June hike slipped to approximately 70% from near certainty earlier in the week. We are puzzled that the market remains committed to a hike in June but skeptical about future hikes in 2018. In our view, June is a close call and will be sensitive to financial conditions in the next few weeks. We are therefore holding to our forecast that the Fed will pause at the upcoming meeting, but the Fed’s narrative between now and June 3rd (blackout period begins) will be critical for the call.

...

Even before this week’s events, we had been arguing that June was a close call for the following reasons:

1. Inflation has slowed: While the March weakness was due to "special factors" the disappointment in April was widespread. This has prompted us to revise down our forecast for core PCE inflation this year to 1.7% from 1.9% previously (see the Hot Topic). Meanwhile, wage growth remains sticky, which could lead the Fed to revise down their estimate of NAIRU in June’s SEP.

2. Credit conditions have deteriorated: According to the Fed's own loan officer survey, demand for consumer loans declined over the prior three months while banks have continued to tighten lending standards.

3. Real activity data have surprised to the downside: Survey measures have come off the highs and hard data have been mixed to slightly weaker, sending data surprise measures lower.

4. The Fed's narrative is stale: The April FOMC statement was a placeholder given the uncertainty around the data. The Fed can easily change the narrative about the June meeting in the coming two weeks.

...

We think the June meeting remains a close call and would put the probability of a hike at just under even odds – 45% chance of a hike and 55% of a pause. Conditional on the Fed not hiking in June, we think the probability of a hike in September is about 70%.

emphasis added

BLS: Unemployment Rates Lower in 10 states in April, Three States at New Series Lows

by Calculated Risk on 5/19/2017 10:21:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in April in 10 states, higher in 1 state, and stable in 39 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Nineteen states had jobless rate decreases from a year earlier, and 31 states and the District had little or no change

...

Colorado had the lowest unemployment rate in April, 2.3 percent, followed by Hawaii and North Dakota, 2.7 percent each. The rates in Arkansas (3.5 percent), Colorado (2.3 percent), and Oregon (3.7 percent) set new series lows. (All state series begin in 1976.) New Mexico and Alaska had the highest jobless rates, 6.7 percent and 6.6 percent, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

The states are ranked by the highest current unemployment rate. New Mexico, at 6.7%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently no state has an unemployment rate at or above 7% (light blue); Only two states are at or above 6% (dark blue). The states are New Mexico (6.7%), and Alaska (6.6%).

Thursday, May 18, 2017

Sacramento Housing in April: Sales down 3%, Active Inventory down 16% YoY

by Calculated Risk on 5/18/2017 01:03:00 PM

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

This data suggested healing in the Sacramento market and other distressed markets showed similar improvement. Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In April, total sales were down 2.7% from April 2016, and conventional equity sales were down 0.8% compared to the same month last year.

In April, 4.7% of all resales were distressed sales. This was down from 5.5% last month, and down from 6.5% in April 2016.

The percentage of REOs was at 2.8%, and the percentage of short sales was 1.9%.

Here are the statistics.

This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 15.7% year-over-year (YoY) in April. This was the 24th consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 15.6% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Philly Fed: "Regional manufacturing activity continued to expand" in May

by Calculated Risk on 5/18/2017 09:11:00 AM

From the Philly Fed: Current Indicators Reflect Continued Growth

Results from the May Manufacturing Business Outlook Survey suggest that regional manufacturing activity continued to expand this month. The diffusion indexes for general activity and shipments improved notably from their April readings. The indexes for new orders and employment, however, fell modestly from last month but remained at high readings. Although most of the survey’s future indicators fell this month, the readings suggest that most firms still expect growth to continue over the next six months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

...

The index for current manufacturing activity in the region increased from a reading of 22.0 in April to 38.8 this month. The index has been positive for 10 consecutive months. This month, the index recovered some of the declines of the previous two months, but it still remains slightly below its high reading of 43.3 in February ...

...

Firms reported an increase in manufacturing employment this month, but the current employment index fell 3 points. The index has remained positive for six consecutive months. The percentage of firms reporting an increase in employment was 23 percent, lower than the 27 percent that reported increases in April. Firms also reported an increase in work hours this month: The average workweek index remained positive for the seventh consecutive month and increased 3 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through April) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

This suggests the ISM manufacturing index will show solid expansion in May.

Weekly Initial Unemployment Claims decrease to 232,000

by Calculated Risk on 5/18/2017 08:33:00 AM

The DOL reported:

In the week ending May 13, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 4,000 from the previous week's unrevised level of 236,000. The 4-week moving average was 240,750, a decrease of 2,750 from the previous week's unrevised average of 243,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 240,750.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, May 17, 2017

Mortgage Rates Decline to 4%

by Calculated Risk on 5/17/2017 05:25:00 PM

From Matthew Graham at Mortgage News Daily: Rates Respond to Political Scandal by Plummeting to 2017 Lows

Mortgage rates surged significantly lower today, as a part of a broad-based market movement following a political scandal that began taking shape yesterday afternoon. You can choose your preferred media outlet to digest all of the details, but the issue surrounds communications between Trump, former FBI Director Comey, and the potential for the details of those communications to be demanded by House Oversight Chair Chaffetz.Here is a table from Mortgage News Daily:

...

We're often talking about just how small the day-to-day movements are that we're tracking in these daily write-ups. Today was an exception, with most lenders moving a full eighth of a percentage point lower in rate. That's the king of improvement we only see a few times a year. This time, it brought conventional 30yr fixed rates to the best levels of 2017. Many of the best-qualified borrowers will be seeing quotes in the 3.875%-4.0% range now as opposed to 4.0-4.125% before today.

emphasis added

Lawler: Early Read on Existing Home Sales in April

by Calculated Risk on 5/17/2017 01:45:00 PM

From housing economist Tom Lawler:

Based on publicly available state and local realtor/MLS reports released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.56 million in April, down 2.6% from March’s preliminary pace and up 1.5% from last April’s seasonally adjusted pace. Unadjusted sales as estimated by the NAR last month should be about 2.8% LOWER than last April’s pace, with the “adjusted/unadjusted” YOY growth difference reflecting this April’s lower business day count, as well as the different timing of Easter (April 16 this year vs. March 27 last year.)

On the inventory front, local realtor/MLS data suggest that the monthly increase in the number of homes for sale last month was slightly higher than last April’s increase, and I project that the NAR’s estimate of the existing home inventory for April will be 2.00 million, up 9.3% from March and down 5.7% from last April.

Finally, realtor/MLS suggest that the NAR’s estimate of the median existing single-family home sales price for April will be up about 7.0% from last April.

Areas that experienced a double-digit decline in YOY home sales included, but were not limited to, Portland (Oregon), Minneapolis, DC (city), San Francisco Bay Area, Boston, New Hampshire, South Central Wisconsin (includes Dane County), Spokane, Peoria, Springfield (Illinois), Louisville, and Grand Rapids.

emphasis added

CR Note: The NAR is scheduled to release existing home sales for April next Wednesday, May 24th. The early consensus is for sales of 5.71 million SAAR (take the under).

NY Fed: "Household Debt Surpasses its Peak Reached During the Recession in 2008"

by Calculated Risk on 5/17/2017 11:13:00 AM

The Q1 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Surpasses its Peak Reached During the Recession in 2008

The Federal Reserve Bank of New York today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt reached $12.73 trillion in the first quarter of 2017 and finally surpassed its $12.68 trillion peak reached during the recession in 2008. This marked a $149 billion (1.2%) quarterly increase and nearly three years of continued growth since the long period of deleveraging following the Great Recession.

...

“Almost nine years later, household debt has finally exceeded its 2008 peak but the debt and its borrowers look quite different today. This record debt level is neither a reason to celebrate nor a cause for alarm. But it does provide an opportune moment to consider debt performance,” said Donghoon Lee, Research Officer at the New York Fed. “While most delinquency flows have improved markedly since the Great Recession and remain low overall, there are divergent trends among debt types. Auto loan and credit card delinquency flows are now trending upwards, and those for student loans remain stubbornly high.”

Mortgage balances increased again while originations declined and median credit scores of borrowers for new mortgages increased, reflecting tightening underwriting.

Mortgage delinquencies worsened slightly and foreclosure notations increased but remained low by historical standards.

...

Bankruptcy notations reached another low the 18-year history of this series.

This quarter saw a notable uptick in credit card debt transitioning into delinquencies, a continued upward trend of auto loans transitioning into serious delinquencies, and student loan transitions into serious delinquencies remaining high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1. Household debt previously peaked in 2008, and bottomed in Q2 2013.

Mortgage debt increased in Q1, from the NY Fed:

Mortgage balances, the largest component of household debt, increased again during the first quarter. Mortgage balances shown on consumer credit reports on March 31 stood at $8.63 trillion, an increase of $147 billion from the fourth quarter of 2016. Balances on home equity lines of credit (HELOC) declined by $17 billion and now stand at $456 billion. Non-housing balances were mixed in the first quarter. Auto loans and student loan balances grew, by $10 billion and $34 billion respectively, while credit card balances declined by $15 billion.

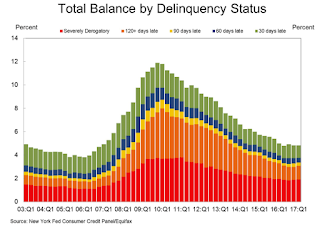

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate was mostly unchanged in Q1. From the NY Fed:

Aggregate delinquency rates were roughly flat in the first quarter of 2017, with some variation across product types. As of March 31, 4.8% of outstanding debt was in some stage of delinquency. Of the $615 billion of debt that is delinquent, $426 billion is seriously delinquent (at least 90 days late or “severely derogatory”).