by Calculated Risk on 1/04/2017 03:00:00 PM

Wednesday, January 04, 2017

U.S. Light Vehicle Sales increase to 18.3 million annual rate in December, Record Year

Based on a preliminary estimate from WardsAuto, light vehicle sales were at a 18.29 million SAAR in December.

That is up about 5% from December 2015, and up 3% from the 17.75 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for December (red, light vehicle sales of 18.29 million SAAR from WardsAuto).

This was above the consensus forecast.

From John Sousanis at WardsAuto December 2016 U.S. LV Sales Thread: U.S. Automakers Set Light-Vehicle Sales Record in 2016

U.S. automakers outpaced analyst expectations in December, ensuring that 2016 was the best year for light-vehicle sales ever. A total of 1.68 million LVs were sold in the final month of the year, edging the full-year tally 0.4% over the prior record, set in 2015.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

Sales for 2016 hit a new annual record.

Sales in 2016 were at 17.465 million, up from the previous record of 17.396 million set last year.

Reis: Office Vacancy Rate declined in Q4 to 15.7%

by Calculated Risk on 1/04/2017 09:28:00 AM

Reis released their Q4 2016 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 15.7% in Q4, down from 15.9% in Q3. This is down from 16.2% in Q4 2015, and down from the cycle peak of 17.6%.

From Reis Economist Barbara Denham:

The office market saw stronger demand in the fourth quarter than in the previous three as net absorption (increase in occupancy) exceeded new supply by the widest margin since before the recession. Still, office rent growth decelerated in the quarter to 0.3%. Office rents have decelerated all year.

The national vacancy rate declined to 15.7% in the fourth quarter of 2016 from 15.9% in the third quarter and 16.2% at year-end 2015. ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 15.7% in Q4. The office vacancy rate is at the lowest level since early 2009, but remains elevated.

Office vacancy data courtesy of Reis.

MBA: Mortgage Applications Decreased Over Two Week Period

by Calculated Risk on 1/04/2017 07:00:00 AM

From the MBA: Mortgage Applications Decreased Over Two Week Period in Latest MBA Weekly Survey

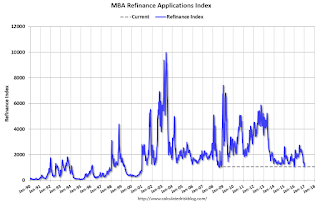

Mortgage applications decreased 12 percent from two weeks earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 30, 2016. The results included adjustments to account for the Christmas holiday.

... The Refinance Index decreased 22 percent from two weeks ago. The seasonally adjusted Purchase Index decreased 2 percent from two weeks earlier. The unadjusted Purchase Index decreased 41 percent compared with two weeks ago and was 1 percent lower than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.39 percent from 4.45 percent, with points increasing to 0.43 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With the current level of mortgage rates, refinance activity will probably decline further.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The purchase index was "1 percent lower than the same week one year ago".

Even with the increase in mortgage rates, purchase activity is still holding up. However refinance activity has declined significantly.

Tuesday, January 03, 2017

Wednesday: Auto Sales, Office Vacancy Survey, FOMC Minutes

by Calculated Risk on 1/03/2017 06:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Lowest in Weeks

Mortgage rates improved slightly to begin 2017, bringing them to the lowest levels in nearly a month, on average. December 8th was the last time rates were lower. During December, conventional 30yr fixed quotes were straying into the 4.375%-4.5% territory for many lenders. Now, nearly every lender is back down to 4.25% at least, with several already down to 4.125%. These rates assume a top tier scenario with no negative adjustments.Wednesday:

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• Early, Reis Q4 2016 Office Survey of rents and vacancy rates.

• All day: Light vehicle sales for December. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in December, from 17.9 million in November (Seasonally Adjusted Annual Rate).

• At 2:00 PM, The Fed will release the FOMC minutes for the December meeting.

Construction Spending increased in November

by Calculated Risk on 1/03/2017 02:34:00 PM

Earlier today, the Census Bureau reported that overall construction spending increased in November:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during November 2016 was estimated at a seasonally adjusted annual rate of $1,182.1 billion, 0.9 percent above the revised October estimate of $1,171.4 billion. The November figure is 4.1 percent above the November 2015 estimate of $1,135.5 billionBoth private and public spending increased in November:

During the first 11 months of this year, construction spending amounted to $1,070.9 billion, 4.4 percent above the $1,025.5 billion for the same period in 2015.

Spending on private construction was at a seasonally adjusted annual rate of $892.8 billion, 1.0 percent above the revised October estimate of $884.3 billion ...

In November, the estimated seasonally adjusted annual rate of public construction spending was $289.3 billion, 0.8 percent above the revised October estimate of $287.1 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been generally increasing, but is 32% below the bubble peak.

Non-residential spending is now 4% above the previous peak in January 2008 (nominal dollars).

Public construction spending is now 11% below the peak in March 2009, and 10% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 3%. Non-residential spending is up 6% year-over-year. Public spending is up 3% year-over-year.

Looking forward, all categories of construction spending should increase in the coming year.

This was above the consensus forecast of a 0.6% increase for November. A solid report.

CoreLogic: House Prices up 7.1% Year-over-year in November

by Calculated Risk on 1/03/2017 11:31:00 AM

Notes: This CoreLogic House Price Index report is for November. The recent Case-Shiller index release was for October. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Prices Up 7.1 Percent in November 2016

Home prices nationwide, including distressed sales, increased year over year by 7.1 percent in November 2016 compared with November 2015 and increased month over month by 1.1 percent in November 2016 compared with October 2016, according to the CoreLogic HPI.

...

“Last summer’s very low mortgage rates sparked demand, and with for-sale inventories low, the result has been a pickup in home-price growth,” said Dr. Frank Nothaft, chief economist for CoreLogic. “With mortgage rates higher today and expected to rise even further in 2017, our national Home Price Index is expected to slow to 4.7 percent year over year by November 2017.”

“Home prices continue to march higher, with home prices in 27 states above their pre-crisis peak levels,” said Anand Nallathambi, president and CEO of CoreLogic. “Nationally, the CoreLogic Home Price Index remains 4 percent below its April 2006 peak, but should surpass that peak by the end of 2017.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.1% in November (NSA), and is up 7.1% over the last year.

This index is not seasonally adjusted, and this was another solid month-to-month increase.

The index is still 4.1% below the bubble peak in nominal terms (not inflation adjusted).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The second graph shows the YoY change in nominal terms (not adjusted for inflation).The YoY increase had been moving sideways over the last two years, but might have picked up recently (the recent pickup could be revised away).

The year-over-year comparison has been positive for almost five consecutive months since turning positive year-over-year in February 2012.

ISM Manufacturing index increased to 54.7 in December

by Calculated Risk on 1/03/2017 10:06:00 AM

The ISM manufacturing index indicated expansion in December. The PMI was at 54.7% in December, up from 53.2% in November. The employment index was at 53.1%, up from 52.3% last month, and the new orders index was at 60.2%, up from 53.0%.

From the Institute for Supply Management: December 2016 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in December, and the overall economy grew for the 91st consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. “The December PMI® registered 54.7 percent, an increase of 1.5 percentage points from the November reading of 53.2 percent. The New Orders Index registered 60.2 percent, an increase of 7.2 percentage points from the November reading of 53 percent. The Production Index registered 60.3 percent, 4.3 percentage points higher than the November reading of 56 percent. The Employment Index registered 53.1 percent, an increase of 0.8 percentage point from the November reading of 52.3 percent. Inventories of raw materials registered 47 percent, a decrease of 2 percentage points from the November reading of 49 percent. The Prices Index registered 65.5 percent in December, an increase of 11 percentage points from the November reading of 54.5 percent, indicating higher raw materials prices for the 10th consecutive month. The PMI®, New Orders, Production and Employment Indexes all registered new highs for the year 2016, and the forward-looking comments from the panel are largely positive.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.8%, and suggests manufacturing expanded at as faster pace in December than in November.

Another solid report.

Monday, January 02, 2017

Tuesday: ISM Manufacturing, Construction Spending

by Calculated Risk on 1/02/2017 08:12:00 PM

Weekend:

• Schedule for Week of Jan 1, 2017

Tuesday:

• 10:00 AM ET, ISM Manufacturing Index for December. The consensus is for the ISM to be at 53.8, up from 53.2 in November. The ISM manufacturing index indicated expansion at 53.2% in November. The employment index was at 52.3%, and the new orders index was at 53.0%.

• Also at 10:00 AM, Construction Spending for November. The consensus is for a 0.6% increase in construction spending.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 7, and DOW futures are up 75 (fair value).

Oil prices were up over the last week with WTI futures at $54.01 per barrel and Brent at $56.82 per barrel. A year ago, WTI was at $36, and Brent was at $37 - so oil prices are up about 50% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.35 per gallon - a year ago prices were at $2.00 per gallon - so gasoline prices are up about 35 cents per gallon year-over-year.

Question #7 for 2017: How much will wages increase in 2017?

by Calculated Risk on 1/02/2017 12:26:00 PM

Last week I posted some questions for 2017: Ten Economic Questions for 2017. I'll try to add some thoughts, and maybe some predictions for each question.

7) Real Wage Growth: Wage growth picked up in 2016. How much will wages increase in 2017?

The most followed wage indicator is the “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report.

The blue line shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth had been running close to 2% since 2010, and picked up a little in 2015, and more in 2016.

As the labor market tightens, nominal wages growth will probably increase further in 2017.

The red line is real wage growth (adjusted using headline CPI). Real wages increased during the crisis because CPI declined sharply. CPI was very low in 2015 - due to the decline in oil prices - so real wage growth picked up in 2015.

There are two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation. All three data series are different, and most of the focus recently has been the CES series (used in the graph above).

![]()

The second graph is from the Atlanta Fed Wage Tracker. This measure is the year-over-year change in nominal wages for individuals.

By following wage changes for individuals, this removes the demographic composition effects (older workers who are retiring tend to be higher paid, and younger workers just entering the workforce tend to be lower paid). The composition effect lower the overall year-over-year change as seen in graph 1.

The Atlanta Fed Wage tracker shows nominal wages are increasing close to 4%. A solid year-over-year gain.

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Altanta Fed Wage Tracker. Perhaps nominal wages will increase more than 3% in 2017 according to the CES.

Here are the Ten Economic Questions for 2017 and a few predictions:

• Question #1 for 2017: What about fiscal and regulatory policy in 2017?

• Question #2 for 2017: How much will the economy grow in 2017?

• Question #3 for 2017: Will job creation slow further in 2017?

• Question #4 for 2017: What will the unemployment rate be in December 2017?

• Question #5 for 2017: Will the core inflation rate rise in 2017? Will too much inflation be a concern in 2017?

• Question #6 for 2017: Will the Fed raise rates in 2017, and if so, by how much?

• Question #7 for 2017: How much will wages increase in 2017?

• Question #8 for 2017: How much will Residential Investment increase?

• Question #9 for 2017: What will happen with house prices in 2017?

• Question #10 for 2017: Will housing inventory increase or decrease in 2017?

Sunday, January 01, 2017

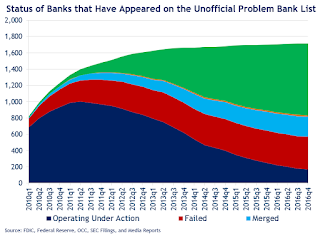

December 2016: Unofficial Problem Bank list declines to 169 Institutions, Q4 2016 Transition Matrix

by Calculated Risk on 1/01/2017 11:18:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources. Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for December 2016. During the month, the list fell from 173 institutions to 169 after five removals and one addition. Assets dropped by $15 billion to an aggregate $45 billion. A year ago, the list held 250 institutions with assets of $75 billion.

This month, actions have been terminated against Flagstar Bank, FSB, Troy, MI ($14.2 billion Ticker: FBC); First Central Savings Bank, Glen Cove, NY ($537 million); International Bank, Raton, NM ($302 million); North Alabama Bank, Hazel Green, AL ($95 million); and Home Federal Bank of Hollywood, Hallandale Beach, FL ($41 million).

The addition this month was Heartland Bank, Little Rock, AR ($219 million).

With it being the end of the fourth quarter, we bring an updated transition matrix to detail how banks are moving off the Unofficial Problem Bank List. Since the Unofficial Problem Bank List was first published on August 7, 2009 with 389 institutions, a total of 1,716 institutions have appeared on a weekly or monthly list at some point. Only 9.8 percent of the banks that have appeared on the list remain today. In all, there have been 1,547 institutions that have transitioned through the list. Departure methods include 883 action terminations, 400 failures, 248 mergers, and 16 voluntary liquidations. Of the 389 institutions on the first published list, 18 or 4.6 percent still remain more than seven years later. The 400 failures represent 23.3 percent of the 1,713 institutions that have made an appearance on the list. This failure rate is well above the 10-12 percent rate frequently cited in media reports on the failure rate of banks on the FDIC's official list.

During this fourth quarter, only eight banks were removed because of an improved financial condition. These eight removals represented only 4.5 percent of the 177 banks at the start of the quarter. This is the smallest number and rate of removal due to rehabilitation since the list was first published. Of note this quarter, is the removal of Flagstar Bank, FSB and its $14.2 billion in assets. This significantly narrows the asset differential to around $10 billion between the unofficial and the FDIC’s official figures. In its last release, the FDIC said there were 132 banks with assets of $35 billion on the official list. Subsequent to the release of the official figures, the FDIC placed First NBC Bank with assets of $4.9 billion under an enforcement action. Hence, we expect for the official figures to show an asset increase when they are released at the end of February 2017.

| Unofficial Problem Bank List | |||

|---|---|---|---|

| Change Summary | |||

| Number of Institutions | Assets ($Thousands) | ||

| Start (8/7/2009) | 389 | 276,313,429 | |

| Subtractions | |||

| Action Terminated | 170 | (63,869,745) | |

| Unassisted Merger | 40 | (9,818,439) | |

| Voluntary Liquidation | 4 | (10,584,114) | |

| Failures | 157 | (184,803,449) | |

| Asset Change | (1,348,079) | ||

| Still on List at 12/31/2016 | 18 | 5,889,603 | |

| Additions after 8/7/2009 | 151 | 39,069,010 | |

| End (12/31//2016) | 169 | 44,958,613 | |

| Intraperiod Deletions1 | |||

| Action Terminated | 713 | 300,183,934 | |

| Unassisted Merger | 208 | 80,570,288 | |

| Voluntary Liquidation | 12 | 2,474,477 | |

| Failures | 243 | 119,858,467 | |

| Total | 1,176 | 503,087,166 | |

| 1Institution not on 8/7/2009 or 12/31/2016 list but appeared on a weekly list. | |||