by Calculated Risk on 11/22/2016 10:09:00 AM

Tuesday, November 22, 2016

Existing Home Sales increased in October to 5.60 million SAAR

From the NAR: Existing-Home Sales Jump Again in October

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, grew 2.0 percent to a seasonally adjusted annual rate of 5.60 million in October from an upwardly revised 5.49 million in September. October's sales pace is 5.9 percent above a year ago (5.29 million) and surpasses June's pace (5.57 million) as the highest since February 2007 (5.79 million). ...

Total housing inventory 3 at the end of October declined 0.5 percent to 2.02 million existing homes available for sale, and is now 4.3 percent lower than a year ago (2.11 million) and has fallen year-over-year for 17 straight months. Unsold inventory is at a 4.3-month supply at the current sales pace, which is down from 4.4 months in September.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October (5.60 million SAAR) were 2.0% higher than last month, and were 5.9% above the October 2015 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.02 million in October from 2.03 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 2.02 million in October from 2.03 million in September. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.3% year-over-year in October compared to October 2015.

Inventory decreased 4.3% year-over-year in October compared to October 2015. Months of supply was at 4.3 months in October.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Monday, November 21, 2016

Tuesday: Existing Home Sales

by Calculated Risk on 11/21/2016 07:37:00 PM

Tuesday:

• At 10:00 AM, Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, down from 5.47 million in September.

Housing economist Tom Lawler expects the NAR to report sales of 5.47 million SAAR in October, unchanged from September's preliminary pace.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for November.

Quarterly Housing Starts by Intent

by Calculated Risk on 11/21/2016 03:11:00 PM

In addition to housing starts for October, the Census Bureau also released the Q3 "Started and Completed by Purpose of Construction" report last week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released last week showed there were 150,000 single family starts, built for sale, in Q3 2016, and that was close to the 148,000 new homes sold for the same quarter, so inventory increased slightly in Q3 (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 2% compared to Q3 2015.

Owner built starts were up 4% year-over-year. And condos built for sale not far above the record low.

The 'units built for rent' has increased significantly in recent years, but is now moving more sideways.

Vehicle Sales Forecast: Sales Over 17 Million SAAR Again in November, Possible Record Year in 2016

by Calculated Risk on 11/21/2016 11:07:00 AM

The automakers will report November vehicle sales on Thursday, December 1st.

Note: There were 25 selling days in November 2016, up from 23 in November 2015.

From WardsAuto: Forecast November U.S. Light-Vehicle Sales Leave Potential for Record Year

U.S. light-vehicle sales results are expected to track above the year-to-date pace for the third straight month in November, leaving open the possibility that 2016 still could finish with record volume.Here is a table (source: BEA) showing the 5 top years for light vehicle sales through October, and the top 5 full years. 2016 will probably finish in the top 3, and could be the best year ever - just beating last year.

With an upward bias, November sales are forecast to end at a 17.7 million-unit seasonally adjusted annual rate, the third consecutive month the SAAR finished above the year-to-date total, which stands at 17.3 million through October.

...

If November’s outlook holds firm, year-to-date volume will total 15.8 million units, a smidgeon above 11-month 2015’s 15.7 million, but keeping the prospect alive that 2016 could end as a record year.

...

WardsAuto is forecasting 2016 to end ahead of 2015. An initial look at December points to a 17.8 million SAAR. Based on the November-December projections, sales will end the year slightly above 17.4 million units, barely topping 2015’s record volume of 17.396 million.

emphasis added

| Light Vehicle Sales, Top 5 Years and Through October | ||||

|---|---|---|---|---|

| Through October | Full Year | |||

| Year | Sales (000s) | Year | Sales (000s) | |

| 1 | 2000 | 14,877 | 2015 | 17,396 |

| 2 | 2001 | 14,487 | 2000 | 17,350 |

| 3 | 2015 | 14,443 | 2001 | 17,122 |

| 4 | 2016 | 14,409 | 2005 | 16,948 |

| 5 | 2005 | 14,307 | 1999 | 16,894 |

Chicago Fed "Economic Growth Increased Slightly in October"

by Calculated Risk on 11/21/2016 09:13:00 AM

From the Chicago Fed: Economic Growth Increased Slightly in October

The Chicago Fed National Activity Index (CFNAI) increased to –0.08 in October from –0.23 in September. All four broad categories of indicators that make up the index increased from September, but all four categories again made nonpositive contributions to the index in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, edged down to –0.27 in October from –0.20 in September. October’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat below the historical trend in October (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, November 20, 2016

Sunday Night Futures

by Calculated Risk on 11/20/2016 07:34:00 PM

Weekend:

• Schedule for Week of Nov 20, 2016

• Some early Thoughts on the Impact of the Trump Economic Policies

• Goldman: "2017 Outlook: Under New Management"

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for October. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $46.14 per barrel and Brent at $47.36 per barrel. A year ago, WTI was at $39, and Brent was at $42 - so oil prices are up year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.13 per gallon - a year ago prices were at $2.09 per gallon - so gasoline prices are up slightly year-over-year.

Some early Thoughts on the Impact of the Trump Economic Policies

by Calculated Risk on 11/20/2016 08:11:00 AM

Just a few thoughts about the economic impact of the Trump plan ...

First, in broad brushes, the Trump economic plan seems to be:

1) Renegotiate trade deals and / or impose tariffs.

2) Stricter enforcement and control on immigration, and the deportation of illegal immigrants.

3) Significant Infrastructure spending.

4) Tax cuts mostly for high income earners and corporations.

5) No changes to Social Security and Medicare.

6) Deregulation.

We can see why this appeals to many Trump supporters: More favorable trade deals or tariffs means less price competition for domestic producers of goods. Less immigration (and deportations) means less labor competition in the U.S.. More government infrastructure spending means more jobs. Small business owners like the sound of deregulation. And everyone likes tax cuts, even if most of the benefits accrue to high income earners.

Mr. Trump has also promised no changes to Social Security and Medicare. I've spoken to several Trump supporters - who are counting on social security and medicare in retirement - and they believe strongly that Mr. Trump will protect both programs (House Speaker Paul Ryan says they will privatize Medicare, but Mr. Trump's supporters don't think that will happen).

Most analysts think there will be fiscal stimulus in 2017 and 2018, with a combination of tax cuts and some increase in infrastructure spending. In general, analysts believe that any changes to trade agreements will take time, and that deportations will not increase significantly. The bottom line for analysts is that the portions of the program that will boost the economy in the short term will be enacted, and the portions that won't (trade deals, deportations) and changes to the ACA (Obamacare) will be delayed.

This is why analysts have been somewhat positive on the impact of the Trump economic proposals for 2017. However no one knows what will actually be proposed. What matters is the details.

A few thoughts on the details:

Members of Mr. Trump's team have been talking about a $1 trillion infrastructure plan. However the infrastructure proposal is really a proposal for about $100+ billion in tax credits to spur private investment in infrastructure. The $1 trillion in infrastructure investment is the projected size of the private investment, not the proposed government spending. This proposal is actually very modest in terms of a fiscal boost. If this is a privatization scheme, then there might be a modest short term boost, but the long term impact will be negative.

On trade, there are winners and losers. Everyone who shops at WalMart and other large retailers benefits from lower prices due to imports, however for people who have lost jobs because of cheaper imported goods, the lower prices does not offset their lower wages (these are the losers). If there are tariffs, everyone will pay more at WalMart, and some people might get higher paying jobs in the U.S.. There are winners and losers - but the net impact of tariffs on the U.S. economy will probably be negative.

On deregulation: Usually regulations are intended to prevent long term negative events, so deregulating has a short term positive impact - even if the regulation is important. An example would be FDA drug approval. If the FDA stopped regulating drugs, there would be snake oil salesmen everywhere. The negative impact of the non-approved treatments would not be realized for some time, and the victims would have no recourse later - since the snake oil salesmen would have moved on. The FDA is not perfect, but these are necessary regulations to protect consumers. The same is true for banking regulation (as we learned during the great recession).

And on tax cuts: Most of the benefits will probably go to high income earners. These are people with a propensity to save, so the boost to the economy will be modest.

I expect the estate tax will be repealed and that will increase wealth inequality in the U.S.. Most people don't realize that the estate tax only falls on a few estates - and that much of the wealth that is transferred to heirs has never been taxed! As an example, imagine that someone owns stock in a company, or owns real estate, for many years. And the stock or real estate appreciates significantly. When the individual dies, there is a step-up in basis to the current market value - and the capital gain on the appreciation is never paid. Just something to remember when this debate heats up.

Bottom line: we need to wait for the details, but there will probably be a modest stimulus boost for 2017.

Saturday, November 19, 2016

Goldman: "2017 Outlook: Under New Management"

by Calculated Risk on 11/19/2016 03:25:00 PM

A few excerpts from analysis by Goldman Sachs economists Zach Pandl and Jan Hatzius: 2017 Outlook: Under New Management

The prospects for significant changes in policy under the new administration and an economy moving into the later stages of the business cycle implies high uncertainty, and an especially interesting US economic outlook this year. We think the odds of a recession over the next 1-2 years continue to look relatively low, and see signs of firming growth in recent data ...CR Note: I have more thoughts on policy soon.

Any fiscal stimulus from the next administration would be an added tailwind for 2017 growth, and we think meaningful tax and spending legislation is likely next year. However, we would caution that (1) the current fiscal backdrop may limit the scope for large deficit-financed tax cuts or spending increases, (2) aspects of the Trump agenda, such as trade restrictions, are less favorable for growth, and (3) the economy is already operating close to full employment, which limits the possible upside to growth without generating higher inflation.

...

For most of the last eight years, policymakers have been solely focused on shoring up the recovery; today they also must consider the risk of overdoing it. Given above-trend growth, and with the prospect of fiscal stimulus, we see the US economy moving into modest disequilibrium over the next 1-2 years, with an unemployment rate falling below its long-run sustainable rate, and inflation rising above the Fed’s target.

emphasis added

Schedule for Week of Nov 20, 2016

by Calculated Risk on 11/19/2016 10:47:00 AM

The key economic reports this week are October News Home sales and Existing Home sales.

Happy Thanksgiving to All!

8:30 AM ET: Chicago Fed National Activity Index for October. This is a composite index of other data.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, down from 5.47 million in September.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, down from 5.47 million in September.Housing economist Tom Lawler expects the NAR to report sales of 5.47 million SAAR in October, unchanged from September's preliminary pace.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for November.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 250 thousand initial claims, up from 235 thousand the previous week.

8:30 AM: Durable Goods Orders for October from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

9:00 AM: FHFA House Price Index for September 2016. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.7% month-to-month increase for this index.

10:00 AM ET: New Home Sales for September from the Census Bureau.

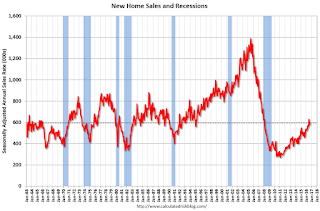

10:00 AM ET: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for an decrease in sales to 590 thousand Seasonally Adjusted Annual Rate (SAAR) in October from 593 thousand in September.

10:00 AM: University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 91.6, unchanged from the preliminary reading 91.6.

2:00 PM: FOMC Minutes for Meeting of November 1-2

All US markets will be closed in observance of the Thanksgiving Day Holiday.

The NYSE and the NASDAQ will close at 1:00 PM ET.

Friday, November 18, 2016

Mortgage "Rates Rip to Highest Levels Since July 2015"

by Calculated Risk on 11/18/2016 05:59:00 PM

From Matthew Graham at Mortgage News Daily: Rates Rip to Highest Levels Since July 2015

It was all pain, all the time for mortgage rates today. Since the election, the average conventional 30yr fixed rate has risen roughly 0.5%, putting November 2016 on a short list of 4 worst months in more than a decade. Two of those months were back to back amid the 2013 taper tantrum and the other was at the end of 2010. Let it be known that the recent surge in rates is more than a mere post-election knee-jerk. Financial markets are fully repricing their expectations of the future, and we can't even begin to assess how that future might actually pan out until Trump takes office.CR Note: Refinance activity will decline sharply, and I expect some slowdown in housing (still thinking about this).

In other words, buckle up for a higher mortgage rate environment. Rates won't necessarily be immune from good days over the next few months, but I certainly wouldn't expect a quick, triumphant return to the promised land (rates from 2 weeks ago, and below) within the same time frame. The most prevalent conventional 30yr fixed rate quote is now 4.125% on top tier scenarios, and more than a few lenders are already up to 4.25%.

emphasis added

Here is a table from Mortgage News Daily: