by Calculated Risk on 2/22/2016 07:15:00 PM

Monday, February 22, 2016

Tuesday: Existing Home Sales, Case-Shiller House Prices, Richmond Fed Mfg Survey

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways Again; Anxiety Builds

For now, the most prevalently-quoted conventional 30yr fixed rate remains 3.625% on top tier scenarios. Some of the less aggressive lenders are back up to 3.75%, but that was the case as of late last week as well.Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices. The consensus is for a 5.9% year-over-year increase in the Comp 20 index for November. The Zillow forecast is for the National Index to increase 5.3% year-over-year in November.

• At 10:00 AM, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.46 million in December. Economist Tom Lawler expects the NAR to report sales of 5.36 million SAAR for January.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for February.

A comment on the January Black Knight Mortgage Delinquency Data

by Calculated Risk on 2/22/2016 04:43:00 PM

This morning I posted some mortgage delinquency data from Black Knight (formerly LPS). The data showed an increase in delinquencies in January to 5.09%. Several people asked me if this is a leading indicator of a potential problem. The answer is no.

Here is what I wrote in 2012 when the delinquency rate was at 8%:

At the current rate of decline, the number of delinquent lonas will be back to "normal" in about three years (around 4.5% to 5% of loans are delinquent even in good times). However the number of loans in the foreclosure process hasn't change year-over-year - although that will probably change soon with the mortgage servicer settlement (around 0.5% of loans in foreclosure is "normal").The percent of loans in delinquency is now close to the normal range, although there are still an excessive number of seriously delinquent loans. As the delinquency rate approaches normal, it will not be unusual for the rate to increase in some months - no worries.

Note that the number of loans in the foreclosure process is still way above normal at 1.30% in January 2016; the lenders are still working through the backlog.

DOT: Vehicle Miles Driven increased 4.2% year-over-year in December

by Calculated Risk on 2/22/2016 12:51:00 PM

With lower gasoline prices, driving has really picked up!

The Department of Transportation (DOT) reported today:

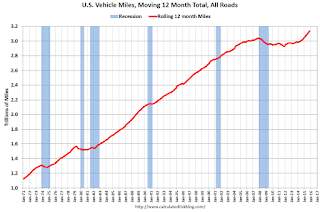

Travel on all roads and streets changed by 4.2% (10.6 billion vehicle miles) for December 2015 as compared with December 2014.The following graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Travel for the month is estimated to be 264.2 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for December 2015 is 268.5 billion miles, a 4.0% (10.4 billion vehicle miles) increase over December 2014. It also represents a 1.4% change (3.7 billion vehicle miles) compared with November 2015.

The rolling 12 month total is moving up - mostly due to lower gasoline prices - after moving sideways for several years.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Miles driven (rolling 12) had been below the previous peak for 85 months - an all time record - before reaching a new high for miles driven in January.

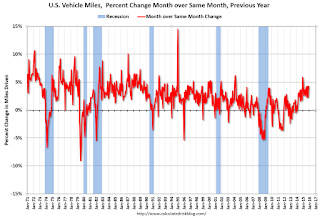

The second graph shows the year-over-year change from the same month in the previous year.

In December 2015, gasoline averaged $2.14 per gallon according to the EIA. That was down significantly from December 2014 when prices averaged $2.63 per gallon. Gasoline prices have continued to decline, and vehicle miles will probably up sharply year-over-year in January.

In December 2015, gasoline averaged $2.14 per gallon according to the EIA. That was down significantly from December 2014 when prices averaged $2.63 per gallon. Gasoline prices have continued to decline, and vehicle miles will probably up sharply year-over-year in January.Gasoline prices aren't the only factor - demographics are also important. However, with lower gasoline prices, miles driven on a rolling 12 month basis, is setting new highs each month.

Black Knight's First Look at January Mortgage Data

by Calculated Risk on 2/22/2016 09:01:00 AM

From Black Knight: Black Knight Financial Services’ First Look at January Mortgage Data: Delinquencies Up Sharply; Prepayment Rate Drops

- Delinquency rate up 6.6 percent in January; back above 5 percent nationally for the first time in 11 monthsAccording to Black Knight's First Look report for January, the percent of loans delinquent increased 6.6% in January compared to December, and declined 7.1% year-over-year.

- Prepayment rate (historically a good indicator of refinance activity) dropped 29 percent to its lowest level since February 2014

- Foreclosure sales (completions) up nearly 16 percent following holiday moratoriums

- Active foreclosure inventory continues to decline; down 26 percent from last year

The percent of loans in the foreclosure process declined 4.5% in December and were down 25.7% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.09% in January, down from 4.79% in December.

The percent of loans in the foreclosure process declined in January to 1.30%.

The number of delinquent properties, but not in foreclosure, is down 229,000 properties year-over-year, and the number of properties in the foreclosure process is down 226,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for January in early March.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2016 | Dec 2015 | Jan 2015 | Jan 2014 | |

| Delinquent | 5.09% | 4.78% | 5.48% | 6.25% |

| In Foreclosure | 1.30% | 1.37% | 1.76% | 2.41% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,575,000 | 2,408,000 | 2,764,000 | 3,150,000 |

| Number of properties in foreclosure pre-sale inventory: | 659,000 | 689,000 | 885,000 | 1,213,000 |

| Total Properties | 3,234,000 | 3,097,000 | 3,649,000 | 4,363,000 |

Chicago Fed: "Index shows economic growth picked up in January"

by Calculated Risk on 2/22/2016 08:35:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in January

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.28 in January from –0.34 in December. Two of the four broad categories of indicators that make up the index increased from December, and two of the four categories made positive contributions to the index in January.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to –0.15 in January from –0.30 in December. January’s CFNAI-MA3 suggests that growth in national economic activity was somewhat below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was somewhat below the historical trend in January (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, February 21, 2016

Sunday Night Futures

by Calculated Risk on 2/21/2016 07:36:00 PM

From Marcoblog: Are Paychecks Picking Up the Pace?

Based on the Atlanta Fed's Wage Growth Tracker (WGT), the median annual growth in hourly wage and salary earnings of continuously employed workers in 2015 was 3.1 percent—up from 2.5 percent in 2014 and 2.2 percent in 2013. That is, the typical wage growth of workers employed for at least 12 months appears to be trending higher.Weekend:

However, wage growth by job type varies considerably. For example, the WGT for part-time workers has been unusually low since 2010. ...

The take-away? Wage growth for continuously employed workers appears to have picked up some steam in 2015, and the recent trend in wage growth is positive across a variety of job characteristics. Wage growth for people in lower-skill jobs has increased during the last couple of years, consistent with evidence of increasing tightness in the market for those types of jobs. The largest discrepancy in wage growth appears to be among part-time workers, whose median gain in hourly wages in 2015 still fell well short of those in full-time jobs.

• Schedule for Week of February 21, 2016

• Fannie and Freddie: REO inventory declined in Q4, Down 34% Year-over-year

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for January. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 4 and DOW futures are down 32 (fair value).

Oil prices were down over the last week with WTI futures at $29.64 per barrel and Brent at $33.01 per barrel. A year ago, WTI was at $50, and Brent was at $60 - so prices are down about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $1.71 per gallon (down about $0.45 per gallon from a year ago).

Fannie and Freddie: REO inventory declined in Q4, Down 34% Year-over-year

by Calculated Risk on 2/21/2016 11:11:00 AM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae: Fannie Mae Reports Net Income of $11.0 Billion and Comprehensive Income of $10.6 Billion for 2015

Fannie Mae reported annual net income of $11.0 billion and annual comprehensive income of $10.6 billion in 2015. For the fourth quarter of 2015, Fannie Mae reported net income of $2.5 billion and comprehensive income of $2.3 billion. The company reported a positive net worth of $4.1 billion as of December 31, 2015, resulting in a dividend obligation to Treasury of $2.9 billion, which the company expects to pay in March 2016.Fannie Mae reported the number of REO declined to 57,253 at the end of 2015 compared to 87,063 at the end of 2014.

And from Freddie Mac: Freddie Mac Reports Net Income of $6.4 Billion for Full-Year 2015; Comprehensive Income of $5.8 Billion

Freddie Mac today reported net income of $6.4 billion for the full-year 2015, compared to net income of $7.7 billion for the full-year 2014. The company also reported comprehensive income of $5.8 billion for the full-year 2015, compared to comprehensive income of $9.4 billion for the full-year 2014.Freddie Mac reported the number of REO (Real Estate Owned) declined to 17,004 at the end of 2015 compared to 25,768 at the end of 2014.

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 for both Fannie and Freddie, and combined inventory is down 34% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007. For Fannie, this is the lowest level since Q2 2008.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Saturday, February 20, 2016

Schedule for Week of February 21, 2016

by Calculated Risk on 2/20/2016 08:11:00 AM

The key reports this week are the second estimate of Q4 GDP, January Existing and New Home sales, and the Case-Shiller House Price Index for December.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the November 2015 report (the Composite 20 was started in January 2000).

The consensus is for a 5.9% year-over-year increase in the Comp 20 index for November. The Zillow forecast is for the National Index to increase 5.3% year-over-year in November.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.46 million in December.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.32 million SAAR, down from 5.46 million in December.Economist Tom Lawler expects the NAR to report sales of 5.36 million SAAR for January.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the November sales rate.

The consensus is for a decrease in sales to 520 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 544 thousand in December.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 262 thousand the previous week.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

9:00 AM: FHFA House Price Index for December 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM ET: Gross Domestic Product, 4th quarter 2015 (Second estimate). The consensus is that real GDP increased 0.4% annualized in Q4, revised down from 0.7%.

10:00 AM ET: Personal Income and Outlays for January. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 91.0, up from the preliminary reading 90.7.

Friday, February 19, 2016

Goldman: Inflation "likely to rise more than bond markets currently discount"

by Calculated Risk on 2/19/2016 07:01:00 PM

Some interesting comments from a research note by Goldman Sachs economists Sven Jari Stehn and Jan Hatzius: Meeting the Low Bar. A few excerpts:

In recent years, economic forecasters have been too optimistic about GDP growth but too pessimistic about employment across many advanced economies. To better understand this puzzle, we construct a new supply side model for the US, the Euro area, Japan, and the UK. ...

... our results have two potential implications for bond markets. First, with output and employment already close to potential in the US and the UK, inflation there is likely to rise more than bond markets currently discount. Second, assuming that the hit to potential is truly one-off, potential growth should pick up modestly in coming years, and thus challenge the market’s view that we have entered an era of secular stagnation and permanently depressed real interest rates.

Quarterly Housing Starts by Intent

by Calculated Risk on 2/19/2016 02:53:00 PM

In addition to housing starts for January, the Census Bureau also released the Q4 "Started and Completed by Purpose of Construction" report this week.

It is important to remember that we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

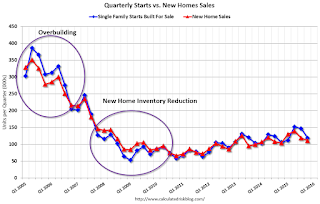

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released yesterday showed there were 119,000 single family starts, built for sale, in Q4 2015, and that was above the 111,000 new homes sold for the same quarter, so inventory increased slightly in Q4 (Using Not Seasonally Adjusted data for both starts and sales).

The first graph shows quarterly single family starts, built for sale and new home sales (NSA).

Click on graph for larger image.

Click on graph for larger image.In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are generally starting a few more homes than they are selling, and the inventory of under construction and completed new home sales is increasing, but still low.

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories mostly under control.

The second graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Single family starts built for sale were up about 12% compared to Q4 2014.

Single family starts built for sale were up about 12% compared to Q4 2014. Owner built starts were up slightly year-over-year. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly over the last few years, and is near the highest level since the mid-80s, and was up 8% compared to Q4 2014.