by Calculated Risk on 12/02/2015 09:50:00 PM

Wednesday, December 02, 2015

Thursday: Yellen, ISM Non-Mfg, Unemployment Claims

From the WSJ: Yellen Signals Fed on Track to Raise Rates in December

Federal Reserve Chairwoman Janet Yellen signaled she’s ready to raise short-term interest rates this month barring a surprise that shakes her confidence in the economy.Thursday:

She also suggested she sees dissension within her ranks, which could complicate her moves toward ending seven years of near-zero rates.

“I don’t need unanimity. I think we have to tolerate some dissent,” Ms. Yellen said Wednesday, in answer to a question after delivering a speech on the economic outlook. “I wouldn’t try to stifle dissents, and I would even expect some at critical junctures.”

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 260 thousand the previous week.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for October. The consensus is a 1.4% increase in orders.

• Also at 10:00 AM, the ISM non-Manufacturing Index for October. The consensus is for index to decrease to 58.2 from 59.1 in October.

• Also at 10:00 AM, Testimony by Fed Chair Janet Yellen, Economic Outlook, Before the Joint Economic Committee, U.S. Senate, Washington, D.C.

• At 1:10 PM, Speech by Fed Vice Chairman Stanley Fischer, Financial Stability and Shadow Banks, At the Federal Reserve Bank of Cleveland Financial Stability Conference, Washington, D.C.

Fed's Beige Book: "Economic activity increased at a modest pace"

by Calculated Risk on 12/02/2015 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Richmond and based on information collected before November 20, 2015. "

The twelve Federal Reserve District reports indicate that economic activity increased at a modest pace in most regions of the country since the previous Beige Book report. Economic growth was modest in the Districts of Cleveland, Richmond, Atlanta, Chicago, St. Louis, Dallas and San Francisco. In the Minneapolis District the economy grew moderately, while in the Kansas City District growth was steady on balance with mixed conditions across sectors. In the New York District economic conditions leveled off since the previous report, and in the Philadelphia District aggregate business activity continued to grow at a modest pace. In the Boston District, growth was somewhat slower despite reports of revenue increases.And on real estate:

Housing markets grew at a moderate pace on balance, and home prices also increased modestly since the previous Beige Book. ... Residential construction grew at a modest to moderate pace since the previous report. The Cleveland and Chicago Districts reported moderate growth, while New York, Philadelphia, St. Louis, and Kansas City Districts reported modest growth in residential construction. In the New York and Atlanta Districts, residential construction was noted as steady.Real Estate growth was modest to moderate ...

Commercial construction strengthened modestly in most Districts since the previous report. ... Commercial leasing activity generally grew at a moderate pace.

emphasis added

Yellen: Expect Continued Growth, Further Reductions in Labor Slack, Inflation to Rise to 2 Percent

by Calculated Risk on 12/02/2015 12:02:00 PM

From Fed Chair Janet Yellen: The Economic Outlook and Monetary Policy

Let me now turn to where I see the economy is likely headed over the next several years. To summarize, I anticipate continued economic growth at a moderate pace that will be sufficient to generate additional increases in employment, further reductions in the remaining margins of labor market slack, and a rise in inflation to our 2 percent objective. I expect that the fundamental factors supporting domestic spending that I have enumerated today will continue to do so, while the drag from some of the factors that have been weighing on economic growth should begin to lessen next year. Although the economic outlook, as always, is uncertain, I currently see the risks to the outlook for economic activity and the labor market as very close to balanced.Yellen is prepared to raise rates this month.

Turning to the factors that have been holding down growth, as I already noted, the higher foreign exchange value of the dollar, as well as weak growth in some foreign economies, has restrained the demand for U.S. exports over the past year. In addition, lower crude oil prices have reduced activity in the domestic oil sector. I anticipate that the drag on U.S. economic growth from these factors will diminish in the next couple of years as the global economy improves and the adjustment to prior declines in oil prices is completed.

Although developments in foreign economies still pose risks to U.S. economic growth that we are monitoring, these downside risks from abroad have lessened since late summer. Among emerging market economies, recent data support the view that the slowdown in the Chinese economy, which has received considerable attention, will likely continue to be modest and gradual. China has taken actions to stimulate its economy this year and could do more if necessary. A number of other emerging market economies have eased monetary and fiscal policy this year, and economic activity in these economies has improved of late. Accommodative monetary policy is also supporting economic growth in the advanced economies. A pickup in demand in many advanced economies and a stabilization in commodity prices should, in turn, boost the growth prospects of emerging market economies.

A final positive development for the outlook that I will mention relates to fiscal policy. This year the effect of federal fiscal policy on real GDP growth has been roughly neutral, in contrast to earlier years in which the expiration of stimulus programs and fiscal policy actions to reduce the federal budget deficit created significant drags on growth. Also, the budget situation for many state and local governments has improved as the economic expansion has increased the revenues of these governments, allowing them to increase their hiring and spending after a number of years of cuts in the wake of the Great Recession. Looking ahead, I anticipate that total real government purchases of goods and services should have a modest positive effect on economic growth over the next few years.

Regarding U.S. inflation, I anticipate that the drag from the large declines in prices for crude oil and imports over the past year and a half will diminish next year. With less downward pressure on inflation from these factors and some upward pressure from a further tightening in U.S. labor and product markets, I expect inflation to move up to the FOMC's 2 percent objective over the next few years. Of course, inflation expectations play an important role in the inflation process, and my forecast of a return to our 2 percent objective over the medium term relies on a judgment that longer-term inflation expectations remain reasonably well anchored. In this regard, recent measures from the Survey of Professional Forecasters, the Blue Chip Economic Indicators, and the Survey of Primary Dealers have continued to be generally stable. The measure of longer-term inflation expectations from the University of Michigan Surveys of Consumers, in contrast, has lately edged below its typical range in recent years. However, this measure often seems to respond modestly, though temporarily, to large changes in actual inflation, and the very low readings on headline inflation over the past year may help explain some of the recent decline in the Michigan measure.6 Market-based measures of inflation compensation have moved up some in recent weeks after declining to historically low levels earlier in the fall. While the low level of these measures appears to reflect, at least in part, changes in risk and liquidity premiums, we will continue to monitor this development closely. Convincing evidence that longer-term inflation expectations have moved lower would be a concern because declines in consumer and business expectations about inflation could put downward pressure on actual inflation, making the attainment of our 2 percent inflation goal more difficult.

emphasis added

ADP: Private Employment increased 217,000 in November

by Calculated Risk on 12/02/2015 08:20:00 AM

Private sector employment increased by 217,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 183,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by 13,000 jobs in November, down from 22,000 the previous month. The construction industry added 16,000 jobs after gaining over 30,000 in each of the two previous months. Meanwhile, manufacturing rebounded from two straight months of shedding jobs to add 6,000 in November.

Service-providing employment rose by 204,000 jobs in November, a strong increase from an upwardly revised 174,000 in October. ...

Mark Zandi, chief economist of Moody’s Analytics, said, “Job growth remains strong and steady. The current pace of job creation is twice that needed to absorb growth in the working age population. The economy is fast approaching full employment and will be there no later than next summer.”

The BLS report for November will be released Friday, and the consensus is for 190,000 non-farm payroll jobs added in November.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey, Purchase Applications up 30% YoY

by Calculated Risk on 12/02/2015 07:02:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 27, 2015. This week’s results included an adjustment for the Thanksgiving holiday.

...

The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index decreased 28 percent compared with the previous week and was 30 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.12 percent from 4.14 percent, with points increasing to 0.50 from 0.49 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

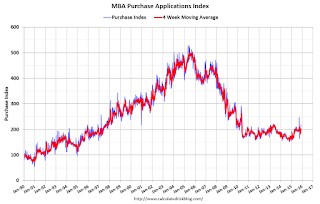

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 30% higher than a year ago.

Tuesday, December 01, 2015

Wednesday: Yellen Speech, ADP Employment, Beige Book

by Calculated Risk on 12/01/2015 08:16:00 PM

An excerpt from Tim Duy at Fed Watch: The Final Countdown

Bottom Line: Just how data-dependent is the Fed when it comes to December? Not much, I think. They are likely just looking for evidence that basic labor market trends remain intact to justify pulling the pin on higher rates. Absent any sharp financial disruptions or disastrous data, it looks like we are on the final countdown to the first rate hike of this cycle. Beyond that, they will proceed very cautiously; this is especially the case if they don’t see evidence of still-declining slack in the form of rising wages and inflation. And if the economy turns choppy as the drivers of recent growth loose their momentum, policy will turn choppy as well. Indeed, in such an environment, future rate hikes would likely comes in fits and starts. Thus while 100bp of tightening is a reasonable baseline for next year, the path is not likely to be a smooth 25bp every other meeting. That will likely pose some interesting communications challenges for the Fed.Wednesday:

emphasis added

• At 10:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 183,000 payroll jobs added in November, up from 182,000 in October.

• At 12:25 PM, Speech by Fed Chair Janet Yellen, Economic Outlook, At the Economic Club of Washington, Washington, D.C.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

U.S. Light Vehicle Sales at 18.2 million annual rate in November

by Calculated Risk on 12/01/2015 03:00:00 PM

Based on a preliminary WardsAuto estimate, light vehicle sales were at a 18.18 million SAAR in November.

NOTE: Daimler is expected to report tomorrow.

That is up about 7% from October 2014, and up slightly from the 18.13 million annual sales rate last month.

This was the third consecutive month over 18 million.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for November (red, light vehicle sales of 18.18 million SAAR from WardsAuto).

This was above the consensus forecast of 18.0 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

This was another very strong month for auto sales and it appears 2015 will be the one of the best years ever for light vehicle sales.

Construction Spending increased 1.0% in October, Up 13% YoY

by Calculated Risk on 12/01/2015 01:31:00 PM

The Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2015 was estimated at a seasonally adjusted annual rate of $1,107.4 billion, 1.0 percent above the revised September estimate of $1,096.6 billion. The October figure is 13.0 percent above the October 2014 estimate of $979.6 billion.Both private spending and public spending increased:

During the first 10 months of this year, construction spending amounted to $888.1 billion, 10.7 percent above the $802.3 billion for the same period in 2014.

Spending on private construction was at a seasonally adjusted annual rate of $802.4 billion, 0.8 percent above the revised September estimate of $795.8 billion. ...

In October, the estimated seasonally adjusted annual rate of public construction spending was $304.9 billion, 1.4 percent above the revised September estimate of $300.8 billion.

emphasis added

This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 41% below the bubble peak.

Non-residential spending is only 3% below the peak in January 2008 (nominal dollars).

Public construction spending is now 6% below the peak in March 2009 and about 15% above the post-recession low.

On a year-over-year basis, private residential construction spending is up 17%. Non-residential spending is up 15% year-over-year. Public spending is up 6% year-over-year.

Looking forward, all categories of construction spending should increase this year and in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This was above the consensus forecast of a 0.6% increase, also spending for August and September were revised up. Another solid construction report.

CoreLogic: House Prices up 6.8% Year-over-year in October

by Calculated Risk on 12/01/2015 11:25:00 AM

Notes: This CoreLogic House Price Index report is for October. The recent Case-Shiller index release was for September. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up 6.8 Percent Year Over Year in October

Home prices nationwide, including distressed sales, increased by 6.8 percent in October 2015 compared with October 2014 and increased by 1.0 percent in October 2015 compared with September 2015, according to the CoreLogic HPI.

“Many markets have experienced a low inventory of homes for sale along with strong buyer demand, which is sustaining upward pressure on home prices. These conditions are likely to persist as we enter 2016,” said Dr. Frank Nothaft, chief economist for CoreLogic. “A year from now, as we finish out October 2016, we expect the CoreLogic national Home Price Index appreciation to slow to 5.2 percent.”

“The rise in home prices over the past few years has largely been a healthy trend. The shadow inventory has been reduced significantly and home equity levels are now approaching pre-recession levels,” said Anand Nallathambi, president and CEO of CoreLogic. “As we move forward, the rise in home prices will need to be better correlated to family income trends over time to avoid homes becoming unaffordable for many. This is especially true in several metropolitan areas where home prices have grown rapidly.”

emphasis added

This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.0% in October (NSA), and is up 6.8% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The year-over-year comparison has been positive for forty four consecutive months.

ISM Manufacturing index decreased to 48.6 in November

by Calculated Risk on 12/01/2015 10:08:00 AM

The ISM manufacturing index indicated contraction in November. The PMI was at 48.6% in November, down from 50.1% in October. The employment index was at 51.3%, up from 47.6% in October, and the new orders index was at 48.9%, down from 52.9%.

From the Institute for Supply Management: November 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector contracted in November for the first time in 36 months, since November 2012, while the overall economy grew for the 78th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The November PMI® registered 48.6 percent, a decrease of 1.5 percentage points from the October reading of 50.1 percent. The New Orders Index registered 48.9 percent, a decrease of 4 percentage points from the reading of 52.9 percent in October. The Production Index registered 49.2 percent, 3.7 percentage points below the October reading of 52.9 percent. The Employment Index registered 51.3 percent, 3.7 percentage points above the October reading of 47.6 percent. The Prices Index registered 35.5 percent, a decrease of 3.5 percentage points from the October reading of 39 percent, indicating lower raw materials prices for the 13th consecutive month. The New Export Orders Index registered 47.5 percent, unchanged from October, and the Imports Index registered 49 percent, up 2 percentage points from the October reading of 47 percent. Ten out of 18 manufacturing industries reported contraction in November, with lower new orders, production and raw materials inventories accounting for the overall softness in November."

emphasis added

Here is a long term graph of the ISM manufacturing index.

This was below expectations of 50.5%, and indicates manufacturing contracted in November.