by Calculated Risk on 11/03/2015 11:44:00 AM

Tuesday, November 03, 2015

Freddie: REO inventory declined in Q3, Down 31% Year-over-year

Note: Fannie Mae is scheduled to report on Thursday.

From Freddie Mac:

Freddie Mac today reported a net loss of $475 million for the third quarter of 2015, compared to net income of $4.2 billion for the second quarter of 2015. The company also reported a comprehensive loss of $501 million for the third quarter of 2015, compared to comprehensive income of $3.9 billion for the second quarter of 2015.And on Real Estate Owned (REO):

“For the first time in four years, Freddie Mac had a net loss in the most recent quarter. This $0.5 billion loss was caused mainly by the accounting associated with our use of derivatives, whereby the derivatives are marked-tomarket but many of the assets and liabilities being hedged are not. The resulting difference between GAAP reporting and the actual underlying economics, which has created significant GAAP income volatility in our quarterly financial statements, reduced the after tax earnings in the quarter by an estimated $1.5 billion as interest rates declined significantly” said Donald H. Layton, chief executive officer. “In the prior quarter, we had the opposite result with a $1.5 billion positive contribution to earnings as rates rose significantly.”

Our single-family REO inventory (measured in number of properties) declined 31% from December 31, 2014 to September 30, 2015, primarily due to our loss mitigation efforts and a larger proportion of properties being sold to third parties at foreclosure auction.Notice that most of the REO is from loans originated in 2005 through 2008, and they are heavily Alt-A loans.

...

Our REO acquisition activity is disproportionately high for certain types of mortgage loans, including mortgage loans with certain higher-risk characteristics. For example, while the percentage of interest-only and Alt-A mortgage loans in our single-family credit guarantee portfolio, based on UPB, was approximately 1% and 3%, respectively, at September 30, 2015, the percentage of our REO acquisitions during the nine months ended September 30, 2015 that had been financed by either of these mortgage loan types represented approximately 20% of our total REO acquisitions, based on mortgage loan amount prior to acquisition. In addition, mortgage loans from our 2005-2008 Legacy single-family book comprised approximately 69% of our REO acquisition activity during the nine months ended September 30, 2015.

As of September 30, 2015, approximately 52% of our REO properties were unable to be marketed because the properties were occupied, under repair, or are located in states with a redemption period and 13% of the properties were being evaluated for listing and determination of our sales strategy. As of September 30, 2015, approximately 22% of our REO properties were listed and available for sale and 13% of our inventory was pending the settlement of sales. Though it varied significantly in different states, the average holding period of our single-family REO properties, excluding any redemption period, was 251 days and 221 days for our REO dispositions during the nine months ended September 30, 2015 and the nine months ended September 30, 2014, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Freddie Real Estate Owned (REO).

REO inventory decreased in Q3 for Freddie, and and inventory is down 31% year-over-year. For Freddie, this is the lowest level of REO since Q4 2007.

Short term delinquencies are at normal levels, but there are still a fairly large number of legacy properties in the foreclosure process with long time lines in judicial foreclosure states.

CoreLogic: House Prices up 6.4% Year-over-year in September

by Calculated Risk on 11/03/2015 10:03:00 AM

Notes: This CoreLogic House Price Index report is for September. The recent Case-Shiller index release was for August. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic US Home Price Report Shows Home Prices Up 6.4 Percent Year Over Year

According to the CoreLogic HPI, home prices nationwide, including distressed sales, increased by 6.4 percent in September 2015 compared with September 2014 and increased by 0.6 percent in September 2015 compared with August 2015.

“After nearly 10 years of very high home price volatility, home price increases have been remarkably stable for the last 15 months, ranging between a 4.8 percent and 6.5 percent year-over-year increase,” said Sam Khater, deputy chief economist for CoreLogic. “Home price volatility is now back to the long-term trend prior to the boom and bust which is a good barometer of the market’s stability and health.”

“The continued growth in home prices is welcome news for many homeowners but more markets are becoming overvalued. In the near term, this trend is likely to continue and pose evaluated risks to the housing economy,” said Anand Nallathambi, president and CEO of CoreLogic. "More has to be done to expand inventories if we are going to address the emerging affordability crisis, especially in hot markets like California and Colorado.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 0.6% in September (NSA), and is up 6.4% over the last year.

This index is not seasonally adjusted, and this was a solid month-to-month increase.

The second graph shows the YoY change in nominal terms (not adjusted for inflation).

The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.

The YoY increase had been moving sideways over most of the last year, but has picked up a little recently.The year-over-year comparison has been positive for forty three consecutive months.

Monday, November 02, 2015

Tuesday: Auto Sales

by Calculated Risk on 11/02/2015 08:02:00 PM

An excerpt from a research piece by Goldman Sachs economist Alec Phillips on the impact of the budget deal:

• The budget deal that the President signed into law today allows for greater federal spending in 2016. Along with a slightly positive trend at the state and local level, it should result in a modestly expansionary fiscal stance (+0.3% of GDP), for the first time in five years.Tuesday:

• The agreement looks likely to raise the federal contribution to quarterly GDP growth primarily in 1H 2016. Since Congress has already funded the government through mid-December at the lower 2015 level, we do not expect the deal to affect the current quarter.

• The budget deal removes most of the remaining fiscal policy uncertainty through the 2016 election. Congress still needs to pass spending bills by December, but the risk of a government shutdown at that point appears low.

• All day: Light vehicle sales for October. The consensus is for light vehicle sales to decrease to 17.7 million SAAR in October from 18.1 million in September (Seasonally Adjusted Annual Rate).

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is a 0.9% decrease in orders.

Fannie Mae: Mortgage Serious Delinquency rate declined in September, Lowest since August 2008

by Calculated Risk on 11/02/2015 04:46:00 PM

Fannie Mae reported today that the Single-Family Serious Delinquency rate declined in September to 1.59% from 1.62% in August. The serious delinquency rate is down from 1.96% in September 2014, and this is the lowest level since August 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Note: Freddie Mac reported last week.

The Fannie Mae serious delinquency rate has only fallen 0.37 percentage points over the last year - the pace of improvement has slowed - and at that pace the serious delinquency rate will not be below 1% until 2017.

The "normal" serious delinquency rate is under 1%, so maybe Fannie Mae serious delinquencies will be close to normal some time in 2017. This elevated delinquency rate is mostly related to older loans - the lenders are still working through the backlog.

Fed Survey: Banks reports stronger demand for CRE loans

by Calculated Risk on 11/02/2015 02:08:00 PM

From the Federal Reserve: The October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the October survey results indicated that, on balance, banks reported little change in their standards on commercial and industrial (C&I) loans in the third quarter of 2015. In addition, banks reported having eased some loan terms, such as spreads and loan maturities, on net. However, banks also indicated that they increased premiums charged on riskier loans for larger firms on net. With respect to commercial real estate (CRE) lending, on balance, survey respondents reported that standards on loans secured by nonfarm nonresidential properties, loans secured by multifamily residential properties, and construction and land development loans remained about unchanged. On the demand side, banks reported that demand for C&I loans was about unchanged, on balance, and moderate net fractions of survey respondents experienced stronger demand for all three categories of CRE loans during the third quarter.

Regarding loans to households, banks reported having eased lending standards on loans eligible for purchase by the government-sponsored enterprises and on qualified mortgage (QM) loans over the past three months on net. On balance, modest fractions of banks indicated having eased standards for credit card loans as well as for auto loans. On the demand side, modest net fractions of banks reported weaker demand across most categories of home-purchase loans. In contrast, respondents experienced stronger demand for credit card loans on net.

emphasis added

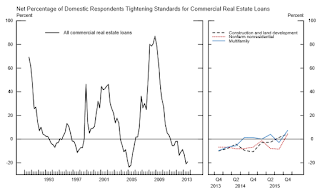

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Mostly standards were unchanged for various categories of CRE (right half of graph).

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.

Banks are seeing a pickup in demand for all categories of CRE - including multi-family.This suggests that we will see further increases in commercial real estate development.

Construction Spending increased 0.6% in September, Up 14.1% YoY

by Calculated Risk on 11/02/2015 11:31:00 AM

The Census Bureau reported that overall construction spending increased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2015 was estimated at a seasonally adjusted annual rate of $1,094.2 billion, 0.6 percent above the revised August estimate of $1,087.5 billion. The September figure is 14.1 percent above the September 2014 estimate of $959.2 billion.Both private spending and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $794.2 billion, 0.6 percent above the revised August estimate of $789.7 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas has been declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In September, the estimated seasonally adjusted annual rate of public construction spending was $300.0 billion, 0.7 percent above the revised August estimate of $297.8 billion.

emphasis added

As an example, construction spending for private lodging is up 33% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 11% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing, but is 42% below the bubble peak.

Non-residential spending is only 4% below the peak in January 2008 (nominal dollars).

Public construction spending is now 8% below the peak in March 2009 and about 14% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 17%. Non-residential spending is up 15% year-over-year. Public spending is up 9% year-over-year.

Looking forward, all categories of construction spending should increase this year and in 2016. Residential spending is still very low, non-residential is increasing (except oil and gas), and public spending has also increasing after several years of austerity.

This was at the consensus forecast of a 0.4% increase, also spending for July and August were revised up slightly. Another solid construction report.

ISM Manufacturing index decreased to 50.1 in October

by Calculated Risk on 11/02/2015 10:04:00 AM

The ISM manufacturing index barely suggested expansion in October. The PMI was at 50.1% in October, down from 50.2% in September. The employment index was at 47.6%, down from 50.5% in September, and the new orders index was at 52.9%, up from 50.1%.

From the Institute for Supply Management: October 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October for the 34th consecutive month, and the overall economy grew for the 77th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The October PMI® registered 50.1 percent, a decrease of 0.1 percentage point from the September reading of 50.2 percent. The New Orders Index registered 52.9 percent, an increase of 2.8 percentage points from the reading of 50.1 percent in September. The Production Index registered 52.9 percent, 1.1 percentage points above the September reading of 51.8 percent. The Employment Index registered 47.6 percent, 2.9 percentage points below the September reading of 50.5 percent. Backlog of Orders registered 42.5 percent, an increase of 1 percentage point from the September reading of 41.5 percent. The Prices Index registered 39 percent, an increase of 1 percentage point from the September reading of 38 percent, indicating lower raw materials prices for the 12th consecutive month. The New Export Orders Index registered 47.5 percent, up 1 percentage point from September, and the Imports Index registered 47 percent, down 3.5 percentage points from the September reading of 50.5 percent. Comments from the panel reflect concern over the high price of the dollar and the continuing low price of oil, mixed with cautious optimism about steady to increasing demand in several industries."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was at expectations of 50.0%, and indicates slower manufacturing expansion in October.

Black Knight September Mortgage Monitor

by Calculated Risk on 11/02/2015 09:38:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for September today. According to BKFS, 4.87% of mortgages were delinquent in September, up from 4.79% in August. BKFS reported that 1.46% of mortgages were in the foreclosure process, down from 1.89% in September 2014.

This gives a total of 6.33% delinquent or in foreclosure. It breaks down as:

• 2,457,000 properties that are 30 or more days delinquent, but not in foreclosure.

• 737,000 loans in foreclosure process.

For a total of 3,194,000 loans delinquent or in foreclosure in September. This is down from 3,800,000 in September 2014.

Press Release: Black Knight’s September Mortgage Monitor: Recent Surge in Purchase Originations Driven Primarily by High-Credit Borrowers

oday, the Data and Analytics division of Black Knight Financial Services, Inc. (NYSE: BKFS) released its latest Mortgage Monitor Report, based on data as of the end of September 2015. ...

“Purchase mortgage originations are up significantly in 2015,” said Graboske. “Q2 2015 purchase originations were up 15 percent from the same quarter in 2014. In June, we saw the highest level of purchase lending since June 2007 and early Q3 figures show purchase originations are up 11 percent from the same period last year. What’s striking about this rise, though, is that it’s being driven almost entirely by high-credit borrowers. Year-over-year comparisons of purchase originations from sub-700 credit score borrowers show that purchase volumes from lower-credit borrowers are actually flat to slightly down from last year’s levels. Only 20 percent of purchase loans originated in the past three months have gone to borrowers with credit scores below 700. That’s the lowest level we’ve seen in well over 10 years. The weighted average credit score for purchase mortgages has also hit an all-time high of about 755."

emphasis added

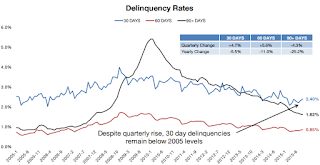

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the delinquency rates for the 30, 60 and 90 day buckets.

From Black Knight:

30-day and 60-day delinquencies saw quarterly increases due to market seasonality in Q3, rising 4.7 and 5.6 percent respectivelyThere is much more in the mortgage monitor.

Despite the Q3 rise in 30-day delinquencies, they remain below 2005’s pre-crisis levels; 60-day delinquencies remain slightly above 2005 levels

Positive movement continues in 90-day inventory, despite the seasonal inflow of new delinquencies, on both a quarterly and yearly basis

90-day delinquencies are down 25 percent over the past year

Sunday, November 01, 2015

Monday: ISM Mfg Index, Construction Spending

by Calculated Risk on 11/01/2015 08:49:00 PM

From the WSJ: Retailers Work Harder to Lure Holiday Employees

Retailers are facing a shrinking pool of workers as they staff up for the holidays, prompting some to offer more hours or higher pay to make sure they have enough cashiers or salespeople for the Christmas crush.Seasonal hiring in October usually gives a good indication for the holiday season. Something to watch in the employment report on Friday.

Weekend:

• Schedule for Week of November 1, 2015

Monday:

• At 10:00 AM ET, the ISM Manufacturing Index for October. The consensus is for the ISM to be at 50.0, down from 50.2 in September. The employment index was at 50.5%, and the new orders index was at 50.1%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for a 0.4% increase in construction spending.

• At 2:00 PM, the October 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve.

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are down 6 and DOW futures are dwon 36 (fair value).

Oil prices were up over the last week with WTI futures at $46.21 per barrel and Brent at $49.36 per barrel. A year ago, WTI was at $81, and Brent was at $85 - so prices are down about 40% year-over-year (It was a year ago that prices were falling sharply).

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.19 per gallon (down about $0.80 per gallon from a year ago).

Hotel Occupancy: 2015 on pace for Best Year Ever

by Calculated Risk on 11/01/2015 09:02:00 AM

From HotelNewsNow.com: STR: US results for week ending 24 October

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 18-24 October 2015, according to data from STR, Inc.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average. Hotels are now in the Fall business travel season.

In year-over-year measurements, the industry’s occupancy increased 1.7% to 70.6%. Average daily rate for the week was up 4.6% to US$124.76. Revenue per available room increased 6.4% to finish the week at US$88.08.

emphasis added

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The red line is for 2015, dashed orange is 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.I added 2001 (yellow) to show the impact of 9/11/2001 on hotel occupancy. Occupancy was already down in 2001 due to the recession, and really collapsed following 9/11.

For 2015, the 4-week average of the occupancy rate is solidly above the median for 2000-2007, and above last year.

Right now 2015 is above 2000 (best year for hotels), and 2015 will probably be the best year ever for hotels. This is why lodging investment is up 39% year-over-year!

Occupancy Year-to-date:

1) 2015 67.7%

2) 2000 67.1%

3) 2014 66.6%

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com