by Calculated Risk on 10/22/2015 02:30:00 PM

Thursday, October 22, 2015

NMHC: Apartment Market Conditions Slightly Tighter in October Survey

From the National Multifamily Housing Council (NMHC): NMHC Quarterly Survey of Apartment Conditions October 2015

The Market Tightness Index decreased by 8 points from last quarter (and increased by 1 point from a year earlier) to 53. Thirty-one percent of respondents reported tighter conditions than three months ago.

This is the seventh consecutive quarter where the index indicates tighter conditions. And the index indicated tighter conditions in 21 of the 23 quarters.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter. This indicates market conditions were tighter over the last quarter.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010.

Kansas City Fed: Regional Manufacturing Activity "Steadied" in October

by Calculated Risk on 10/22/2015 12:17:00 PM

From the Kansas City Fed: Tenth District Manufacturing Activity Steadied

The Federal Reserve Bank of Kansas City released the October Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity steadied somewhat and was expected to remain largely unchanged heading forward.The earlier decline in the Kansas City region manufacturing was probably mostly due to lower oil prices, although respondents are also blame weaker exports on the strong dollar.

“Following six months of composite index readings of worse than -6, this month’s reading of -1 was somewhat encouraging,” said Wilkerson. “Modest increases in new orders and production nearly offset declines in employment, supplier delivery time, and inventory indexes.”

...

Tenth District manufacturing activity steadied somewhat, and expectations for future activity were largely flat following last month’s more negative reading. Most price indexes edged higher for the first time in several months.

The month-over-month composite index was -1 in October, up from -8 in September and -9 in August ...

emphasis added

Existing Home Sales in September: 5.55 million SAAR

by Calculated Risk on 10/22/2015 10:11:00 AM

From the NAR: Existing-Home Sales Regain Momentum in September

Total existing–home sales, which are completed transactions that include single–family homes, townhomes, condominiums and co–ops, increased 4.7 percent to a seasonally adjusted annual rate of 5.55 million in September from a slightly downwardly revised 5.30 million in August, and are now 8.8 percent above a year ago (5.10 million). ...

Total housing inventory at the end of September decreased 2.6 percent to 2.21 million existing homes available for sale, and is now 3.1 percent lower than a year ago (2.28 million). Unsold inventory is at a 4.8–month supply at the current sales pace, down from 5.1 months in August.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in September (5.55 million SAAR) were 4.7% higher than last month, and were 8.8% above the September 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 2.21 million in September from 2.27 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

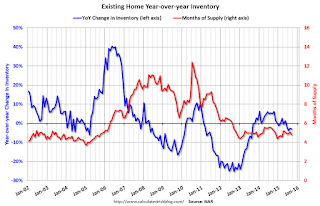

According to the NAR, inventory decreased to 2.21 million in September from 2.27 million in August. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 3.1% year-over-year in September compared to September 2014.

Inventory decreased 3.1% year-over-year in September compared to September 2014. Months of supply was at 4.8 months in September.

This was above expectations of sales of 5.35 million. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increased to 259,000, 4-Week Average Lowest since 1973

by Calculated Risk on 10/22/2015 08:34:00 AM

The DOL reported:

In the week ending October 17, the advance figure for seasonally adjusted initial claims was 259,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 255,000 to 256,000. The 4-week moving average was 263,250, a decrease of 2,000 from the previous week's revised average. This is the lowest level for this average since December 15, 1973 when it was 256,750. The previous week's average was revised up by 250 from 265,000 to 265,250.The previous week was revised up to 256,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 263,250. This is the lowest level in over 40 years.

This was below the consensus forecast of 265,000, and the low level of the 4-week average suggests few layoffs.

Wednesday, October 21, 2015

Thursday: Existing Home Sales, Unemployment Claims, Apartment Tightness Index and More

by Calculated Risk on 10/21/2015 06:57:00 PM

Here is a hint ... take the "over" on existing home sales.

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for 265 thousand initial claims, up from 255 thousand the previous week.

• Also at 8:30 AM, the Chicago Fed National Activity Index for September. This is a composite index of other data.

• At 9:00 AM, the FHFA House Price Index for August 2015. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% month-to-month increase for this index.

• At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 5.35 million SAAR, up from 5.31 million in August. Economist Tom Lawler estimates the NAR will report sales of 5.56 million SAAR. A key will be the reported year-over-year change in inventory of homes for sale.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September.

• During the day: Q3 NMHC Apartment Tightness Index.

Payroll Employment and Unemployment Claims

by Calculated Risk on 10/21/2015 02:18:00 PM

I've been asked again about the relationship between initial unemployment claims and monthly payroll employment. Why are claims so low, yet employment gains have slowed?

Here is a repeat of a previous answer with updated graphs. There is definitely a general relationship between payroll employment and unemployment claims as shown in the first graph. Note that unemployment claims are graphed inverted.

Note: For smoothing, this graph use a 3-month centered average of net payroll employment, and the 4-week average of initial unemployment claims.

A few observations:

1) Even with a "low level" of initial weekly claims, there are a large number of claims per week (and per year). If there were 260,000 initial weekly claims per week, that would mean 13 million layoffs per year! However, some of these layoffs are regular - as an example when workers are furloughed (common in some industries) they are eligible for unemployment benefits.

2) Unemployment benefits have been trending down over time. This is probably because of changes in hiring practices.

3) Following the recession, a number of analysts pointed out that when claims dropped below 400 thousand per week, the economy would probably start adding jobs. That was pretty close, but a rough number.

4) Even though there is a general relationship, claims do not suggest a coming surge in employment. As the economy has improved, it is easier to find a new job - so some people who might have filed for unemployment don't because they find new employment.

Each month, when I post an "employment preview", I look at weekly claims (especially for the BLS reference week). This seems to provide a hint - sometimes.

Talking about turnover, the second graph is from JOLTS that I post each month (Job Openings and Labor Turnover Survey).

In August there were almost 5.1 million workers hired, and about 4.9 million total separations (Layoffs, quits, and other). That is a significant amount of turnover each month.

AIA: Strong Rebound for Architecture Billings Index in September

by Calculated Risk on 10/21/2015 10:17:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Strong Rebound for Architecture Billings Index

The Architecture Billings Index (ABI) returned to positive territory after a slight dip in August, and has seen growth in six of the nine months of the year so far. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 53.7, up from a mark of 49.1 in August. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.0, down from a reading of 61.8 the previous month.

“Aside from uneven demand for design services in the Northeast, all regions are project sectors are in good shape,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Areas of concern are shifting to supply issues for the industry, including volatility in building materials costs, a lack of a deep enough talent pool to keep up with demand, as well as a lack of contractors to execute design work.”

...

• Regional averages: South (54.5), Midwest (54.2), West (51.7) Northeast (43.7)

• Sector index breakdown: mixed practice (52.6), institutional (51.5), commercial / industrial (50.9) multi-family residential (49.5)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 53.7 in September, up from 49.1 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

The multi-family residential market was negative for the eighth consecutive month - and this might be indicating a slowdown for apartments - or at least less growth.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment over the next 12 months.

MBA: Mortgage Applications Increase in Latest Weekly Survey, Purchase Applications up 9% YoY

by Calculated Risk on 10/21/2015 07:03:00 AM

This index has had some wild swings recently due to the TILA-RESPA regulatory change that led to a surge in activity as borrowers filed applications before the change, and then a sharp decline in the survey released last week.

From the MBA: Government Applications Drive Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 16, 2015. This week’s results include an adjustment to account for the Columbus Day holiday.

...

The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 16 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 9 percent higher than the same week one year ago.

“On an adjusted basis, application volume increased last week, led by a sharp rebound in government volume. We expect that application volume will remain volatile over the next few weeks as the industry continues to implement TILA-RESPA integrated disclosures,” said Mike Fratantoni, MBA’s Chief Economist.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.95 percent, the lowest level since May 2015, from 3.99 percent, with points decreasing to 0.43 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity remains low.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 9% higher than a year ago.

The wild swings should resolve fairly quickly.

Tuesday, October 20, 2015

Retail: October Seasonal Hiring vs. Holiday Retail Sales

by Calculated Risk on 10/20/2015 05:09:00 PM

Every year I track seasonal retail hiring for hints about holiday retail sales. At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales.

First, here is the NRF forecast for this year: National Retail Federation Forecasts Holiday Sales to Increase 3.7%

[T]he National Retail Federation ... expects sales in November and December (excluding autos, gas and restaurant sales) to increase a solid 3.7 percent to $630.5 billion — significantly higher than the 10-year average of 2.5 percent. Holiday sales in 2015 are expected to represent approximately 19 percent of the retail industry’s annual sales of $3.2 trillion. Additionally, NRF is forecasting online sales to increase between 6 and 8 percent to as much as $105 billion.Note: NRF defines retail sales as including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

ccording to NRF, retailers are expected to hire between 700,000 and 750,000 seasonal workers this holiday season, in line with last year’s 714,000 new holiday positions.

Here is a graph of retail hiring for previous years based on the BLS employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired about 755 thousand seasonal workers last year (using BLS data, Not Seasonally Adjusted), and 186 thousand seasonal workers last October.

Note that in the early '90s, retailers started hiring seasonal workers earlier - and the trend towards hiring earlier has continued.

The following scatter graph is for the years 2005 through 2014 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.84 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.84 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.When the October employment report is released on November 6th, I'll be looking at seasonal retail hiring for hints on what the retailers expect for the holiday season.

Comments on September Housing Starts

by Calculated Risk on 10/20/2015 01:32:00 PM

Total housing starts in September were above expectations, mostly due to an increase in the volatile multi-family sector.

However permits were down in September for multi-family (and down slightly year-over-year).

Earlier: Housing Starts increased to 1.206 Million Annual Rate in September

This first graph shows the month to month comparison between 2014 (blue) and 2015 (red).

Single family starts are running 11.0% ahead of 2014 through September, and single family starts were up 12.0% year-over-year in September.

Starts for 5+ units are up 14.8% for the first nine months compared to last year.

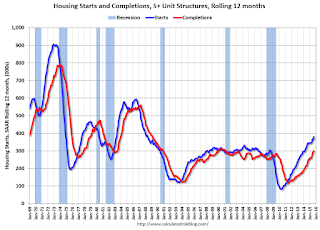

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years, and completions (red line) have lagged behind - but completions have been catching up (more deliveries), and will continue to follow starts up (completions lag starts by about 12 months).

Multi-family completions are increasing sharply and are up 25% year-over-year.

I think most of the growth in multi-family starts is probably behind us - in fact multi-family starts might have peaked in June (at 510 thousand SAAR) - although I expect solid multi-family starts for a few more years (based on demographics).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

The housing recovery continues, but I expect less growth from multi-family going forward.