by Calculated Risk on 7/02/2015 09:55:00 AM

Thursday, July 02, 2015

June Employment Report Comments and Graphs

Earlier: June Employment Report: 223,000 Jobs, 5.3% Unemployment Rate

This was a decent employment report with 223,000 jobs added, although April and May were revised down by a combined 60,000 jobs.

Unfortunately wage growth is still weak, from the BLS: "In June, average hourly earnings for all employees on private nonfarm payrolls were unchanged at $24.95. Over the year, average hourly earnings have risen by 2.0 percent." Weekly hours were unchanged for the fourth month in a row.

A few more numbers: Total employment increased 223,000 from May to June and is now 3.5 million above the previous peak. Total employment is up 12.2 million from the employment recession low.

Private payroll employment also increased 223,000 from May to June, and private employment is now 4.0 million above the previous peak. Private employment is up 12.8 million from the recession low.

In June, the year-over-year change was just over 2.9 million jobs.

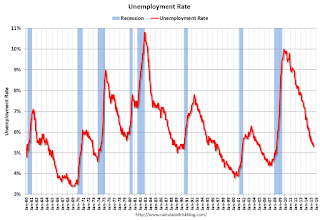

Note: The unemployment rate falling to 5.3%, and still little real wage growth - and still a large number of people working part time for economic reasons - indicates slack in the labor market. My view, partially based on demographics, is that the unemployment rate can fall below 5% without a significant pickup in inflation.

Overall this was a decent report.

Employment-Population Ratio, 25 to 54 years old

In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate was declined in June to 80.8%, and the 25 to 54 employment population ratio was unchanged at 77.2%. As the recovery continues, I expect the participation rate for this group to increase a little more (or at least stabilize for a couple of years) - although the participation rate has been trending down for this group since the late '90s.

Average Hourly Earnings

The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth increased 2.0% YoY - and although the series is noisy - it does appear wage growth is trending up a little. Wages will probably pick up a little more this year.

Note: CPI has been running under 2%, so there has been some real wage growth.

Part Time for Economic Reasons

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 6.5 million, changed little in June. These individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.The number of persons working part time for economic reasons decreased in June to 6.51 million from 6.65 million in May. This is the lowest level since Sept 2008 and suggests slack still in the labor market.

These workers are included in the alternate measure of labor underutilization (U-6) that declined to 10.5% in June (lowest level since July 2008).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 2.121 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 2.502 million in May.

This is trending down - and is at the lowest level since September 2008 - but is still high.

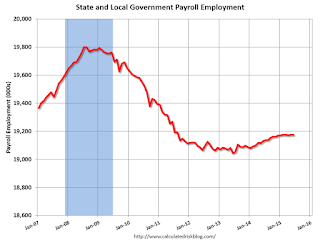

State and Local Government

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.)

This graph shows total state and government payroll employment since January 2007. State and local governments had lost jobs for four straight years. (Note: Scale doesn't start at zero to better show the change.) In June 2015, state and local governments added zero jobs. State and local government employment is now up 132,000 from the bottom, but still 626,000 below the peak.

State and local employment is now generally increasing - slowly. And Federal government layoffs appear to have ended (Federal payrolls were unchanged in June, and Federal employment is up 5,000 year-to-date).

Overall this was a decent employment report for June.

June Employment Report: 223,000 Jobs, 5.3% Unemployment Rate

by Calculated Risk on 7/02/2015 08:33:00 AM

From the BLS:

Total nonfarm payroll employment increased by 223,000 in June, and the unemployment rate declined to 5.3 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in professional and business services, health care, retail trade, financial activities, and in transportation and warehousing.

...

The change in total nonfarm payroll employment for April was revised from +221,000 to +187,000, and the change for May was revised from +280,000 to +254,000. With these revisions, employment gains in April and May combined were 60,000 lower than previously reported.

...

In June, average hourly earnings for all employees on private nonfarm payrolls were unchanged at $24.95. Over the year, average hourly earnings have risen by 2.0 percent.

emphasis added

Click on graph for larger image.

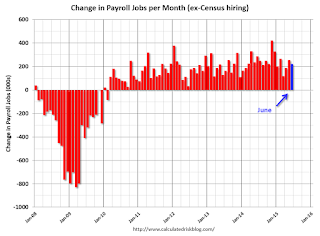

Click on graph for larger image.The first graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

Total payrolls increased by 223 thousand in June (private payrolls also increased 223 thousand).

Payrolls for April and May were revised down by a combined 60 thousand.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In June, the year-over-year change was over 2.9 million jobs.

That is a solid year-over-year gain.

The third graph shows the employment population ratio and the participation rate.

The third graph shows the employment population ratio and the participation rate.The Labor Force Participation Rate decreased in June to 62.6%. This is the percentage of the working age population in the labor force. A large portion of the recent decline in the participation rate is due to demographics.

The Employment-Population ratio decreased to 59.3% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in June to 5.3%.

This was below expectations of 228,000 jobs, and revisions were down, and no wage growth (some wage weakness is seasonal) ... still a decent report.

I'll have much more later ...

Wednesday, July 01, 2015

Thursday: Jobs, Jobs, Jobs

by Calculated Risk on 7/01/2015 08:14:00 PM

Here is the employment preview I posted earlier: Preview: Employment Report for June

Goldman Sachs is forecasting:

We forecast nonfarm payroll growth of 220k in June, a bit below consensus expectations. Labor market indicators were mixed in June, suggesting a print roughly in line with the 217k monthly average seen so far in 2015. We expect the unemployment rate to decline by one-tenth to 5.4%. Finally, average hourly earnings are likely to rise a softer 0.1% in June as a result of calendar effects.Merrill Lynch is forecasting:

We look for job growth of 220,000, a slowdown from the 280,000 pace in May but consistent with the recent trend. As a result, the unemployment rate will likely lower to 5.4% from 5.5%. With the continued tightening in the labor market, we think average hourly earnings (AHE) will increase a “strong” 0.2%, allowing the yoy rate to hold at 2.3%.Nomura is forecasting:

[W]e forecast a 230k increase in private payrolls, with a 5k increase in government jobs, implying that total nonfarm payrolls will gain 235k. ... We forecast that average hourly earnings for private employees rose by 0.17% m-o-m in June, a slower pace than trend due to a calendar quirk. Last, we expect the household survey to show that the unemployment rate ticked down to 5.4% from 5.5%, previously.Thursday:

• At 8:30 AM ET, the Employment Report for June. The consensus is for an increase of 228,000 non-farm payroll jobs added in June, down from the 280,000 non-farm payroll jobs added in May. The consensus is for the unemployment rate to decrease to 5.4%.

• At 8:30 AM, initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 270 thousand from 271 thousand.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May. The consensus is a 0.3% decrease in orders.

Preview: Employment Report for June

by Calculated Risk on 7/01/2015 05:49:00 PM

Bold prediction: Tomorrow will feel like a Friday!

On Thursday at 8:30 AM ET, the BLS will release the employment report for June. The consensus, according to Bloomberg, is for an increase of 230,000 non-farm payroll jobs in June (with a range of estimates between 202,000 to 252,000), and for the unemployment rate to decline to 5.4%.

The BLS reported 280,000 jobs added in May.

Here is a summary of recent data:

• The ADP employment report showed an increase of 237,000 private sector payroll jobs in June. This was above expectations of 220,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month, but in general, this suggests employment growth slightly above expectations.

• The ISM manufacturing employment index increased in June to 55.5%. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS manufacturing payroll jobs increased about 10,000 in June. The ADP report indicated a 7,000 increase for manufacturing jobs.

The ISM non-manufacturing index for June will be released next Monday.

• Initial weekly unemployment claims averaged close to 271,000 in June, about the same as in May - and the lowest monthly average since early 2001. For the BLS reference week (includes the 12th of the month), initial claims were at 268,000; down from 275,000 during the reference week in May.

This suggests a lower level of layoffs in June.

• The final June University of Michigan consumer sentiment index increased to 96.1 from the May reading of 90.0. Sentiment is frequently coincident with changes in the labor market, but there are other factors too - like gasoline prices.

• On small business hiring: The small business index from Intuit showed a 25,000 increase in small business employment in June, the same as in May. From Intuit: Small Businesses Employment Increases in June

Small business employment rose by 25,000 jobs in June, an increase of 0.13 percent, matching the gains seen in May. Although the hiring rate fell slightly, it should not be regarded as a reversal of the upward trend that began in June 2009.• Trim Tabs reported that the U.S. economy added 190,000 jobs in June. From TrimTabs:

“Small business employment remains 500,000 below the peak of 21.2 million people employed by small businesses in March 2007,” said Woodward. “Part of this continuing shortfall is because housing construction has failed to return to pre-crisis or even normal levels.”

“A sign of stronger small business activity is the hiring rate, which has been rising slowly but steadily since September 2009. The hiring rate always exceeds the employment increase because hiring reflects replacing workers who leave, as well as added workers,” Woodward said.

TrimTabs Investment Research estimates that the U.S. economy added 190,000 jobs in June, the lowest level in 12 months.• Conclusion: Unfortunately none of the indicators above is very good at predicting the initial BLS employment report. However it looks like this should be another 200+ month (based on ADP, ISM manufacturing, unemployment claims, and small business hiring). There is always some randomness to the employment report, but my guess is in the low 200s.

“Job growth last month broke a streak of eleven consecutive monthly gains exceeding 200,000,” said David Santschi, chief executive officer of TrimTabs. “The economy seems to have lost some momentum heading into the dog days of summer.”

TrimTabs’ employment estimates are based on analysis of daily income tax deposits to the U.S. Treasury from the paychecks of the 142 million U.S. workers subject to withholding.

U.S. Light Vehicle Sales decreased to 17.1 million annual rate in June

by Calculated Risk on 7/01/2015 02:51:00 PM

Based on an AutoData estimate, light vehicle sales were at a 17.1 million SAAR in June. That is up 1.5% from June 2014, and down 3.5% from the 17.7 million annual sales rate last month.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for June (red, light vehicle sales of 17.1 million SAAR from WardsAuto).

This was close to the consensus forecast of 17.2 million SAAR (seasonally adjusted annual rate).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This was below the consensus forecast, but another strong month. It appears 2015 will be the best year for light vehicle sales since 2001.

Reis: Office Vacancy Rate unchanged in Q2 to 16.6%

by Calculated Risk on 7/01/2015 01:45:00 PM

Reis released their Q2 2015 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged compared to Q1 at 16.6%. This is down from 16.9% in Q2 2014, and down from the cycle peak of 17.6%.

From Reis:

The national vacancy rate remained unchanged at 16.6% during the second quarter. Vacancy compression stalled this quarter because net absorption was slightly outpaced by new construction. This appears to be just a pause as vacancy compression has been more consistent in recent quarters. With the economy and labor market continuing to improve, demand should outpace new construction by a wider margin over time, resulting in more rapid vacancy compression than has occurred up to this point.

...

Occupied stock increased by 8.154 million square feet during the second quarter. This was an increase versus last quarter. However, more heartening data can be found in the year‐to‐date net absorption figure of 15.607 million SF. This is a 22% increase over 2014’s year‐to‐date absorption and the best midyear performance since before the recession. This provides the strongest evidence yet that greater demand is returning to the office market. Although the pace of improvement has been slower than in previous recoveries, it appears that this recovery is finally gaining momentum. We expect this to continue going forward as ongoing increases in hiring translate into greater space needs for office users.

New construction of 8.303 million SF is a bounce back from the first quarter. Most of the new inventory coming online is preleased. Although it is slowly increasing, there remains little new purely speculative development in the market. This will likely persist until vacancy is far lower – with such an elevated vacancy rate, investors and lenders remain cautious about green lighting construction that does not have a pre‐leased component. When this stringent pre‐leasing prerequisite is finally dropped it will be a clear sign to the market that the recovery is in full swing. However, we have not yet arrived at that juncture.

...

Asking and effective rents both grew by 0.7% during the second quarter, marking the nineteenth consecutive quarter of asking and effective rent growth. These growth rates are a decrease from last quarter when both grew by roughly 1.0%. As we mentioned last quarter, annualized rent growth of closer to 4%, which was observed during the two previous quarters, was going to be difficult to maintain in such a high‐vacancy environment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.6% in Q2.

Office vacancy data courtesy of Reis.

Construction Spending increased 0.8% in May

by Calculated Risk on 7/01/2015 10:59:00 AM

Earlier today, the Census Bureau reported that overall construction spending increased in May:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2015 was estimated at a seasonally adjusted annual rate of $1,035.8 billion, 0.8 percent above the revised April estimate of $1,027.0 billion. The May figure is 8.2 percent above the May 2014 estimate of $957.6 billion.Both Private and public spending increased:

Spending on private construction was at a seasonally adjusted annual rate of $752.4 billion, 0.9 percent above the revised April estimate of $745.6 billion. ...Note: Non-residential for offices and hotels is generally increasing, but spending for oil and gas has been declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because oil prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In May, the estimated seasonally adjusted annual rate of public construction spending was $283.4 billion, 0.7 percent above the revised April estimate of $281.5 billion.

emphasis added

As an example, construction spending for private lodging is up 30% year-over-year, whereas spending for power (includes oil and gas) construction peaked in mid-2014 and is down 24% year-over-year.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has been increasing recently, and is 47% below the bubble peak.

Non-residential spending is only 5% below the peak in January 2008 (nominal dollars).

Public construction spending is now 13% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 8%. Non-residential spending is up 13% year-over-year. Public spending is up 3% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup (except oil and gas), and public spending has probably hit bottom after several years of austerity.

This was above the consensus forecast of a 0.5% increase, and spending for January through April was revised up. A solid report.

ISM Manufacturing index increased to 53.5 in June

by Calculated Risk on 7/01/2015 10:06:00 AM

The ISM manufacturing index suggested expansion in June. The PMI was at 53.5% in June, up from 52.8% in May. The employment index was at 55.5%, up from 51.7% in May, and the new orders index was at 56.0%, up from 55.8%.

From the Institute for Supply Management: June 2015 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in June for the 30th consecutive month, and the overall economy grew for the 73rd consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The June PMI® registered 53.5 percent, an increase of 0.7 percentage point over the May reading of 52.8 percent. The New Orders Index registered 56 percent, an increase of 0.2 percentage point from the reading of 55.8 percent in May. The Production Index registered 54 percent, 0.5 percentage point below the May reading of 54.5 percent. The Employment Index registered 55.5 percent, 3.8 percentage points above the May reading of 51.7 percent, reflecting growing employment levels from May at a faster rate. Inventories of raw materials registered 53 percent, an increase of 1.5 percentage points from the May reading of 51.5 percent. The Prices Index registered 49.5 percent, the same reading as in May, indicating lower raw materials prices for the eighth consecutive month. Comments from the panel indicate mostly stable to improving business conditions, with the notable exception relating to the oil and gas markets. Also noted is the negative effect on egg prices and availability due to the avian flu outbreak."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 53.2%, and indicates slightly faster expansion in June. Solid internals.

ADP: Private Employment increased 237,000 in June

by Calculated Risk on 7/01/2015 08:19:00 AM

Private sector employment increased by 237,000 jobs from May to June according to the June ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 220,000 private sector jobs added in the ADP report.

...

Goods-producing employment rose by12,000 jobs in June, after adding 11,000 in May. The construction industry had another solid month in June adding 19,000 jobs, down from 28,000 last month. Meanwhile, manufacturing added 7,000 jobs in June, after losing 2,000 in May.

Service-providing employment rose by 225,000 jobs in June, a strong rise from 192,000 in May. The ADP National Employment Report indicates that professional/business services contributed 61,000 jobs in June, almost double May’s 32,000. Trade/transportation/utilities grew by 50,000, the same as the previous month. The 19,000 new jobs added in financial activities was an increase from last month’s 12,000.

...

Mark Zandi, chief economist of Moody’s Analytics, said, “The U.S. job machine remains in high gear. The current robust pace of job growth is double that needed to absorb the growth in the working age population. The only blemish in the job market is the loss of jobs in the energy sector. Most encouraging is the healthy rate of job growth among the nation’s smallest companies.”

The BLS report for June will be released tomorrow, Thursday, and the consensus is for 228,000 non-farm payroll jobs added in June.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Purchase Index up 14% YoY

by Calculated Risk on 7/01/2015 07:00:00 AM

From the MBA: Mortgage Applications Drop in Latest MBA Weekly Survey as Rates Increase

Mortgage applications decreased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 26, 2015. ...

The Refinance Index decreased 5 percent from the previous week to its lowest level since December 2014. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 14 percent higher than the same week one year ago.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.26 percent, its highest level since October 2014, from 4.19 percent, with points decreasing to 0.33 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With higher rates, refinance activity is at the lowest level since December 2014.

2014 was the lowest year for refinance activity since year 2000, and refinance activity will probably stay low for the rest of 2015.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is 14% higher than a year ago.