by Calculated Risk on 3/24/2015 05:50:00 PM

Tuesday, March 24, 2015

ATA Trucking Index declined in February

Here is an indicator that I follow on trucking, from the ATA: ATA Truck Tonnage Index Fell 3.1% in February

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index decreased 3.1% in February, following a revised gain of 1.3% during the previous month. In February, the index equaled 131.6 (2000=100), the lowest level since September 2014.

Compared with February 2014, the SA index increased 3%, although this was the smallest year-over-year gain since June of last year and below the 2014 annual increase of 3.7%. ...

“The February drop in truck tonnage was not a surprise,” said ATA Chief Economist Bob Costello. “Retail sales, manufacturing output and housing starts were all off during the month, so the tonnage decline fits with those indicators. The surprise would have been had tonnage increased with all of those sectors falling.”

Costello added that the winter weather that impacted a large portion of the country during February had a negative impact on truck tonnage as well as industries that drive tonnage, like retail, manufacturing and housing starts.

Trucking serves as a barometer of the U.S. economy, representing 69.1% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.7 billion tons of freight in 2013. Motor carriers collected $681.7 billion, or 81.2% of total revenue earned by all transport modes.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is now up 3.0% year-over-year.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in February

by Calculated Risk on 3/24/2015 02:57:00 PM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities and areas in February.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic is up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

Foreclosures are up in several areas, especially in Florida.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Feb-15 | Feb-14 | Feb-15 | Feb-14 | Feb-15 | Feb-14 | Feb-15 | Feb-14 | |

| Las Vegas | 9.3% | 14.0% | 9.7% | 12.0% | 19.0% | 26.0% | 37.4% | 46.8% |

| Reno** | 7.0% | 13.0% | 7.0% | 7.0% | 14.0% | 20.0% | ||

| Phoenix | 4.4% | 5.3% | 5.8% | 8.3% | 10.1% | 13.7% | 29.9% | 35.4% |

| Sacramento | 6.3% | 12.4% | 8.6% | 7.0% | 14.9% | 19.4% | 19.8% | 26.5% |

| Minneapolis | 2.7% | 5.0% | 15.3% | 25.3% | 18.1% | 30.3% | ||

| Mid-Atlantic | 5.3% | 7.7% | 15.1% | 10.9% | 20.4% | 18.6% | 21.2% | 21.4% |

| Orlando | 5.3% | 9.4% | 27.0% | 23.8% | 32.3% | 33.2% | 42.2% | 48.2% |

| California * | 6.2% | 9.0% | 6.8% | 8.0% | 13.0% | 17.0% | ||

| Bay Area CA* | 4.8% | 6.3% | 4.5% | 5.0% | 9.3% | 11.3% | 26.7% | 28.4% |

| So. California* | 6.1% | 9.0% | 6.1% | 6.7% | 12.2% | 15.7% | 28.0% | 31.0% |

| Florida SF | 4.9% | 8.4% | 24.0% | 23.6% | 28.9% | 32.0% | 42.4% | 47.9% |

| Florida C/TH | 2.9% | 6.0% | 18.8% | 17.8% | 21.7% | 23.8% | 69.4% | 73.2% |

| Tampa MSA SF | 5.2% | 9.9% | 26.6% | 24.9% | 31.8% | 34.8% | 43.2% | 46.4% |

| Tampa MSA C/TH | 2.4% | 5.3% | 19.0% | 19.2% | 21.5% | 24.6% | 65.4% | 71.2% |

| Miami MSA SF | 7.7% | 13.8% | 22.5% | 16.4% | 30.1% | 30.1% | 42.2% | 48.7% |

| Miami MSA C/TH | 3.6% | 7.5% | 23.5% | 18.3% | 27.1% | 25.8% | 71.9% | 75.2% |

| Northeast Florida | 37.6% | 44.5% | ||||||

| Chicago (city) | 29.9% | 40.0% | ||||||

| Hampton Roads | 22.6% | 30.7% | ||||||

| Des Moines | 21.3% | 23.3% | ||||||

| Georgia*** | 27.1% | 35.3% | ||||||

| Omaha | 19.6% | 25.6% | ||||||

| Pensacola | 36.7% | 41.8% | ||||||

| Knoxville | 23.9% | 27.4% | ||||||

| Richmond VA | 13.9% | 22.2% | 21.5% | 22.2% | ||||

| Springfield IL** | 15.3% | 18.3% | 21.4% | N/A | ||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||

Key Measures Show Low Inflation in February

by Calculated Risk on 3/24/2015 12:01:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (3.0% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.0% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. Motor fuel added to inflation in February following several months of steep declines. However oil and gasoline prices declined again in March, and will pull down inflation again.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.6% annualized rate) in February. The CPI less food and energy rose 0.2% (1.9% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 3.0% annualized, trimmed-mean CPI was at 2.0% annualized, and core CPI was at 1.9% annualized.

On a year-over-year basis these measures suggest inflation remains below the Fed's target of 2% (median CPI is slightly above 2%).

The key question for the Fed is if these key measures will move back towards 2%.

Comments on New Home Sales

by Calculated Risk on 3/24/2015 11:03:00 AM

The new home sales report for February was above expectations at 539 thousand on a seasonally adjusted annual rate basis (SAAR).

Also, sales for January were revised up (sales for November and December was revised slightly).

Sales in 2015 are off to a solid start, although this is just two months of data.

Earlier: New Home Sales at 539,000 Annual Rate in February

The Census Bureau reported that new home sales this year, through February, were 81,000, Not seasonally adjusted (NSA). That is up 19% from 68,000 during the same period of 2014 (NSA). This is very early - and the next six months are usually the strongest of the year NSA - but this is a solid start.

Sales were up 24.8% year-over-year in February.

This graph shows new home sales for 2014 and 2015 by month (Seasonally Adjusted Annual Rate).

The year-over-year gain will be strong in Q1 (the first half was especially weak in 2014), and I expect the year-over-year increases to slow later this year.

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next few years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales.

I expect existing home sales to move sideways (distressed sales will continue to decline and be partially offset by more conventional / equity sales). And I expect this gap to slowly close, mostly from an increase in new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 539,000 Annual Rate in February

by Calculated Risk on 3/24/2015 10:05:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 539 thousand.

January sales were revised up from 481 thousand to 500 thousand, and December sales were revised down slightly from 482 thousand to 479 thousand.

"Sales of new single-family houses in February 2015 were at a seasonally adjusted annual rate of 539,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent above the revised January rate of 500,000 and is 24.8 percent above the February 2014 estimate of 432,000."

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the previous two years, new home sales are still close to the bottoms for previous recessions.

The second graph shows New Home Months of Supply.

The months of supply was declined in February at 4.7 months.

The months of supply was declined in February at 4.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally adjusted estimate of new houses for sale at the end of February was 210,000. This represents a supply of 4.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

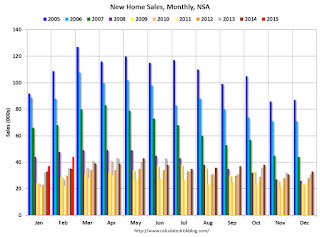

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In February 2015 (red column), 44 thousand new homes were sold (NSA). Last year 35 thousand homes were sold in February. This is the highest for February since 2008.

The high for February was 109 thousand in 2005, and the low for February was 22 thousand in 2011.

This was way above expectations of 475,000 sales in February, and is a strong start to 2015. I'll have more later today.