by Calculated Risk on 3/24/2015 08:31:00 AM

Tuesday, March 24, 2015

BLS: CPI increased 0.2% in February, Core CPI increased 0.2%

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index was unchanged before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.2% increase for CPI, and above the forecast of a 0.1% increase in core CPI.

The seasonally adjusted increase in the all items index was broad-based, with increases in shelter, energy, and food indexes all contributing. The energy index rose after a long series of declines, increasing 1.0 percent as the gasoline index turned up after falling in recent months. The food index, unchanged last month, also rose in February, though major grocery store food group indexes were mixed.

The index for all items less food and energy rose 0.2 percent in February, the same increase as in January.

emphasis added

Monday, March 23, 2015

Tuesday: New Home Sales, CPI, Richmond Fed Mfg

by Calculated Risk on 3/23/2015 07:54:00 PM

With oil and gasoline prices up a little in February compared to January, CPI will probably show a positive monthly change for the first time since October. The CPI might still be down year-over-year - or close to unchanged.

As an example, WTI oil averaged $47.22 per barrel in January and increased to $50.58 in February. However oil and gasoline prices have declined again in March - WTI was at $47.42 today - and will push down inflation again in March.

Tuesday:

• 8:30 AM ET, the Consumer Price Index for February. The consensus is for a 0.2% increase in CPI, and for core CPI to increase 0.1%.

• At 9:00 AM, the FHFA House Price Index for January 2015. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, New Home Sales for February from the Census Bureau. The consensus is for a decrease in sales to 475 thousand Seasonally Adjusted Annual Rate (SAAR) in February from 481 thousand in January.

• Also at 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for March.

Lawler: Net Home Orders for Three Large Builders in Latest Quarter

by Calculated Risk on 3/23/2015 04:52:00 PM

From housing economist Tom Lawler:

Below is a table showing net home orders for the quarter ended February 28 of 2015 compared to the comparable quarter of the previous two years.

At least for these three builders, the beginning of this year’s “spring” (a misnomer) home selling season looks materially better than last year’s disappointing season.

| Net Home Orders, Quarter Ending February 28 | YOY % Change | ||||

|---|---|---|---|---|---|

| 2015 | 2014 | 2013 | 2015 | 2014 | |

| Lennar Corp. | 5,287 | 4,465 | 4,055 | 18.4% | 10.1% |

| KB Home | 2,189 | 1,765 | 1,671 | 24.0% | 5.6% |

| Hovnanian Ent. | 1,514 | 1,402 | 1,581 | 8.0% | -11.3% |

| Total | 8,990 | 7,632 | 7,307 | 17.8% | 4.4% |

Philly Fed: State Coincident Indexes increased in 46 states in January

by Calculated Risk on 3/23/2015 03:55:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for January 2015. In the past month, the indexes increased in 46 states, decreased in two, and remained stable in two, for a one-month diffusion index of 88. Over the past three months, the indexes increased in 48 states and decreased in two, for a three-month diffusion index of 92.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In January, 47 states had increasing activity (including minor increases). This measure has been moving up and down, and is in the normal range for a recovery.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and is almost all green again. It seems likely that several oil producing states will turn red sometime in 2015 - possibly Texas, North Dakota, Alaska or Oklahoma.

A Few Comments on February Existing Home Sales

by Calculated Risk on 3/23/2015 12:28:00 PM

Inventory is still very low (down 0.5% year-over-year in February). This will be important to watch over the next month at the start of the Spring buying season.

Note: As usually happens, housing economist Tom Lawler's estimate was closer than the consensus to the NAR reported sales rate.

Also, the NAR reported total sales were up 4.7% from February 2014, however normal equity sales were up even more, and distressed sales down sharply. From the NAR (from a survey that is far from perfect):

Distressed sales – foreclosures and short sales – were 11 percent of sales in February, unchanged for the third consecutive month and down from 16 percent a year ago. Eight percent of February sales were foreclosures and 3 percent were short sales. Foreclosures sold for an average discount of 17 percent below market value in February (15 percent in January), while short sales were discounted 15 percent (12 percent in January).Last year in February the NAR reported that 16% of sales were distressed sales.

A rough estimate: Sales in February 2014 were reported at 4.66 million SAAR with 16% distressed. That gives 746 thousand distressed (annual rate), and 3.91 million equity / non-distressed. In February 2015, sales were 4.88 million SAAR, with 11% distressed. That gives 537 thousand distressed - a decline of about 28% from February 2014 - and 4.34 million equity. Although this survey isn't perfect, this suggests distressed sales were down sharply - and normal sales up around 10%.

Important: If total existing sales decline a little, or move side-ways - due to fewer distressed sales- that is a positive sign for real estate.

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in February (red column) were slightly higher than last year (NSA), and below sales in February 2013.

Earlier:

• Existing Home Sales in February: 4.88 million SAAR, Inventory down slightly Year-over-year

Existing Home Sales in February: 4.88 million SAAR, Inventory down slightly Year-over-year

by Calculated Risk on 3/23/2015 10:05:00 AM

The NAR reports: Existing-Home Sales Slightly Improve in February, Price Growth Gains Steam

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.2 percent to a seasonally adjusted annual rate of 4.88 million in February from 4.82 million in January. Sales are 4.7 percent higher than a year ago and above year-over-year totals for the fifth consecutive month. ...

Total housing inventory at the end of February increased 1.6 percent to 1.89 million existing homes available for sale, but remains 0.5 percent below a year ago (1.90 million). For the second straight month, unsold inventory is at a 4.6-month supply at the current sales pace.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February (4.88 million SAAR) were 1.2% higher than last month, and were 4.7% above the February 2014 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.89 million in February from 1.86 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.89 million in February from 1.86 million in January. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 0.5% year-over-year in February compared to February 2014.

Inventory decreased 0.5% year-over-year in February compared to February 2014. Months of supply was at 4.6 months in February.

This was slightly below expectations of sales of 4.94 million (Right at economist Tom Lawler's forecast of 4.87 million). For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Chicago Fed: "Index shows economic growth slightly below average in February"

by Calculated Risk on 3/23/2015 09:06:00 AM

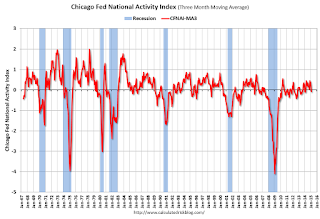

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth slightly below average in February

The Chicago Fed National Activity Index (CFNAI) edged lower to –0.11 in February from –0.10 in January. Two of the four broad categories of indicators that make up the index decreased from January, and two of the four categories made negative contributions to the index in February.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, declined to –0.08 in February from +0.26 in January. February’s CFNAI-MA3 suggests that growth in national economic activity was slightly below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly below the historical trend in February (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Black Knight: Mortgage Delinquencies Declined in February, Lowest since August 2007

by Calculated Risk on 3/23/2015 07:01:00 AM

According to Black Knight's First Look report for February, the percent of loans delinquent decreased 3.7% in February compared to January, and declined 10% year-over-year.

The percent of loans in the foreclosure process declined 2% in February and were down about 29% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 5.36% in February, down from 5.56% in January. The normal rate for delinquencies is around 4.5% to 5%. This is the lowest level of delinquencies since August 2007.

The percent of loans in the foreclosure process declined in February to 1.58%. This was the lowest level of foreclosure inventory since December 2007.

The number of delinquent properties, but not in foreclosure, is down 453,000 properties year-over-year, and the number of properties in the foreclosure process is down 315,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for February in early April.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Feb 2015 | Jan 2015 | Feb 2014 | Feb 2013 | |

| Delinquent | 5.36% | 5.56% | 5.97% | 6.80% |

| In Foreclosure | 1.58% | 1.61% | 2.22% | 3.38% |

| Number of properties: | ||||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,646,000 | 1,701,000 | 1,749,000 | 1,927,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,067,000 | 1,112,000 | 1,242,000 | 1,483,000 |

| Number of properties in foreclosure pre-sale inventory: | 800,000 | 815,000 | 1,115,000 | 1,694,000 |

| Total Properties | 3,512,000 | 3,628,000 | 4,106,000 | 5,104,000 |

Sunday, March 22, 2015

Monday: Existing Home Sales

by Calculated Risk on 3/22/2015 07:59:00 PM

From Nick Timiraos at the WSJ: Oil Price Drop Hurts Spending on Business Investments

Prospects for an uptick in business investment this year are facing a major drag: The collapse in oil prices is spurring significant cutbacks for the energy-production industry, which had been a standout in an otherwise lackluster U.S. expansion.Overall the decline in oil prices will be a positive for the US economy, but there are clearly certain sectors that are taking a hit.

Business capital spending increased 6% last year because of gains from a broad base of U.S. industries. The drag from energy this year could cut that growth rate in half in 2015, according to economists at Goldman Sachs.

Monday:

• 8:30 AM ET, the Chicago Fed National Activity Index for February. This is a composite index of other data.

• At 10:00 AM, Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 4.94 million on seasonally adjusted annual rate (SAAR) basis. Sales in January were at a 4.82 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.87 million SAAR.

• At 12:20 PM, Speech by Fed Vice Chairman Stanley Fischer, Monetary Policy Lessons and the Way Ahead, At the Economic Club of New York, New York, N.Y

Weekend:

• Schedule for Week of March 22, 2015

From CNBC: Pre-Market Data and Bloomberg futures: currently S&P futures are up 3 and DOW futures are up 30 (fair value).

Oil prices were up slightly over the last week with WTI futures at $46.16 per barrel and Brent at $54.81 per barrel. A year ago, WTI was at $100, and Brent was at $107 - so prices are down 50%+ year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up to $2.42 per gallon (down more than $1.00 per gallon from a year ago). Prices in California are now declining following a refinery fire in February and a strike that is now over.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Fed: Q4 Household Debt Service Ratio near Record Low

by Calculated Risk on 3/22/2015 10:38:00 AM

The Fed's Household Debt Service ratio through Q4 2014 was released Friday: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q4, and is near the record low set in Q4 2012. Note: The financial obligation ratio (FOR) is also near a record low (not shown)

The DSR for mortgages (blue) declined further in Q4. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With lower interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

This data suggests household cash flow is in much better shape now.