by Calculated Risk on 2/22/2015 11:08:00 AM

Sunday, February 22, 2015

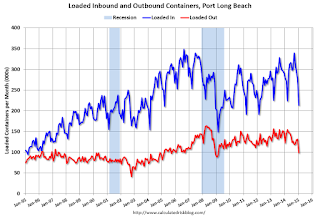

Long Beach Port Traffic Declined Sharply in January

The Port of Long Beach released container traffic statistics for January (the Port of Los Angeles hasn't released January data yet).

The Long Beach data showed a significant decline in port traffic due to the labor issues that were tentatively settled on Friday.

Note: There is usually a seasonal slowdown in February or March (depending on the timing of the Chinese New Year). February traffic will be very slow this year, but March should be strong.

Imports were down 23.5% year-over-year in January, and exports were down 19.6% year-over-year.

This decline in traffic was primarily due to the ongoing labor negotiations.

Saturday, February 21, 2015

Schedule for Week of February 22, 2015

by Calculated Risk on 2/21/2015 01:11:00 PM

The key economic reports this week are January new home sales on Wednesday, existing home sales on Monday, the second estimate of Q4 GDP on Friday, and Case-Shiller house prices on Tuesday.

Fed Chair Janet Yellen will provide testimony to the Senate and House on Tuesday and Wednesday.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for sales of 5.00 million on seasonally adjusted annual rate (SAAR) basis. Sales in December were at a 5.04 million SAAR. Economist Tom Lawler estimates the NAR will report sales of 4.90 million SAAR.

A key will be the reported year-over-year increase in inventory of homes for sale.

10:30 AM: Dallas Fed Manufacturing Survey for February.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.

9:00 AM: S&P/Case-Shiller House Price Index for December. Although this is the December report, it is really a 3 month average of October, November and December prices.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the November 2014 report (the Composite 20 was started in January 2000).

The consensus is for a 4.7% year-over-year increase in the National Index for December. The Zillow forecast is for the National Index to increase 4.7% year-over-year in December, and for prices to increase 0.5% month-to-month seasonally adjusted.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for February.

10:00 AM: Conference Board's consumer confidence index for February. The consensus is for the index to decrease to 99.1 from 102.9.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking, Housing, and Urban Affairs Committee, Washington, D.C.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for a decrease in sales to 471 thousand Seasonally Adjusted Annual Rate (SAAR) in January from 481 thousand in December.

10:00 AM: Testimony, Fed Chair Janet Yellen, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 290 thousand from 283 thousand.

8:30 AM: Consumer Price Index for January. The consensus is for a 0.6% decrease in CPI, and for core CPI to increase 0.1%.

9:00 AM: FHFA House Price Index for December 2014. This was originally a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.5% increase.

8:30 AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

11:00 AM: the Kansas City Fed manufacturing survey for February.

8:30 AM: Gross Domestic Product, 4th quarter 2014 (second estimate). The consensus is that real GDP increased 2.1% annualized in Q4, down from the advance estimate of 2.6%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 58.3, down from 59.4 in January.

9:55 AM: University of Michigan's Consumer sentiment index (final for February). The consensus is for a reading of 94.0, up from the preliminary reading of 93.6, but down from the December reading of 98.1.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 2.0% increase in the index.

1:30 PM: Speech, Fed Vice Chairman Stanley Fischer, Conducting Monetary Policy with a Large Balance Sheet, At the 2015 U.S. Monetary Policy Forum, New York, New York

Unofficial Problem Bank list declines to 378 Institutions

by Calculated Risk on 2/21/2015 08:01:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 21, 2015.

Changes and comments from surferdude808:

The OCC released its latest enforcement actions leading to eight removals from the Unofficial Problem Bank List. After the removals, the list stands at 378 institutions with assets of $117.9 billion. We updated asset figures with 2014q4 financials, which accounted for a $812 million of the $3.2 billion decline in assets this week. A year ago, the list held 578 institutions with assets of $193.0 billion.

The OCC terminated actions against Armed Forces Bank, National Association, Fort Leavenworth, KS ($1.7 billion); Academy Bank, National Association, Colorado Springs, CO ($325 million); Mission National Bank, San Francisco, CA ($177 million); Southern Commerce Bank, National Association, Tampa, FL ($70.2 million); The First National Bank of Sullivan, Sullivan, IL ($60 million); Olmsted National Bank, Rochester, MN ($54 million); SunBank, National Association, Phoenix, AZ ($32 million); and Armed Forces Bank of California, National Association, San Diego, CA ($17 million).

Next week, we anticipate the FDIC will provide an update on its enforcement action activity, industry results for the third quarter, and updated aggregate figures for their official problem bank list.

Friday, February 20, 2015

West Coast Port Deal Reached

by Calculated Risk on 2/20/2015 10:15:00 PM

Some good news from the LA Times: Shipping lines and dockworkers reach deal, port shutdown averted

Shipping companies and the dockworkers union have reached a tentative deal on a new labor contract, union officials said Friday night, staving off a shutdown of 29 ports that would have choked off trade through the West Coast.

...

It will take weeks, if not months, just to clear the current backlog, port officials said.

A Comment on Greece

by Calculated Risk on 2/20/2015 05:11:00 PM

There was an agreement today (pending some proposals on Monday) to extend the Greek bailout for four months.

My first reaction is that there seem to be two possible outcomes in four months:

1) The technocrats at the ECB / EU / IMF agree to change the target for the primary budget surplus. The current plan is for Greece to run a primary surplus of 3.0% in 2015 and 4.5% in 2016, however that assumed that the unemployment rate would peak at 14.8% (instead the unemployment rate increased to close to 28%), and that GDP would start increasing in 2012 - instead GDP kept falling - and Greece is now in a Great Depression size contraction.

Contractionary policy has been very contractionary!

It is amazing that Greece is even running a primary budget surplus with a collapsing economy. If the primary target isn't change, the depression will continue. A little growth would help everyone, so easing the primary budget target is critical.

2) The Greeks will take the four months and ready the drachma printing presses.

Point 1 is possible, but the technocrats are the only hope for Greece, not the politicians. See the following quote from German Finance minister Wolfgang Schauble in 2013:

"Nobody in Europe sees this contradiction between fiscal policy consolidation and growth,” Schauble said. “We have a growth-friendly process of consolidation, and we have sustainable growth, however you want to word it.”Not everyone is blind to the obvious - some people in Europe see the obvious contradiction (just look at the data for Europe as a whole and Greece in particular). Too many politicians can't (or won't) look at the data and change their minds.

Lawler: Homebuilder Summary Table

by Calculated Risk on 2/20/2015 03:52:00 PM

Economist Tom Lawler sent me the summary tables below for selected publicly-traded home builders.

The first table is for Q4.

This second and third tables are for Calendar Years 2014, 2013, and 2012.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 12/14 | 12/13 | % Chg | 12/14 | 12/13 | % Chg | 12/14 | 12/13 | % Chg |

| D.R. Horton | 7,370 | 5,454 | 35.1% | 7,973 | 6,188 | 28.8% | $281,036 | 263,542 | 6.6% |

| PulteGroup | 3,232 | 3,214 | 0.6% | 5,316 | 4,964 | 7.1% | $334,000 | 325,000 | 2.8% |

| NVR | 2,713 | 2,631 | 3.1% | 3,469 | 3,342 | 3.8% | $375,500 | 365,300 | 2.8% |

| The Ryland Group | 1,547 | 1,428 | 8.3% | 2,489 | 2,178 | 14.3% | $338,000 | 314,000 | 7.6% |

| Beazer Homes | 966 | 895 | 7.9% | 885 | 1,038 | -14.7% | $295,600 | 279,300 | 5.8% |

| Standard Pacific | 978 | 878 | 11.4% | 1,475 | 1,343 | 9.8% | $491,000 | 446,000 | 10.1% |

| Meritage Homes | 1,272 | 1,131 | 12.5% | 1,863 | 1,468 | 26.9% | $369,000 | 363,000 | 1.7% |

| MDC Holdings | 887 | 752 | 18.0% | 1,242 | 1,252 | -0.8% | $397,000 | 368,200 | 7.8% |

| M/I Homes | 773 | 793 | -2.5% | 1,105 | 1,120 | -1.3% | $322,000 | 292,000 | 10.3% |

| Total | 19,738 | 17,176 | 14.9% | 25,817 | 22,893 | 12.8% | $336,302 | $321,436 | 4.6% |

| Net Orders | Settlements | Average Closing Price $ | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Calendar Year | 2014 | 2013 | 2012 | 2014 | 2013 | 2012 | 2014 | 2013 | 2012 |

| D.R. Horton | 31,625 | 25,315 | 22,513 | 30,455 | 25,161 | 19,954 | 276,296 | 255,646 | 228,395 |

| PulteGroup | 16,652 | 17,080 | 19,039 | 17,196 | 17,766 | 16,505 | 329,000 | 305,000 | 276,000 |

| NVR | 12,389 | 11,800 | 10,954 | 11,859 | 11,834 | 9,843 | 368,500 | 349,100 | 317,073 |

| The Ryland Group | 7,668 | 7,263 | 5,781 | 7,677 | 7,035 | 4,897 | 333,000 | 296,000 | 262,000 |

| Beazer Homes | 4,819 | 4,989 | 5,111 | 4,798 | 5,056 | 4,603 | 287,960 | 262,004 | 229,126 |

| Standard Pacific | 4,967 | 4,898 | 4,014 | 4,956 | 4,602 | 3,291 | 478,000 | 413,000 | 362,000 |

| Meritage Homes | 5,944 | 5,615 | 4,795 | 5,862 | 5,259 | 4,238 | 365,000 | 339,000 | 279,000 |

| MDC Holdings | 4,623 | 4,327 | 4,342 | 4,366 | 4,710 | 3,740 | 377,300 | 345,400 | 307,800 |

| M/I Homes | 3,663 | 3,787 | 3,020 | 3,721 | 3,472 | 2,765 | 313,000 | 286,000 | 264,000 |

| Total | 92,350 | 85,074 | 79,569 | 90,890 | 84,895 | 69,836 | 326,777 | 302,631 | 269,578 |

| Net Orders (% Change) | Settlements (% Change) | Average Closing Price (% Change) | ||||

|---|---|---|---|---|---|---|

| Calendar Year | 2014 vs. 2013 | 2013 vs. 2012 | 2014 vs 2013 | 2013 vs. 2012 | 2014 vs 2013 | 2013 vs. 2012 |

| D.R. Horton | 24.9% | 12.4% | 21.0% | 26.1% | 8.1% | 11.9% |

| PulteGroup | -2.5% | -10.3% | -3.2% | 7.6% | 7.9% | 10.5% |

| NVR | 5.0% | 7.7% | 0.2% | 20.2% | 5.6% | 10.1% |

| The Ryland Group | 5.6% | 25.6% | 9.1% | 43.7% | 12.5% | 13.0% |

| Beazer Homes | -3.4% | -2.4% | -5.1% | 9.8% | 9.9% | 14.3% |

| Standard Pacific | 1.4% | 22.0% | 7.7% | 39.8% | 15.7% | 14.1% |

| Meritage Homes | 5.9% | 17.1% | 11.5% | 24.1% | 7.7% | 21.5% |

| MDC Holdings | 6.8% | -0.3% | -7.3% | 25.9% | 9.2% | 12.2% |

| M/I Homes | -3.3% | 25.4% | 7.2% | 25.6% | 9.4% | 8.3% |

| Total | 8.6% | 6.9% | 7.1% | 21.6% | 8.0% | 12.3% |

Greece: Tentative Deal, 4 Month Extension, Possible 2 PM ET Press Conference

by Calculated Risk on 2/20/2015 01:52:00 PM

Just an update: Some details have leaked out, although the text is not available yet. It appears there will be a four month extension of the loan agreement - not the program - and the Greek government will standstill for four months - with no additional austerity, and no new spending programs. This is all tentative and the details could be wrong.

Press conference here, possibly as soon as 2 PM ET.

Lawler: Regional Home Price Declines Used to be Quite Common; Just Not All at the Same Time

by Calculated Risk on 2/20/2015 10:45:00 AM

Some interesting analysis from housing economist Tom Lawler:

Using the Freddie Mac Home Price Index for 369 MSAs, below is a chart showing the number of MSAs where the FMHPI over 60-month period ending in the date shown either (1) declined, or (2) fell by at least 10%. (The FMHPIs are based on repeat transactions of homes backing GSE mortgages, and data are available back to January 1975.) The first chart covers the five-year period ending January 1980 through the five-year period ending December 1999.

In five-year periods that including the late 70’s there were very few MSAs whose HPI fell over those five years, mainly because this was a period of very high inflation (see last page). That changed significantly as inflation fell (and following a serve recession), and the number of MSAs experiencing home price declines over a five year period increased significantly in the 80’s – with the most severe declines coming in the oil-patch states. There was another significantly jump in the number of areas experiencing “sustained” home price declines in the 90’s, including many Northeast markets (including the Boston “bubble/bust,” with the bust from the late 80’s through the early/mid 90’s) and the California “boom/bust” (especially Southern California, with the bust from the summer of 1990 through the beginning of 1996.

The above chart doesn’t reflect the number of MSAs who have ever experienced a decline in home prices over a five-year period from 1975 to 1999, but rather the number whose HPI over the same five-year period experienced a drop. Over the 1975-1999 period the FMHPI for 198 MSAs saw a decline over some five year period, and the FMHPI for 87 MSAs fell by 10% or more. And for the top 25 MSAs (in terms of population), 15 experienced a decline in home prices over some five period from 1975 to 1999, with eight experienced a double-digit drop over some five year period (including four out of the top five MSAs.).

Now let’s look at the same chart, but expanding to include the period through 2005.

As the chart indicates, from the five-year period ending in late 2001 through the five-year period ending in late 2005, there were NO MSAs that saw a decline in their respective FMHPIs. Stated another way, for folks trying to “model” mortgage credit default using loan-level data only available on mortgages originated from 1996 through 2005, there were virtually NO areas of the country that were “distressed” in terms of experiencing a decline in home prices over any five-year period.

Now let’s extend the chart through September of 2014.

Oh My!

Finally, here is a chart comparing consumer price inflation (cumulative, using the CPI-U-RS) over a rolling 60-month period with the number of MSAs experiencing a decline in their respective HPIs over the same rolling 60-month period. The chart ends in 2005.

During the period from the second half of the 70’s through the very early part of the 80’s, there were few MSAs experiencing sustained home price declines, in part because of high inflation. That was obviously not the case during the period from the latter half of the 90’s through the middle of last decade.

Fannie and Freddie: REO inventory declined in Q4, Down 25% Year-over-year

by Calculated Risk on 2/20/2015 09:06:00 AM

Fannie and Freddie reported results this week. Here is some information on Real Estate Owned (REOs).

From Fannie Mae:

The continued decrease in the number of our seriously delinquent single-family loans, as well as lengthy foreclosure timelines in a number of states, have resulted in a reduction in the number of REO acquisitions and fewer dispositions in 2014 compared with 2013 and 2012.The decline in REO is related to fewer delinquencies (higher house prices and a better economy), and long foreclosure time lines in some states (like Florida).

...

We recognized a benefit for credit losses in 2014 primarily due to increases in home prices of 4.7% in 2014. Higher home prices decrease the likelihood that loans will default and reduce the amount of credit loss on loans that do default, which impacts our estimate of losses and ultimately reduces our total loss reserves and provision for credit losses.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in Q4 for both Fannie and Freddie, and combined inventory is down 25% year-over-year. For Freddie, this is the lowest level of REO since Q2 2008. For Fannie, this is the lowest level since 2009.

Delinquencies are falling, but there are still a large number of properties in the foreclosure process with long time lines in judicial foreclosure states.

Thursday, February 19, 2015

Lawler: Preliminary Table of Distressed Sales and Cash buyers for Selected Cities in January

by Calculated Risk on 2/19/2015 07:43:00 PM

Economist Tom Lawler sent me the preliminary table below of short sales, foreclosures and cash buyers for a few selected cities in January.

On distressed: Total "distressed" share is down in most of these markets mostly due to a decline in short sales (Mid-Atlantic and Orlando are up year-over-year because of an increase foreclosure as lenders work through the backlog).

Short sales are down in these areas.

The All Cash Share (last two columns) is declining year-over-year. As investors pull back, the share of all cash buyers will probably continue to decline.

It is pretty amazing that distressed sales still make up almost 40% of sales in Orlando. Florida has been very slow to recover from the severe damage of the housing bubble.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Jan-15 | Jan-14 | Jan-15 | Jan-14 | Jan-15 | Jan-14 | Jan-15 | Jan-14 | |

| Las Vegas | 9.7% | 17.0% | 9.4% | 11.0% | 19.1% | 28.0% | 36.0% | 46.3% |

| Reno** | 10.0% | 16.0% | 6.0% | 9.0% | 16.0% | 25.0% | ||

| Phoenix | 3.7% | 6.8% | 6.5% | 9.6% | 10.2% | 16.5% | 32.0% | 36.3% |

| Sacramento | 6.9% | 11.8% | 9.5% | 8.4% | 16.4% | 20.2% | 22.7% | 26.6% |

| Minneapolis | 4.1% | 5.5% | 16.0% | 24.0% | 20.1% | 29.5% | ||

| Mid-Atlantic | 5.8% | 8.5% | 15.2% | 12.2% | 21.0% | 20.7% | 21.4% | 22.9% |

| Orlando | 5.3% | 11.7% | 33.9% | 25.7% | 39.2% | 37.4% | 47.1% | 49.2% |

| California * | 6.4% | 10.7% | 6.7% | 7.7% | 13.1% | 18.4% | ||

| Bay Area CA* | 4.0% | 8.5% | 4.5% | 5.2% | 8.5% | 13.7% | 22.6% | 25.8% |

| So. California* | 6.5% | 10.7% | 5.7% | 6.6% | 12.2% | 17.3% | 24.9% | 29.9% |

| Chicago (city) | 24.1% | 35.0% | ||||||

| Hampton Roads | 27.6% | 29.5% | ||||||

| Northeast Florida | 38.2% | 46.2% | ||||||

| Toledo | 37.6% | 43.9% | ||||||

| Tucson | 34.8% | 38.2% | ||||||

| Des Moines | 22.0% | 22.2% | ||||||

| Georgia*** | 31.3% | N/A | ||||||

| Omaha | 24.0% | 26.4% | ||||||

| Pensacola | 38.3% | 42.7% | ||||||

| Memphis* | 14.8% | 19.1% | ||||||

| Springfield IL** | 16.2% | 28.5% | ||||||

| *share of existing home sales, based on property records **Single Family Only ***GAMLS | ||||||||