by Calculated Risk on 10/02/2014 10:46:00 AM

Thursday, October 02, 2014

Reis: Apartment Vacancy Rate increased in Q3 to 4.2%, First quarterly increase since 2009

Reis reported that the apartment vacancy rate increased in Q3 to 4.2% from 4.1% in Q2. In Q3 2013 (a year ago), the vacancy rate was at 4.3%, and the rate peaked at 8.0% at the end of 2009.

Some comments from Reis Senior Economist Ryan Severino:

The national vacancy rate increased by 10 basis points to 4.2% during the third quarter. This is the first quarterly increase in vacancy since the fourth quarter of 2009. This is something that we have been warning about for some time. The national vacancy rate has been below 5.5% since the third quarter of 2011, a virtually unprecedented run. Ultimately, market conditions that tight were going to serve as a catalyst for new construction activity. Although the surge in construction occurred a bit late, due to the fallout from the Great Recession, it is now arriving. New construction continues to increase over time and will likely reach a post‐recession high this year. Meanwhile, demand has clearly declined from levels observed during 2010 and 2011. This type of slowing is expected, but demand should remain robust. The number of 20‐ to 30‐year olds, the prime rental cohort, will not peak until 2018 which should keep demand rather stout. However, the apartment market, like virtually all property types, is cyclical, and has a propensity to overbuild, even when things are booming. With construction anticipated to outpace net absorption over the next four years, we expect the national vacancy rate to slowly drift upward. However, we do not foresee a massive expansion in vacancy rates of the sort that accompanies recessions.

...

Nonetheless, 4.2% is still an incredibly tight market environment. Even as vacancy drifts slowly higher in the coming years, we do not anticipate that it will not surpass 5% by the end of the forecast horizon in 2018.

Construction overtook demand by a relatively wide margin during the third quarter, with a difference of 8,822 units. The 46,055 units delivered were just behind the fourth quarter of 2013's 47,950 units which are a post‐recession high. Moreover, completions this quarter were higher than completions for all of 2011 at construction's trough. In retrospect, the pullback in completions during the early stages of this year was at least partially attributable to the inclement weather experienced throughout much of the country. Once the weather improved, construction levels accelerated quickly. The market remains posed to deliver the highest level of new completions since 1999 when the economy was booming. That stands in contrast to today when economic growth is accelerating, but hardly booming.

However, net absorption has not ground to a halt. Though down from levels during 2010 and 2011, year to date, net absorption is actually tracking ahead of last year's pace, demonstrating just how strong demand remains ‐ despite the fact that the recovery in demand began four and a half years ago. Demographics are supporting demand. The most common age in the United States is 22, followed closely by 23, and then 21. There are a lot of young people in the market that are predominantly renters and not homeowners. This will continue to provide significant demand, even as new supply growth accelerates.

...

Asking and effective rents both grew by 1.0% during the third quarter. This is an increase from the second quarter and reflective of the seasonality often observed in the apartment market. Rents tend to grow the fastest during warmer months which are more conducive to moving and greater demand for apartment units, all else being equal. Year‐over‐year growth in rents appears to have stalled a bit this quarter. The 12‐month change in rent growth for asking and effective rents is 3.2% and 3.4%, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

Apartment vacancy data courtesy of Reis.

Weekly Initial Unemployment Claims decrease to 287,000

by Calculated Risk on 10/02/2014 08:35:00 AM

The DOL reports:

In the week ending September 27, the advance figure for seasonally adjusted initial claims was 287,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 293,000 to 295,000. The 4-week moving average was 294,750, a decrease of 4,250 from the previous week's revised average. The previous week's average was revised up by 500 from 298,500 to 299,000.The previous week was revised up to 295,000.

There were no special factors impacting this week's initial claims.

The following graph shows the 4-week moving average of weekly claims since January 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 294,750.

This was below the consensus forecast of 297,000 and in the normal range for an economic expansion.

Wednesday, October 01, 2014

Thursday: Unemployment Claims, Q3 Apartment Vacancy Rate

by Calculated Risk on 10/01/2014 08:56:00 PM

An interesting article on foreign buyers of U.S. real estate from Dionne Searceyoct at the NY Times: Indians Join the Wave of Investors in Condos and Homes in the U.S.

Foreign buyers now make up 7 percent of total existing-home sales ... Of those, Indians represent 6 percent of the purchases, spending $5.8 billion, up from $3.9 billion over the same period a year ago and on par with buyers from Britain.Thursday:

Canadians have long bought American property and still do so in big numbers, with purchases centered for the most part in Arizona, Florida and more recently in Las Vegas. Canada still accounts for the largest share of buyers, but China is the fastest-growing source of clients, according to the realtors’ group.

And Chinese buyers are bigger spenders. Their real estate purchases in the United States nearly doubled from last April to last March, increasing to $22 billion from the previous period. They accounted for nearly a quarter of all international sales in the current period.

• Early, Reis Q3 2014 Apartment Survey of rents and vacancy rates.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 297 thousand from 293 thousand.

• At 10:00 AM, Manufacturers' Shipments, Inventories and Orders (Factory Orders) for August. The consensus is for a 9.4 decrease in August orders.

Zillow: Case-Shiller House Price Index expected to slow further year-over-year in August

by Calculated Risk on 10/01/2014 06:01:00 PM

The Case-Shiller house price indexes for July were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Hopefully Zillow will start estimating the National Index.

From Zillow: Find Out Next Month’s Case-Shiller Numbers Today

The July S&P/Case-Shiller (SPCS) data out this morning indicated continued slowing in the housing market with the annual change in the 20-city index falling to 6.7 percent from 8.1 percent the prior month. Our current forecast for SPCS next month indicates further slowing with the annual increase in the 20-City Composite Home Price Index falling to 5.7 percent in August.So the Case-Shiller index will probably show a lower year-over-year gain in August than in July (6.7% year-over-year for the Composite 20 in July, 5.6% year-over-year for the National Index).

The non-seasonally adjusted (NSA) monthly increase in July for the 20-City index was 0.6 percent, and we expect it to fall to 0.3 percent next month.

All forecasts are shown in the table below. These forecasts are based on the July SPCS data release this morning and the August 2014 Zillow Home Value Index (ZHVI), released September 18. Officially, the SPCS Composite Home Price Indices for August will not be released until Tuesday, October 28.

| Zillow August 2014 Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | August 2013 | 178.71 | 174.56 | 164.49 | 160.57 |

| Case-Shiller (last month) | July 2014 | 188.29 | 184.50 | 173.34 | 169.67 |

| Zillow Forecast | YoY | 5.8% | 5.8% | 5.7% | 5.7% |

| MoM | 0.4% | 0.1% | 0.3% | 0.1% | |

| Zillow Forecasts1 | 189.1 | 184.7 | 173.9 | 169.8 | |

| Current Post Bubble Low | 146.45 | 149.90 | 134.07 | 137.12 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 29.1% | 23.2% | 29.7% | 23.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

U.S. Light Vehicle Sales decrease to 16.34 million annual rate in September

by Calculated Risk on 10/01/2014 02:58:00 PM

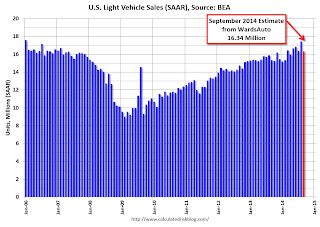

Based on an WardsAuto estimate, light vehicle sales were at a 16.34 million SAAR in September. That is up 7% from September 2013, but down 6% from the 17.4 million annual sales rate last month.

This was below the consensus forecast of 16.8 million SAAR (seasonally adjusted annual rate).

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for September (red, light vehicle sales of 17.34 million SAAR from WardsAuto).

From WardsAuto:

After an August sales spike that drove the monthly SAAR to 17.45 million, September U.S. light vehicle sales cooled somewhat, dropping to an annualized rate just below 16.4 million on deliveries of 1.24 million LVs.

September's tally, nonetheless, represented a 4.7% uptick in daily sales compared with same-month year-ago, and brought year-to-date deliveries to 12.37 million units, a 5.4% improvement over the first nine months of 2013.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.Note: dashed line is current estimated sales rate.

This was the fifth consecutive month with a sales rate over 16 million.

Reis: Office Vacancy Rate unchanged in Q3 at 16.8%

by Calculated Risk on 10/01/2014 01:08:00 PM

Reis released their Q3 2014 Office Vacancy survey this morning. Reis reported that the office vacancy rate was unchanged in Q3 compared to Q2 at 16.8%. This is down slightly from 16.9% in Q3 2013, and down from the cycle peak of 17.6%.

From Reis Senior Economist Ryan Severino:

The national vacancy rate once again held steady, registering 16.8% for the third consecutive quarter. Although this is superficially alarming, a few qualifications are necessary and important. First, net absorption technically outpaced new construction once again. However, much like last quarter, the difference was not sufficient enough to push the vacancy rate downward. Nonetheless, it is important to note that demand is not evaporating ‐ it is simply not producing a declining vacancy rate in recent quarters. Second, as we have observed in the recent past, construction and net absorption remain linked to each other due to the ongoing preleasing requirement in place for new construction financing. That has a tendency to keep supply and demand roughly in balance during weak recoveries such as this one when there is relatively little demand for existing inventory.On absorption and new construction:

Third, this pattern is not without precedent. Something similar occurred just last year. The national vacancy rate was identical during the first three quarters of 2013 before declining again during the fourth quarter. Therefore, this pause in vacancy compression needs to be examined in the proper context ‐ it is not signaling that the market recovery is going to reverse and vacancy rates will soon begin increasing. However, the unchanged vacancy rate serves as a stark reminder that five years removed from the advent of economic recovery in the United States, the office market recovery remains in early stages. If the labor market recovery continues its acceleration, this will change, but through the third quarter of this year its struggles continue.

emphasis added

Net absorption increased by 7.157 million square feet during the third quarter. This is a rebound from last quarter's 3.171 million SF. Although this is far from a healthy level of demand, it is back closer to the trend in net absorption that has occurred in recent quarters. Therefore, last quarter's weak reading appears to be an anomaly and the longer‐term trend in increasing net absorption, though relatively tepid, remains intact. The ongoing improvement in the labor market will serve as a catalyst for net absorption in the coming quarters. New construction totaled 4.791 million square feet during the third quarter. Construction levels remain far below those indicative of a healthy market environment.On rents:

Asking and effective rents both grew by 0.4% during the third quarter. This is a slight deceleration from last quarter's performance for both rent metrics. Nevertheless, asking and effective rents have now risen for sixteen consecutive quarters. Moreover, we continue to see modest but ongoing acceleration in rent growth over time. Asking rent growth was 1.6% during 2011, 1.8% during 2012, and 2.1% in 2013, and 2.5% over the prior 12 months ending with the second quarter of this year. During the third quarter, the 12‐month change in asking rent increased just slightly to 2.6%. Given how elevated the national vacancy rate remains, we should not expect much acceleration in rent growth until the vacancy rate declines to a more conducive level, hundreds of basis points below the current 16.8% rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was unchanged at 16.8% in Q3, and was down from 16.9% in Q2 2013. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010, and Q1 2011.

There will not be a significant pickup in new construction until the vacancy rate falls much further.

Office vacancy data courtesy of Reis.

Construction Spending decreased 0.8% in August

by Calculated Risk on 10/01/2014 10:42:00 AM

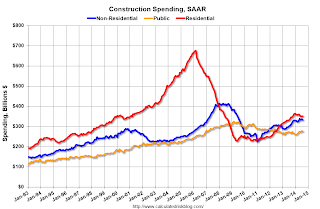

Earlier the Census Bureau reported that overall construction spending decreased in August:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during August 2014 was estimated at a seasonally adjusted annual rate of $961.0 billion, 0.8 percent below the revised July estimate of $968.8 billion. The August figure is 5.0 percent above the August 2013 estimate of $915.3 billion.Both private and public spending decreased in August:

Spending on private construction was at a seasonally adjusted annual rate of $685.0 billion, 0.8 percent below the revised July estimate of $690.3 billion. Residential construction was at a seasonally adjusted annual rate of $351.7 billion in August, 0.1 percent below the revised July estimate of $352.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $333.3 billion in August, 1.4 percent below the revised July estimate of $338.1 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $275.9 billion, 0.9 percent below the revised July estimate of $278.5 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has declined recently and is 48% below the peak in early 2006 - but up 54% from the post-bubble low.

Non-residential spending is 20% below the peak in January 2008, and up about 48% from the recent low.

Public construction spending is now 14% below the peak in March 2009 and about 7% above the post-recession low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 4%. Non-residential spending is up 9% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2014. Residential spending is still very low, non-residential is starting to pickup, and public spending has probably hit bottom after several years of austerity.

This was a weak report - well below the consensus forecast of a 0.5% increase - and there were also downward revisions to spending in June and July.

ISM Manufacturing index declines to 56.6 in September

by Calculated Risk on 10/01/2014 10:06:00 AM

The ISM manufacturing index suggests slower expansion in September than in August. The PMI was at 56.6% in September, down from 59.0% in August. The employment index was at 54.6%, down from 58.1% in August, and the new orders index was at 60.0%, down from 66.7%.

From the Institute for Supply Management: September 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in September for the 16th consecutive month, and the overall economy grew for the 64th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The September PMI® registered 56.6 percent, a decrease of 2.4 percentage points from August’s reading of 59 percent, indicating continued expansion in manufacturing. The New Orders Index registered 60 percent, a decrease of 6.7 percentage points from the 66.7 percent reading in August, indicating growth in new orders for the 16th consecutive month. The Production Index registered 64.6 percent, 0.1 percentage point above the August reading of 64.5 percent. The Employment Index grew for the 15th consecutive month, registering 54.6 percent, a decrease of 3.5 percentage points below the August reading of 58.1 percent. Inventories of raw materials registered 51.5 percent, a decrease of 0.5 percentage point from the August reading of 52 percent, indicating growth in inventories for the second consecutive month. Comments from the panel reflect a generally positive business outlook, while noting some labor shortages and continuing concern over geopolitical unrest."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 58.0%, but still shows decent expansion in September.

ADP: Private Employment increased 213,000 in September

by Calculated Risk on 10/01/2014 08:18:00 AM

Private sector employment increased by 213,000 jobs from August to September according to the August ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly above the consensus forecast for 200,000 private sector jobs added in the ADP report.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "Job gains remain strong and steady. The pace of job growth has been remarkably similar for the past several years. Especially encouraging most recently is the increasingly broad base nature of those gains. Nearly all industries and companies of all sizes are adding consistently to payrolls.”

The BLS report for September will be released on Friday.

MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

by Calculated Risk on 10/01/2014 07:00:00 AM

From the MBA: Mortgage Applications Decrease Slightly in Latest MBA Weekly Survey

Mortgage applications decreased 0.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 26, 2014. ...

The Refinance Index decreased 0.3 percent from the previous week. The seasonally adjusted Purchase Index remained unchanged from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 11 percent lower than the same week one year ago. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 4.33 percent from 4.39 percent, with points decreasing to 0.31 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index is down 76% from the levels in May 2013.

Refinance activity is very low this year and will be the lowest since year 2000.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, the unadjusted purchase index is down about 11% from a year ago.