by Calculated Risk on 3/03/2014 06:24:00 PM

Monday, March 03, 2014

Weekly Update: Housing Tracker Existing Home Inventory up 5.9% year-over-year on March 3rd

Here is another weekly update on housing inventory ...

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then usually peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for January). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012, 2013 and 2014.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2014 is now 5.9% above the same week in 2013 (red is 2014, blue is 2013).

Inventory is still very low, but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? My guess is inventory will be up 10% to 15% year-over-year by the end of 2014 (inventory would still be below normal).

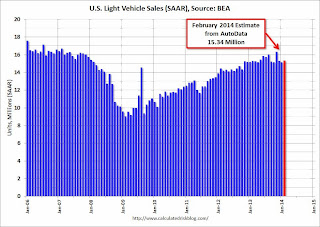

U.S. Light Vehicle Sales increase to 15.3 million annual rate in February

by Calculated Risk on 3/03/2014 02:55:00 PM

Based on an AutoData estimate, light vehicle sales were at a 15.34 million SAAR in February. That is up slightly from February 2013, and up 1.8% from the sales rate last month.

This was slightly below the consensus forecast of 15.4 million SAAR (seasonally adjusted annual rate).

Click on graph for larger image.

Click on graph for larger image.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for February (red, light vehicle sales of 15.34 million SAAR from AutoData).

Weather had an impact in February, from WardsAuto:

"John Felice, [Ford] vice president-U.S. Marketing, Sales and Service, says (delayed) orders should be filled this month, which will help March results. The executive also says February started slow, but built momentum as the month progressed, which also bodes well for sales this month."The second graph shows light vehicle sales since the BEA started keeping data in 1967.

...

“Weather continued to impact the industry in February, but GM sales started to thaw during the Winter Olympic Games as our brand and marketing messages took hold,” Kurt McNeil, GM vice president-Sales Operations, says in a statement.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.Unlike residential investment, auto sales bounced back fairly quickly following the recession and were a key driver of the recovery.

Looking forward, the growth rate will slow for auto sales, and most forecasts are for around a small gain in 2014 to around 16.1 million light vehicles. Of course 2014 is off to a slow start.

Construction Spending increased in January

by Calculated Risk on 3/03/2014 10:45:00 AM

The Census Bureau reported that overall construction spending increased in January:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during January 2014 was estimated at a seasonally adjusted annual rate of $943.1 billion, 0.1 percent above the revised December estimate of $941.9 billion. The January figure is 9.3 percent above the January 2013 estimate of $863.1 billion.Private spending increased in January, but public spending was down:

Spending on private construction was at a seasonally adjusted annual rate of $670.8 billion, 0.5 percent above the revised December estimate of $667.5 billion. Residential construction was at a seasonally adjusted annual rate of $359.9 billion in January, 1.1 percent above the revised December estimate of $356.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $310.9 billion in January, 0.2 percent below the revised December estimate of $311.5 billion. ...

In January, the estimated seasonally adjusted annual rate of public construction spending was $272.3 billion, 0.8 percent below the revised December estimate of $274.4 billion.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 47% below the peak in early 2006, and up 57% from the post-bubble low.

Non-residential spending is 25% below the peak in January 2008, and up about 39% from the recent low.

Public construction spending is now 16% below the peak in March 2009 and up just about 3% from the recent low.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 15%. Non-residential spending is up 9% year-over-year. Public spending is up 2% year-over-year.

To repeat a few key themes:

1) Private residential construction is usually the largest category for construction spending, and is now the largest category once again. Usually private residential construction leads the economy, so this is a good sign going forward.

2) Private non-residential construction spending usually lags the economy. There was some increase this time for a couple of years - mostly related to energy and power - but the key sectors of office, retail and hotels are still at very low levels. Based on the architecture billings index, I expect private non-residential to increase this year.

3) Public construction spending was down in January, but is up 3% from the low in April. It appears that the drag from public construction spending is over. Public spending has declined to 2006 levels (not adjusted for inflation) and was a drag on the economy for 4+ years. In real terms, public construction spending has declined to 2001 levels.

Looking forward, all categories of construction spending should continue to increase. Residential spending is still very low, non-residential should start to pickup, and public spending appears to have bottomed.

ISM Manufacturing index increased in February to 53.2

by Calculated Risk on 3/03/2014 10:00:00 AM

The ISM manufacturing index indicated faster expansion in February than in January. The PMI was at 53.2% in February, up from 51.3% in January. The employment index was at 52.3%, unchanged from 52.3% in January, and the new orders index was at 54.5%, up from 51.2% in January.

From the Institute for Supply Management: February 2014 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in February for the ninth consecutive month, and the overall economy grew for the 57th consecutive month, say the nation's supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The February PMI® registered 53.2 percent, an increase of 1.9 percentage points from January's reading of 51.3 percent indicating expansion in manufacturing for the ninth consecutive month. The New Orders Index registered 54.5 percent, an increase of 3.3 percentage points from January's reading of 51.2 percent. The Production Index registered 48.2 percent, a decrease of 6.6 percentage points compared to January's reading of 54.8 percent. Inventories of raw materials increased by 8.5 percentage points to 52.5 percent. As in January, several comments from the panel mention adverse weather conditions as a factor impacting their businesses in February. Other comments reflect optimism in terms of demand and growth in the near term."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.9%.

Personal Income increased 0.3% in January, Spending increased 0.4%

by Calculated Risk on 3/03/2014 08:43:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $43.9 billion, or 0.3 percent ... in January, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $48.1 billion, or 0.4 percent.On inflation, the PCE price index increased at a 1.2% annual rate in January, and core PCE prices increased at a 1.1% annual rate. This is very low and far below the Fed's 2% target.

...

The change in the January estimate of personal income was affected by several special factors. Personal income in January was boosted by several provisions of the Affordable Care Act (ACA), which affected government social benefit payments to persons. In addition, personal income was boosted by cost-of-living adjustments to several federal transfer programs and by pay raises for civilian and military personnel. In contrast, the change in personal income in January was reduced by the expiration of Emergency Unemployment Compensation programs and by lump-sum social security benefit payments that had boosted December personal income. In summary, excluding all of these special factors, personal income increased $23.7 billion, or 0.2 percent, in January, in contrast to a decrease of $15.1 billion, or 0.1 percent, in December.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.3 percent in January, in contrast to a decrease of 0.1 percent in December. ... The price index for PCE increased 0.1 percent in January, compared with an increase of 0.2 percent in December. The PCE price index, excluding food and energy, increased 0.1 percent in January, the same increase as in December.

The following graph shows real Personal Consumption Expenditures (PCE) through January 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

This is just one month of Q1, but this suggests an increase in the PCE contribution to growth similar to Q4.

Sunday, March 02, 2014

Monday: Auto Sales, Personal Income and Outlays, ISM Mfg Index, Construction Spending

by Calculated Risk on 3/02/2014 09:08:00 PM

Monday:

• All day, Light vehicle sales for February. The consensus is for light vehicle sales to increase to 15.4 million SAAR in February (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in January.

• At 8:30 AM ET, the Personal Income and Outlays report for January. The consensus is for a 0.2% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:00 AM, the Markit US PMI Manufacturing Index for February.

• At 10:00 AM, the ISM Manufacturing Index for February. The consensus is for an increase to 51.9 from 51.3 in January. The ISM manufacturing index indicated expansion in January at 51.3%. The employment index was at 52.3%, and the new orders index was at 51.2%.

• Also at 10:00 AM, Construction Spending for January. The consensus is for a 0.1% decrease in construction spending.

Weekend:

• Schedule for Week of March 2nd

From MarketWatch: Asia Markets live blog: The China Factory Story

Japan (Nikkei Average) down 2.5%From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 16 and DOW futures are down 126 (fair value).

Sydney (S&P/ASX 200) down 0.8%

Seoul (Kospi) down 0.2%

Oil prices are up with WTI futures at $104.08 per barrel and Brent at $110.93 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.44 per gallon (up sharply over the last month, but down significantly from the same week a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

LA Times: New Home construction still near record lows

by Calculated Risk on 3/02/2014 10:36:00 AM

From E. Scott Reckard at the LA Times: Supply of new homes for sale remains extremely low

About 15,000 new homes will be sold this year in the six-county region — 58% less than the 20-year average, predicts Pete Reeb, an economist with John Burns Real Estate Consulting in Irvine.Builders in LA have choices: build in more remote areas with open land - but those areas are still struggling, build smaller in-fill projects, or go vertical (high rise condominium projects). Over time, I expect the LA area to go vertical.

... Only about 10% of today's new projects are attached condominiums, compared with half in previous expansions, said housing consultant Jeff Meyers, who heads Meyers Research in Beverly Hills. ...

The delayed recovery in home construction owes to a variety of factors. Many smaller builders were wiped out by the housing crash, and those that remain can't get financial backing from institutional investors. The larger, publicly traded builders, meanwhile, are reviving stalled projects. But they remain leery of launching new developments in more affordable areas with open land, such as the Inland Empire, where income and employment remain depressed.

Developers are also struggling with a shortage of ready-to-build lots — those with government approvals, streets and utilities in place. That's because planning for new developments screeched to a halt when the housing market imploded. It will be at least next year before the slowly reviving process makes many new projects feasible, said Randall Lewis, executive vice president of Lewis Group ...

Saturday, March 01, 2014

Fannie Mae, Freddie Mac: Mortgage Serious Delinquency rate declined in January

by Calculated Risk on 3/01/2014 07:08:00 PM

Fannie Mae reported Friday that the Single-Family Serious Delinquency rate declined in January to 2.33% from 2.38% in December. The serious delinquency rate is down from 3.18% in January 2013, and this is the lowest level since November 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Freddie Mac reported that the Single-Family serious delinquency rate declined in January to 2.34% from 2.39% in December. Freddie's rate is down from 3.20% in January 2012, and is at the lowest level since February 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Click on graph for larger image

Click on graph for larger image

The Fannie Mae serious delinquency rate has fallen 0.85 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in about eighteen months. Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be back to normal in late 2015 or 2016.

Schedule for Week of March 2nd

by Calculated Risk on 3/01/2014 12:42:00 PM

This will be a busy week for economic data with several key reports including the February employment report on Friday.

Other key reports include the ISM manufacturing index on Monday, February vehicle sales on Monday, January Personal Income and Outlays on Monday, the ISM service index on Wednesday, and the January trade deficit report on Friday.

The Fed will release the Q4 Flow of Funds report on Thursday.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 15.4 million SAAR in February (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in January.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to increase to 15.4 million SAAR in February (Seasonally Adjusted Annual Rate) from 15.2 million SAAR in January.This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

8:30 AM ET: Personal Income and Outlays for January. The consensus is for a 0.2% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:00 AM ET: The Markit US PMI Manufacturing Index for February.

10:00 AM ET: ISM Manufacturing Index for February. The consensus is for an increase to 51.9 from 51.3 in January.

10:00 AM ET: ISM Manufacturing Index for February. The consensus is for an increase to 51.9 from 51.3 in January.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in January at 51.3%. The employment index was at 52.3%, and the new orders index was at 51.2%.

10:00 AM: Construction Spending for January. The consensus is for a 0.1% decrease in construction spending.

No economic releases scheduled.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 158,000 payroll jobs added in January, down from 175,000 in January.

10:00 AM: ISM non-Manufacturing Index for February. The consensus is for a reading of 53.6, down from 54.0 in January. Note: Above 50 indicates expansion, below 50 contraction.

2:00 PM: Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Early: Trulia Price Rent Monitors for February. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 338 thousand from 348 thousand.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for January. The consensus is for a 0.5% decrease in January orders.

12:00 PM: Q4 Flow of Funds Accounts of the United States from the Federal Reserve.

8:30 AM: Employment Report for February. The consensus is for an increase of 150,000 non-farm payroll jobs in February, up from the 113,000 non-farm payroll jobs added in January.

The consensus is for the unemployment rate to be unchanged at 6.6% in February.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through January.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through January.The economy has added 8.5 million private sector jobs since employment bottomed in February 2010 (7.8 million total jobs added including all the public sector layoffs).

There are still almost 291 thousand fewer private sector jobs now than when the recession started in 2007.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. Imports increased, and exports decreased in December.

The consensus is for the U.S. trade deficit to increase to $39.0 billion in January from $38.7 billion in December.

3:00 PM: Consumer Credit for January from the Federal Reserve. The consensus is for credit to increase $14.5 billion in January.

Unofficial Problem Bank list declines to 566 Institutions

by Calculated Risk on 3/01/2014 10:21:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for February 28, 2014.

Changes and comments from surferdude808:

Busy week as the FDIC closed a couple of banks, provided an update on its enforcement action activities, and released industry results and the Official Problem Bank List for the fourth quarter of 2013. In all, there were 12 removals that dropped the unofficial list to 566 institutions with assets of $182.1 billion. Assets declined by $10.9 billion from last week with $4.5 billion coming from the update to assets through year-end 2013. A year ago, the list held 808 institutions with assets of $298.1 billion.

Among the 12 removals were six action terminations, four mergers, and two failures. Action were terminated against Patriot Bank, Houston, TX ($1.3 billion); Kaw Valley Bank, Topeka, KS ($364 million); Insouth Bank, Brownsville, TN ($301 million); Northpointe Bank, Grand Rapids, MI ($300 million); SouthernTrust Bank, Goreville, IL ($49 million); and D'Hanis State Bank, Hondo, TX ($47 million). Also, the FDIC terminated a Prompt Corrective Action order against Oxford Bank, Oxford, MI ($261 million Ticker: OXBC).

Removals through unassisted mergers include First Place Bank, Warren, OH ($2.5 billion Ticker: FPFC); Great Florida Bank, Coral Gables, FL ($1.0 billion Ticker: GFLB); First National Bank of New York, Merrick, NY ($255 million); and Premier Service Bank, Riverside, CA ($128 million).

After a month off, the FDIC got back to closing two banks -- Millennium Bank, National Association, Sterling, VA ($130 million Ticker: MBVA); and Vantage Point Bank, Horsham, PA ($63 million).

The FDIC told us this week there are 467 institutions with assets of $153 billion on the Official Problem Bank List. The unofficial list has 99 more institutions and $29.1 billion more in assets. The difference is down from 130 institutions and $47.2 billion in assets last quarter. The differences have narrowed from 157 institutions and $65 billion in assets a year ago. In contrast, the official list had higher totals four years ago with 58 and $76.9 billion more in institutions and assets, respectively.