by Calculated Risk on 12/23/2013 08:36:00 PM

Monday, December 23, 2013

Tuesday: New Home Sales, Durable Goods, Richmond Fed Mfg Survey and More

China remains a risk, from the WSJ: China Cash Crunch Shows Central Bank's Difficulties

A cash crunch among China's banks intensified, highlighting the difficulties faced by the central bank in managing an increasingly stressed financial system.Tuesday: All US markets will close early

...

The current squeeze is driven by several factors, analysts said. One is a little-noticed drop in China's year-end government spending. ... Banks are becoming more cautious and are hoarding more cash for future needs in case the cash squeeze worsens. Some of them are also boosting provisions for potential loan defaults.

...

"To prevent systemic risks, and reduce the impact on liquidity, the supervision of the interbank market will continue to be strengthened," analysts at Bank of China Ltd. said in a report Monday, adding that interbank lending was "accentuating hidden dangers" in the financial system. The rise in rates came despite the Chinese central bank's announcement late Friday that it had injected more than 300 billion yuan into the financial system over a three-day period following the increase in interbank rates last week.

• At 7:00 AM ET, Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for November from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 9:00 AM, the FHFA House Price Index for October 2013. This was original a GSE only repeat sales, however there is also an expanded index. The consensus is for a 0.4% increase.

• At 10:00 AM, New Home Sales for November from the Census Bureau. The consensus is for an increase in sales to 450 thousand Seasonally Adjusted Annual Rate (SAAR) in November from 444 thousand in October.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for December. The consensus is a reading of 10, down from 13 in November (above zero is expansion).

Ten Economic Questions for 2014

by Calculated Risk on 12/23/2013 05:58:00 PM

Here is a review of the Ten Economic Questions for 2013.

I'll follow up some thoughts on each of these questions. I'm sure there are other important questions, but these are the ones I'm thinking about now.

1) Economic growth: Heading into 2014, it seems most analysts expect faster economic growth. So do I. Will 2014 be the best year of the recovery so far? Could 2014 be the best year since the '90s? Or will 2014 disappoint?

2) Employment: How many payroll jobs will be added in 2014? Will we finally see some pickup over the approximately 2.1 to 2.3 million job creation rate of 2011, 2012, and 2013?

3) Unemployment Rate: The unemployment rate is still elevated at 7.0% in November. For the last three years I've been too pessimistic on the unemployment rate because I was expecting some minor bounce back in the participation rate. Instead the participation rate continued to decline. Maybe 2014 will be the year the participation rate increases a little, or at least stabilizes.

What will the unemployment rate be in December 2014?

4) Inflation: The Fed has made it clear they will tolerate a little more inflation, but currently the inflation rate is running well below the Fed's 2% target. Will the inflation rate rise in 2014? Will too much inflation be a concern in 2014?

5) Monetary Policy: It appears the Fed's current plan is to reduce their monthly asset purchases by about $10 billion at each FOMC meeting in 2014. That would put the monthly purchases at close to zero in December 2014. Will the Fed complete QE3 in 2014? Or will the Fed continue to buy assets in 2015?

6) Residential Investment: Residential investment (RI) picked was up solidly in 2012 and 2013. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. Even with the recent increases, RI is still at a historical low level. How much will RI increase in 2014?

7) House Prices: It appears house prices - as measured by the national repeat sales index (Case-Shiller, CoreLogic) - will be up about 12% or so in 2013. What will happen with house prices in 2014?

8) Housing Credit: Will we see easier mortgage lending in 2014? Will we see positive mortgage equity withdrawal (MEW) after six years of negative MEW?

9) Housing Inventory: It appears housing inventory bottomed in early 2013. Will inventory increase in 2014, and, if so, by how much?

10) Downside Risks: What are the downside risks in 2014?

I'm sure there are other key questions, but these are the ones I'm thinking about now.

Weekly Update: Housing Tracker Existing Home Inventory up 2.3% year-over-year on Dec 23rd

by Calculated Risk on 12/23/2013 02:49:00 PM

Here is another weekly update on housing inventory ... for the tenth consecutive week, housing inventory is up year-over-year. This suggests inventory bottomed early in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for November). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years.

Click on graph for larger image.

Click on graph for larger image.

This graph shows the Housing Tracker reported weekly inventory for the 54 metro areas for 2010, 2011, 2012 and 2013.

In 2011 and 2012, inventory only increased slightly early in the year and then declined significantly through the end of each year.

Inventory in 2013 is now 2.3% above the same week in 2012 (red is 2013, blue is 2012).

Inventory is still very low - and barely up year-over-year - but this increase in inventory should slow house price increases.

Note: One of the key questions for 2014 will be: How much will inventory increase? I'll post some thoughts on inventory at the end of the year.

Chicago Fed: "Economic growth picked up in November"

by Calculated Risk on 12/23/2013 12:23:00 PM

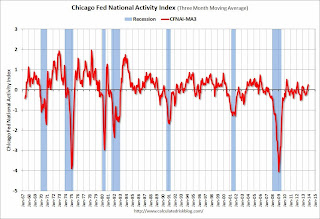

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth picked up in November

Led by gains in employment- and production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to +0.60 in November from –0.07 in October.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to +0.25 in November from +0.12 in October, marking its second consecutive reading above zero and highest reading since February 2012. November’s CFNAI-MA3 suggests that growth in national economic activity was above its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests limited inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in November (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Final December Consumer Sentiment at 82.5

by Calculated Risk on 12/23/2013 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for December was at 82.5, up from the November reading of 75.1, and unchanged from the preliminary December reading of 82.5.

This was below the consensus forecast of 83.0. Sentiment has generally been improving following the recession - with plenty of ups and downs - and one big spike down when Congress threatened to "not pay the bills" in 2011. The decline in October and early November was probably also due to the government shutdown and another threat to "not pay the bills".

As usual sentiment rebounds fairly quickly following event driven declines, and I expect to see sentiment at post-recession highs very soon.

Personal Income increased 0.2% in November, Spending increased 0.5%

by Calculated Risk on 12/23/2013 08:53:00 AM

The BEA released the Personal Income and Outlays report for November:

Personal income increased $30.1 billion, or 0.2 percent ... in November according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $63.0 billion, or 0.5 percent.On inflation, the PCE price index decreased at a 0.3% annual rate in October, and core PCE prices increased at a 1.2% annual rate. This is very low and far below the Fed's 2% target.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.5 percent in November, compared with an increase of 0.4 percent in October. ... The price index for PCE increased less than 0.1 percent in November, in contrast to a decrease of less than 0.1 percent in October. The PCE price index, excluding food and energy, increased 0.1 percent in November, the same increase as in October.

The following graph shows real Personal Consumption Expenditures (PCE) through November 2013 (2009 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Using the two-month method to estimate Q4 PCE growth (first two months of the quarter), PCE was increasing at a 4.1% annual rate in Q4 2013 (using mid-month method, PCE was increasing at 4.6% rate). This suggests solid PCE growth in Q4.

LPS: Mortgage Delinquency Rate increased in November, Down almost 10% year-over-year

by Calculated Risk on 12/23/2013 07:01:00 AM

According to the First Look report for November to be released today by Lender Processing Services (LPS), the percent of loans delinquent increased in November compared to October, and declined about 9.4% year-over-year. Also the percent of loans in the foreclosure process declined further in November and were down 29% over the last year.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) increased to 6.45% from 6.28% in October. The normal rate for delinquencies is around 4.5% to 5%.

The percent of loans in the foreclosure process declined to 2.50% in November from 2.54% in October. The is the lowest level since late 2008.

The number of delinquent properties, but not in foreclosure, is down 342,000 properties year-over-year, and the number of properties in the foreclosure process is down 511,000 properties year-over-year.

LPS will release the complete mortgage monitor for November in early January.

| LPS: Percent Loans Delinquent and in Foreclosure Process | |||

|---|---|---|---|

| November 2013 | October 2013 | November 2012 | |

| Delinquent | 6.45% | 6.28% | 7.03% |

| In Foreclosure | 2.50% | 2.54% | 3.61% |

| Number of properties: | |||

| Number of properties that are 30 or more, and less than 90 days past due, but not in foreclosure: | 1,958,000 | 1,869,000 | 1,999,000 |

| Number of properties that are 90 or more days delinquent, but not in foreclosure: | 1,283,000 | 1,283,000 | 1,584,000 |

| Number of properties in foreclosure pre-sale inventory: | 1,256,000 | 1,276,000 | 1,767,000 |

| Total Properties | 4,497,000 | 4,428,000 | 5,350,000 |

Sunday, December 22, 2013

Monday: Personal Income and Outlays, Consumer Sentiment

by Calculated Risk on 12/22/2013 08:17:00 PM

Monday:

• At 8:30 AM ET, the Personal Income and Outlays report for November. The consensus is for a 0.5% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• Also at 8:30 AM, the Chicago Fed National Activity Index for November. This is a composite index of other data.

• At 9:00 AM, the Chemical Activity Barometer (CAB) for December from the American Chemistry Council. This appears to be a leading economic indicator.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 83.5, up from the preliminary reading of 82.5, and up from the November reading of 75.1.

Weekend:

• Schedule for Week of December 22nd

• Review: Ten Economic Questions for 2013

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are up 10 and DOW futures are up 82 (fair value).

Oil prices have been moving up with WTI futures at $99.25 per barrel and Brent at $111.81 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $3.24 per gallon. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Review: Ten Economic Questions for 2013

by Calculated Risk on 12/22/2013 12:38:00 PM

Next week I'll post some economic questions for 2014, but first here is a review of my Ten Economic Questions for 2013.

After posting the list, I followed up with a discussion of each question. The goal was to provide an overview of what I was expecting in 2013 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand when I was wrong).

I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2013: Europe and the Euro

Even though I've been pessimistic on Europe (In 2011, I correctly argued that the eurozone was heading into recession), I was less pessimistic than many others. Each of the last two years, I argued the eurozone would stay together ... My guess is the eurozone makes it through another year without losing any countries or a serious collapse. Obviously several countries are near the edge, and the key will be to return to expansion soon.Correct: The Eurozone survived another year. The good news is it is now obvious to almost everyone that "austerity" alone failed. The bad news is that many policymakers remain blind to the obvious.

Note: unless the eurozone "implodes", I don't think Europe poses a large downside risk to the US.

Even with bad policies, eventually the European economies will start to grow again. And it appears that is starting to happen now. Of course many problems remain.

9) Question #9 for 2013: How much will Residential Investment increase?

New home sales will still be competing with distressed sales (short sales and foreclosures) in many areas in 2013 - and probably even more foreclosures in some judicial states. Also I've heard some builders might be land constrained in 2013 (not enough finished lots in the pipeline). Both of these factors could slow the growth of residential investment, but I expect another solid year of growth.Forecast was a little high: We have start data through November, and starts this year are up 19% over the same period in 2012. New home sales are up 15% through the first ten months of 2013 compared to the same period in 2012. This is a little below my forecast, but another solid year for housing.

... I expect growth for new home sales and housing starts in the 20% to 25% range in 2013 compared to 2012.

8) Question #8 for 2013: Will Housing inventory bottom in 2013?

If prices increase enough then some of the potential sellers will come off the fence, and some of these underwater homeowners will be able to sell. It might be enough for inventory to bottom in 2013.Correct: It appears inventory bottomed early in 2013, and inventory was up 5% year-over-year in November according to the NAR. Inventory is still low, but this increase in inventory should slow the rate of house price increases.

Right now my guess is active inventory will bottom in 2013, probably in January. At the least, the rate of year-over-year inventory decline will slow sharply.

7) Question #7 for 2013: What will happen with house prices in 2013?

Calling the bottom for house prices in 2012 now appears correct.Forecast was too low: The Case-Shiller Comp 20 and National indexes both increased about 7% in 2012. The seasonally adjusted Case-Shiller Comp 20 index was up 13.3% year-over-year in September, and the National Index is up 11% through Q3 . Other indexes show less appreciation - and I expect price increases to slow - but my initial prediction for house prices this year was too low.

[E]ven though I expect inventories to be low this year, I think we will see more inventory come on the market in 2013 than 2012, as sellers who were waiting for a better market list their homes, and as some "underwater" homeowner (those who owe more than their homes are worth) finally can sell without taking a loss.

Also I expect more foreclosure in some judicial states, and I think the price momentum in Phoenix and other "bounce back" areas will slow.

All of these factors suggest further prices increases in 2013, but at a slower rate than in 2012.

6) Question #6 for 2013: What will happen with Monetary Policy and QE3?

I expect the FOMC will review their purchases at each meeting just like they used to review the Fed Funds rate. We might see some adjustments during the year, but currently I expect the Fed to purchase securities at about the same level all year.Correct: The Fed kept their purchases steady all year, and will start to reduce QE asset purchases in January (announced at the meeting last week).

5) Question #5 for 2013: Will the inflation rate rise or fall in 2013?

I still expect inflation to be near the Fed's target. With high unemployment and low resource utilization, I don't see inflation as a threat in 2013.Forecast was a little too high: Inflation has been below the Fed's target all year. This is a significant issue for the Fed, and it appears my inflation forecast was a little high.

4) Question #4 for 2013: What will the unemployment rate be in December 2013?

My guess is the participation rate will remain around 63.6% in 2013, and with sluggish employment growth, the unemployment rate will be in the mid-to-high 7% range in December 2013 (little changed from the current rate).Forecast was too high: The unemployment rate was at 7.0% in November. I was too pessimistic on the unemployment rate because the participation rate has continued to decline.

3) Question #3 for 2013: How many payroll jobs will be added in 2013?

Both state and local government and construction hiring should improve in 2013. Unfortunately there are other employment categories that will be hit by the austerity (especially the increase in payroll taxes). I expect that will offset any gain from construction and local governments. So my forecast is close to the previous two years, a gain of about 150,000 to 200,000 payroll jobs per month in 2013.Correct: Through November 2013, the economy has added an average of 173 thousand jobs per month - about as expected.

2) Question #2 for 2013: Will the U.S. economy grow in 2013?

[R]ight now it appears the drag from austerity will probably offset the pickup in the private sector - and we can expect another year of sluggish growth in 2013 probably in the 2% range again.Correct: It now looks like GDP will increase in the 2.2% to 2.4% range for 2013.

1) Question #1 for 2013: US Fiscal Policy

[T]the House will fold their [early 2013] losing hand [on the debt ceiling] soon. ...Mostly Correct: The House did fold early this year, but I was wrong about the sequester (bad policy). Unfortunately I was also correct about the government shutdown.

Although the negotiations on the "sequester" will be tough, I suspect something will be worked out (remember the goal is to limit the amount of austerity in 2013). The issue that might blow up is the “continuing resolution", and that might mean a partial shut down of the government. This wouldn't be catastrophic (like the "debt ceiling"), but it would still cause problems for the economy and is a key downside risk.

And a final prediction: If we just stay on the current path ... I think the deficit will decline faster than most people expect over the next few years. Eventually the deficit will start to increase again due to rising health care costs (this needs further attention), but that isn't a short term emergency.

And I was definitely correct about the deficit decreasing faster than most people expected. This has really surprised some policymakers (who unfortunately are still not paying attention).

Luckily 2014 is an election year, and with the recent budget agreement, I don't expect the House to be a huge downside risk next year (assuming Congress "pays the bills").

Overall 2013 unfolded about as expected. I'm expecting Stronger Economic Growth in 2014, and longer term, the future's so bright ...

Saturday, December 21, 2013

ATA Trucking Index increased 2.7% in November

by Calculated Risk on 12/21/2013 04:44:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Jumped 2.7% in November

The American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.7% in November, after falling 1.9% in October. ... In November, the index equaled 128.5 (2000=100) versus 125.1 in October. November’s level is a record high. Compared with November 2012, the SA index surged 8.1% ...

...

“Tonnage snapped back in November, which fits with several other economic indicators,” said ATA Chief Economist Bob Costello. “Assuming that December isn’t weak, tonnage growth this year will be more than twice the gain in 2012.”

Tonnage increased 2.3% in 2012. Costello noted tonnage accelerated in the second half of the year, indicating that the economy is likely stronger some might believe.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is up solidly year-over-year. The monthly decline in October was probably related to the government shutdown, but the index bounced back in November to a record high.