by Calculated Risk on 11/21/2013 12:37:00 PM

Thursday, November 21, 2013

Zillow: Negative Equity declines sharply in Q3

From Zillow: U.S. Negative Equity Rate Falls at Fastest Pace Ever in Q3

According to the third quarter Zillow Negative Equity Report, the national negative equity rate fell at its fastest pace in the third quarter, dropping to 21% of all homeowners with a mortgage underwater from 31.4% at its peak in the first quarter of 2012. In the third quarter of 2013, more than 1.4 million American homeowners were freed from negative equity, and 4.9 million mortgaged homeowners have been freed since the beginning of 2012. However, roughly 10.8 million homeowners with a mortgage still remain underwater. Moreover, the effective negative equity rate nationally — where the loan-to-value ratio is more than 80%, making it difficult for a homeowner to afford the down payment on another home — is 39.2% of homeowners with a mortgage. While not all of these homeowners are underwater, they have relatively little equity in their homes, and therefore selling and buying a new home while covering all of the associated costs (real estate agent fees, closing costs and a new down payment) would be difficult. Of all homeowners – roughly one-third of homeowners do not have a mortgage and own their homes free and clear – 14.7% are underwater.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q3 2013 compared to Q3 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure 7 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in 2013 Q3 vs. 2012 Q3. Even though many homeowners are still underwater and haven’t crossed the 100% LTV threshold to enter into positive equity, they are moving in the right direction. The good news is that, with these high rates of appreciation, negative equity has been reduced at a fast pace in the near-term. However, we expect negative equity rate reduction to slow in the fourth quarter and next year as home value appreciation is already moderating and will continue to do so later this year and into the next. ... On average, a U.S. homeowner in negative equity owes $74,632 more than what the house is worth, or 41.8% more than the home’s value. While roughly a fifth of homeowners with a mortgage are underwater, 92% of these homeowners are current on their mortgage payments.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (the light red columns). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 7.3% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Note: CoreLogic will release their Q3 negative equity report in the next couple of weeks. For Q2, CoreLogic reported there were 7.1 million properties with negative equity, and that will be down further in Q3.

Philly Fed Manufacturing Survey indicates Slower Expansion in November

by Calculated Risk on 11/21/2013 10:00:00 AM

From the Philly Fed: November Manufacturing Survey

Manufacturing growth in the region continued in November but did not match the pace of growth in the preceding month, according to firms responding to this month’s Business Outlook Survey. The survey’s broadest indicators for general activity, new orders, shipments, and employment were positive, signifying growth, but readings for each fell from October. The survey's indicators of future activity also moderated but continue to suggest general optimism about growth over the next six months.This was below the consensus forecast of a reading of 15.5 for November.

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, declined from 19.8 in October to 6.5 this month. The index has now been positive for six consecutive months.

Labor market indicators showed little improvement this month. The current employment index fell 14 points from its reading in October (which was at a two-year high), to 1.1.

emphasis added

Click on graph for larger image.

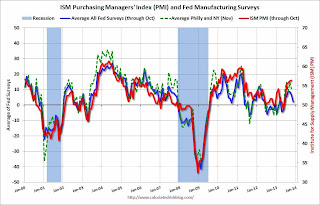

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through November. The ISM and total Fed surveys are through October.

The average of the Empire State and Philly Fed surveys has been positive for six consecutive months. This suggests slower expansion in the ISM report for November.

Also Market released their Flash PMI for November this morning that suggests faster manufacturing expansion:

At 54.3, the Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1, which is based on approximately 85% of usual monthly survey replies, rose to an eight-month high in November. This was up from a one-year low of 51.8 in October.

Weekly Initial Unemployment Claims decline to 323,000

by Calculated Risk on 11/21/2013 08:36:00 AM

The DOL reports:

In the week ending November 16, the advance figure for seasonally adjusted initial claims was 323,000, a decrease of 21,000 from the previous week's revised figure of 344,000. The 4-week moving average was 338,500, a decrease of 6,750 from the previous week's revised average of 345,250.The previous week was up from 339,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 338,500.

Some of the recent volatility in weekly claims was due to processing problems in California (now resolved).

Wednesday, November 20, 2013

Thursday: Unemployment Claims, PPI, Philly Fed Mfg Survey

by Calculated Risk on 11/20/2013 08:10:00 PM

No big surprises in the FOMC minutes. From the WSJ: Bond Buying Likely to Be Pared 'in Coming Months,' but Conveying Thinking on Low Rates Proves Vexing

Federal Reserve officials still expect to start pulling back on the central bank's $85 billion-a-month bond-buying program "in coming months," but they are looking for ways to stress that they will keep short-term interest rates low for a long time after it ends.The short version: the Fed will start to "taper" soon, but the Fed Funds rate will be low for a long long time.

...

Officials discussed the possibility of linking any changes to the forward guidance to cuts to the bond-buying program. The changes in the guidance could be made "either to improve clarity or to add to policy accommodation, perhaps in conjunction with a reduction in the pace of asset purchases as part of a rebalancing of the Committee's tools," the minutes said

Fed officials also contemplated reassuring market participants that short-term interest rates are likely to stay near zero long after the 6.5% threshold is crossed, a message Fed Chairman Ben Bernanke delivered in a speech Tuesday night. They also discussed adding language to their policy statement indicating that even after the first increase in their benchmark short-term rate, they "anticipated keeping the rate below its longer-run equilibrium value for some time, as economic headwinds were likely to diminish only slowly."

Thursday:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 339 thousand last week.

• Also at 8:30 AM, the Producer Price Index for October. The consensus is for a 0.2% decrease in producer prices (0.1% increase in core).

• At 10:00 AM, the Philly Fed manufacturing survey for November. The consensus is for a reading of 15.5, down from 19.8 last month (above zero indicates expansion).

AIA: "Architecture Billings Index Slows Down" in October

by Calculated Risk on 11/20/2013 04:29:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Slows Down

Following three months of accelerating demand for design services, the Architecture Billings Index (ABI) reflected a somewhat slower pace of growth in October. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 51.6, down from a mark of 54.3 in September. This score reflects an increase in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.5, up from the reading of 58.6 the previous month.

“There continues to be a lot of uncertainty surrounding the overall U.S. economic outlook and therefore in the demand for nonresidential facilities, which often translates into slower progress on new building projects,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “That is particularly true when you factor in the federal government shutdown that delayed many projects that were in the planning or design phases.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.6 in October, down from 54.3 in September. Anything above 50 indicates expansion in demand for architects' services. This index has indicated expansion in 13 of the last 14 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index is not as strong as during the '90s - or during the bubble years of 2004 through 2006 - but the increases in this index over the past year suggest some increase in CRE investment in 2014.

FOMC Minutes: Discussion of how to communicate that rates will be low for a long long time

by Calculated Risk on 11/20/2013 02:00:00 PM

There was a policy planning discussion on how best to communicate that rates would be low for a long time.

From the Fed: Minutes of the Federal Open Market Committee, October 29-30, 2013. First an excerpt on fiscal policy:

Participants generally saw the direct economic effects of the partial shutdown of the federal government as temporary and limited, but a number of them expressed concern about the possible economic effects of repeated fiscal impasses on business and consumer confidence. More broadly, fiscal policy, which has been exerting significant restraint on economic growth, was expected to become somewhat less restrictive over the forecast period. Nonetheless, it was noted that the stance of fiscal policy was likely to remain one of the most important headwinds restraining growth over the medium term.On asset purchases (taper in "coming months"):

During this general discussion of policy strategy and tactics, participants reviewed issues specific to the Committee's asset purchase program. They generally expected that the data would prove consistent with the Committee's outlook for ongoing improvement in labor market conditions and would thus warrant trimming the pace of purchases in coming months.On forward guidance:

As part of the planning discussion, participants also examined several possibilities for clarifying or strengthening the forward guidance for the federal funds rate, including by providing additional information about the likely path of the rate either after one of the economic thresholds in the current guidance was reached or after the funds rate target was eventually raised from its current, exceptionally low level. A couple of participants favored simply reducing the 6-1/2 percent unemployment rate threshold, but others noted that such a change might raise concerns about the durability of the Committee's commitment to the thresholds. Participants also weighed the merits of stating that, even after the unemployment rate dropped below 6-1/2 percent, the target for the federal funds rate would not be raised so long as the inflation rate was projected to run below a given level. In general, the benefits of adding this kind of quantitative floor for inflation were viewed as uncertain and likely to be rather modest, and communicating it could present challenges, but a few participants remained favorably inclined toward it. Several participants concluded that providing additional qualitative information on the Committee's intentions regarding the federal funds rate after the unemployment threshold was reached could be more helpful. Such guidance could indicate the range of information that the Committee would consider in evaluating when it would be appropriate to raise the federal funds rate. Alternatively, the policy statement could indicate that even after the first increase in the federal funds rate target, the Committee anticipated keeping the rate below its longer-run equilibrium value for some time, as economic headwinds were likely to diminish only slowly. Other factors besides those headwinds were also mentioned as possibly providing a rationale for maintaining a low trajectory for the federal funds rate, including following through on a commitment to support the economy by maintaining more-accommodative policy for longer. These or other modifications to the forward guidance for the federal funds rate could be implemented in the future, either to improve clarity or to add to policy accommodation, perhaps in conjunction with a reduction in the pace of asset purchases as part of a rebalancing of the Committee's tools.

Participants also discussed a range of possible actions that could be considered if the Committee wished to signal its intention to keep short-term rates low or reinforce the forward guidance on the federal funds rate. For example, most participants thought that a reduction by the Board of Governors in the interest rate paid on excess reserves could be worth considering at some stage, although the benefits of such a step were generally seen as likely to be small except possibly as a signal of policy intentions. By contrast, participants expressed a range of concerns about using open market operations aimed at affecting the expected path of short-term interest rates, such as a standing purchase facility for shorter-term Treasury securities or the provision of term funding through repurchase agreements. Among the concerns voiced was that such operations would inhibit price discovery and remove valuable sources of market information; in addition, such operations might be difficult to explain to the public, complicate the Committee's communications, and appear inconsistent with the economic thresholds for the federal funds rate. Nevertheless, a number of participants noted that such operations were worthy of further study or saw them as potentially helpful in some circumstances.

emphasis added

Key Measures Shows Low Inflation in October

by Calculated Risk on 11/20/2013 11:52:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.4% annualized rate) in October. The 16% trimmed-mean Consumer Price Index also increased 0.1% (1.1% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for October here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.1% (-0.7% annualized rate) in October. The CPI less food and energy increased 0.1% (1.5% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.0%, the trimmed-mean CPI rose 1.7%, the CPI rose 1.0%, and the CPI less food and energy rose 1.7%. Core PCE is for September and increased just 1.2% year-over-year.

On a monthly basis, median CPI was at 1.4% annualized, trimmed-mean CPI was at 1.1% annualized, and core CPI increased 1.5% annualized.

These measures indicate inflation remains below the Fed's target.

Existing Home Sales in October: 5.12 million SAAR, Inventory up 0.9% Year-over-year

by Calculated Risk on 11/20/2013 10:00:00 AM

The NAR reports: October Existing-Home Sales Cool but Low Inventory Drives Prices

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, fell 3.2 percent to a seasonally adjusted annual rate of 5.12 million in October from 5.29 million in September, but are 6.0 percent higher than the 4.83 million-unit level in October 2012.

Total housing inventory at the end of October declined 1.8 percent to 2.13 million existing homes available for sale, which represents a 5.0-month supply at the current sales pace; the relative supply was 4.9 months in September. Unsold inventory is 0.9 percent above a year ago, when there was a 5.2-month supply.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in October 2013 (5.12 million SAAR) were 3.2% lower than last month, and were 6.0% above the October 2012 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory was declined to 2.13 million in October from 2.17 million in September. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory was declined to 2.13 million in October from 2.17 million in September. Inventory is not seasonally adjusted, and inventory usually increases from the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory increased 0.9% year-over-year in October compared to October 2012. The year-over-year change for September was revised down to unchanged, so this is the year-over-year increase in inventory since early 2011 and indicates inventory bottomed earlier this year.

Inventory increased 0.9% year-over-year in October compared to October 2012. The year-over-year change for September was revised down to unchanged, so this is the year-over-year increase in inventory since early 2011 and indicates inventory bottomed earlier this year.Months of supply was at 5.0 months in October.

This was close to expectations of sales of 5.13 million. For existing home sales, the key number is inventory - and inventory is still low, but up year-over-year. I'll have more later ...

Retail Sales increased 0.4% in October

by Calculated Risk on 11/20/2013 08:43:00 AM

On a monthly basis, retail sales increased 0.4% from September to October (seasonally adjusted), and sales were up 3.9% from October 2012. From the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for October, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $428.1 billion, an increase of 0.4 percent from the previous month, and 3.9 percent above October 2012. ...The August to September 2013 percent change was revised from -0.1 percent to virtually unchanged.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 29.1% from the bottom, and now 13.2% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 0.2%.

Excluding gasoline, retail sales are up 26.5% from the bottom, and now 13.8% above the pre-recession peak (not inflation adjusted).

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.Retail sales ex-gasoline increased by 5.4% on a YoY basis (3.9% for all retail sales).

This was above the consensus forecast of no change for retail sales.

MBA: Mortgage Refinance Applications decrease, Purchase Applications Increase

by Calculated Risk on 11/20/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 15, 2013. This week’s results include an adjustment to account for the Veteran’s Day holiday. ...

The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. ...

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.46 percent from 4.44 percent, with points decreasing to 0.38 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

The refinance index declined 7% last week.

The refinance index is down 62% from the levels in early May.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has fallen since early May, and the 4-week average of the purchase index is now down about 3% from a year ago.