by Calculated Risk on 12/26/2012 08:39:00 AM

Wednesday, December 26, 2012

LPS: House Price Index increased 0.3% in October, Up 4.3% year-over-year

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses October closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: U.S. Home Prices Up 0.3 Percent for the Month; Up 4.3 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on October 2012 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 22.6% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 53.6% from the peak in Las Vegas, 45.5% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and barely off in Austin and Houston.

Looking at the year-over-year price change throughout the year - in May, the LPS HPI was up 0.4% year-over-year, in June the index was up 0.9% year-over-year, 1.8% in July, 2.6% in August, 3.6% in September, and now 4.3% in October. This is steady improvement on a year-over-year basis. Note: Case-Shiller for October will be this morning.

Tuesday, December 25, 2012

Wednesday: Case-Shiller House Prices, Richmond Fed Manufacturing Survey

by Calculated Risk on 12/25/2012 07:33:00 PM

First a great story about Jack Klugman from Joshua Green at the WaPo: Jack Klugman’s secret, lifesaving legacy

And for those seeing Les Mis this week, here are couple of incredible performances of "I Dreamed a Dream", first by Ruthie Henshall at the 10th Anniversary and another by Lea Salonga at the 25th Anniversary Concert.

Wednesday economic releases:

• At 9:00 AM, the S&P/Case-Shiller House Price Index for October will be released. Although this is the October report, it is really a 3 month average of August, September and October. The consensus is for a 4.1% year-over-year increase in the Composite 20 index (NSA) for September. The Zillow forecast is for the Composite 20 to increase 4.1% year-over-year, and for prices to increase 0.3% month-to-month seasonally adjusted.

• At 10:00 AM, the Richmond Fed Survey of Manufacturing Activity for December will be released. The consensus is for a decrease to 6 for this survey from 9 in November (Above zero is expansion).

A couple of posts yesterday:

• Review of My 2012 Forecasts

• Ten Economic Questions for 2013

Two more questions this week for the December economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Private Investment and the Business Cycle

by Calculated Risk on 12/25/2012 01:01:00 PM

A little holiday cheer ...

Discussions of the business cycle frequently focus on consumer spending (PCE: Personal consumption expenditures), but the key is to watch private domestic investment, especially residential investment. Even though private investment usually only accounts for around 15% of GDP, the swings for private investment are significantly larger than for PCE during the business cycle, so private investment has an outsized impact on GDP at transitions in the business cycle.

The first graph shows the real annualized change in GDP and private investment since 1960 (this is a 3 quarter centered average to smooth the graph).

GDP has fairly small annualized changes compared to the huge swings in investment, especially during and just following a recession. This is why investment is one of the keys to the business cycle.

Click on graph for larger image.

Click on graph for larger image.

Note that during the recent recession, the largest decline for GDP was in Q4 2008 (a 8.9% annualized rate of decline). On a three quarter center averaged basis (as presented on graph), the largest decline was 5.9% annualized.

However the largest decline for private investment was a 43% annualized rate! On a three quarter average basis (on graph), private investment declined at a 35% annualized rate.

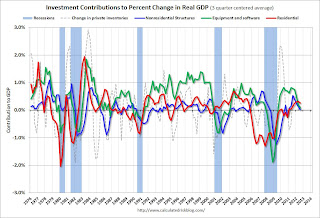

The second graph shows the contribution to GDP from the four categories of private investment: residential investment, equipment and software, nonresidential structures, and "Change in private inventories". Note: this is a 3 quarter centered average of the contribution to GDP.

This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment lags the business cycle. Red is residential, green is equipment and software, and blue is investment in non-residential structures. The usual pattern - both into and out of recessions is - red, green, and blue.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession.

The dashed purple line is the "Change in private inventories". This category has significant ups and downs, but is always negative during a recession, and provides a boost to GDP just after a recession.

The key leading sector - residential investment - has lagged this recovery because of the huge overhang of existing inventory. Usually residential investment is a strong contributor to GDP growth and employment in the early stages of a recovery, but not this time - and that weakness was a key reason why the recovery was sluggish so far.

Residential investment finally turned positive during 2011 and made a positive contribution to GDP in 2012.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is starting to increase.

What does this mean for the business cycle? Usually residential investment would turn down before a recession, and that isn't happening right now. Instead residential investment is starting to increase.

The third graph shows residential investment as a percent of GDP. Residential investment as a percent of GDP is just above the record low, and it seems likely that residential investment as a percent of GDP will increase further in 2013.

The key downside risk for the US economy in 2013 is too much austerity, too quickly. However, barring a policy mistake (I expect a fiscal agreement), it seems unlikely there will be a sharp decline in private investment in 2013. This is because residential investment is already near record lows as a percent of GDP and will probably increase further in 2013, and that suggests the US will avoid a new recession in 2013.

Happy Holidays!

by Calculated Risk on 12/25/2012 09:01:00 AM

Happy Holidays and Merry Christmas to all!

A couple of posts yesterday:

• Review of My 2012 Forecasts

• Ten Economic Questions for 2013

And a repeat gift ... a common question, using excel, is how do you get from this:

Thanks to all. Happy Holidays!

Monday, December 24, 2012

Ten Economic Questions for 2013

by Calculated Risk on 12/24/2012 06:43:00 PM

Here are some questions I'm thinking about ...

1) US Policy: This is probably the biggest downside risk for the US economy in 2013. I assume some sort of fiscal agreement will be reached soon, but how much austerity will be included? What will happen with the Alternative Minimum Tax (AMT)? What about emergency unemployment benefits? What about extending the mortgage relief for debt forgiveness (important for short sales)?

And what about other policy in 2013 such as the "default ceiling" (aka debt ceiling)? In 2011, the threat of a US government default slowed the economy to almost a standstill for a month. Right now the White House is taking the Ronald Reagan approach (when the Democrats pulled a similar reckless stunt) and they are saying President Obama will only sign a clean debt ceiling bill. Good. Hopefully default is off the table, but you never know.

2) Economic growth: Heading into 2013 there are still significant downside risks from the European financial crisis and from U.S. fiscal policy. Will the U.S. economy grow in 2013? Or will there be another recession?

3) Employment: How many payroll jobs will be added in 2013? Will we finally see some pickup over the approximately 2 million private sector job creation rate of 2011 and 2012?

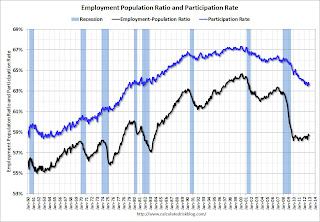

4) Unemployment Rate: The unemployment rate is still elevated at 7.7% in November. For the last two years I've been too pessimistic on the unemployment rate because I was expecting some minor bounce back in the participation rate. Instead the participation rate continued to decline. Maybe 2013 will be the year the participation rate increases a little, or at least stabilizes. Economists at the SF Fed wrote about this last week: Will the Jobless Rate Drop Take a Break?

The recent recession was unusual in its depth and its duration. Labor market conditions have remained difficult for a long time. As a result, large numbers of discouraged workers have stopped looking for jobs. A big unknown is whether these workers will stay out of the labor force permanently or enter as the economy recovers. If these workers join the labor force, increasing participation could have a major impact on the unemployment rate in the coming years.What will the unemployment rate be in December 2013?

5) Inflation: The Fed has made it clear they will tolerate a little more inflation, but currently the inflation rate is running below the Fed's 2% target. Will the inflation rate rise or fall in 2013?

6) Monetary Policy: Currently the Fed is planning to buy $85 billion in Treasury and agency mortgage-backed securities per month as part of the open-ended QE3. Will the Fed continue all year at this pace? Or will the Fed increase their purchase rate? Or will the Fed decrease their purchase rate, stop these purchases, or even sell some securities?

7) House Prices: It now appears house prices, as measured by the national repeat sales indexes, bottomed in early 2012? What will happen with house prices in 2013?

8) Housing Inventory: Over the last few years, we've seen a dramatic plunge in existing home inventory. Will inventory bottom in 2013?

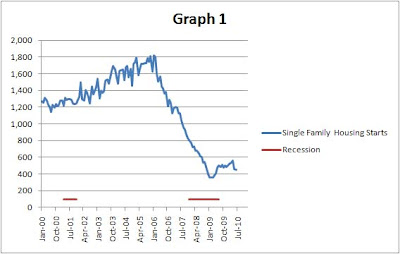

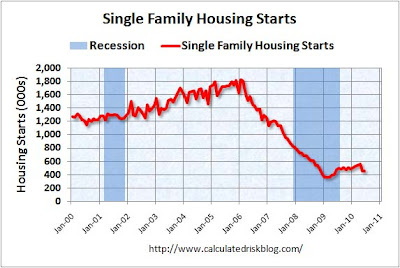

9) Residential Investment: Residential investment (RI) picked up in 2012, with new home sales and housing starts increasing 20% or so. Note: RI is mostly investment in new single family structures, multifamily structures, home improvement and commissions on existing home sales. This still leaves RI at a historical low level. How much will RI increase in 2013?

10) Europe and the Euro: What will happen in Europe in 2013? Will a country leave the euro this coming year, will the euro-zone implode, or will 2013 be the bottom for the euro-zone economies?

I'm sure there are other key questions, but these are the ones I'm thinking about now.

Review of My 2012 Forecasts

by Calculated Risk on 12/24/2012 11:52:00 AM

Near the end of each year I try to post a few general forecasts for the coming year. The purpose is to try to provide an overview of how I think the economy will perform.

Some years there are BIG calls, like in late 2006 when I predicted a recession would start in 2007 (made it by one month!). Another “BIG” call example was in early 2009 when I started writing about a second half economic recovery.

Most of my forecasts are more mundane, as an example for 2012 GDP, I wrote:

“my guess is growth will be sluggish relative to the slack in the system, but above the 2011 growth rate. “Right now “sluggish” looks correct, and if Q4 2012 GDP is at or above 1.6% (annualized), then 2012 will actually be better than 2011 (Q4 over Q4 of previous year). But even if I had been wrong, I find it useful to write down some forecasts and then to understand why I was right or wrong. (I’d say my guess on growth was about right).

Of course my BIG call for 2012 was that house prices would finally find a bottom as measured by the national repeat sales indexes (see: The Housing Bottom is Here). In early 2012, I wrote:

“My guess is that nominal house prices, using the national repeat sales indexes and not seasonally adjusted, will bottom in March 2012.”As of right now – with prices up almost 5% seasonally adjusted since early this year – the house price bottom call looks correct.

Note: When I wrote that post, the consensus was house prices would decline throughout 2012. Since then the consensus has changed and most analysts now think prices bottomed early this year.

I did get a couple of forecasts wrong in 2012. For the unemployment rate, I wrote:

A couple of predictions.Even though I’ve been arguing that most of the decline in the participation rate over the last few years was due to changing demographics (as opposed to cyclical due to the recession), I still thought we’d see some slight increase in participation in 2012 – and that didn’t happen.

• The participation rate will rise slightly in 2012 and probably end the year in the 64.0% to 64.5% range.

• The unemployment rate will still be in the 8% to 9% range in December 2012.

Click on graph for larger image.

Click on graph for larger image.The participation rate fell to 63.6% in November, and the unemployment rate declined to 7.7%. (Participation rate is the blue line. This is the percentage of the working age population in the labor force).

Since I was wrong on the participation rate, my forecast for the unemployment rate was too pessimistic.

I was also too pessimistic on foreclosures. I wrote:

Will foreclosure activity increase in 2012?The policy changes were announced, but the lenders focused more on modifications and short sales than foreclosures, and foreclosure activity has only picked up recently in some judicial foreclosure states.

This is a difficult question. There are several significant policy changes in the works: 1) a possible Mortgage Settlement, 2) HARP refinance (the automated program starts in March), and 3) a REO to rental program. It appears the overall goal of these policy changes is to reduce the large backlog of seriously delinquent loans while, at the same time, not flood the housing market with distressed homes.

My guess is the policy changes will all be announced in the next few months, and that foreclosure activity will increase significantly.

On employment I was close. I wrote:

My guess is private employment will increase around 150 to 200 thousand per month on average in 2012; about the same rate as in 2011.That was about right. The economy has added 1.7 million private sector jobs through November (over 1.8 million including the preliminary benchmark revision).

With over 13 million unemployed workers - and 5.6 million unemployed for more than 26 weeks - adding 2 million private sector jobs will not seem like much of job recovery for many Americans. Hopefully I'm too pessimistic.

A key forecast – that appears correct – was that the drag from state and local governments would end around mid-year. I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, and state and local government employment increased by 4,000 in November.

This graph shows total state and government payroll employment since January 2007. State and local governments lost 129,000 jobs in 2009, 262,000 in 2010, and 230,000 in 2011. So far in 2012, state and local governments have actually added a few jobs, and state and local government employment increased by 4,000 in November.Note: The dashed line shows an estimate including the benchmark revision.

It appears most of the state and local government layoffs are over, however the Federal government layoffs are ongoing.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

This graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 6 quarters (through Q3 2012).

The red bars are for state and local governments. Although not as large a negative as the worst of the housing bust (and much smaller spillover effects), this decline has been relentless and unprecedented. The good news is the drag appears to be ending, and state and local governments actually added to GDP growth in Q3 2012 - for the first time since Q3 2009.

A few more forecasts - On monetary policy I wrote:

• I expect the Fed will change their communication strategy and add a likely future path of the Fed Funds rate to the quarterly economic forecasts.The Fed introduced the new communication strategy, and then changed it again near the end of 2012. They waited a little longer than I expected, and the FOMC announced QE3 in September.

• I think QE3 is likely, but more towards mid-year - and [timing] is data dependent.

And on inflation:

The bottom line is the inflation rate will probably stay low in 2012 with high unemployment and low resource utilization. I expect QE3 to be announced before mid-year, and that will probably keep the inflation rate near the Fed's target (as opposed to falling further). But I don't see inflation as a significant threat in 2012.The inflation outlook was correct. It is stunning how many analysts and policymakers have consistently been wrong on inflation for the last several years - and they still haven't changed their views or models!

And on Europe and the Euro:

So once again my guess is the euro will survive another year without losing any countries (Assuming a Greek debt deal). There will be plenty of blowups along the way, but I think the impact on the US economy will be fairly minimal.I was pessimistic on Europe, but less pessimistic than many others. And once again Europe made it through another year.

All and all the economy evolved about as I expected in 2012. I’ll try to post some forecasts for 2013 soon, but I’ll wait until we see the details of the fiscal agreement. Policy matters – and the key downside risk for the US economy in 2013 is rapid austerity.

"Fiscal Cliff": Weary eyes turn toward the Senate

by Calculated Risk on 12/24/2012 09:23:00 AM

From the NY Times: Search for Way Through Fiscal Impasse Turns to the Senate

Senators Kay Bailey Hutchison of Texas and Johnny Isakson of Georgia, both Republicans, implored Senate leaders to reach an accommodation with Mr. Obama when Congress returns on Thursday, even if that meant that taxes would go up for those with high incomes and that spending cuts would be put off.I think Isakson is correct about what will happen in January - that Congress will approve an agreement after the tax cuts expire so they can claim they are cutting taxes. Politics is weird.

“The president’s statement is right,” Mr. Isakson said Sunday on the ABC program “This Week.” “No one wants taxes to go up on the middle class."...

“The truth of the matter is, if we do fall off the cliff after the president is inaugurated, he’ll come back, propose just what he proposed yesterday in leaving Washington, and we’ll end up adopting it,” Mr. Isakson continued. “But why should we put the markets in such turmoil and the people in such misunderstanding or lack of confidence? Why not go ahead and act now?”

Sunday, December 23, 2012

Sunday Night Futures

by Calculated Risk on 12/23/2012 09:34:00 PM

Happy Holidays to all. There are no releases scheduled for Monday, and the U.S. markets will close early.

We will also get a two day break from the "fiscal cliff"!

Weekend:

• Summary for Week Ending Dec 21st

• Schedule for Week of Dec 23rd

The Asian markets are mostly green tonight, with both the Shanghai Composite and the Hang Seng up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 4 and DOW futures are down 30.

Oil prices have moved up a little recently withWTI futures at $88.46 per barrel and Brent at $108.80 per barrel. Gasoline prices are now near the low for the year.

Gasoline Prices near Low for Year, Expected to Increase

by Calculated Risk on 12/23/2012 05:39:00 PM

Another update on gasoline prices. It looks like prices will finish the year near the low, but probably increase soon.

From CNN: Gas prices slide, but the decline won't last, survey says

The average cost of a gallon of regular gasoline is $3.26, down 58 cents over the past 11 weeks, the Lundberg Survey found.Yesterday:

But that good news at the pump is unlikely to continue, says publisher Tribly Lundberg.

“Higher crude oil prices are translating into higher wholesale gasoline prices,” and retailers will need to pass them through, she says. Expect prices to jump 5 or 10 cents per gallon soon.

• Summary for Week Ending Dec 21st

• Schedule for Week of Dec 23rd

Here is a graph from Gasbuddy.com showing the roller coaster ride for gasoline prices. If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

DOT: Vehicle Miles Driven increased 0.3% in October

by Calculated Risk on 12/23/2012 01:39:00 PM

The Department of Transportation (DOT) reported Friday:

Travel on all roads and streets changed by +0.3% (0.9 billion vehicle miles) for October 2012 as compared with October 2011. Travel for the month is estimated to be 251.5 billion vehicle miles.Vehicle miles driven decreased in the Northeast (probably impacted by Hurricane Sandy) and increased in all other regions. The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by +0.6% (14.9 billion vehicle miles). The Cumulative estimate for the year is 2,464.5 billion vehicle miles of travel.

The rolling 12 month total is still moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 59 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in October compared to October 2011. In October 2012, gasoline averaged of $3.81 per gallon according to the EIA. Last year, prices in October averaged $3.51 per gallon.

Gasoline prices were up in October compared to October 2011. In October 2012, gasoline averaged of $3.81 per gallon according to the EIA. Last year, prices in October averaged $3.51 per gallon. However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it may be years before we see a new peak in miles driven.