by Calculated Risk on 11/23/2012 08:34:00 PM

Friday, November 23, 2012

Las Vegas: Visitor Traffic on pace for Record High, Convention Attendance Lags

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic has recovered and here is an update.

Through September visitor traffic is running just ahead of the 2007 pace (the previous peak) and it is possible Las Vegas will see 40 million visitors this year. However convention attendance is barely ahead of last year, and about 20% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2012 is estimated based on traffic through September.

The gamblers are back, but not the conventions ...

ATA Trucking Index declines sharply in October, Impacted by Hurricane Sandy

by Calculated Risk on 11/23/2012 04:09:00 PM

This is a minor indicator that I follow. Clearly truck tonnage was impacted by Hurricane Sandy in October, and we will probably see a bounce back in November and December.

From ATA: ATA Truck Tonnage Index Fell 3.8% in October

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 3.8% in October after falling 0.4% in September. (The 0.4% decrease in September was revised from a 0.1% gain ATA reported on October 23, 2012.) October’s drop was the third consecutive totaling 4.7%. As a result, the SA index equaled 113.7 (2000=100) in October, the lowest level since May 2011. Compared with October 2011, the SA index was off 2.1%, the first year-over-year decrease since November 2009. Year-to-date, compared with the same period last year, tonnage was up 2.9%.Note from ATA:

...

“Clearly Hurricane Sandy negatively impacted October’s tonnage reading,” ATA Chief Economist Bob Costello said. “However, it is impossible for us to determine the exact impact.”

Costello noted that a large drop in fuel shipments into the affected area likely put downward pressure on October’s tonnage level since fuel is heavy freight, in addition to reductions in other freight.

“I’d expect some positive impact on truck tonnage as the rebuilding starts in the areas impacted by Sandy, although that boost may only be modest in November and December,” he said. “Excluding the Hurricane impacts, I still think truck tonnage is decelerating along with factory output and consumer spending on tangible-goods.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

Even with the sharp decline in October, the index is at the pre-recession level. However, even before the hurricane, the index was mostly moving sideways this year due to the slowdown in manufacturing.

Q3 GDP: Here come the upward revisions

by Calculated Risk on 11/23/2012 11:55:00 AM

Next Thursday, the BEA will release the second estimate of Q3 GDP. The consensus is GDP will be revised up to 2.8% annualized growth, from the advance estimate of 2.0%. This would be a pretty sharp upward revision.

As an example, from Nomura analysts today:

"We believe real GDP growth will be revised significantly upward to an annualized pace of 3.0% versus the originally reported 2.0%, supported by greater inventory building and better net trade statistics than previously estimated."It is important to remember that the "advance" estimate is based on incomplete source data, or data subject to revisions. It appears the missing data (mostly for September) was better than expected, and that revisions have been favorable for GDP. I'll post some more Q3 estimates later.

LA area Port Traffic: Inbound Traffic up in October

by Calculated Risk on 11/23/2012 09:13:00 AM

I've been following port traffic for some time. Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for October. LA area ports handle about 40% of the nation's container port traffic. This data suggests trade with Asia will be fairly steady in October.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, both inbound and outbound traffic are up slightly compared to the 12 months ending in September.

In general, inbound and outbound traffic has been mostly moving sideways recently.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of October, loaded outbound traffic was up slightly compared to October 2011, and loaded inbound traffic was up 5% compared to October 2011.

For the month of October, loaded outbound traffic was up slightly compared to October 2011, and loaded inbound traffic was up 5% compared to October 2011.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday - so imports will probably decline in November.

Thursday, November 22, 2012

Irwin: "Five economic trends to be thankful for"

by Calculated Risk on 11/22/2012 07:30:00 PM

From Neil Irwin at the WaPo looked for a few positives: Five economic trends to be thankful for. Some excerpts a few comments:

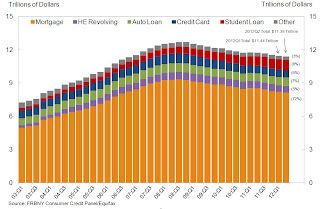

Household debt is way down. ... The good news is that in the past three years, Americans have made remarkable progress cleaning up their balance sheets and paying down those debts. After peaking at nearly 98 percent of economic output at the start of 2009, the household debt was down to 83 percent of GDP in the spring of 2012. ...CR Note: This level is still fairly high, but households have made progress. We will have more data next week when the NY Fed releases their Q3 Report on Household Debt and Credit.

Click on graph for larger image.

Click on graph for larger image.This graph is from the Q2 NY Fed Report on Household Debt and Credit and shows that aggregate consumer debt has been decreasing.

From the NY Fed: "Household indebtedness declined to $11.38 trillion [in Q2], a $53 billion decline from the first quarter of 2012. Outstanding household debt has decreased $1.3 trillion since its peak in Q3 2008."

Note: Irwin uses a different starting point, and also looks at household debt as percent of GDP (a good way to look at debt), and clearly household is debt is down significantly.

Irwin:

The cost of servicing that debt is way, way down. ... In late 2007, debt service payments added up to a whopping 14 percent of disposable personal income. Now it’s down to 10.7 percent, about the same as in the early 1990s. ..CR Note: Here is the data source: Household Debt Service and Financial Obligations Ratios.

Irwin:

Electricity and natural gas prices are falling. ... The retail price for consumers’ gas service piped into their homes is down 8.4 percent in the year ended in October. The lower wholesale price of natural gas is also pulling down electricity prices; they are off 1.2 percent over the past year. ...CR Note: I track the JOLTS data every month, and, as Irwin notes, layoffs and discharges are down.

Businesses aren’t firing people. ... While businesses aren’t adding new workers at a pace that would put the hordes of unemployed back on the job very rapidly, they also aren’t slashing jobs at a very rapid clip. Private employers laid off or discharged 1.62 million people in September, according to the Labor Department’s Job Openings and Labor Turnover data. ...

Irwin:

Housing is dramatically more affordable. ... In the spring of 2006, ... typical American home buyer would have faced a monthly mortgage payment of $1,247 a month ... home prices have fallen, so have mortgage rates ... Add it all up, and in the spring of 2012 that median American house would require a mortgage payment of only $889 a month ...CR Note: I'm not sure of all the numbers Irwin is using, but according to Case-Shiller, the Composite 20 house price index declined 31% from the peak (some areas more, some much less). Factor in low mortgage rates, and the payment would have fallen even further. There are definitely positive trends.

Happy Thanksgiving!

Zillow forecasts Case-Shiller House Price index to increase 3.0% Year-over-year for September

by Calculated Risk on 11/22/2012 11:58:00 AM

Note: The Case-Shiller report to be released next Tuesday is for September (really an average of prices in July, August and September).

Zillow Forecast: September Case-Shiller Composite-20 Expected to Show 3% Increase from One Year Ago

On Tuesday November 27th, the Case-Shiller Composite Home Price Indices for September will be released. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) will be up by 3 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will be up 2.3 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from August to September will be 0.4 percent for the 20-City Composite, as well as for the 10-City Composite Home Price Index (SA). All forecasts are ... are based on a model incorporating the previous data points of the Case-Shiller series, the September Zillow Home Value Index data and national foreclosure re-sales.Zillow's forecasts for Case-Shiller have been pretty close.

CR Note: It looks like house prices will be up about 5% this year based on the Case-Shiller indexes.

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

|---|---|---|---|---|---|

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Sept 2011 | 155.61 | 152.55 | 141.96 | 139.12 |

| Case-Shiller (last month) | Aug 2012 | 158.62 | 155.35 | 145.87 | 142.7 |

| Zillow Sept Forecast | YoY | 2.3% | 2.3% | 3.0% | 3.0% |

| MoM | 0.3% | 0.4% | 0.3% | 0.4% | |

| Zillow Forecasts1 | 159.1 | 156 | 146.3 | 143.3 | |

| Current Post Bubble Low | 146.5 | 149.38 | 134.08 | 136.65 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Feb-12 | |

| Above Post Bubble Low | 8.6% | 4.4% | 9.1% | 4.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Europe Summit Update

by Calculated Risk on 11/22/2012 09:24:00 AM

No announcements yet. There is much more being dicussed at the summit than just the Greek situation. Here are a few articles ...

From the WSJ: EU Leaders Prepare for Battle Royal at Summit

European Union leaders are headed to Brussels on Thursday for a big showdown over the bloc's spending budget, in a battle that pits richer against poorer member states, the East of the continent against the West, and the U.K. against almost everyone else.From the Financial Times: German Doubts Force Rethink on Greece

...

European Council President, Herman Van Rompuy, who will preside over the two-day meeting, has vowed repeatedly to keep heads of state in Brussels through the weekend to avert a collapse of the talks, arguing that a deal is needed urgently to ensure the EU and its institutions continue to function properly.

The Multiannual Financial Framework, as the 2014 to 2020 budget is known, sets out the headline figures allocated to different EU programs and activities, ranging from foreign policy to transport and infrastructure.

After almost 10 hours of intense talks on Tuesday night, eurozone finance ministers failed to agree on how fast to cut Greece’s debt pile. They called a further meeting next week to settle differences and release €44bn of long-overdue aid.From Reuters: EU's Rehn Sees Definitive Deal on Greek Aid on Monday

excerpt with permission

Greece has taken all the steps necessary to secure its next tranche of aid and euro zone finance ministers should be able to sign off definitively on the assistance on Monday, the European commissioner for economic affairs said on Wednesday.And from Reuters: Spain Kicks Off 2013 Funding With Strong Bond Sale

"I trust everyone will reconvene in Brussels on Monday with the necessary constructive spirit, and move beyond the detrimental mindset of red lines," Olli Rehn told the European Parliament.

Spain sold nearly 4 billion euros of bonds with ease at an auction on Thursday that kicked off its funding program for a daunting 2013 ...

Wednesday, November 21, 2012

Thursday: Happy Thanksgiving!

by Calculated Risk on 11/21/2012 08:22:00 PM

Happy Thanksgiving to all!

The US markets are closed on Thursday, however there might be some news from the European Union Summit Meeting. CR is always open.

Thanks again to Joe Weisenthal at Business Insider for his nice comments today, and to Paul Krugman for adding even more: All Hail Calculated Risk.

While I'm giving thanks - I'm forever thankful for having the privilege of knowing and sharing this blog with Doris "Tanta" Dungey, thanks to my friend Tom Lawler for all of our data discussions and for allowing me to excerpt from his newsletter, to surferdude808 for all his work on tracking problem banks, and to Ken Cooper for his help with the comments. I'm thankful for all the wonderful people I've met while blogging. And thanks to all the commenters too, and to all the readers!

And on topic, Jon Hilsenrath at the WSJ interviewed San Francisco Fed President John Williams today: Fed's Williams: Fed Not Near Limit on Bond Buying. A short excerpt:

WSJ: Would a reduction in the monthly flow of the Fed's purchases right now be counterproductive?What to do when Twist expires will be a key topic at the December FOMC meeting. It seems likely the $85 billion a month in purchases of mortgages and long-term Treasury securities will continue next year.

WILLIAMS: I would say that interest rates and financial conditions today in the market are based on the expectation that we will continue these policies into next year. That would include long-term Treasury purchases. A decision not to continue buying long-term Tereasurys when Twist expires I think that would be a surprise to markets and that would be counterproductive. In my view it would push long-term rates up and cause financial conditions to be a little less supportive of growth. That's my interpretation of market expectations today.

DOT: Vehicle Miles Driven decreased 1.5% in September

by Calculated Risk on 11/21/2012 04:52:00 PM

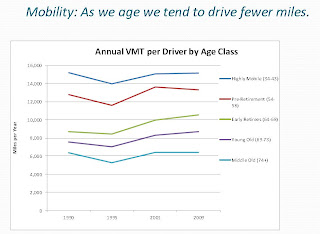

I first started tracking monthly vehicle miles to see the impact of the recession on driving. Since then we've seen the impact of demographics and changing preferences ... very interesting.

The Department of Transportation (DOT) reported today:

Travel on all roads and streets changed by -1.5% (-3.6 billion vehicle miles) for September 2012 as compared with September 2011. ◦Travel for the month is estimated to be 237.1 billion vehicle miles.The following graph shows the rolling 12 month total vehicle miles driven.

Cumulative Travel for 2012 changed by 0.6% (14.2 billion vehicle miles).

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 58 months - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.

Gasoline prices were up in September compared to September 2011. In September 2012, gasoline averaged of $3.91 per gallon according to the EIA. Last year, prices in September averaged $3.67 per gallon, so - just looking at gasoline prices - it is no surprise that miles driven decreased year-over-year in September.Just looking at gasoline prices suggest miles driven will be down again in October - especially with the very high prices in California. Nationally gasoline prices averaged $3.81 in October, up sharply from $3.51 a year ago.

However, as I've mentioned before, gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.

This graph from the Federal Highway Administration is based on the National Household Travel Survey shows the miles driven by certain age groups over time. The key is a large group is moving into the older age brackets, so their miles driven will decline - a large group is moving the from the "54 to 58" age group into the higher age groups.Also miles driven has been falling for lower age groups over the last few years, and the next survey will probably show that decline. Here is an article on younger drivers: Young People Are Driving Less—And Not Just Because They're Broke (ht KarmaPolice)

An April study by the U.S. Public Interest Research Group found that between 2001 and 2009 the average annual vehicle miles traveled by Americans ages 16 to 34 fell by close to a quarter, from 10,300 to 7,900 per capita (four times greater than the drop among all adults), and from 12,800 to 10,700 among those with jobs.With all these factors, it may be years before we see a new peak in miles driven.

...

The PIRG researchers concluded that this change couldn’t simply be pegged to the economy, but indicates a value shift.

Business Insider Interview

by Calculated Risk on 11/21/2012 02:07:00 PM

I spoke with Joe Weisenthal at Business Insider yesterday. He wrote a way too nice article and included some of our conversation: The Genius Who Invented Economics Blogging Reveals How He Got Everything Right And What's Coming Next

Genius? Hardly. I just paid attention and put 2 plus 2 together.

And I didn't get "everything right", but I did get most of the US macro trends correct over the last 8 years. I started blogging in January 2005, and most of my early posts were about housing, as an example: Housing: Speculation is the Key

And I definitely didn't invent economics blogging. Barry Ritholtz and others were ahead of me.

In the interview, I mentioned the "doomer" mentality. Many people now think of the '90s as a great decade for the economy - and it was. But there were doomsday predictions every year. As an example, in 1994 Larry Kudlow was arguing the Clinton tax increases would lead to a severe recession or even Depression. Wrong. By the end of the '90s, there were many people concerned about the stock bubble and I shared that concern, but there were doomers every year (mostly wrong).

In the Business Insider interview, I said: "I’m not a roaring bull, but looking forward, this is the best shape we’ve been in since ’97". Obviously the economy is still sluggish, and the unemployment rate is very high at 7.9%, but I was looking forward. I mentioned the downside risks from Europe and US policymakers (the fiscal slope), but I think the next few years could see a pickup in growth.

In the article I highlighted two of the reasons I expect a pickup in growth that I've mentioned before on the blog; a further increase in residential investment, and the end of the drag from state and local government cutbacks.

I also mentioned an excellent piece on autos from David Rosenberg back in early 2009. His piece made me think about auto sales - and I came to a different conclusion than Rosenberg, see: Vehicle Sales. I started expecting auto sales to bottom, and that led me to be more optimistic for the 2nd half of 2009.

I enjoyed talking with Joe - although he was way too nice - and, yes, that is a picture of me.