by Calculated Risk on 11/21/2012 08:30:00 AM

Wednesday, November 21, 2012

Weekly Initial Unemployment Claims decline to 410,000

The DOL reports:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 410,000, a decrease of 41,000 from the previous week's revised figure of 451,000. The 4-week moving average was 396,250, an increase of 9,500 from the previous week's revised average of 386,750.The previous week was revised up from 439,000.

[New York] +43,956 Increase in initial claims due to Hurricane Sandy. These separations were primarily in the construction, food service, and transportation industries.

[New Jersey] +31,094 Increase in initial claims due to Hurricane Sandy. These separation were primarily in the accommodation and food services, manufacturing, transportation and warehousing, administrative service, healthcare and social assistance,construction, retail, professional, trade, educational service, and public administration industries.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/21/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.54 percent from 3.52 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 7 of the last 9 weeks and is now near the high for the year - but this index still isn't showing an increase like other housing reports.

Zillow: House Prices increased 4.7% Year-over-year in October

by Calculated Risk on 11/21/2012 12:22:00 AM

From Zillow: October Marks 12th Consecutive Month of National Home Value Increases

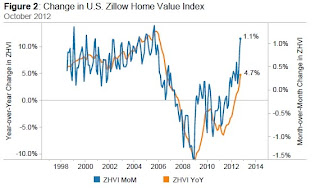

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400. This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006 ...

In October, 276 (75%) of the 366 markets showed monthly home value appreciation, and 228 (62%) of the 366 markets saw annual home value appreciation. Among the top 30 metros, 29 experienced monthly home value appreciation and 26 saw annual increases.

Click on graph for larger image.

Click on graph for larger image. The graph from Zillow shows both the year-over-year and month-over-month change for the Zillow HPI.

This is a very strong month-over-month increase, and the largest year-over-year increase since 2006.

Tuesday, November 20, 2012

Wednesday: Unemployment claims, Consumer sentiment

by Calculated Risk on 11/20/2012 09:04:00 PM

There is an EU summit meeting on Thursday, so there might be some news over the holiday.

From Reuters: Euro zone mulls Greek debt buy-back up to 40 billion euros

Euro zone finance ministers are considering allowing Athens to buy back up to 40 billion euros of its own bonds at a discount as one of a number of measures to cut Greek debt to 120 percent of GDP within the next eight years.Wednesday:

...

Under a proposal discussed by ministers, Greece would offer private-sector bondholders around 30 cents for every euro of Greek debt they hold ... The ministers, who failed to reach agreement last week, have also discussed granting Greece a 10-year moratorium on paying interest on about 130 billion euros of loans from the euro zone's emergency fund ...There is also the possibility of reducing the interest rate on loans made by euro zone countries directly to Greece in 2010, from 1.5 percent to just 0.25 percent ...

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 415 thousand from 439 thousand. Note: Claims increased sharply last week due to Hurricane Sandy.

• At 9:00 AM, The Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for November. The consensus is for a decline to 51.0 in November, from 51.5 in October.

• At 9:55 AM, the finale Reuters/University of Michigan's Consumer sentiment index for November will be released). The consensus is for a decline to 84.0 from the preliminary reading of 84.9. Goldman Sachs is forecasting a decline in confidence to 81.0, and Merrill Lynch is forecasting a decline to 83.

• At 10:00 AM, the Conference Board Leading Indicators for October. The consensus is for a 0.2% decrease in this index.

• During the day: The AIA's Architecture Billings Index for October will be released (a leading indicator for commercial real estate).

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• Quarterly Housing Starts by Intent compared to New Home Sales

• All Housing Investment and Construction Graphs

WaPo: Price-to-rent ratio for Certain Cities

by Calculated Risk on 11/20/2012 05:46:00 PM

Neil Irwin at the WaPo looks at the price-to-rent ratio for several cities using Case-Shiller prices and Owner's equivalent rent (OER) from the BLS. This is the same approach I use with the national data very month.

From Neil Irwin at the WaPo: Why Atlanta, New York, and Chicago are poised to drive a housing recovery

A good way to look at which housing markets are potentially overvalued and which are undervalued—and where the market seems to be begging for new home construction and where there is still a surplus of unneeded houses—is to look at the relationship between rents and home prices. Over long periods of time, the price to rent a given house should rise at about the same rate as the price to buy one.Irwin only looked at Case-Shiller cities with monthly OER data. However the BLS has semi-annual OER data for several more Case-Shiller cities.

But over shorter periods of time, the two can diverge. And when they do, it is usually a sign that something curious is up in that market. For example, from 2000 to 2005, prices in the Miami metro area rose by 136 percentage points more than did rents, a sure sign that it was one of the nation’s most bubbly housing markets.

...

The best news out of this analysis, though, may be this: Most of the largest U.S. cities have housing markets that have been in pretty good balance over the last year, with prices rising at about the same rate as rents. That’s true of the Washington metro area ( where prices are up 4.3 percent, rents up 2.4 percent), and also of San Francisco, Los Angeles, Boston, Dallas, Seattle, and Cleveland.

And that may be the best sign for the housing market of all. After all these years of bubbles and busts, ups and downs, there finally is a measure of stability.

Click on graph for larger image.

Click on graph for larger image.This graph shows the price-to-rent ratio of Case-Shiller and OER for Denver, Portland and San Diego (cities Irwin didn't include).

The BLS only provides first and second half OER data for these cities, so I averaged six months of the Case-Shiller indexes to calculate the price-to-rent ratio. I set the ratio to 1.0 for the period 1997 through 2000.

It appears San Diego is back to normal, and prices in Denver and Portland might be a little high by this measure.