by Calculated Risk on 7/03/2012 08:42:00 AM

Tuesday, July 03, 2012

Reis: Office Vacancy Rate unchanged in Q2 at 17.2%

Reis reports that the office vacancy rate was unchanged in Q2 at 17.2%. Comments from Reis Senior Economist Ryan Severino:

The office sector absorbed 4.138 million SF during the second quarter, the sixth consecutive quarterly gain in occupied stock since the beginning of 2011. However, national vacancies ceased falling. This is reflective of the ongoing weakness in the labor market recovery.

...

National asking and effective rent both grew by 0.3% during the second quarter, but this represents a slowdown from the 0.5% and 0.6% growth rates that asking and effective rents respectively achieved during the first quarter. Annual gains of 1.6 and 2.0 percent, respectively, are virtually unchanged from last quarter, and remain feeble.

...

Supply growth in the office sector remains muted. During the second quarter of 2012 only 1.606 million square feet of office space were completed, the equivalent of one large office building. This represents the lowest quarterly level on record since Reis began tracking quarterly market data in 1999. Nonetheless, demand for space during the quarter was so weak that even with such little supply being delivered, the level of absorption that we observed during the quarter was insufficient to generate a vacancy rate decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis is reporting the vacancy rate was unchanged at 17.2% in Q2, and down from 17.5% in Q2 2011. The vacancy rate peaked in this cycle at 17.6% in Q3 and Q4 2010.

As Reis noted, there are very few new office buildings being built in the US, and new construction will probably stay low for several years.

Monday, July 02, 2012

Tuesday: Auto Sales, Factory Orders

by Calculated Risk on 7/02/2012 08:38:00 PM

Special Note: Stephen Campbell, frequent commenter under the name Nova, and author of "American Apocalypse" has passed away. Very sad news. Nova wrote parts of American Apocalypse several years ago in the comments of CR, and many of us followed along. He will be greatly missed.

The key report on Tuesday will be auto sales. Remember sales were depressed last year because of the tsunami in Japan, and the automakers report a comparison to the same month in the previous year. Some automakers were hit harder than others, so what will matter is the Seasonally Adjusted Annual Rate (SAAR).

• All day: Light vehicle sales for June. Light vehicle sales are expected to increase to 13.9 million SAAR from 13.8 million in May.

• At 10:00 AM ET, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for May will be released. The consensus is for a 0.1% increase in orders.

• Also at 10:00 AM, the Trulia Price & Rent Monitors for June will be released. This is the new index from Trulia that uses asking prices adjusted both for the mix of homes listed for sale and for seasonal factors.

• Early: Reis is expected to released their Q2 Office Vacancy report.

The Asian markets are mostly green tonight. The Nikkei is up 0.4%, and the Shanghai Composite is up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 and Dow futures are down slightly.

Oil: WTI futures are down to $83.43 (this is down from $109.77 in February, but up last week) and Brent is at $97.21 per barrel. According to a formula from Professor Hamilton, the price of Brent would suggest gasoline at $3.27 per gallon (the current national average price is $3.35, so even with the increase in Brent, gasoline prices will probably fall further).

Note: SIFMA recommends US markets close at 2:00 PM ET in advance of the Independence Day Holiday on July 4th.

CoreLogic: House Price Index increases in May, Up 2.0% Year-over-year

by Calculated Risk on 7/02/2012 03:08:00 PM

Notes: This CoreLogic House Price Index report is for May. The Case-Shiller index released last week was for April. Case-Shiller is currently the most followed house price index, however CoreLogic is used by the Federal Reserve and is followed by many analysts. The CoreLogic HPI is a three month weighted average and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® May Home Price Index Shows Third Consecutive Monthly Increase

Home prices nationwide, including distressed sales, increased on a year-over-year basis by 2.0 percent in May 2012 compared to May 2011. On a month-over-month basis, home prices, including distressed sales, also increased by 1.8 percent in May 2012 compared to April 2012. The May 2012 figures mark the third consecutive increase in home prices nationwide on both a year-over-year and month-over-month basis.

Excluding distressed sales, home prices nationwide increased on a year-over-year basis by 2.7 percent in May 2012 compared to May 2011. On a month-over-month basis excluding distressed sales, the CoreLogic HPI indicates home prices increased 2.3 percent in May 2012 compared to April 2012, the fourth month-over-month increase in a row. Distressed sales include short sales and real estate owned (REO) transactions.

The CoreLogic Pending HPI indicates that house prices, including distressed sales, will rise by at least another 1.4 percent from May 2012 to June 2012. Excluding distressed sales, house prices are also poised to rise by 2.0 percent during that same time period.

“The recent upward trend in U.S. home prices is an encouraging signal that we may be seeing a bottoming of the housing down cycle,” said Anand Nallathambi, president and chief executive officer of CoreLogic. “Tighter inventory is contributing to broad, but modest, price gains nationwide and more significant gains in the harder-hit markets, like Phoenix.”

Click on graph for larger image.

Click on graph for larger image. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index was up 1.8% in May, and is up 2.0% over the last year.

The index is off 30% from the peak - and is up 5% from the post-bubble low set in February (the index is NSA, so some of the increase is seasonal).

The second graph is from CoreLogic. The year-over-year comparison has turned positive.

The second graph is from CoreLogic. The year-over-year comparison has turned positive.This is the third consecutive month with a year-over-year increase, and excluding the tax credit bump, these are the first year-over-year increases since 2006.

Construction Spending in May: Private spending increases, Public Spending declines

by Calculated Risk on 7/02/2012 11:30:00 AM

Catching up ... This morning the Census Bureau reported that overall construction spending increased in May:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during May 2012 was estimated at a seasonally adjusted annual rate of $830.0 billion, 0.9 percent above the revised April estimate of $822.5 billion. The May figure is 7.0 percent above the May 2011 estimate of $775.8 billion.Private construction spending increased while public spending decreased:

Spending on private construction was at a seasonally adjusted annual rate of $560.4 billion, 1.6 percent above the revised April estimate of $551.8 billion. ... In May, the estimated seasonally adjusted annual rate of public construction spending was $269.6 billion, 0.4 percent below the revised April estimate of $270.7 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 61% below the peak in early 2006, and up 17% from the recent low. Non-residential spending is 28% below the peak in January 2008, and up about 30% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and at a new post-bubble low.

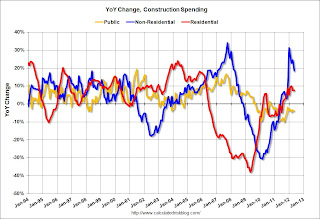

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending are positive, but public spending is down on a year-over-year basis. The year-over-year improvements in private non-residential is mostly related to energy spending (power and electric).

The year-over-year improvement in private residential investment is an important change (the positive in 2010 was related to the tax credit). Construction is now the "bright spot" for the economy, however the improvement in residential construction is being somewhat offset by declines in public construction spending.

ISM Manufacturing index declines in June to 49.7

by Calculated Risk on 7/02/2012 10:00:00 AM

This is the first contraction in the ISM index since the recession ended in 2009. PMI was at 49.7% in June, down from 53.5% in May. The employment index was at 56.6%, down from 56.9%, and new orders index was at 47.8%, down from 60.1%.

From the Institute for Supply Management: June 2012 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector contracted in June for the first time since July 2009; however, the overall economy grew for the 37th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 49.7 percent, a decrease of 3.8 percentage points from May's reading of 53.5 percent, indicating contraction in the manufacturing sector for the first time since July 2009, when the PMI registered 49.2 percent. The New Orders Index dropped 12.3 percentage points in June, registering 47.8 percent and indicating contraction in new orders for the first time since April 2009, when the New Orders Index registered 46.8 percent. The Production Index registered 51 percent, and the Employment Index registered 56.6 percent. The Prices Index for raw materials decreased significantly for the second consecutive month, registering 37 percent, which is 10.5 percentage points lower than the 47.5 percent reported in May. Comments from the panel range from continued optimism to concern that demand may be softening due to uncertainties in the economies in Europe and China."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was below expectations of 52.0%. This suggests manufacturing contracted in June for the first time since July 2009.

This was a weak report, and the decline in new orders was especially significant.

Eurozone Recession: Record Unemployment, Manufacturing Shrinks

by Calculated Risk on 7/02/2012 09:04:00 AM

From Eurostat: Euro area unemployment rate at 11.1%

The euro area (EA17) seasonally-adjusted unemployment rate was 11.1% in May 2012, compared with 11.0% in April. It was 10.0% in May 2011. The EU27 unemployment rate was 10.3% in May 2012, compared with 10.2% in April4. It was 9.5% in May 2011.From the WSJ: Euro-Zone Data Show No Sign of Improvement

Eurostat estimates that 24.868 million men and women in the EU27, of whom 17.561 million were in the euro area, were unemployed in May 2012.

Activity at euro-zone factories continued to fall sharply in June, while the currency area's unemployment rate rose to a record high in May ...It is no surprise that Germany's export economy is starting to feel the impact of the eurozone recession. The "good" news is Spanish 10-year bond yields are down to 6.27%, and Italian yields are down to 5.71%.

In a particularly worrying sign for the currency bloc's economy, German manufacturing activity fell at its fastest rate in three years—the latest evidence that Europe's biggest national economy is braking ... The final reading of the manufacturing purchasing managers' index was 45.1 in June [below 50 is contraction]

And the ECB is expected to cut rates on Thursday.

Sunday, July 01, 2012

Monday: ISM Manufacturing, Construction Spending

by Calculated Risk on 7/01/2012 09:57:00 PM

The key report Monday will be the ISM Manufacturing survey. Most of the regional surveys were weak in June, and the ISM index will probably decline too.

• At 10:00 AM ET, the ISM Manufacturing Index for June will be released. The consensus is for a decrease to 52.0 from 53.5 in May.

• Also at 10:00 AM, Construction Spending for May will be released. The consensus is for a 0.2% increase in construction spending.

The Asian markets are green tonight. The Nikkei is up 0.3%, and the Shanghai Composite is up slightly.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P 500 futures are down about 2, and Dow futures are down 23.

Oil: WTI futures are up to $84.37 (this is down from $109.77 in February, but up last week) and Brent is at $97.27 per barrel. According to a formula from Professor Hamilton, the price of Brent would suggest gasoline at $3.27 per gallon (the current national average price is $3.35, so even with the increase in Brent, gasoline prices will probably fall further).

Yesterday:

• Summary for Week Ending June 29th

• Schedule for Week of July 1st

For the monthly economic question contest (questions for July):

Housing: Investor Buying in Oakland

by Calculated Risk on 7/01/2012 05:16:00 PM

A report on investor buying in Oakland: Who Owns Your Neighborhood? The Role of Investors in Post-Foreclosure Oakland (ht picosec, Tom)

From the San Francisco Chronicle: Investors buying, renting many Oakland foreclosures

According to the Urban Strategies Council's report, real estate investors have purchased - usually with cash - 42 percent of the 10,508 homes in Oakland that went into foreclosure between January 2007 and October 2011.The report focuses on the impact of non-local ownership on Oakland neighborhoods. However, another impact of cash-flow investor buying, is that these properties will probably not be sold any time soon - and this keeps the level of inventory down in these communities. This is one of the reasons that inventory has declined sharply.

Many of these investors are turning the homes into rental properties ...

"They are massive landlords in neighborhoods that historically have had high rates of homeownership, and very few people are aware of the investor activity that's taking place under their feet," said Steve King, the organization's housing and economic development coordinator.

...

In its report, the Urban Strategies Council, which focuses on development issues in low-income urban areas, argues that banks and government-controlled financial institutions Fannie Mae and Freddie Mac could be doing more to help families buy foreclosed homes.

Among its recommendations: Expand programs that give owner-occupiers and nonprofits a "first look" at foreclosed homes before they go up for auction.

Yesterday:

• Summary for Week Ending June 29th

• Schedule for Week of July 1st

Update: Recovery Measures

by Calculated Risk on 7/01/2012 11:57:00 AM

By request, here is an update to four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that several major indicators are still significantly below the pre-recession peaks.

Click on graph for larger image.

Click on graph for larger image.

This graph is for real GDP through Q1 2012. Real GDP returned to the pre-recession peak in Q3 2011, and has been at new post-recession highs for three consecutive quarters.

At the worst point - in Q2 2009 - real GDP was off 5.1% from the 2007 peak.

Real GDP has performed better than other indicators ...

Real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak through the May report released Friday.

This measure was off 10.7% at the trough in October 2009.

Real personal income less transfer payments is still 3.7% below the previous peak.

The third graph is for industrial production through May.

The third graph is for industrial production through May.

Industrial production was off over 17% at the trough in June 2009, and has been one of the stronger performing sectors during the recovery.

However industrial production is still 3.4% below the pre-recession peak.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

Payroll employment is still 3.6% below the pre-recession peak.

All of these indicators collapsed in 2008 and early 2009, and only real GDP is back to the pre-recession peak. At the current pace of improvement, industrial production will be back to the pre-recession peak in early 2013, personal income less transfer payments in 2014, and employment in 2015.

June Contest Winners: A Tie!

by Calculated Risk on 7/01/2012 10:00:00 AM

For the economic question contest in June, the leaders were (Congratulations all!):

First Place tie:

Jeremy Strouse

Bryant Dodson

Alexander Petrov

4th Place tie:

Walt Tucker

Bill Dawers

Bill Jefferies

Yesterday:

• Summary for Week Ending June 29th

• Schedule for Week of July 1st

And the first two questions for July: