by Calculated Risk on 4/25/2012 02:00:00 PM

Wednesday, April 25, 2012

FOMC Forecasts and Bernanke Press Conference

Here are the updated projections from the April meeting.

Fed Chairman Ben Bernanke's press conference starts at 2:15 PM ET. Here is the video stream.

Below are the update projections starting with when participants project the initial increase in the target federal funds rate should occur, and the participants view of the appropriate path of the federal funds rate. I've included the chart from the January meeting to show the change.

Click on graph for larger image.

"The shaded bars represent the number of FOMC participants who project that the initial increase in the target federal funds rate (from its current range of 0 to ¼ percent) would appropriately occur in the specified calendar year."

There was a slight shift to 2014.

Probably two participants moved from 2015 to 2014, and both participants who viewed 2016 as appropriate have moved to 2015.

A key is the same number of participants think the FOMC should raise rates before 2014.

Most participants still think the Fed Funds rate will be in the current range into 2014.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2012 | 2013 | 2014 |

| April 2012 Projections | 2.4 to 2.9 | 2.7 to 3.1 | 3.1 to 3.6 |

| January 2012 Projections | 2.2 to 2.7 | 2.8 to 3.2 | 3.3 to 4.0 |

| November 2011 Projections | 2.5 to 2.9 | 3.0 to 3.5 | 3.0 to 3.9 |

GDP projections have been revised up slightly for 2012, and revised down for 2013 and 2014.

The unemployment rate declined to 8.2% in March, and the projection for 2012 has been revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2012 | 2013 | 2014 |

| April 2012 Projections | 7.8 to 8.0 | 7.3 to 7.7 | 6.7 to 7.4 |

| January 2012 Projections | 8.2 to 8.5 | 7.4 to 8.1 | 6.7 to 7.6 |

| November 2011 Projections | 8.5 to 8.7 | 7.8 to 8.2 | 6.8 to 7.7 |

The forecasts for overall and core inflation were revised up to reflect the recent increase in inflation.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2012 | 2013 | 2014 |

| April 2012 Projections | 1.9 to 2.0 | 1.6 to 2.0 | 1.7 to 2.0 |

| January 2012 Projections | 1.4 to 1.8 | 1.4 to 2.0 | 1.6 to 2.0 |

| November 2011 Projections | 1.4 to 2.0 | 1.5 to 2.0 | 1.5 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2012 | 2013 | 2014 |

| April 2012 Projections | 1.8 to 2.0 | 1.7 to 2.0 | 1.8 to 2.0 |

| January 2012 Projections | 1.5 to 1.8 | 1.5 to 2.0 | 1.6 to 2.0 |

| November 2011 Projections | 1.5 to 2.0 | 1.4 to 1.9 | 1.5 to 2.0 |

FOMC Statement: Economy "expanding moderately"

by Calculated Risk on 4/25/2012 12:32:00 PM

Information received since the Federal Open Market Committee met in March suggests that the economy has been expanding moderately. Labor market conditions have improved in recent months; the unemployment rate has declined but remains elevated. Household spending and business fixed investment have continued to advance. Despite some signs of improvement, the housing sector remains depressed. Inflation has picked up somewhat, mainly reflecting higher prices of crude oil and gasoline. However, longer-term inflation expectations have remained stable.Here is the previous FOMC Statement for comparison.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects economic growth to remain moderate over coming quarters and then to pick up gradually. Consequently, the Committee anticipates that the unemployment rate will decline gradually toward levels that it judges to be consistent with its dual mandate. Strains in global financial markets continue to pose significant downside risks to the economic outlook. The increase in oil and gasoline prices earlier this year is expected to affect inflation only temporarily, and the Committee anticipates that subsequently inflation will run at or below the rate that it judges most consistent with its dual mandate.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee expects to maintain a highly accommodative stance for monetary policy. In particular, the Committee decided today to keep the target range for the federal funds rate at 0 to 1/4 percent and currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014.

The Committee also decided to continue its program to extend the average maturity of its holdings of securities as announced in September. The Committee is maintaining its existing policies of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. The Committee will regularly review the size and composition of its securities holdings and is prepared to adjust those holdings as appropriate to promote a stronger economic recovery in a context of price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Dennis P. Lockhart; Sandra Pianalto; Sarah Bloom Raskin; Daniel K. Tarullo; John C. Williams; and Janet L. Yellen. Voting against the action was Jeffrey M. Lacker, who does not anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate through late 2014.

The Bottom for House Prices

by Calculated Risk on 4/25/2012 11:37:00 AM

First a comment: Back in February, I argued that The Housing Bottom is Here. My previous house price call was back in December 2010, and at that time I thought we'd see another 5% to 10% decline on the repeat sales indexes. Corelogic is down 7.3% since October 2010, and the Case-Shiller composites indexes (NSA) are down about 7.6% (both will probably fall further with the March report). About what I expected.

Here are some more bottom calls (or close to bottom calls). Most of the following analysts and economists haven't called a bottom before - so this isn't the usual annual "Rite of Spring" bottom calls, but we have to be careful about an echo chamber since we all look at the similar data. Also these are just forecasts ...

From John Gittelsohn and Prashant Gopal at Bloomberg: Housing Declared Bottoming in U.S.

Economists including Bank of Tokyo-Mitsubishi UFJ's Chris Rupkey, Bank of America Corp.'s Michelle Meyer and Mark Fleming of CoreLogic Inc. are also predicting prices are close to a trough after a 35 percent slump from a July 2006 peak, even as the threat of more foreclosures loom to boost supply.The article also has some more bearish comments including some from Robert Shiller.

...

Meyer, senior economist with Bank of America in New York, said the recovery will be led by the parts of the country with fewer foreclosures and more job growth. She estimates that U.S. prices will reach bottom this year and stay little changed until 2014, when they may gain about 2.5 percent.

...

"It's just a matter of months before we get positive year- over-year numbers in the overall index," Fleming said in a telephone interview from Washington. "Our data lags the reality. The turnaround is happening in the March, April and May time frame."

From Zillow: U.S. Home Values Post Largest Monthly Gain Since 2006; Majority of Markets Covered by Zillow Home Value Forecast To Hit Bottom by Late 2012

Home values in the United States increased, rising 0.5 percent from February to March, according to Zillow's first quarter Real Estate Market Reports. This marks the largest monthly increase in the Zillow Home Value Index (ZHVI) since May 2006, when home values also rose 0.5 percent.And NDD at the Bonddad Blog has a summary of recent data: Housing overview part 2: prices

Nationally, the Zillow Home Value Forecast shows that home values will fall 0.4 percent over the next 12 months, with many months showing no change or slight appreciation late this year, suggesting that U.S. home values could reach a bottom in late 2012.

"For people who have been waiting to time their home purchase close to market bottom, it's time to start shopping," said Zillow Chief Economist Dr. Stan Humphries. "When the bottom will hit will vary by market, and it's nearly impossible to time a purchase exactly right."

And finally, a well known private forecasting group (that I can't name) put a research note this morning, based on their own surveys, saying that house prices have probably found a bottom.

ATA Trucking index Increased 0.2% in March

by Calculated Risk on 4/25/2012 09:33:00 AM

From ATA: ATA Truck Tonnage Index Up 0.2% in March

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index rose 0.2% in March after increasing 0.5% in February. (February’s rise was unchanged from the preliminary gain we reported on March 27th.) The SA index stood at 119.5 (2000=100), up from 119.3 in February. Compared with March 2011, the SA index was up 2.7%, which was the smallest year-over-year increase since December 2009.

...

“March tonnage, and the first quarter overall, was reflective of an economy that is growing, but growing moderately,” ATA Chief Economist Bob Costello said. “The pace of freight definitely slowed from the torrid pace in late 2011.”

“Most economic indicators still look good, which will continue to support tonnage going forward,” he said. Costello also noted that the industry should not expect the rate of growth seen over the last couple of years, when tonnage grew 5.8% in both 2010 and 2011. “Expect tonnage overall this year to be up at a more moderate rate, perhaps less than 3%, which is more in-line with normal growth.”

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index. The index is above the pre-recession level and up 2.7% year-over-year. More sluggish growth.

From ATA:

Trucking serves as a barometer of the U.S. economy, representing 67.2% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9 billion tons of freight in 2010. Motor carriers collected $563.4 billion, or 81.2% of total revenue earned by all transport modes.

MBA: Mortgage Purchase activity increased slightly, Refinance activity declined, Record Low Mortgage Rates

by Calculated Risk on 4/25/2012 08:39:00 AM

Form the MBA: Mortgage Applications Decrease Despite Survey Low Rates in Latest MBA Weekly Survey

The Refinance Index decreased 5.6 percent from the previous week, with the Conventional Refinance Index decreasing by 6.1 percent and the Government Refinance Index decreasing by 2.1 percent. The seasonally adjusted Purchase Index increased 2.7 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 73.4 percent of total applications from 75.2 percent the previous week.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.04 percent from 4.05 percent,with points decreasing to 0.40 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This is the lowest 30-year fixed interest rate recorded in the history of the survey.

...

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.32 percent from 3.33 percent, while points remained unchanged at 0.41 (including the origination fee) for 80 percent LTV loans. This is the lowest 15-year fixed interest rate recorded in the history of the survey.

Tuesday, April 24, 2012

Misc: California 99ers Lose 20 Weeks, Richmond Fed index increases, FHFA House Prices increase year-over-year

by Calculated Risk on 4/24/2012 11:06:00 PM

A few miscellaneous articles ...

• From Kathleen Pender at the San Francisco Chronicle: California Fed-Ed jobless benefits to end mid-May

Starting in mid-May, no one in California can begin or continue receiving this final round of federal benefits, known as Fed-Ed in California and Extended Benefits elsewhere.Update: California has one of the highest state unemployment rates at 11%, so it seemed a little weird that California workers would lose the Fed-Ed benefits. However, aocording to the Record Searchlight (ht josap), the Fed-Ed program requires that the unemployment rate be "10% higher than it was during the same three-month period during one of the last three years".

About 90,000 Californians are receiving Fed-Ed. Their benefits will end abruptly in mid-May, even if they still have weeks remaining in their Fed-Ed claim.

The program's end will reduce the maximum weeks of unemployment to 79 from 99 for most people in California, although a small segment can get up to 89.

• Earlier today from the Richmond Fed: Manufacturing Activity Picks Up the Pace in April; Expectations Remain Upbeat

In April, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — advanced seven points to 14 from March's reading of 7. ... The manufacturing employment index moved up four points to end at 10, and the average workweek indicator edged up one point to 3. The wage index added three points to 14.This was slightly above expectations of a reading of 8.

• From the FHFA: FHFA House Price Index Up 0.3 Percent in February

U.S. house prices rose 0.3 percent on a seasonally adjusted basis from January to February, according to the Federal Housing Finance Agency’s monthly House Price Index. ... For the 12 months ending in February, U.S. prices rose 0.4 percent, the first 12-month increase since the July 2006 - July 2007 interval.The FHFA monthly index is for Fannie and Freddie loans only. Fannie and Freddie have significantly lower default rates than the overall market, and that probably has helped stabilize this index.

On March New Home Sales:

• New Home Sales in March at 328,000 Annual Rate

• Comments on Housing and "Distressing Gap" Graph • New Home Sales graphs

On House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in February NSA

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

• House Price graphs

Philly Fed State Coincident Indexes increased in March

by Calculated Risk on 4/24/2012 08:02:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2012. In the past month, the indexes increased in 48 states, decreased in one state (Rhode Island), and remained stable in one state (South Dakota), for a one-month diffusion index of 94. Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In March, 49 states had increasing activity, up from 47 in February. The number of states with increasing activity has been at or above 47 for the last seven consecutive months.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession. Now the map is all green. The recovery may be sluggish, but it is widespread geographically.

On March New Home Sales:

• New Home Sales in March at 328,000 Annual Rate

• Comments on Housing and "Distressing Gap" Graph • New Home Sales graphs

On House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in February NSA

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

• House Price graphs

LPS: Percent of delinquent mortgage loans declined in March

by Calculated Risk on 4/24/2012 04:15:00 PM

LPS released their First Look report for March today. LPS reported that the percent of loans delinquent declined in March from February. However the percent of loans in the foreclosure process remained at a very high level.

LPS reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) declined to 7.09% from 7.57% in February. This is the lowest delinquency rate since August 2008; however the percent of delinquent loans is still significantly above the normal rate of around 4.5% to 5%. The percent of delinquent loans peaked at 10.97%, so delinquencies have fallen over half way back to normal. Note: There is a seasonal pattern for delinquencies, and it is not unusual to see a decline in March.

The following table shows the LPS numbers for March 2012, and also for last month (Feb 2012) and one year ago (Mar 2011).

| LPS: Loans Delinquent and in Foreclosure | |||

|---|---|---|---|

| Mar-12 | Feb-12 | Mar-11 | |

| Delinquent | 7.09% | 7.57% | 7.78% |

| In Foreclosure | 4.14% | 4.13% | 4.21% |

| Loans Less than 90 days | 1,888,000 | 2,059,000 | 2,122,000 |

| Loans More than 90 days | 1,643,000 | 1,722,000 | 1,989,000 |

| Loans In foreclosure | 2,060,000 | 2,065,000 | 2,222,000 |

| Total | 5,591,000 | 5,846,000 | 6,333,000 |

The number of delinquent loans is down about 14% year-over-year (580,000 fewer mortgages deliquent), but the number of loans in the foreclosure process has only declined slightly year-over-year. This remains far above the "normal" level of around 0.5%.

On March New Home Sales:

• New Home Sales in March at 328,000 Annual Rate

• Comments on Housing and "Distressing Gap" Graph • New Home Sales graphs

On House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in February NSA

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

• House Price graphs

Comments on Housing and "Distressing Gap" Graph

by Calculated Risk on 4/24/2012 02:49:00 PM

The solid new home sales report this morning is further confirmation that the recovery for the housing industry has started. New home sales are up about 17% from the weakest three month period during the housing bust. That is a significant improvement, even if the absolute levels are still very low.

The debate is now about the strength of the recovery, not whether there is a recovery. My view is housing will remain sluggish for some time, and I expect 2012 to be another historically weak year, but better than 2011.

For house prices, the Case-Shiller index has a serious lag, and the key right now is to see if the year-over-year change is declining (it is). Note: The current Case-Shiller report was an average of December, January and February closing prices, and some of those sales were probably negotiated last October, about six months ago!

More current, but less reliable, pricing data (such as asking prices, new home prices and some anecdotal comments) suggest that house prices have stopped falling in most areas, and I expect the year-over-year change in the Case-Shiller index to turn slightly positive in the not too distant future (it is difficult to predict when, although I'll try in a couple of months). Of course the number of REO sales (lender Real Estate Owned) are down, and some of the improvement is related to fewer foreclosures and other distressed sales.

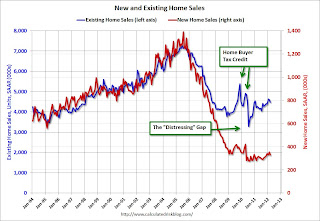

Here is an update to the "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through March. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Click on graph for larger image.

Click on graph for larger image.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders haven't been able to compete with the low prices of all the foreclosed properties.

I expect this gap to eventually close, but it will probably take a number of years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

On March New Home Sales:

• New Home Sales in March at 328,000 Annual Rate

• New Home Sales graphs

On House Prices:

• Case Shiller: House Prices fall to new post-bubble lows in February NSA

• Real House Prices and Price-to-Rent Ratio at late '90s Levels

• House Price graphs

Real House Prices and Price-to-Rent Ratio at late '90s Levels

by Calculated Risk on 4/24/2012 11:51:00 AM

Another Update: Case-Shiller, CoreLogic and others report nominal house prices. It is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio.

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1998 and early 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.

The first graph shows the quarterly Case-Shiller National Index SA (through Q4 2011), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through February) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is back to January 2003 levels, and the CoreLogic index (NSA) is back to January 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1998 levels, the Composite 20 index is back to January 2000, and the CoreLogic index back to May 1999.

In real terms, all appreciation in the '00s is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to October 1998 levels, the Composite 20 index is back to February 2000 levels, and the CoreLogic index is back to June 1999.

In real terms - and as a price-to-rent ratio - prices are mostly back to late 1990s or early 2000 levels.

Earlier:

• Case Shiller: House Prices fall to new post-bubble lows in February NSA

• New Home Sales in March at 328,000 Annual Rate