by Calculated Risk on 12/23/2011 07:25:00 PM

Friday, December 23, 2011

Unofficial Problem Bank list declines to 973 institutions

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Dec 23, 2011. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

We were only half right on anticipations this week as we accurately anticipated no closings but inaccurately anticipated the FDIC would release its formal enforcement activities for November 2011. Thus, it was a quiet week with only one removal leaving the Unofficial Problem Bank List at 973 institutions with assets of $397.6 billion. A year ago, the list held 919 institutions with assets of $407.9 billion. The removal was CapitalBank, Greenwood, SC ($629 million), which merged on an unassisted basis with Park Sterling Bank, Charlotte, NC.Earlier on November Home Sales:

• New Home Sales increase in November to 315,000 SAAR

• Home Sales: Distressing Gap

• New Home Sales graphs

Mortgage Settlement Update: Some details, Deal to be announced in January "at the earliest"

by Calculated Risk on 12/23/2011 03:47:00 PM

There are a quite a few details in this article by Massimo Calabresi at TIME: Details of Mortgage Servicing Settlement Between Banks and AGs Begin to Emerge

... the banks will commit to three categories of the settlement: $5 billion in cash payments, mostly to the states, $3 billion in refinancing for underwater mortgages, and $17 billion in principal reduction.There are many more details in the article.

...

Of the $5 billion, $1.5 billion will go to people who have been foreclosed on and were abused in some way during the process. The claims are nearly instantaneous ... the payments are also small: $1,500 to $2,000. ... no one taking the payment would be giving up any rights to bring cases against the banks for wrongful eviction or other claims they may have.

...

The bulk of the money—$17 billion—would go to principal reduction for homeowners and a menu of other elements ...

In return for the $5 billion in cash and the $20 billion in credits, the banks would be released from claims against them for servicing and foreclosure abuses that might be brought against them by the states and the federal government. The states also release the banks from origination claims ... The banks do not get immunity or a release of for individual claims by homeowners ... They also don’t get released for securitization abuses ...

According to the article, the details will be announced in January at the earliest.

Home Sales: Distressing Gap

by Calculated Risk on 12/23/2011 12:12:00 PM

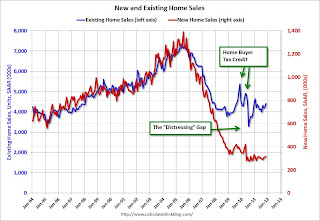

Here is the first "distressing gap" graph after the benchmark revision for existing home sales. Even with the significant downward revisions to existing home sales for the years 2007 through 2011, most of the distressing gap remains.

The following graph shows existing home sales (left axis) and new home sales (right axis) through November. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image.

Click on graph for larger image.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

On November Home Sales:

• New Home Sales increase in November to 315,000 SAAR

• New Home Sales graphs

Earlier in the week on Existing Home sales:

• Existing Home Sales in November: 4.42 million SAAR, 7.0 months of supply

• Existing Home Sales Revisions

• Existing Home Sales graphs

New Home Sales increase in November to 315,000 SAAR

by Calculated Risk on 12/23/2011 10:00:00 AM

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 315 thousand. This was up from a revised 310 thousand in October (revised up from 307 thousand).

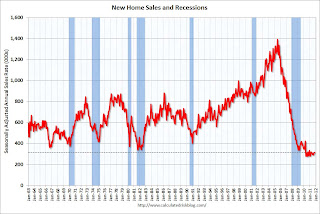

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in November 2011 were at a seasonally adjusted annual rate of 315,000 ... This is 1.6 percent (±12.2%)* above the revised October rate of 310,000 and is 9.8 percent (±19.5%)* above the November 2010 estimate of 287,000.

Click on graph for larger image in graph gallery.

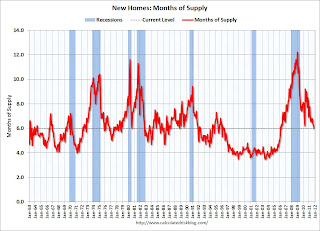

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply decreased to 6.0 in November.

The all time record was 12.1 months of supply in January 2009.

This is now close to normal (less than 6 months supply is normal).

This is now close to normal (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of November was 158,000. This represents a supply of 6.0 months at the current sales rate.On inventory, according to the Census Bureau:

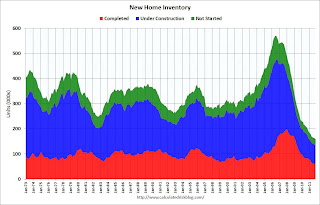

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 59,000 units in November. The combined total of completed and under construction is at the lowest level since this series started.

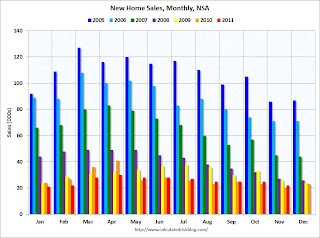

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In November 2011 (red column), 22 thousand new homes were sold (NSA). This was the second weakest November since this data has been tracked, and was just above the record low for November of 20 thousand set in 2010. The high for November was 86 thousand in 2005.

This was slightly above the consensus forecast of 313 thousand, and just above the record low for the month of November set last year (NSA).

This was slightly above the consensus forecast of 313 thousand, and just above the record low for the month of November set last year (NSA). New home sales have averaged only 300 thousand SAAR over the 19 months since the expiration of the tax credit ... mostly moving sideways at a very low level ... although sales have been increasing a little lately.

Personal Income increased 0.1% in November, Spending increased 0.1%

by Calculated Risk on 12/23/2011 08:30:00 AM

The BEA released the Personal Income and Outlays report for November:

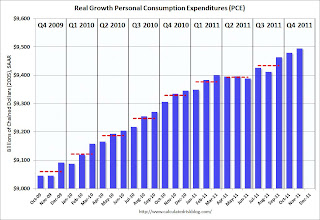

Personal income increased $8.5 billion, or 0.1 percent ... in November, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $13.1 billion, or 0.1 percent in November.The following graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.2 percent in November ... The price index for PCE decreased less than 0.1 percent in November, compared with a decrease of 0.1 percent in October. The PCE price index, excluding food and energy, increased 0.1 percent in November

Click on graph for larger image.

Click on graph for larger image.PCE increased 0.1% in November, and real PCE increased 0.2%.

Note: The PCE price index, excluding food and energy, increased 0.1 percent.

The personal saving rate was at 3.5% in November.

Both personal income and spending were lower than expectations. Using the "two month" method to forecast real Q4 PCE growth suggests an increase of about 2.9% in Q4 - the strongest quarter this year.

Thursday, December 22, 2011

Reports: Fed could signal near zero rates into 2014, House ready to pass payroll tax cut extension

by Calculated Risk on 12/22/2011 05:34:00 PM

From Luca Di Leo and Jon Hilsenrath at the WSJ: Fed Could Keep Rates Near Zero Into 2014

The Federal Reserve could signal it is likely to keep short-term interest rates near zero into 2014 or beyond ... When the Fed revises its communications approach, there is a good chance it will cease offering a fixed date for the timing of rate increases. Instead, officials could signal their intentions by publishing a range of their forecasts for rates along with their quarterly economic projections.This change in communication strategy will probably happen at the two day January FOMC meeting on the 24th and 25th. If so, the sentence in the FOMC statement - "The Committee ... currently anticipates that economic conditions ... are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013." would be replaced with the forecast of future rates.

From the WaPo: House GOP agrees to 2-month extension of payroll tax cut

[T]op House Republicans have agreed to extend the payroll tax cut for 160 million Americans for two months, according to Democratic and Republican congressional aides. As part of the deal, Senate leaders will appoint a conference committee to negotiate a full-year tax cut after Jan. 1.It was just a matter of when ...

...

The measure also extends unemployment benefits for two months and averts a cut in the reimbursement rate for doctors who treat Medicare patients.

More House Price Indexes show price declines in October

by Calculated Risk on 12/22/2011 04:00:00 PM

The Case-Shiller House Price index for October will be released Tuesday, Dec 27th. Based on released data, it appears the seasonally adjusted Case-Shiller indexes will fall to new post-bubble lows in October (but not the NSA indexes). Here are a few other recently released indexes:

• Yesterday from FNC: Home Prices Continue to Weaken: Down 0.6% in October

FNC’s latest Residential Price Index™ (RPI), released Wednesday, indicates that October U.S. home prices continued to weaken at a modest pace despite recent positive home-sales data. The trend is a reminder that the housing market remains constrained by weak economic fundamentals and the overhang of distressed properties. October marks the third month of continued price declines and is unfortunately accompanied by a moderate downward index revision to the previous month.The FNC index tables for three composite indexes and 30 cities are here.

Based on the latest data on non-distressed home sales (existing and new homes) through October, FNC’s national RPI shows that single-family home prices fell in October to a seasonally unadjusted rate of 0.6%. The September index value is revised downward from -0.4% to -0.9%.

• From Radar Logic today Home Prices Decline Year-Over-Year in October for Fifth Year in a Rowa

Home prices fell 5.4 percent year over year through October 20, making 2011 the fifth year in a row in which the 25-metropolitan-statistical-area (MSA) RPX Composite price has declined year over year in October. The Composite price declined 2.0 percent on a month-over-month basis, the largest such decline in three years.• CoreLogic reported earlier this month for October: CoreLogic: House Price Index declined 1.3% in October basis

...

The S&P/Case-Shiller 10-City composite for September 2011, published last month, was 155.73 and the 20-City composite was 141.97. The October 2011 10-City composite index, to be published next Tuesday, will be about 152, and the 20-City index will be roughly 139.

October Home Price Index (HPI®) which shows that home prices in the U.S. decreased 1.3 percent on a month-over-month basis, the third consecutive monthly decline. According to the CoreLogic HPI, national home prices, including distressed sales, also declined by 3.9 percent on a year-over-year basis in October 2011 compared to October 2010.• From FHFA today: FHFA House Price Index Falls 0.2 Percent in October

U.S. house prices fell 0.2 percent on a seasonally adjusted basis from September to October, according to the Federal Housing Finance Agency’s monthly House Price Index.... For the 12 months ending in October, U.S. prices fell 2.8• From Zillow: Zillow Forecast: October Case-Shiller Composite-20 Expected to Show 3.5% Decline from One Year Ago

percent.

The Case-Shiller Composite Home Price Indices for October will be released on Tuesday, the 27th of December. Zillow predicts that the 20-City Composite Home Price Index (non-seasonally adjusted, NSA) will decline by 3.5 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) will show a year-over-year decline of 3.2 percent. The seasonally adjusted (SA) month-over-month change from September to October will be -0.8 percent and -0.7 percent for the 20 and 10-City Composite Home Price Index (SA), respectively.Based on the Radar Logic and Zillow forecasts, the Case-Shiller (SA) indexes will be at new post bubble lows in October (not the NSA indexes yet).

Chicago Fed: Economic activity index declined in November

by Calculated Risk on 12/22/2011 02:10:00 PM

Catching up: Earlier today, the BEA released the third estimate for Q3 GDP showing real GDP growth of 1.8% in Q3, revised down from 2.0%. A large portion of the revision was from personal consumption expenditures.

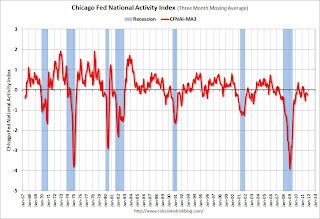

The Chicago Fed release the national activity index (a composite index of other indicators): Index shows economic activity decreased in November

Led by declines in production-related indicators, the Chicago Fed National Activity Index decreased to –0.37 in November from –0.11 in October. Two of the four broad categories of indicators that make up the index decreased from October, and only the employment, unemployment, and hours category was positive in November.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, remained level, at –0.24, from October to November. November’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. Likewise, the economic slack reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

Click on graph for larger image.

Click on graph for larger image.According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Philly Fed State Coincident Indexes increase in November

by Calculated Risk on 12/22/2011 12:05:00 PM

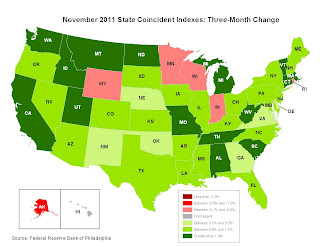

From the Philly Fed:

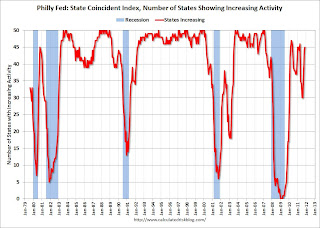

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2011. In the past month, the indexes increased in 44 states, decreased in four, and remained unchanged in two (Hawaii and Wyoming) for a one-month diffusion index of 80. Over the past three months, the indexes increased in 43 states, decreased in six, and remained unchanged in one (Hawaii) for a three-month diffusion index of 74.Note: These are coincident indexes constructed from state employment data. From the Philly Fed:

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on graph for larger image.

Click on graph for larger image.This is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

In November, 45 states had increasing activity, up from 44 in October. This is the highest level since April.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from a few months ago.

Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all green earlier this year - but this is an improvement from a few months ago.Earlier:

• Weekly Initial Unemployment Claims decline to 364,000

• Final December Consumer Sentiment at 69.9

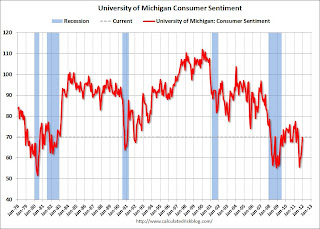

Final December Consumer Sentiment at 69.9

by Calculated Risk on 12/22/2011 09:55:00 AM

The final December Reuters / University of Michigan consumer sentiment index increased to 69.9, up from the preliminary reading of 67.7, and up from the November reading of 64.1.

Click on graph for larger image.

Consumer sentiment is usually impacted by employment (and the unemployment rate) and gasoline prices. Gasoline prices are falling, but still high, and the unemployment rate is also falling - but still very high.

Most of the recent sharp decline was event driven due to the debt ceiling debate, and sentiment has rebounded as expected. Now it is all about jobs - and gasoline prices.

Sentiment is still very weak, although above the consensus forecast of 68.0.