by Calculated Risk on 12/02/2011 12:30:00 PM

Friday, December 02, 2011

Seasonal Retail Hiring, Duration of Unemployment, Unemployment by Education and Diffusion Indexes

Here are the earlier employment posts:

• November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

• Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

• NEW Employment graph gallery (fast, no scripting)

And a few more graphs ...

According to the BLS employment report, retailers hired seasonal workers at close to the pre-crisis pace in November.

Click on graph for larger image.

Click on graph for larger image.Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Retailers hired 423.5 thousand workers (NSA) net in November, and 547.2 thousand in October and November combined. This is more hiring than last year, and this is about the same level as in 2006 and 2007. Note: this is NSA (Not Seasonally Adjusted).

This suggests retailers are somewhat optimistic about the holiday season.

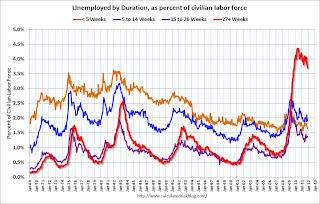

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force. The graph shows the number of unemployed in four categories: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.Only one category increased in November: The "15 to 26 Weeks" group. This is probably spillover from the increase in short term unemployment in August and September. A little bit of good news is that short term unemployment (less than 14 weeks) has declined.

The the long term unemployed declined to 3.7% of the labor force - this is still very high, but the lowest since October 2009.

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).

This graph shows the unemployment rate by four levels of education (all groups are 25 years and older).Unfortunately this data only goes back to 1992 and only includes one previous recession (the stock / tech bust in 2001). Clearly education matters with regards to the unemployment rate - and it appears all four groups are generally trending down.

Although education matters, it appears that the college educated category is declining the slowest (and was the only category to increase in November).

Note: This says nothing about the quality of jobs - as an example, a college graduate working at minimum wage would be considered "employed".

This is a little more technical. The BLS diffusion index for total private employment was at 54.7 in November, down from 59.6 in October. For manufacturing, the diffusion index decreased to 49.4, down from 52.5 in October.

This is a little more technical. The BLS diffusion index for total private employment was at 54.7 in November, down from 59.6 in October. For manufacturing, the diffusion index decreased to 49.4, down from 52.5 in October. Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.It appears job growth was spread across fewer industries in November.

We'd like to see the diffusion indexes consistently above 60 - and even in the 70s like in the '1990s.

Employment Summary, Part Time Workers, and Unemployed over 26 Weeks

by Calculated Risk on 12/02/2011 10:10:00 AM

This was another weak report, and the headline number was slightly below consensus forecasts. However there were some positives too: the unemployment rate declined to 8.6% and the payroll employment was revised up for September and October.

There were only 120,000 jobs added in November. There were 140,000 private sector jobs added, and 20,000 government jobs lost.

The change in total employment was revised up for September and October. "The change in total nonfarm payroll employment for September was revised from +158,000 to +210,000, and the change for October was revised from +80,000 to +100,000."

The household survey showed an increase of 278,000 jobs in November. This increase in the household survey - along with a 315,000 decline in the labor force - pushed the unemployment rate down sharply to 8.6%. The participation rate fell to 64.0%, and the employment population ratio increased to 58.5%. This is the fourth straight monthly increase in the employment population ratio from the low in July at 58.1%.

U-6, an alternate measure of labor underutilization that includes part time workers and marginally attached workers, declined to 15.6% - this remains very high. U-6 was in the 8% range in 2007.

The average workweek was unchanged at 34.3 hours, and average hourly earnings decreased slightly. "The average workweek for all employees on private nonfarm payrolls was unchanged at 34.3 hours in November ... Average hourly earnings for all employees on private nonfarm payrolls decreased in November by 2 cents, or 0.1 percent, to $23.18. ... Over the past 12 months, average hourly earnings have increased by 1.8 percent." This is sluggish earnings growth, and earnings are being impacted by the large number of unemployed and marginally employed workers.

Through the first eleven months of 2011, the economy has added 1.448 million total non-farm jobs or just 131 thousand per month. This is a better pace of payroll job creation than last year, but the economy still has 6.2 million fewer payroll jobs than at the beginning of the 2007 recession. The economy has added 1.711 million private sector jobs this year, or about 156 thousand per month.

There are a total of 13.3 million Americans unemployed and 5.7 million have been unemployed for more than 6 months. Very grim.

Overall this was another weak employment report and suggests sluggish economic growth.

Percent Job Losses During Recessions

Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - this time aligned at maximum job losses.

In the previous post, the graph showed the job losses aligned at the start of the employment recession.

The following graph shows the employment population ratio, the participation rate, and the unemployment rate.

The unemployment rate declined to 8.6% (red line).

The unemployment rate declined to 8.6% (red line).

The Labor Force Participation Rate was declined to 64.0% in November (blue line). This is the percentage of the working age population in the labor force. The participation rate is well below the 66% to 67% rate that was normal over the last 20 years, although some of the decline is due to the aging population.

The Employment-Population ratio increased to 58.5% in November (black line).

Note: the household survey showed another strong gain in jobs, and that - combined with a decline in the labor force - is why the unemployment rate declined sharply with few payroll jobs added.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) dropped by 378,000 over the month to 8.5 million.The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) decreased to 8.5 million in November from 9.27 million in October. This just reverses some of the increase in August and September.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 15.6% in November from 16.2% in October.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 5.691 million workers who have been unemployed for more than 26 weeks and still want a job. This was down from 5.876 million in October. This is still very high, but this is the lowest number since Oct 2009. Long term unemployment remains a serious problem.

More graphs coming ...

November Employment Report: 120,000 Jobs, 8.6% Unemployment Rate

by Calculated Risk on 12/02/2011 08:30:00 AM

From MarketWatch: U.S. economy adds 120,000 jobs in November

The U.S. gained 120,000 jobs in November and the unemployment rate fell to 8.6% from 9.0%, the Labor Department said Friday. The government also revised jobs data for October and September to show that 72,000 additional jobs were created. ... Hiring in October was revised up to 100,000 from 80,000 and the job gains in September were revised up to 210,00 from 158,000. In November, companies in the private sector hired 140,000 workers ... Government cut 20,000 jobs...

Click on graph for larger image.

Click on graph for larger image.The following graph shows the unemployment rate. The unemployment rate declined to 8.6%.

Some of the decline in in the unemployment rate was related to a decline in the number of workers in the labor force.

I'll have more on this soon (the BLS website is having a problem).

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring.

The second graph shows the job losses from the start of the employment recession, in percentage terms. The dotted line is ex-Census hiring. The red line is moving slowly upwards.

This was still a weak report, and slightly below consensus. There were decent upwards revisions to the September and October reports. I'll have much more soon ...

Thursday, December 01, 2011

Europe: Hints of a Deal

by Calculated Risk on 12/01/2011 11:01:00 PM

From the Financial Times: Shape of last-ditch eurozone deal emerges

The deal involves bilateral fiscal agreements - and then possibly the ECB getting more involved.

From the WSJ: A Euro Crisis Deal Emerges

European Central Bank President Mario Draghi signaled the bank could ramp up its role battling the debt crisis if euro-zone governments enforce tougher deficit cutting—suggesting outlines are emerging of a deal that investors have been clamoring to see happen.From the NY Times: French President Warns of Dire Consequences if Euro Crisis Goes Unsolved

Saying that he wanted to tell the truth to the French people, President Nicolas Sarkozy said Thursday night that Europe could be “swept away” by the euro crisis if it does not change. He said that Europe would “have to make crucial choices in the next few weeks,” and that France and Germany together were supporting a new treaty to tighten fiscal discipline and promote economic convergence in the euro zone.The Italian 2 year yield was down sharply to 6.32%, and the 10 year yield was down to 6.65%.

The Spanish 2 year yield was down sharply to 4.78%, and the 10 year yield was down to 5.74%.

The Belgian 10 year yield was down to 4.75%, and the French 10 year yield was down to 3.1%.

Earlier:

• ISM Manufacturing index indicates slightly faster expansion in November

• LPS: Mortgages In Foreclosure Process at an All-Time High

• Construction Spending increased in October

• U.S. Light Vehicle Sales at 13.6 million SAAR in November, Highest since Aug 2009

Employment Situation Preview: Better, but still Weak

by Calculated Risk on 12/01/2011 06:38:00 PM

Tomorrow (Friday) the BLS will release the November Employment Situation Summary at 8:30 AM ET. Bloomberg is showing the consensus is for an increase of 131,000 payroll jobs in November, and for the unemployment rate to remain unchanged at 9.0%. The consensus has been moving up all week and the "whisper" employment number is probably even higher.

Overall the economic data for November was fairly weak suggesting sluggish growth, but somewhat improved compared to recent months. So I'd expect a little better employment report - but that isn't saying much.

Here is a summary of recent data:

• The ADP employment report showed an increase of 206,000 private sector payroll jobs in November. Unfortunately ADP hasn't been very useful in predicting the BLS report. Also note that government payrolls have been shrinking by about 27,000 on average per month this year, so this suggests around 206,000 private nonfarm payroll jobs added, minus 27,000 government workers - or around 179,000 total jobs added in November.

• The ISM manufacturing employment index decreased to 51.8% from 53.5% in October. Based on a historical correlation between the ISM index and the BLS employment report for manufacturing, this reading suggests a loss of a few thousand private payroll jobs for manufacturing in October.

The ISM non-manufacturing index for November will be released next Monday.

• Initial weekly unemployment claims averaged about 396,000 in November, down from 404,000 per week in October, and down from 418,000 per week in September.

For the BLS reference week (includes the 12th of the month), initial claims were at the lowest level since March and April - and the BLS reported an average of 205,500 jobs added for those two months.

• The final November Reuters / University of Michigan consumer sentiment index increased to 64.1 from 60.9 in October. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. In general this low level would suggest a weak labor market - but slightly better than in August, September and October (the BLS reported an average of 114,000 per month for those three months).

• And on the unemployment rate from Gallup: U.S. Unemployment Ticks Up in Mid-November

Unemployment, as measured by Gallup without seasonal adjustment, is 8.5% in mid-November -- up from 8.3% in mid-October, but down significantly from 9.2% in mid-November 2010. Gallup's mid-month unemployment measure suggests the government is likely to report no change in its seasonally adjusted unemployment rate for November 2011.NOTE: The Gallup poll results are Not Seasonally Adjusted (NSA), so use with caution. Usually the NSA unemployment rate increases in November - so this would suggest little change in the headline seasonally adjusted unemployment rate.

There always seems to be some randomness to the employment report, but it does seem the situation has improved somewhat (lower initial weekly unemployment claims, more job openings). I'll go with the consensus forecast this month.

U.S. Light Vehicle Sales at 13.6 million SAAR in November, Highest since Aug 2009

by Calculated Risk on 12/01/2011 03:53:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 13.63 million SAAR in November. That is up 11.4% from November 2010, and up 3.1% from the sales rate last month (13.22 million SAAR in Oct 2011).

This was above the consensus forecast of 13.4 million SAAR.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 13.63 million SAAR from Autodata Corp).

Click on graph for larger image.

Click on graph for larger image.

This was the highest sales rate since August 2009 ("Cash-for-clunkers"), and other than August 2009, this was the highest since June 2008.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

This shows the huge collapse in sales in the 2007 recession. This also shows the impact of the tsunami and supply chain issues on sales, especially in May and June.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a strong positive contribution to Q4 GDP. Sales in Q3 averaged 12.45 million SAAR, and so far (October and November) sales have averaged 13.42 million SAAR in Q4, an increase of 7.6% over Q3.

Construction Spending increased in October

by Calculated Risk on 12/01/2011 02:12:00 PM

Note: I'll post a graph of November auto sales around 4 PM ET.

This morning the Census Bureau reported that overall construction spending increased in October:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during October 2011 was estimated at a seasonally adjusted annual rate of $798.5 billion, 0.8 percent (±1.6%) above the revised September estimate of $792.1 billion. The October figure is 0.4 percent (±1.9%) below the October 2010 estimate of $802.0 billion.Private construction spending increased in October:

Spending on private construction was at a seasonally adjusted annual rate of $518.6 billion, 2.3 percent (±1.1%) above the revised September estimate of $507.1 billion. Residential construction was at a seasonally adjusted annual rate of $239.0 billion in October, 3.4 percent (±1.3%) above the revised September estimate of $231.2 billion. Nonresidential construction was at a seasonally adjusted annual rate of $279.6 billion in October, 1.3 percent (±1.1%) above the revised September estimate of $275.9 billion.

Click on graph for larger image.

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending is 65% below the peak in early 2006, and non-residential spending is 32% below the peak in January 2008.

Public construction spending is now 14% below the peak in March 2009.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, both private residential and non-residential construction spending have turned positive, but public spending is now falling on a year-over-year basis as the stimulus spending ends. The year-over-year improvements in private non-residential are mostly due to energy spending (power and electric).

Earlier:

• ISM Manufacturing index indicates slightly faster expansion in November

• LPS: Mortgages In Foreclosure Process at an All-Time High

LPS: Mortgages In Foreclosure Process at an All-Time High

by Calculated Risk on 12/01/2011 11:33:00 AM

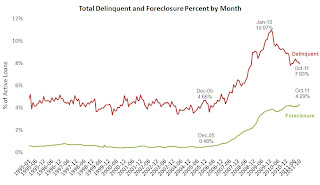

From LPS Applied Analytics: LPS' Mortgage Monitor Report Shows Delinquencies Down Nearly 30 Percent from Peak, Foreclosure Inventory at an All-Time High

The October Mortgage Monitor report released by Lender Processing Services, Inc. (NYSE: LPS) shows mortgage delinquencies continue their decline, now nearly 30 percent off their January 2010 peak. Meanwhile, foreclosure inventories are on the rise, reaching an all-time high at the end of October of 4.29 percent of all active mortgages. The average days delinquent for loans in foreclosure extended as well, setting a new record of 631 days since last payment, while the average days delinquent for loans 90 or more days past due but not yet in foreclosure decreased for the second consecutive month.According to LPS, 7.93% of mortgages were delinquent in October, down from 8.09% in September, and down from 9.29% in October 2010.

Judicial vs. non-judicial foreclosure processes remain a significant factor in the reduction of foreclosure pipelines from state to state, with non-judicial foreclosure inventory percentages less than half that of judicial states. ...

The October data also showed that mortgage originations are on the rise, reaching levels not seen since mid-2010. Mortgage prepayment rates have also spiked, as much of the new origination is related to borrower refinancing ...

LPS reports that a record 4.29% of mortgages were in the foreclosure process, up from 4.18% in September, and up from 3.92% in October 2010. This gives a total of 12.22% delinquent or in foreclosure. It breaks down as:

• 2.33 million loans less than 90 days delinquent.

• 1.76 million loans 90+ days delinquent.

• 2.21 million loans in foreclosure process.

For a total of 6.30 million loans delinquent or in foreclosure in October.

Click on graph for larger image.

Click on graph for larger image.This graph shows the total delinquent and in-foreclosure rates since 1995.

The total delinquent rate has fallen to 7.93% from the peak in January 2010 of 10.97%. A normal rate is probably in the 4% to 5% range, so there is a long ways to go.

However the in-foreclosure rate at 4.29% is a new record high. There are still a large number of loans in this category (about 2.21 million) - and the average days delinquent for loans in foreclosure set a "new record of 631 days since last payment" in October.

This graph provided by LPS Applied Analytics shows foreclosure inventories by process.

This graph provided by LPS Applied Analytics shows foreclosure inventories by process. As LPS noted "Judicial vs. non-judicial foreclosure processes remain a significant factor in the reduction of foreclosure pipelines from state to state, with non-judicial foreclosure inventory percentages less than half that of judicial states. This is largely a result of the fact that foreclosure sale rates in non-judicial states have been proceeding at four to five times that of judicial. Non-judicial foreclosure states made up the entirety of the top 10 states with the largest year-over-year decline in non-current loans percentages."

The third graph shows the origination percentage by product and year. This is a reminder that the worst of the worst loans were private label and were made in 2005 and 2006. Luckily the GSEs and FHA had a much smaller percentage of the market then.

The third graph shows the origination percentage by product and year. This is a reminder that the worst of the worst loans were private label and were made in 2005 and 2006. Luckily the GSEs and FHA had a much smaller percentage of the market then.As LPS notes: "FHA and the GSEs represent a much larger share, but of a smaller market."

The details in this report suggest slow improvement - with the exception of the large number of loans stuck in the foreclosure process.

Earlier:

• ISM Manufacturing index indicates slightly faster expansion in November

ISM Manufacturing index indicates slightly faster expansion in November

by Calculated Risk on 12/01/2011 10:00:00 AM

PMI was at 52.7% in November, up from 50.8% in October. The employment index was at 51.8%, down from 53.5%, and new orders index was at 56.7%, up from 52.4%.

From the Institute for Supply Management: November 2011 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in November for the 28th consecutive month, and the overall economy grew for the 30th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The PMI registered 52.7 percent, an increase of 1.9 percentage points from October's reading of 50.8 percent, indicating expansion in the manufacturing sector for the 28th consecutive month. The New Orders Index increased 4.3 percentage points from October to 56.7 percent, reflecting the second month of growth after three months of contraction. While the Prices Index, at 45 percent, increased 4 percentage points from the October reading of 41 percent, prices of raw materials continued to decrease (registering below 50 percent) for the second consecutive month. Respondents cite continuing concerns about the general economic environment, government regulations and European financial conditions, but are cautiously more optimistic about the next few months based on lower raw materials pricing and favorable levels of new orders."

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 51.7%, and suggests manufacturing expanded at a slightly faster rate in November than in October. It appears manufacturing employment barely expanded in October with the employment index at 51.8%. New orders were up, and prices declined.

Weekly Initial Unemployment Claims increase to 402,000

by Calculated Risk on 12/01/2011 08:30:00 AM

The DOL reports:

In the week ending November 26, the advance figure for seasonally adjusted initial claims was 402,000, an increase of 6,000 from the previous week's revised figure of 396,000. The 4-week moving average was 395,750, an increase of 500 from the previous week's revised average of 395,250.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week to 395,750.

This is the third week in a row with the 4-week average below 400,000. This is still elevated, but an improvement over recent months.

And here is a long term graph of weekly claims: