by Calculated Risk on 8/03/2011 07:44:00 AM

Wednesday, August 03, 2011

MBA: Mortgage Applications Increase, But Still Low

The MBA reports: Mortgage Applications Increase, But Still Low in Latest MBA Weekly Survey

The Refinance Index increased 7.8 percent from the previous week. The seasonally adjusted Purchase Index increased 5.1 percent from one week earlierThe following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates fell, with the rate on 15-year mortgages reaching a new low in our survey. Refinance application volume increased, but even though 30-year mortgage rates are back below 4.5 percent, the refinance index is still almost 30 percent below last year's level. Factors such as negative equity and a weak job market continue to constrain borrowers. Purchase activity increased off of a low base, returning to levels of one month ago, but remains weak by historical standards." [said Michael Fratantoni, MBA's Vice President of Research and Economics].

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.45 percent from 4.57 percent, with points decreasing to 0.78 from 1.14 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The four week average of the purchase index is at best moving sideways at about 1997 levels. Of course this doesn't include the large number of cash buyers ... but this suggests purchase activity remains fairly weak.

Mortgage rates fell last week - and will be even lower this week.

Tuesday, August 02, 2011

Misc: Europe is a Mess, House For Sale Listings Decline

by Calculated Risk on 8/02/2011 07:36:00 PM

• Europe is a mess. Here is a graph of the 10 year spread (Italy to Germany) from Bloomberg. And for Spain to Germany. The Italian spread is at 3.713, and the Spanish spread is at 3.87. Both new highs ...

• As we've been discussing for several months ... from Nick Timiraos at the WSJ: Sliding Sales Listings Lift Housing Outlook

The number of homes listed for sale declined sharply in a number of U.S. cities during the second quarter, offering glimmers of hope that some housing markets are starting to recover.Earlier:

• Recession Measures (Graphs showing how little the economy has recovered).

• FHA sells record number of REO in June

• U.S. Light Vehicle Sales 12.23 million Annual Rate in July

U.S. Light Vehicle Sales 12.23 million Annual Rate in July

by Calculated Risk on 8/02/2011 03:47:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.23 million SAAR in July. That is up 6.1% from July 2010, and up 6.2% from the sales rate last month (June 2011).

Although still below the sales rate earlier this year - before the tragedy in Japan - this was above the consensus forecast of 11.9 million SAAR.

It appears most of the supply issues will be resolved over the next 30 to 60 days, and sales will probably be stronger in August.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for July (red, light vehicle sales of 12.23 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate.

Note: dashed line is current estimated sales rate.

Growth in auto sales should make a solid contribution to Q3 GDP as sales bounce back from Q2, however further sales growth will obviously depend on the overall economy and jobs and income growth.

FHA sells record number of REO in June

by Calculated Risk on 8/02/2011 03:11:00 PM

Note: I'll post on vehicle sales soon.

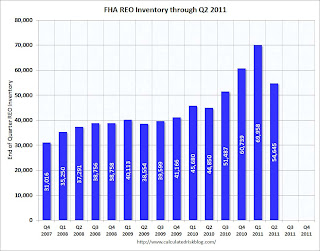

Earlier this year, Tom Lawler noted that the FHA was having REO inventory problems, and the FHA's REO inventory increased in Q1.

It now appears the FHA REO problem has been solved. The FHA sold a record number of REO in April, more in May, and another new record in June.

According to HUD, the FHA acquired 7,667 REO in June and sold a record 13,609 properties (breaking the record of 12,671 properties sold in May). The FHA REO inventory has declined from 69,958 at the end of Q1 2011, to 54,645 at the end of Q2.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Fannie and Freddie are expected to release results including REO aquisitions and inventory later this week. From Diana Golobay at HousingWire: Fannie Earnings Expected Later This Week, Freddie After

Freddie Mac spokesperson Michael Cosgrove noted the company could release its Q210 earnings later this week but may wait until close of business Monday. Fannie Mae spokesperson Jason Vasquez also said earnings are anticipated "sometime this week," ... it is believed that Fannie will release Thursday, with Freddie to follow after, sources say.I expect Fannie and Freddie to report declines in REO inventory in Q2 too.

Recession Measures

by Calculated Risk on 8/02/2011 12:55:00 PM

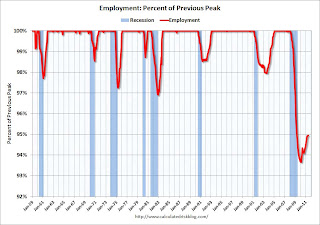

By request, here are four key indicators used by the NBER for business cycle dating: GDP, Employment, Industrial production and real personal income less transfer payments.

Note: The following graphs are all constructed as a percent of the peak in each indicator. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%.

These graphs show that no major indicator has returned to the pre-recession levels - and most are still way below the pre-recession peaks.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph is for real GDP through Q2 2011 and shows real GDP is still 0.4% below the previous pre-recession peak.

At the worst point, real GDP was off 5.1% from the 2007 peak.

And real GDP has performed better than other indicators ...

This graph shows real personal income less transfer payments as a percent of the previous peak.

This graph shows real personal income less transfer payments as a percent of the previous peak.

With the revisions, this measure was off almost 11% at the trough - a significant downward revision and shows the recession was much worse than originally thought.

Real personal income less transfer payments is still 5.1% below the previous peak.

It will be some time before this indicator returns to pre-recession levels.

This graph is for industrial production through June.

This graph is for industrial production through June.

Industrial production had been one of the stronger performing sectors because of inventory restocking and some growth in exports.

However industrial production is still 7.6% below the pre-recession peak, and it will probably be some time before industrial production returns to pre-recession levels.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

The final graph is for employment. This is similar to the graph I post every month comparing percent payroll jobs lost in several recessions.

On the timing of the trough of the recession, GDP and industrial production would suggest the end of Q2 2009 (and June 2009). The other two indicators would suggest later troughs.

And of course the recovery in all indicators has been very sluggish compared to recent recessions.