by Calculated Risk on 7/26/2010 08:30:00 AM

Monday, July 26, 2010

Chicago Fed: Economic activity declined in June

Note: This is a composite index based on a number of economic releases.

From the Chicago Fed: Index shows economic activity declined in June

Led by deterioration in production- and employment-related indicators, the Chicago Fed National Activity Index declined to –0.63 in June, down from +0.31 in May. Three of the four broad categories of indicators that make up the index made negative contributions in June, while the sales, orders, and inventories category made the lone positive contribution.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.05 in June from +0.31 in May. The CFNAI-MA3 suggests that growth in national economic activity returned very close to its historical trend in June after reaching its highest level since March 2006 in May. With regard to inflation, it indicates subdued inflationary pressure from economic activity over the coming year.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.This is a compositive of other indicators. June was definitely a weak month.

Sunday, July 25, 2010

European Stress Tests: Not very stressful

by Calculated Risk on 7/25/2010 07:32:00 PM

It was announced last week that the stress tests didn't consider a sovereign default, and here is more ...

From David Enrich at the WSJ: Europe's 'Stress Tests' Relied on Mild Assumptions (ht jb)

In some of the 20 countries that conducted the tests, regulators figured that property values would keep rising or hold steady in a worst-case economic scenario.These are the two assumptions that put the most stress on households - lost jobs and negative equity. I guess in some European countries property prices only go up, and the unemployment rate only goes down.

In other cases, unemployment rates in a double-dip recession crept up by as little as 0.1 percentage point from the tests' so-called benchmark scenario, which is based on current economic conditions.

Earlier today: Weekly Summary and Schedule, July 25th

Yesterday: Sovereign default Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

Private Investment?

by Calculated Risk on 7/25/2010 03:38:00 PM

The WSJ is quoting Treasury Secretary Timothy Geithner as saying it is time for private investment to take over from government stimulus:

“We need to make that transition now to a recovery led by private investment,” Mr. Geithner said Sunday on NBC’s “Meet the Press.”I discussed this last week - in most sectors of the economy there is over capacity or too much supply (housing), so there is no reason for significant new private investment.

...

“I think the most likely thing is you’ll see an economy that gradually strengthens over the next year or two, you’ll see job growth start to come back, investments expanding ... but we’ve got a long way to go still,” Mr. Geithner said.

Earlier today: Weekly Summary and Schedule, July 25th

Yesterday: Sovereign default Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

Weekly Summary and Schedule, July 25th

by Calculated Risk on 7/25/2010 11:29:00 AM

The focus this week will be on the Q2 GDP report to be released on Friday. There are also two key housing reports: New Home Sales on Monday and Case-Shiller house prices on Tuesday.

On Monday, the June Chicago Fed National Activity Index will be released at 8:30 AM. This is a composite index of other data.

At 10 AM on Monday, the Census Bureau will release the New Home Sales report for June. The consensus is for a slight increase to 310 thousand at a seasonally adjusted annual rate (SAAR) from the record low 300 thousand in May.

Also on Monday, the Dallas Fed Manufacturing survey for July will be released at 10:30 AM. This is one of several regional surveys that will be released this week. Usually I don't highlight the minor regional reports, but right now I'm looking for hints of a slowdown in industrial production.

On Tuesday, the May Case-Shiller house price index will be released at 9:00 AM. The consensus is for a slight increase in the house price index. At 10:00 AM, the Conference Board will release Consumer Confidence for July (consensus is for a slight decrease from June). Also at 10:00 AM, the Richmond Fed Manufacturing Survey for July will be released.

Also at 10 AM Tuesday, the Census Bureau will release the Q2 Housing Vacancies and Homeownership report. This report provides the homeownership rate and estimates of the homeowner and rental vacancy rates.

On Wednesday, the MBA mortgage purchase index will be released. The purchase index is at the same level as in 1996 – suggesting further weakness in housing. Also on Wednesday, the June Durable Goods Orders will be released at 8:30 AM. The consensus is for a 1.0% increase.

Also on Wednesday, at 2 PM ET, the Fed will release the Beige Book for July. This will be closely scrutinized for further evidence of a 2nd half slowdown.

On Thursday, the initial weekly unemployment claims will be released. Consensus is for a decline to 460 thousand from 464 thousand last week. Also on Thursday, the Kansas City Fed Manufacturing survey will be released at 11 AM.

And on Friday, at 8:30 AM, the BEA will release the Q2 GDP report. The consensus is for real annualized GDP growth of 2.5% in Q2, down from a sluggish 2.7% in Q1. Also on Friday, the Chicago Purchasing Manager index for July will be released at 9:45 AM. And the FDIC will probably be busy on Friday afternoon ...

And a summary of last week:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in June 2010 (5.37 million SAAR) were 5.1% lower than last month, and were 9.8% higher than June 2009 (4.89 million SAAR).

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.99 million in June from 3.89 million in May. The all time record high was 4.58 million homes for sale in July 2008.

Months of supply increased to 8.9 months in June from 8.3 months in May. A normal market has under 6 months of supply, so this is already high - and probably excludes some substantial shadow inventory.

The next graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 4.7% YoY in June. This is the third consecutive month of a year-over-year increases in inventory, and this is the largest YoY increase since early 2008.

Inventory increased 4.7% YoY in June. This is the third consecutive month of a year-over-year increases in inventory, and this is the largest YoY increase since early 2008. This increase in inventory is especially bad news because the reported inventory is already historically very high, and the 8.9 months of supply in June is well above normal.

The months-of-supply will jump in July as sales collapse - probably to double digits - and a double digit months-of-supply would be a really bad sign for house prices ...

This was another a weak report. Sales were slightly above expectations (5.37 million at a seasonally adjusted annual rate vs. expectations of 5.3 million), but the YoY increase in inventory and the increase in months-of-supply are the real stories.

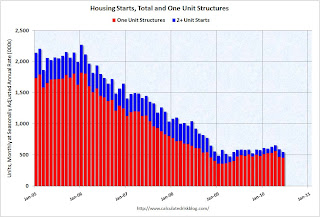

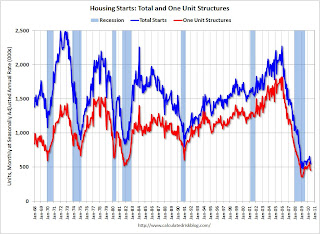

Total housing starts were at 549 thousand (SAAR) in June, down 5% from the revised May rate of 578,000 (revised down from 593 thousand), and up 15% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

Total housing starts were at 549 thousand (SAAR) in June, down 5% from the revised May rate of 578,000 (revised down from 593 thousand), and up 15% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Single-family starts declined 0.7% to 454,000 in June. This is 26% above the record low in January 2009 (360 thousand).

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.

This graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for over a year.This was way below expectations of 580 thousand (I took the under!), and is good news for the housing market longer term (there are already too many housing units), but bad news for the economy and employment short term.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 14 in June. This is the lowest level since April 2009.

The record low was 8 set in January 2009, but 14 is very low ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

This suggests the slump for commercial real estate design is ongoing. According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So there will probably be further declines in CRE investment into 2011.

Best wishes to all.

More State and Local Government Layoffs and the Pension Crisis

by Calculated Risk on 7/25/2010 08:36:00 AM

From Tom Abate at the San Fransicso Chronicle: Public pensions put state, cities in crisis

The recent layoff of 80 police officers in Oakland could be the harbinger of things to come ...The author argues that many of these layoffs are happening because pensions are straining state and local government budgets.

"This is not unique to Oakland," said Ron Cottingham, president of the Police Officers Research Association of California. "Stockton is having this happen. So is Sacramento."

The article contains some information on a recent scandal and the size of most pensions:

[T]he city of Bell (Los Angeles County) ... has been paying its city manager nearly $800,000 a year and setting him and other highly paid local officials up for huge pensions.The pension problem is a long term issue, but in the short term, the state and local government layoffs will contribute to the unemployment problem.

Scandals like this fuel public outrage and overshadow the reality that while abuses occur, and fatter pension payouts are on the rise, the average CalPERS beneficiary currently gets just over $24,000 a year, and 78 percent of all the fund's recipients get $36,000 or less.

Saturday, July 24, 2010

Charlie Rose: Geithner on Financial Regulatory Reform and Elizabeth Warren

by Calculated Risk on 7/24/2010 08:25:00 PM

Early today: Part 5B of Sovereign default series: What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

Here is the full interview at CharlieRose.com.

Charlie Rose (about 6 mins): "Will Professor Elizabeth Warren be the new director of the consumer agency?"

Treasury Secretary Timothy Geithner: "She is a incredibly capable effective advocate for reform. She was way ahead of her time - way ahead of the country - in pointing out what was actually happening in the credit business. All the bad stuff that was happening. The looming housing crisis. She was pioneering in pointing out those risks. And she is the most effective advocate of reform we have in the country on these questions. And obviously I think she would do a great job in that position."

Charlie Rose: "She has the qualities you are looking for?"

Geithner: "Absolutely. Without a doubt."

A short preview (doesn't include Warren comments).

More new condo inventory

by Calculated Risk on 7/24/2010 04:30:00 PM

Another update on condos as shadow inventory ...

From Roger Vincent at the LA Times: Luxury condo tower in Century City is completed

The prices, exceeding $2,700 per square foot, were a record high for Los Angeles-area condos. ... In recognition that times have changed, developer Related Cos. reduced prices as much as 25% on the building's 140 units. ... About 25% of the building's residential space has been sold or is in escrow ...So 75% are still for sale.

A handful of other deluxe condominium projects have opened in recent months

There are some areas - like Las Vegas and Miami - that have a huge number of vacant high rise condos. But there are also many smaller buildings that are mostly vacant in a number of cities (like in New York, Chicago, San Diego, Raliegh, N.C. and Irvine, Ca).

Unless the high rise condos are listed for sale, they are not included in either the new home inventory report (from the Census Bureau) or the existing home inventory report (from NAR). They are part of the shadow inventory ...

Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

by Calculated Risk on 7/24/2010 08:30:00 AM

CR Note: This series is from reader "some investor guy".

In Part 5A, I showed a Really Bad scenario consistent with some very bad historic default rates for sovereign debt. That produced an estimate of $15.3 trillion of defaulted sovereign debt, with $7.5 to $10.5 trillion of losses.

In today’s post, we look at the effects of sovereign default on credit default swaps, interest rate swaps and options, and currency exchange contracts.

Sovereign risk can make its way into over the counter markets in many ways, including:

A. For credit default swaps, the sovereigns are often the “reference entity”. In other words, market participants are often buying and selling insurance related to a potential future default of a country on its debt.

B. Sovereign bonds are a major form of collateral for over the counter trades. The collateral itself is often marked to market. Thus, movements in interest rates often changes the value of highly rated sovereign bonds posted as collateral, and a participant might post more or fewer bonds as collateral as a result. However, sovereign bonds are typically subject to larger haircuts if downgraded, and might not be accepted at all if rated lower than BB-.

C. Sovereigns ARE the participants in a large number of contracts. Yes, many governments and/or their central banks or sovereign wealth funds are active participants in OTC markets. The author’s impression is that sovereign participation in the CDS market is low, but participation in interest rate and FX markets is considerably higher.

OTC markets are huge. Their notional values are over $600 trillion, and exceed all other forms of investment combined (source: BIS Quarterly Review, June 2010 ). During the 2008 crisis, the market values of CDS, interest rate derivatives, and FX contracts was about the same as all outstanding sovereign debt, or all outstanding equities.

There are also exchange-traded interest and FX futures and options, about $67 trillion in 2009 (source: BIS Quarterly Review, June 2010, page 126).

Unlike stocks and bonds, the total market values for the OTC rise during times of turmoil. That’s partly because when interest rates or FX move from their values when the contracts were entered into, one party to the transaction now has a positive mark to market value for the swap (the other counterparty has a negative mark to market value).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

From mid 2007 to the end of 2008, the market values of FX and interest rate derivatives tripled, even though their notional values moved by less than 9%. The market value of CDS went up by a factor of seven, on an almost unchanged notional value.

Credit Default Swaps.

The next chart shows the ratios of gross and net notional to current outstanding bonds. Unlike the case for many corporate borrowers, for sovereigns it’s rarely the case that even gross notional CDS values exceed sovereign bonds outstanding. It’s even rarer for net notional to exceed outstanding sovereign bonds.

The next chart shows the ratios of gross and net notional to current outstanding bonds. Unlike the case for many corporate borrowers, for sovereigns it’s rarely the case that even gross notional CDS values exceed sovereign bonds outstanding. It’s even rarer for net notional to exceed outstanding sovereign bonds.

Good to know that CDS are unlikely to make sovereign default much worse, right? Well, these are recent CDS numbers, but take note. The ratios of CDS to bonds outstanding are higher for those countries believed to be in the most trouble. If sovereign financial conditions got much worse, the volume of CDS could go up considerably. In our Really Bad scenario, I assume the amount of CDS outstanding on sovereigns triples, and about half of it pays off. Currently there are about $2 trillion of sovereign CDS outstanding. Let’s assume it goes to $6 trillion of notional, that half of that pays off due to the insolvency of reference entity (the country the CDS is written on), or $3 trillion. That produces $3 trillion of payments, but there is a lot of netting. Even with some counterparty problems, net losses will probably not go over $1 trillion. Let’s assume $500 billion to $1 trillion of net payment and losses due to counterparty problems. Not too bad next to $7.5 to $10.5 trillion of losses on defaulted bonds.

Interest Rate and FX Derivatives.

Here the situation is much different. The total notional value of OTC interest rate and derivatives is $500 trillion (half a quadrillion). It is many times the size of the sovereign bond market.

Interest rate and FX derivatives typically start out at inception with a zero market value. Over time, as interest rates move, a contract acquires a market value. Sometimes, those market values are very large. In the 2008 distress, market values rose to $32 trillion from $11 trillion just 18 months before (Source: BIS, Table 19). Much of that market value is collateralized. Much of it is not, especially for sovereigns.

During the 2008 market turmoil, all kinds of typical relationships between rates changed. Significantly, there were no sovereign defaults during that period. A sovereign default would have made this period even more volatile.

During late 2008, huge amounts of collateral were sucked into the over the counter markets. With numerous sovereign defaults, this would likely happen again, probably on a bigger scale. There are several major sovereign-related risks:

1. Sovereigns are frequently counterparties, and many of them typically don’t post any collateral. According to the ISDA Margin Survey 2010, exposures to “sovereign governments and supra-national institutions tend to have the lowest collateralization levels“. Only 25% of what would normally be collateralized is collateralized if the counterparty is a sovereign. Thus, a highly-rated sovereign, its central bank, or another quasi-sovereign entity could accumulate very large risk positions with no collateral. For example, a AAA-rated sovereign might slide to lower ratings and eventually to default, leaving an immense amount of collateral and derivatives payments due.

Does that story sound familiar? It’s what happened to AIG. AIG went from AAA rated in early 2005 to being majority owned by the Federal Reserve in its first bailout in September 2008.

AIG had some poor risk management decisions, aside from selling mostly unhedged credit default swap protection. ISDA asserts that

“Apparently, AIG relied excessively on a credit risk model that did not adequately account for both the sharp decline in the mortgage market and a downgrade of AIG's credit rating. It has been said that AIG would never have needed government assistance if not for its investments in credit default swaps. Perhaps that is true. But it would be more accurate to state that AIG would never have needed government assistance if had not so heavily exposed itself to mortgage backed securities”(ISDA, AIG and Credit Default Swaps, 2009 ).

Good to know that sovereigns don’t provide unhedged credit guarantees, right? Among many other guarantees, it is common for sovereigns to guarantee bank deposits.

If interest rates or exchange rates moved quickly near the time a sovereign was downgraded or defaulted, a number of in-the-money swaps could be anywhere from worrisome to worthless to the other counterparty. Cash is an acceptable form of collateral, so some sovereigns who control their own currencies might print money, though printing really large amounts of it could have unintended consequences. Countries on the Euro don’t have the choice of printing their own money. Often, the native currency is not the one the OTC contract is written in, so any money printed might have to be converted to dollars, euros, or yen.

2. Sovereign bonds are a major form of collateral. As downgrades occur, haircuts become larger, meaning that for every $100 million of collateral required, a counterparty might have to post $112 million of bonds with a BB rating. Then, when the bonds go below BB- (typical Basel II collateral requirements), it wouldn’t be acceptable at all.

3. Sovereign distress and default would likely cause a breakdown between historic relationships and term structures. The relationships between short and long term rates in a particular currency could move to a strong preference toward short term debt, with long term rates going up. The relationships of interest rates in different currencies could move considerably. In Part 5C on banks, we’ll also discuss how LIBOR departed very substantially from its usual relationships in 2008, and in a period of distress this could easily happen again.

4. Many interest rates for OTC contracts are directly set based on a sovereign interest rate, or are strongly influenced by them. Thus, a contract between two banks might be based on a rate which becomes very volatile, or unglued from its historic relationship.

Having defaulted or distressed sovereigns as counterparties could cause cascading defaults. Downgrades of sovereign debt being used as collateral could cause a massive rush for debt which is still highly rated, and cash. Remember that not only will traders have to replace downgraded debt with other collateral, downgraded debt will lose a big portion of its value and is affect traders’ balance sheets, and the entire system will need much more collateral.

Total Current OTC Collateral, Current Credit Risk

At year end 2009, there was only about $3.2 trillion of collateral posted, on over $600 trillion of notional value contracts, ISDA Margin Survey 2010.

With $22 trillion of gross market value of derivatives at year end 2009, BIS shows “gross credit exposure” of $3.7 trillion (Gross market values after taking into account legally enforceable bilateral netting agreements), BIS Quarterly Review, June 2010 Much of the half trillion of uncollateralized exposure is sovereigns. While I have no reason to doubt the BIS data collection on this item, the $3.7 number is not what it might seem to be.

Stress Cases

If you were to assume that there was only $3.7 trillion of credit exposure in the OTC derivatives market, you would be greatly underestimating.

Why? 1. The BIS number assumes that all expected netting actually occurs. These are bilateral contracts. It is not a given that netting will function properly when there are some big defaulted counterparties and quickly rising collateral requirements. 2. The BIS number would be more appropriately titled “gross credit exposure at current market values”. If market values change wildly due to movements in interest rates and FX, the market values of the OTC contracts will rise considerably. Vastly more collateral and/or credit exposure would now be booked at the new prices.

How much more collateral? Between mid 2007 and late 2008, the market value of OTC derivatives rose by $21 trillion (source: BIS). The “gross credit exposure” rose by $2 trillion.

A couple of analogies may help. If a bank looks at a line of credit for a borrower, it has two different risks. First, the risk that the borrower won’t repay part of all of what they have currently borrowed. Second, the risk that they will borrow considerably more, even max out the credit line, and then not pay that amount. The second one is an extreme stress case.

Another example is even more informative for OTC derivatives. Credit default swaps are similar to insurance in many ways. What many people miss is that interest rate and FX derivatives are also similar to insurance in many ways. They are much like the way that property insurers transfer risk around between various companies. Writing homeowners coverage in an area prone to hurricanes involves taking in risk. It is then sliced, diced, moved around in various ways, and mixed in with risk from other areas and hazards. Of course, regulators do tests for adequacy of capital.

In an analysis which sounds like you could simply substitute “financial crisis” for “hurricane”, Rawle King wrote,

“as development increased in coastal areas, a catastrophic hurricane could result in huge government outlays for disaster assistance and present insurers with significant financial hazards, such as the risk of insolvency, a rapid reduction of earnings and statutory surplus, forced asset liquidation to meet cash needs, and ratings downgrade ... for the very highest layers of catastrophe risk, the government (and consequently the taxpayer) is now, by default, the insurer of last resort.”That was published several months before Hurricane Katrina.

“Insurers were caught off-guard by the large losses associated with Hurricane Andrew because of significant errors in actuarial estimates of potential hurricane related losses. Prior to Hurricane Hugo in 1989, the insurance industry never suffered any loss over $1 billion from a single hurricane. Further, most insurance industry experts estimated the probable maximum loss (PML) for a single hurricane in the United States at between $8 and $10 billion, and that such an event would occur only once in a century. Hurricane Andrew took insurers and forecasters by total surprise. In hindsight, because of the lull in hurricane activity during the 1970s and 1980s, insurance policies were underpriced and insurers accepted far more hurricane exposure than could be supported by their capital resources (including reinsurance).”

The low hurricane period of the 1970s and 80s has a close analog in finance, with similar results. The Great Moderation lasted from the late 1980s to 2007. In a speech in 2004, Fed Governor Ben Bernanke said

“One of the most striking features of the economic landscape over the past twenty years or so has been a substantial decline in macroeconomic volatility ...In the Really Bad scenario, we have passed the Great Moderation, and are currently sitting in the relative calm between Hurricane Hugo and the much larger Hurricane Andrew (3x Hugo), or the even larger Hurricane Katrina (6x Hugo).

I have argued today that improved monetary policy has likely made an important contribution not only to the reduced volatility of inflation (which is not particularly controversial) but to the reduced volatility of output as well. Moreover, because a change in the monetary policy regime has pervasive effects, I have suggested that some of the effects of improved monetary policies may have been misidentified as exogenous changes in economic structure or in the distribution of economic shocks. This conclusion on my part makes me optimistic for the future, because I am confident that monetary policymakers will not forget the lessons of the 1970s.”

In our Really Bad scenario, there isn’t enough collateral to cover the gross market values. If collateral was required on all positions of all traders and the market values reached 3x their 2008 values, gross market value would be about $100 trillion dollars. That would exceed all sovereign debt, all corporate debt and all outstanding equities. However, even in a dysfunctional market, there is a lot of netting.

There might not be enough collateral even if netting. In recent years, the ratio of “gross credit exposure” to “gross market value” has been about 14-22% (BIS data). Let’s say that there is a need for a maximum of $20 trillion of collateral given the net positions. While there is probably enough collateral worldwide to cover $20 trillion, it would undoubtedly move market prices for acceptable assets. It would also be difficult to buy or borrow that much in a short time period.

It’s not just collateral. During a crisis, huge amounts of money would be changing hands. Many interest rate and FX contracts would have their scheduled payments.

An estimate of OTC losses.

While this is not a market value estimate like Part 5A, in the Really Bad scenario, defaulted sovereigns, banks, and other counterparties might find themselves unable to make a substantial part of their payments, or provide collateral. The IMF has discussed “the systemic risk associated with cascading counterparty failures” in Making Over-the-Counter Derivatives Safer.

Despite some large efforts by academics, governments, and others to estimate stress case losses, there are a myriad of modeling issues and choices. For the Really Bad scenario, I use a similar assumption to the losses on sovereign bonds. 45% of the counterparties have problems providing collateral or making their derivative payments as due. Losses to their counterparties are 50-69% of what is owed. That results in another $4.5 to $9.0 trillion of losses on interest rates and FX, and $0.5 to 1.0 trillion on CDS. So far, we’re at $12.5 to 20.5 trillion of losses in the Really Bad scenario

Such large losses require that in addition to the sovereigns themselves, a number of large OTC traders would default. The largest traders include banks and other institutions which have already received government rescues or substantial additional capital from governments. The Really Bad scenario assumes that solvent governments do not cover, or cannot cover, many of those traders’ OTC losses. Nouriel Roubini and Michael Pettis have interesting views on this. Due to OTC losses and direct losses on sovereign bonds, in our Really Bad scenario many of those firms would be in bankruptcy, conservatorship, receivership, or liquidation. As a result, massive changes would occur in the OTC market, and financial systems as a whole.

What can be done? Can we just print money? Turn unacceptable collateral into acceptable? Issue IOUs? Can governments change the terms of the OTC contracts? How about austerity, would that help?

Those are in Part 5C. Some Policy Options, Good and Bad. Financial institutions, governments, and central banks can be creative in a crisis. We will look at some previous actions during crises, and some proposals.

Note from Some Investor Guy: I appreciate everyone’s comments on each thread, they help to improve the series as it goes. CR Note: thanks to Some Investor Guy - this series has add over 100,000 visits to CR.

Full Disclosure: Some Investor Guy owns no credit default swaps, interest rate derivatives, or FX contracts. This series is not investment advice nor an offer to buy or sell anything. Unless cited to other sources, opinions are the author’s. Like just about any other analyst, he could be wrong. He might be right, but he is not psychic. He is not a regulator, nor is he running for any elected office. If a regulator or researcher wants to talk about the series, email CR. He will forward it to Some Investor Guy.

CR Note: This is from "Some investor guy".

Series:

• Part 1: How Large is the Outstanding Value of Sovereign Bonds?

• Part 2. How Often Have Sovereign Countries Defaulted in the Past?

• Part 2B: More on Historic Sovereign Default Research

• Part 3. What are the Market Estimates of the Probabilities of Default?

• Part 4. What are Total Estimated Losses on Sovereign Bonds Due to Default?

• Part 5A. What Happens If Things Go Really Badly? $15 Trillion of Sovereign Debt in Default

• Part 5B. Part 5B. What Happens If Things Go Really Badly? More Things Can Go Badly: Credit Default Swaps, Interest Swaps and Options, Foreign Exchange

• Part 5C. Some Policy Options, Good and Bad

• Part 5D. European Banks, What if Things Go Really Badly?

Friday, July 23, 2010

Unofficial Problem Bank List at 792 Institutions

by Calculated Risk on 7/23/2010 11:46:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for July 23, 2010.

Changes and comments from surferdude808:

Failed banks led to a reduction in the Unofficial Problem Bank List this week. The list stands at 792 institutions with aggregate assets of $409.3 billion.

There were seven removals because of failure including Crescent Bank and Trust Company ($1.0 billion), Sterling Bank ($408 million), Home Valley Bank ($258 million Ticker: HVYB), SouthwestUSA Bank ($214 million), Williamsburg First National Bank ($139 million), Community Security Bank ($109 million), and Thunder Bank ($33 million).

There were three additions this week including Metro United Bank, San Diego, CA ($463 million Ticker: MCBI); Bank VI, Salinas, KS ($98 million); and American Loan and Savings Association, Hannibal, MO ($6 million). The other change is a Prompt Corrective Action Order issued by the Federal Reserve against Pacific State Bank ($323 million Ticker: PSBC).

While the FDIC was busy closing some problem institutions, they did not release their enforcement actions for June as we had anticipated they would. Look for it next week.

Bank Failure #103: Home Valley Bank, Cave Junction, Oregon

by Calculated Risk on 7/23/2010 09:17:00 PM

Home Valley, led through shadows

They have much to fear

by Soylent Green is People

From the FDIC: South Valley Bank & Trust, Klamath Falls, Oregon, Assumes All of the Deposits of Home Valley Bank, Cave Junction, Oregon

As of March 31, 2010, Home Valley Bank had approximately $251.80 million in total assets and $229.6 million in total deposits.That makes 7 today ...

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $37.1 million. ... Home Valley Bank is the 103rd FDIC-insured institution to fail in the nation this year, and the second in Oregon. The last FDIC-insured institution closed in the state was Columbia River Bank, The Dalles, on January 22, 2010.