by Calculated Risk on 4/23/2010 11:38:00 PM

Friday, April 23, 2010

Unofficial Problem Bank List April 23, 2010

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 23, 2010.

Changes and comments from surferdude808:

Bank closings dictated many changes to the Unofficial Problem Bank List this week. The failures in Illinois -- Amcore Bank, National Association ($3.8 billion), Broadway Bank ($1.2 billion), New

Century Bank ($510 million), Wheatland Bank ($437 million), Lincoln Park Savings Bank ($205 million), Peotone Bank and Trust Company ($136 million), and Citizens Bank and Trust Company of Chicago ($77 million) -- removed seven banks and $6.3 billion of assets.

Another removal this week was Paragon Bank & Trust ($107 million), a subsidiary of Capitol Bancorp (Ticker: CBC), which merged with its affiliate Michigan Commerce Bank that is also subject to a formal action. There were four additions this week including Sun National Bank, Vineland, NJ ($3.6 billion Ticker: SNBC); Great Florida Bank, Coral Gables, FL ($1.8 billion Ticker: GFLB); Central Virginia Bank, Powhatan, VA ($472 million Ticker: CVBK); and The Bank of Currituck, Moyock, NC ($197 million).

The net of these changes result in the Unofficial Problem Bank List having 694 institutions with aggregate assets of $366.1 billion. Other changes include the termination of the Prompt Corrective Action against Heritage Bank, Topeka, KS, and a name change for AmericasBank to CFG Community Bank. Next week, we look for the FDIC to release its new actions for March 2010.

Bank Failures #55 - 57: More Illinois

by Calculated Risk on 4/23/2010 08:12:00 PM

Good banks are few, far between

Even less so now

by Soylent Green is People

From the FDIC: Northbrook Bank and Trust Company, Northbrook, Illinois, Assumes All of the Deposits of Lincoln Park Savings Bank, Chicago, Illinois

As of December 31, 2009, Lincoln Park Savings Bank had approximately $199.9 million in total assets and $171.5 million in total deposits....From the FDIC: First Midwest Bank, Itasca, Illinois, Assumes All of the Deposits of Peotone Bank and Trust Company, Peotone, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $48.4 million.... Lincoln Park Savings Bank is the 55th FDIC-insured institution to fail in the nation this year, and the eighth in Illinois. The last FDIC-insured institution closed in the state was New Century Bank, Chicago, earlier today.

As of December 31, 2009, Peotone Bank and Trust Company had approximately $130.2 million in total assets and $127.0 million in total deposits. ...From the FDIC: Wheaton Bank & Trust, Wheaton, Illinois, Assumes All of the Deposits of Wheatland Bank, Naperville, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $31.7 million. ... Peotone Bank and Trust Company is the 56th FDIC-insured institution to fail in the nation this year, and the ninth in Illinois. The last FDIC-insured institution closed in the state was Lincoln Park Savings Bank, Chicago, earlier today.

As of December 31, 2009, Wheatland Bank had approximately $437.2 million in total assets and $438.5 million in total deposits. ...Seven in Illinois today ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $133.0 million. ... Wheatland Bank is the 57th FDIC-insured institution to fail in the nation this year, and the tenth in Illinois. The last FDIC-insured institution closed in the state was Peotone Bank and Trust Company, Peotone, earlier today.

Bank Failures #51 -54: Illinois

by Calculated Risk on 4/23/2010 07:13:00 PM

Feds round up gangster-banksters

So much deja-vu

by Soylent Green is People

From the FDIC: Harris National Association, Chicago, Illinois, Assumes All Of The Deposits Of Amcore Bank, National Association, Rockford, Illinois

As of December 31, 2009, Amcore Bank, National Association had approximately $3.8 billion in total assets and $3.4 billion in total deposits....From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All Of The Deposits Of Broadway Bank, Chicago, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $220.3 million. .... Amcore Bank, National Association is the 51st FDIC-insured institution to fail in the nation this year, and the fourth in Illinois. The last FDIC-insured institution closed in the state was Bank of Illinois, Normal, on March 3, 2010.

As of December 31, 2009, Broadway Bank had approximately $1.2 billion in total assets and $1.1 billion in total deposits. ...From the FDIC: Republic Bank Of Chicago, Oak Brook, Illinois, Assumes All Of The Deposits Of Citizens Bank&Trust Company Of Chicago, Chicago, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $394.3 million. ... Broadway Bank is the 52nd FDIC-insured institution to fail in the nation this year, and the fifth in Illinois. The last FDIC-insured institution closed in the state was Amcore Bank, National Association, Rockford, earlier today.

As of December 31, 2009, Citizens Bank&Trust Company of Chicago had approximately $77.3 million in total assets and $74.5 million in total deposits....From the FDIC: MB Financial Bank, National Association, Chicago, Illinois, Assumes All Of The Deposits Of New Century Bank, Chicago, Illinois

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $20.9 million. ... Citizens Bank&Trust Company of Chicago is the 53rd FDIC-insured institution to fail in the nation this year, and the sixth in Illinois. The last FDIC-insured institution closed in the state was Broadway Bank, Chicago, earlier today.

As of December 31, 2009, New Century Bank had approximately $485.6 million in total assets and $492.0 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $125.3 million..... New Century Bank is the 54th FDIC-insured institution to fail in the nation this year, and the seventh in Illinois. The last FDIC-insured institution closed in the state was Citizens Bank&Trust Company of Chicago, Chicago, earlier today.

Rating Agency Testimony: "Must say yes" to Wall Street

by Calculated Risk on 4/23/2010 03:34:00 PM

From Kevin Hall at McClatchy Newspapers: Executives testify: Bond-rating agencies corrupted themselves

Testifying under oath before the Senate Permanent Subcommittee on Investigations, officials who were closely involved in giving investment-grade ratings to complex financial instruments backed by shaky U.S. mortgages described how they were pressured to give Wall Street what it wanted.The testimony is pretty amazing, but how is this being fixed?

...

Called to appear before the panel, Richard Michalek, a former Moody's vice president and senior credit officer, described the ratings process for deals that could bring more than $1 million in fees as a "must say yes" atmosphere.

Home Sales: Distressing Gap

by Calculated Risk on 4/23/2010 01:00:00 PM

First a comment on the seasonal adjustment ... on a Not Seasonally Adjusted (NSA) basis, the Census Bureau reported there were 38,000 new homes sold in March. That is up from 31,000 in March 2009.

Some (or all) of the increase was due to a one time event - the tax credit that expires in April. The Census Bureau doesn't know the number of homes sold due to the tax credit, so they report the Seasonally Adjusted Annual Rate (SAAR) assuming this is the underlying rate of sales. It isn't.

The April new home sales headline number will be distorted too, but the key is the actual underlying sales rate is much lower.

Note: remember the tax credit shows up in the new home sales numbers when the contract is signed (March and April), and in the existing home sales numbers when the transactions are closed (April through June).

The following graph shows existing home sales (left axis) and new home sales (right axis) through March. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The initial gap was caused by the flood of distressed sales. This kept existing home sales elevated, and depressed new home sales since builders couldn't compete with the low prices of all the foreclosed properties.

The spike in existing home sales last year was due primarily to the first time homebuyer tax credit. Notice that there was also a bump last year in new home sales from the tax credit.

We are seeing another bump this year with the expiration of the extension of the tax credit.

The second graph shows the same information as a ratio - new home sales divided by existing home sales - through March 2010. The ratio increased because the tax credit impacts new home sales first. I suspect this ratio will be at or near the all time low later this year.

The ratio increased because the tax credit impacts new home sales first. I suspect this ratio will be at or near the all time low later this year.

Eventually this ratio will return to the historical range of new home sales being around 15% to 20% of existing home sales. However it will probably take a number of years to return to a more normal market.

New Home Sales at 411K in March

by Calculated Risk on 4/23/2010 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 411 thousand. This is an increase from the revised rate of 324 thousand in February (revised from 308 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In March 2010, 38 thousand new homes were sold (NSA).

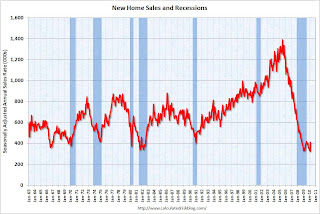

The record low for March was 31 thousand in 2009. The second graph shows New Home Sales vs. recessions for the last 45 years.

The second graph shows New Home Sales vs. recessions for the last 45 years.

Sales of new single-family houses in March 2010 were at a seasonally adjusted annual rate of 411,000 ... This is 26.9 percent (±21.1%) above the revised February rate of 324,000 and is 23.8 percent (±18.7%) above the March 2009 estimate of 332,000.And another long term graph - this one for New Home Months of Supply.

Months of supply declined to 6.7 in March from 8.6 in February. This is significantly below the all time record of 12.4 months of supply set in January 2009, but still higher than normal.

Months of supply declined to 6.7 in March from 8.6 in February. This is significantly below the all time record of 12.4 months of supply set in January 2009, but still higher than normal.The seasonally adjusted estimate of new houses for sale at the end of March was 228,000. This represents a supply of 6.7 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. New home sales are counted when the contract is signed, so this pickup in activity is probably related to the tax credit. Note that that a few thousand extra sales NSA in March can make a huge difference in the SAAR.

Any further pickup in sales because of the tax credit will happen in April and then sales will probably decline again.

Greece Asks for Bailout

by Calculated Risk on 4/23/2010 08:32:00 AM

From Niki Kitsantonis and Matthew Saltmarsh at the NY Times: Greece Calls for Activation of Financial Rescue Package

Describing his country’s economy as “a sinking ship,” the Greek prime minister formally requested an international bailout on Friday ... The plan foresees up to €30 billion, or $40 billion, in loans from Greece’s euro-zone partners, as well as up to €15 billion from the International Monetary Fund.Not exactly a surprise ...

Late Night Greece Update

by Calculated Risk on 4/23/2010 01:36:00 AM

From the WSJ: Bonds Fall as Investors View Bailout and Default as Givens

The European Union's statistical authority said Thursday that Greece's 2009 budget deficit—already yawning—was wider than Athens had estimated. Also Thursday, Moody's Investors Service downgraded Greece's debt rating.And from The Times: Euro suffers as Greek credit rating takes another dive

Those twin developments sent Greek bond prices into a tailspin, a selloff that spread to bond markets in Portugal and Spain.

The euro skidded to its lowest level against the dollar in almost a year last night after Greece suffered another downgrade in its credit rating.The never ending saga ...

...

Sarah Carlson, Moody’s senior analyst for Greece, said: “It is unlikely that the rating will remain at A3, unless the Government’s actions can restore confidence in the markets and counteract the prevailing headwinds of high interest rates and low growth.

Thursday, April 22, 2010

Senate Panel: Rating Agencies Traded Fees for Ratings

by Calculated Risk on 4/22/2010 07:05:00 PM

From Kevin G. Hall and Chris Adams at McClatchy Newspapers:

Senate panel: Ratings agencies rolled over for Wall Street

A Senate panel investigating the causes of the nation's financial crisis on Thursday unveiled evidence that credit-ratings agencies knowingly gave inflated ratings to complex deals backed by shaky U.S. mortgages because of the fees they earned for giving such investment-grade ratings.I'm stunned but not surprised ...

S&P Concerned about Seasonal Adjustment for House Prices

by Calculated Risk on 4/22/2010 04:45:00 PM

From S&P: S&P Issues Statement, Publishes Research on Seasonally-Adjusted Home Price Index Data(PDF)

Economic data which are affected by the time of the year, or the seasons, are often adjusted to remove these effects to make it easier to identify underlying changes in the economy. Seasonal adjustment increases the unadjusted values in weak months and decreases the unadjusted values in strong months to eliminate regular seasonal patterns while leaving the underlying trend unaffected. For the S&P/Case-Shiller Home Price Indices, S&P reports two data sets – before seasonal adjustment and seasonally-adjusted. In some recent reports the two series have given conflicting signals, with the seasonally-adjusted series rising month-over-month and the unadjusted series declining. After reviewing the data, the S&P/Case-Shiller Home Price Index Committee believes that, for the present, the unadjusted series is a more reliable indicator and, thus, reports should focus on the year-over-year changes where seasonal shifts are not a factor. Additionally, if monthly changes are considered, the unadjusted series should be used.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The Census X-12 program breaks down the unadjusted S&P/Case-Shiller Home Price index series into three components: trend, seasonal, and irregular. “Trend” represents the underlying trend in the data, “irregular” consists of changes with no apparent or regular pattern, and “seasonal” are the seasonal factors. Chart 2 shows the three series for the S&P/Case-Shiller Home Price 20-City Composite. The seasonal component shows the same regular pattern as on the first chart, and the trend shows the peak and subsequent drop in home prices. Beginning in January 2008, the irregular component became steadily larger. The increase in the size of the irregular component appears to be the cause of the increase in the seasonal factors ...Diana Olick mentioned this today: Even Good Housing Numbers Aren't Adding Up Right and the S&P note credits a recent note by David Rosenberg, chief economist at Gluskin Sheff. I first raised this issue in July 2009. The irregular components are just too large - and are apparently leading to a huge increase in the seasonal factors.