by Calculated Risk on 4/02/2010 08:43:00 AM

Friday, April 02, 2010

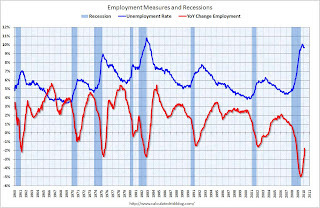

March Employment Report: 162K Jobs Added, 9.7% Unemployment Rate

From the BLS:

Nonfarm payroll employment increased by 162,000 in March, and the unemployment rate held at 9.7 percent, the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 162,000 in March. The economy has lost 2.3 million jobs over the last year, and 8.2 million jobs since the beginning of the current employment recession.

The unemployment rate was steady at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 48,000 (NSA) in March.

This was about at expectations given the level of Census 2010 hiring and some bounce back from the snow storms in February. I'll have much more soon ...

Note: I'll post a live chat with the BLS (starts at 9:30 AM ET), and more graphs around 10:30 AM ET.

Thursday, April 01, 2010

NY Times on Wage Garnishment

by Calculated Risk on 4/01/2010 11:54:00 PM

From John Collins Rudolf at the NY Times: Moves to Garnish Pay Rise as More Debtors Fall Behind (ht Ann)

One of the worst economic downturns of modern history has produced a big increase in the number of delinquent borrowers, and creditors are suing them by the millions.I'm surprised there isn't a move to rework the Orwellian-named "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". We definitely need a consumer financial protection agency. Look at this example from the Times story:

...

Bankruptcy can clear away most debts. Yet sweeping changes to federal law in 2005 — pushed by the banking lobby — complicated that process and more than doubled the average cost of filing, to more than $2,000. Many low-income debtors must save for months before they can afford to go broke.

Ruth M. Owens, a disabled Cleveland woman, was sued by Discover Bank in 2004 for an unpaid credit card. Ms. Owens offered a defense, sending a handwritten note to the court.

“After paying my monthly utilities, there is no money left except a little food money and sometimes it isn’t enough,” she wrote.

Robert Triozzi, a judge at the time, heard the case. He found that over a period of several years, Ms. Owens had paid nearly $3,500 on an original balance of $1,900. But Discover was suing her for $5,564, mostly for late fees, compound interest, penalties and other charges. He called Discover’s actions “unconscionable” and threw the case out.

NY Times: Hu Coming to D.C. suggests possible currency deal

by Calculated Risk on 4/01/2010 10:18:00 PM

From Vikas Bajaj at the NY Times: Coming Visit May Signal Easing by China on Currency

[T]he announcement by Chinese authorities on Thursday that President Hu Jintao will be visiting Washington in two weeks is being seen as the beginning of a possible easing of the friction over the renminbi.There is much more in the article, but I think it is unlikely that China will be named a currency manipulator on April 15th - and likely that China will allow their currency to appreciate.

China experts said it was unlikely that China would have agreed to the visit unless there was at least an informal assurance by the Treasury Department that it would not be named a currency manipulator either on or around April 15 — the deadline for the Obama administration to submit one of its twice-a-year reports on foreign exchange to Congress.

At the same time, economists say the visit, and other Chinese moves, suggest China is finally willing to let the renminbi increase in value.

Countdown: Fed MBS Purchase Program Complete

by Calculated Risk on 4/01/2010 06:14:00 PM

Just to complete the countdown, the NY Fed purchased an additional net $6.074 billion in MBS for the week ending March 31st. That puts the total purchases at $1.25 trillion ... and completes the program right on schedule.

The Fed's balance sheet today shows $1.074 trillion in MBS. As mentioned before, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles. The Fed's balance sheet will probably expand by $150+ billion over the next two months as the remaining contracts settle.

The spread between mortgage rates and treasuries widened slightly, from Bloomberg: Mortgage-Bond Yields That Guide Loan Rates Rise to 3-Month High.

Fannie Mae’s current-coupon 30-year fixed-rate mortgage bonds climbed 0.05 percentage point to 4.56 percent as of 5 p.m. in New York, the highest since Dec. 28, according to data compiled by Bloomberg.Oh boy, a 10 bps widening from the low! I expect the spread to widen slowly and push up mortgage rates a little (at least the spread between the Ten Year and the 30 Year fixed rate).

...

The difference between yields on Washington-based Fannie Mae’s securities and 10-year Treasuries widened for a third day, rising about 0.01 percentage point to 0.69 percentage point, Bloomberg data show.

That spread reached 0.59 percentage point on March 10, the lowest since at least 1984, as the Fed’s purchases of agency mortgage bonds approached their scheduled conclusion. The gap averaged 1.32 percentage points from 2000 through 2009.

On mortgage rates, Freddie Mac reported today:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.08 percent with an average 0.7 point for the week ending April 1, 2010, up from last week when it averaged 4.99 percent. Last year at this time, the 30-year FRM averaged 4.78 percent.

U.S. Light Vehicle Sales 11.8 Million SAAR in March

by Calculated Risk on 4/01/2010 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).

This is a 13.9% increase from the February sales rate. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Excluding August '09 (Cash-for-clunkers), this is the highest level since September 2008. The current level of sales are very low, and are at about the low point for the '90/'91 recession (even with a larger population now).

Most forecasts were for sales over 12 million (SAAR), so the sales rate is a little disappointing given all the incentive programs in March.

Hotel Occupancy Increases for 6th Straight Week

by Calculated Risk on 4/01/2010 02:25:00 PM

From HotelNewsNow.com: STR: Boston leads weekly numbers

Overall, the U.S. industry’s occupancy ended the week with a 5.9-percent increase to 59.9 percent, average daily rate dropped 1.6 percent to US$98.29, and RevPAR was up 4.2 percent to US$58.89.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The average occupancy rate for this week is close to 65% (during the 2004 to 2007 period), so the current 59.9% is still well below normal.

The lower than normal occupancy rate is still pushing down room rates (on a YoY basis) although revenue per available room (RevPAR) increased for the fourth straight week.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

General Motors: March sales increase 20.6% compared to March 2009

by Calculated Risk on 4/01/2010 11:17:00 AM

From MarketWatch: General Motors U.S. March sales rise 20.6%

This is based on a very easy comparison: in March 2009 U.S. light vehicle sales fell 35% to 9.69 million (SAAR) from 14.9 million (SAAR) in March 2008. The sharp decline last year was due to the financial crisis, the recession, and reports of the then impending bankruptcy of GM and Chrysler (Chrysler filed for bankruptcy at the end of April, 2009, GM filed for bankruptcy on June 1, 2009).

I'll add reports from the other major auto companies as updates to this post.

UDDATE 1: From MarketWatch: Ford March U.S. sales rise 39.8% to 183,783 units

UPDATE 2: From MarketWatch: Chrysler U.S. March sales fall 8.3% to 92,623

UPDATE 3: From MarketWatch: Toyota March U.S. sales grow by nearly 41%

NOTE: Once all the reports are released, I'll post a graph of the estimated total March sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for an increase to just over 12 million SAAR in March, from the 10.343 million SAAR in February.

Construction Spending Declines in February

by Calculated Risk on 4/01/2010 10:20:00 AM

Private residential construction spending has turned down again over the last few months. I expect some growth in residential spending in 2010, but the increases will probably be sluggish until the large overhang of existing inventory is reduced.

Private non-residential spending decreased in February, and is now at the lowest level since July 2006. The collapse in non-residential construction spending continues ...  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Private residential construction spending is now 62.9% below the peak of early 2006.

Private non-residential construction spending is 29.0% below the peak of late 2008. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 24.3% on a year-over-year (YoY) basis.

Residential construction spending is down 3.8% from a year ago, and the negative YoY change is getting smaller.

Residential spending will probably exceed non-residential spending later this year - mostly because of continued declines in non-residential spending as major projects are completed.

Here is the report from the Census Bureau: February 2010 Construction at $846.2 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during February 2010 was estimated at a seasonally adjusted annual rate of $846.2 billion, 1.3 percent below the revised January estimate of $857.8 billion. The February figure is 12.8 percent below the February 2009 estimate of $970.4 billion.

ISM Manufacturing Index Shows Expansion in March

by Calculated Risk on 4/01/2010 10:00:00 AM

PMI at 59.6% in March, up from 56.5% in February.

From the Institute for Supply Management: March 2010 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in March for the eighth consecutive month, and the overall economy grew for the 11th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading above 50 shows expansion.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the eighth consecutive month during March. The rate of growth as indicated by the PMI is the fastest since July 2004. Both new orders and production rose above 60 percent this month, closing the first quarter with significant momentum going forward. Although the Employment Index decreased 1 percentage point to 55.1 percent from February's reading of 56.1 percent, signs for employment in the sector continue to improve as the index registered a 10 percent month-over-month improvement, indicating that manufacturers are continuing to fill vacancies. The Inventories Index provided a surprise as it indicated growth for the first time following 46 months of liquidation — perhaps signaling manufacturers' willingness to increase inventories based on expected levels of activity."

...

ISM's Employment Index registered 55.1 percent in March, which is 1 percentage point lower than the seasonally adjusted 56.1 percent reported in February. This is the fourth consecutive month of growth in manufacturing employment. An Employment Index above 49.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added

This suggest the expansion in the manufacturing sector increased at a faster pace in March. This was above expectations.

Weekly Initial Unemployment Claims Decrease

by Calculated Risk on 4/01/2010 08:37:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 27, the advance figure for seasonally adjusted initial claims was 439,000, a decrease of 6,000 from the previous week's revised figure of 445,000. The 4-week moving average was 447,250, a decrease of 6,750 from the previous week's revised average of 454,000.

The advance number for seasonally adjusted insured unemployment during the week ending March 20 was 4,662,000, a decrease of 6,000 from the preceding week's revised level of 4,668,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,750 to 447,250.

The dashed line on the graph is the current 4-week average. The current level of 439,000 (and 4-week average of 447,250) is still high, and suggests continuing weakness in the jobs market. Note: There is no way to compare directly between weekly claims, and net payrolls jobs.