by Calculated Risk on 1/03/2010 09:16:00 AM

Sunday, January 03, 2010

Tourists in Foreclosureville

From Peter Goodman at the NY Times: Real Estate in Cape Coral, Fla., Is Far From a Recovery (ht Craig)

As we navigate this speculator’s paradise turned financial wasteland, Mr. Joseph stands at the front of the bus in a green polo shirt, highlighting specimens like this one: a white stucco house fronted by palm trees and topped by a Spanish tile roof on a canal emptying into the Gulf of Mexico. It last sold in 2005 for $850,000. Yours today for $273,000.Goodman takes us along on a foreclosure tour and provides a few anecdotes about the MESS.

Saturday, January 02, 2010

Cash Buyers Competing with First Time Home Buyers

by Calculated Risk on 1/02/2010 11:01:00 PM

From Dina ElBoghdady at the WaPo: Cash-rich real estate investors trigger bidding wars, frustrate other buyers

Investors have reemerged with brute force in the Washington region's real estate market over the past few months, triggering bidding wars in some neighborhoods teeming with foreclosed properties and hindering traditional home buyers ...We've been seeing a competition all year between cash flow investors and first time home buyers in California. This has pushed up prices in many low end distressed areas (but not all).

"What's happening in this area reflects what's happening in other parts of the country," said Sam Khater, senior economist at First American CoreLogic, which plans to release a report soon on all-cash deals. "In markets where price declines have been steep, we've seen quite a bit of competition between the low-end, first-time home buyers and investors."

...

"There are bidding wars out there. It's like the 2005 market but at discount prices," said Stella Barbour, a real estate agent at Jobin Realty in Northern Virginia.

Back in early 2005, I drew a couple of rough supply-demand diagrams viewing the bubble era speculative buying as storage. This pushed up prices during the bubble (removing properties from supply), and pushed down prices during the bust (forced selling added to the supply). Unlike those speculators, many of the current cash flow investors are probably happy with the return and won't be forced sellers. But they could become sellers in the future, limiting future appreciation.

And it is important to remember that the numbers don't work for investors in the mid-to-high end areas (the rent to price ratio is lower), so this competition is mostly in the low end areas - the same areas that attract first time home buyers.

These bidding wars should be setting off some alarm bells with regulators - not because of the cash flow investors, but because of the loose lending standards for FHA loans.

Krugman: CRISES

by Calculated Risk on 1/02/2010 08:18:00 PM

Here is Professor Krugman's presentation to the Allied Social Science Associations this coming Monday: CRISES

Krugman discusses several currency crises and compares them to the current U.S. deleveraging cycle. Here is an excerpt (picking up near the conclusion):

Plunging prices of houses and CDOs ... don’t produce any corresponding macroeconomic silver lining. ... This suggests that we’re unlikely to see a phoenix-like recovery from the current slump. How long should recovery be expected to take?

Well, there aren’t many useful historical models. But the example that comes closest to the situation facing the United States today is that of Japan after its late-80s bubble burst, leaving serious debt problems behind. And a maximum-likelihood estimate of how long it will take to recover, based on the Japanese example, is ... forever. OK, strictly speaking it’s 18 years, since that’s how long it has been since the Japanese bubble burst, and Japan has never really escaped from its deflationary trap.

This line of thought explains why I’m skeptical about the optimism that’s widespread right now about recovery prospects. The main argument behind this optimism seems to be that in the past, big downturns in the world’s major economies have been followed by fast recoveries. But past downturns had very different causes, and there’s no good reason to regard them as good precedents.

Living in a crisis-ridden world

Looking back at U.S. commentary on past currency crises, what’s striking is the combination of moralizing and complacency. Other countries had crises because they did it wrong; we weren’t going to have one because we do it right.

As I’ve stressed, however, crises often – perhaps usually – happen to countries with great press. They’re only reclassified as sinners and deadbeats after things go wrong. And so it has proved for us, too.

And despite the praise being handed out to those who helped us avoid the worst, we are not handling the crisis well: fiscal stimulus has been inadequate, financial support has contained the damage but not restored a healthy banking system. All indications are that we’re going to have seriously depressed output for years to come. It’s what I feared/predicted in that 2001 paper: “[I]ntellectually consistent solutions to a domestic financial crisis of this type, like solutions to a third-generation currency crisis, are likely to seem too radical to be implemented in practice. And partial measures are likely to fail.”

Maybe policymakers will become wiser in the future. Maybe financial reform will reduce the occurrence of crises: major financial crises were much rarer between the end of World War II and the rise of financial deregulation after 1980 than they were before or since. Meanwhile, however, the fact is that the economic world is a surprisingly dangerous place.

2010 Real Estate: Year of Auction or Short Sale?

by Calculated Risk on 1/02/2010 04:53:00 PM

Lauren Beale asks at the LA Times Money & Company blog: 2010: The year of the real estate auction?

Auctions gained traction in last year's down housing market as a way to sell real estate -- in all price ranges. It's a trend I expect to see more of in 2010, and not just for bank-owned homes.Ms. Beale features a high end home in her post (a very high end home!)

...

Why I'm expecting to see more auctions in the mainstream: It gives the seller a defined time frame; if the house doesn't meet the "reserved price" the seller had in mind, then it can be always listed later; and the idea is still novel enough that the marketing is an attention-grabber for the house.

I think short sales will be a huge story in 2010 with the recent push by the Obama Administration. And I also expect short sale fraud be to be huge story (related party sales, under the table payments to sellers, and more)

More Retail Vacancies Expected in 2010

by Calculated Risk on 1/02/2010 11:59:00 AM

From Roger Vincent at the LA Times: Retail space opens up as big chains shrink

Amid a still-tepid economic recovery, big retail chains are expected to continue closing their less productive stores and retrenching on expansion plans. But at the same time, others will be hurtling into the breach to take advantage of falling rents and vacancies in neighborhoods they couldn't get into a few years ago.The vacancy rate is expected to rise further in 2010, and this will continue to push down rents - leading to more distressed retail properties - and also less investment in Multimerchandise shopping structures.

"The prediction for next year is more re-sizing and relocating of retailers," said real estate broker Richard Rizika of CB Richard Ellis.

There are almost 100 empty big-box retail stores in Los Angeles County, according to a study by Rizika. They have a combined total of 4.5 million square feet, or about 78 football fields' worth of vacant space for rent or sale. Most of that came from liquidated businesses Circuit City Inc., Mervyns and home furnishings chain Linens 'n Things Inc.

Reis is expected to report the U.S. mall vacancy rate for Q4 next week. Reis reported in October that the strip mall vacancy rate hit 10.3% in Q3 2009; the highest vacancy rate since 1992.

"Our outlook for retail properties as a whole is bleak," Victor Calanog, Reis director of research, said. "Until we see stabilization and recovery take root in both consumer spending and business spending and hiring, we do not foresee a recovery in the retail sector until late 2012 at the earliest."

More Lost Decade

by Calculated Risk on 1/02/2010 08:43:00 AM

Another "Lost Decade" story, this time in the WaPo by Neil Irwin: Aughts were a lost decade for U.S. economy, workers

It was, according to a wide range of data, a lost decade for American workers. ...

There has been zero net job creation since December 1999. ... Middle-income households made less in 2008, when adjusted for inflation, than they did in 1999 ... And the net worth of American households ... has also declined when adjusted for inflation ...

Click on graph for WaPo page in new window.

Click on graph for WaPo page in new window.This graphic from the WaPo shows job growth by decade, change in GDP, and percent change in household wealth for every decade since 1940.

Hopefully the '10s will be much better.

Friday, January 01, 2010

HAMP Seen Hurting Housing

by Calculated Risk on 1/01/2010 09:15:00 PM

From Peter Goodman at the NY Times: U.S. Loan Effort Is Seen as Adding to Housing Woes

The Obama administration’s $75 billion program to protect homeowners from foreclosure has been widely pronounced a disappointment, and some economists and real estate experts now contend it has done more harm than good.The article covers a number of topics, but I think these are key:

... desperate homeowners have sent payments to banks in often-futile efforts to keep their homes, which some see as wasting dollars they could have saved in preparation for moving to cheaper rental residences. Some borrowers have seen their credit tarnished while falsely assuming that loan modifications involved no negative reports to credit agencies.

This probably leaves the homeowner far underwater (owing more than their home is worth). When these homeowners eventually try to sell, they will probably still face foreclosure - prolonging the housing slump. These are really not homeowners, they are debtowners / renters.

None of these programs is especially attractive, so I expect more delays and "can kicking" that will keep foreclosures elevated for years.More short sales. Short sale activity is already increasing, and the Treasury introduced the Foreclosure Alternatives Program to help with short sales and Deed-in-Lieu of Foreclosure transactions. However servicers are very afraid of short sale fraud (non-arm length transactions), and short sales are also distressed properties - pushing down prices - something Treasury is desperately trying to avoid. Encouraging servicers to write down principal. This would be very expensive, and if paid for by taxpayers - it would be very unpopular because it would appear to favor speculators over the prudent. This is what Mark Zandi, chief economist at Moody's economy.com is supporting: Mr. Zandi argues that the administration needs a new initiative that attacks a primary source of foreclosures: the roughly 15 million American homeowners who are underwater, meaning they owe the bank more than their home is worth.

...

Mr. Zandi proposes that the Treasury Department push banks to write down some loan balances by reimbursing the companies for their losses. ... “We want to overwhelm this problem,” he said. “If we do go back into recession, it will be very difficult to get out.”Converting homeowners to renters. This is something Dean Baker suggested, and is kind of a Single Family Public Housing program. This would avoid the flood of foreclosures, and the banks could sell the homes over several years.

WSJ: Five Key Housing Issues

by Calculated Risk on 1/01/2010 05:54:00 PM

Nick Timiraos at the WSJ writes: Five Key Housing Issues to Watch in 2010

Here is his list:

I reviewed the status of all these issues in Government Housing Support Update

Although all of these issues are important, I'd probably start from a different perspective:

1) What is the current supply situation and how will it be impacted in 2010?

2) What will happen to demand?

3) What will happen to prices?

As an example, the loan modifications and more loan recasts impact supply, whereas higher mortgage rates, tighter lending standards, and the end of the tax credit will all impact demand. I'll try to address these issues in a 2010 housing overview soon.

Impact of Census on Employment and Unemployment Rate

by Calculated Risk on 1/01/2010 01:02:00 PM

What will be the impact of the 2010 Census on employment? Click on graph for larger image in new window.

Click on graph for larger image in new window.

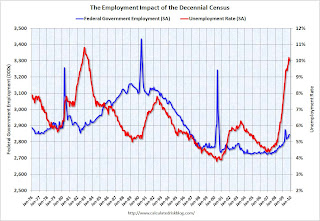

The first graph shows the impact of the decennial Census on Federal Government employment (Seasonally adjusted) and on the unemployment rate.

Note: left on right scales don't start at zero to better show the change.

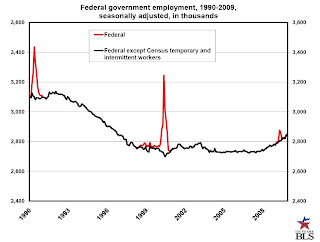

Every 10 years there is a large spike in Federal Government employment, but the Census has little impact on the unemployment rate. The second graph shows the monthly change in Federal government employment during the last two decennial census periods (1990 and 2000).

The second graph shows the monthly change in Federal government employment during the last two decennial census periods (1990 and 2000).

There was a surge in payroll employment in March, April and especially in May. And then almost all of the jobs were lost in the June through September period. We should expect a similar pattern this year.

Note: there are reports that the Census Bureau will hire up to 1.4 million people, however that represents some contingency planning, and includes a number of people already hired temporarily in 2009. We can probably expect a couple hundred thousand people added between January through April, and another 500 thousand or so in May. This could push the unemployment rate down slightly, but probably in the 0.1% to 0.2% range. The BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

The BLS provides a monthly report of Census hiring. This graph is from the BLS report and shows the historical impact of the Census on Federal Government employment.

There was a small spike in employment in April 2009, and currently the decennial census has little impact on employment. This will be something to check every month - especially from March through September.

Chicago PMI revised down, Treasury makes final TARP Bank Investments

by Calculated Risk on 1/01/2010 09:53:00 AM

A couple of stories that I missed yesterday ...

Dow Jones reports that the Chicago Institute for Supply Management revised down the Chicago PMI to 58.7 on Thursday from the announced reading of 60.0 on Wednesday. The most significant change was to the employment index that now shows contraction at 47.6 compared to the announced 51.2.

And the WSJ reports that the Treasury announced they made their final TARP investment in a bank: Treasury Ends TARP Bank Investments (ht jb)

The U.S. Treasury this week officially ended the bank recapitalization portion of its Troubled Asset Relief Program. ... A Treasury spokesman said [10 small banks] would be the last to receive capital under the effort ...