by Calculated Risk on 12/02/2009 12:44:00 AM

Wednesday, December 02, 2009

FHA to Ask Congress for Changes

From Diani Olick at CNBC: FHA to Toughen Mortgage Rules in Lenders Crackdown (ht Brad)

... the Federal Housing Administration is proposing new rules to crack down on lenders and asking Congress for the authority to raise certain borrower requirements ... Those steps will include raising minimum borrower FICO scores, requiring larger down payments, and reducing the maximum permissible seller concession from six percent currently to three percent.These proposals are similar to what Kenneth Harney outlined in the San Francisco Chronicle ten days ago: FHA looking for ways to pump up its reserves. Harney suggested the FHA was looking at four possibilities:

It could also include raising up-front and/or annual insurance premiums, which would require Congressional authority. This is according to the testimony HUD Secretary Shaun Donovan is scheduled to present to the House Financial Services Committee on Wednesday afternoon, obtained by CNBC.

Currently, FHA charges an "up-front" mortgage insurance premium of 1.75 percent of the loan amount. Most borrowers roll that into their loan and finance it. FHA also charges an annual premium, paid in monthly installments, of either 0.5 percent or 0.55 percent, depending on the down payment. To rebuild reserves, FHA could ... raise the up-front premium to 2 percent or as high as the current statutory maximum of 2.25 percent. It could also raise the annual fee...

FHA is by far the most lenient and flexible player when it comes to evaluating applicants' creditworthiness.

Tuesday, December 01, 2009

Leonhardt on Long Term PEs

by Calculated Risk on 12/01/2009 10:04:00 PM

From David Leonhardt at the NY Times Economix: Stocks Start Looking Dear Again

Over the last few years, I’ve come to know and trust a version of the price-earnings ratio preferred by the economists Robert Shiller and John Campbell. It is based on an average of the past 10 years’ worth of corporate earnings, rather than just the past year (or a forecast of the next year’s earnings).And from the earlier piece:

...

What does the ratio say today? That perhaps the recent rally has gone a bit too far.

...

You can read more about the history of this ratio, including the role played by the well-known Benjamin Graham and David Dodd, in this column from 2007, back when the bull market was still raging.

Benjamin Graham and David L. Dodd ... argued that P/E ratios should not be based on only one year’s worth of earnings. It is much better, they wrote in “Security Analysis,” to look at profits for “not less than five years, preferably seven or ten years.”Just some ideas for discussion ...

The Impact of Stimulus on GDP

by Calculated Risk on 12/01/2009 07:01:00 PM

The CBO released a new report today: Estimated Impact of the American Recovery and Reinvestment Act on Employment and Economic Output as of September 2009. Here is their estimate of the impact on GDP:

[The] CBO estimates that in the third quarter of calendar year 2009 ... real (inflation-adjusted) gross domestic product (GDP) was 1.2 percent to 3.2 percent higher, than would have been the case in the absence of ARRA. Those ranges are intended to reflect the uncertainty of such estimates and to encompass most economists’ views on the effects of fiscal stimulus.At both extremes of the range, the economy would still be in recession without the stimulus (note: the BEA reported that GDP grew "at an annual rate of 2.8 percent in the third quarter of 2009" or about 0.7% for the quarter).

This is significant looking forward. The stimulus probably had the peak impact on GDP growth in Q3, and the positive contribution will diminish over the next few quarters. Without a pickup in end demand, the economy could slide back into recession next year.

Professor Krugman issued a Double Dip Warning today:

I’ve never been fully committed to the notion that we’re going to have a “double dip” — that the economy will slide back into recession. But it has been clear for a while that it’s a serious possibility, for two reasons. First, a large part of the growth we’ve had has been driven by the stimulus — but the stimulus has already had its maximum impact on the growth of GDP, will hit its maximum impact on the level of GDP in the middle of next year, and then will begin to fade out. Second, the rise in manufacturing production is to a large extent an inventory bounce — and this, too, will fade out in the quarters ahead.

...

I’d be more sanguine about all of this if there were any indications that private, final demand is taking off — consumers, business investment, whatever. But I haven’t seen anything suggesting that sort of thing.

The chances of a relapse into recession seem to be rising.

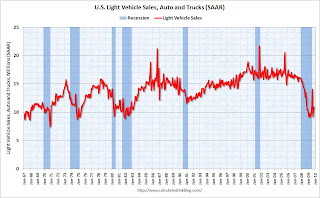

Light Vehicle Sales 10.9 Million SAAR in November

by Calculated Risk on 12/01/2009 03:52:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 10.93 million SAAR from AutoData Corp). The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding July and August, this was the strongest month since October 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are below the lowest point for the '90/'91 recession (even with a larger population).

ISM and Manufacturing Employment

by Calculated Risk on 12/01/2009 02:45:00 PM

From the ISM Manufacturing report on employment:

ISM's Employment Index registered 50.8 percent in November, which is 2.3 percentage points lower than the 53.1 percent reported in October. This is the second month of growth in manufacturing employment following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.The following graph shows the ISM Manufacturing Employment Index vs. the BLS reported monthly change in manufacturing employment (as a percent of manufacturing employment).

The graph includes data from 1948 through 2009. The earlier period (1948 - 1988) is in red, and the last 20 years is in green. The blue diamond is for last month (manufacturing employment fell in October even though the ISM employment Index was at 53.1 percent).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Clearly the ISM employment index is related to changes in BLS employment, however the relationship is noisy, and it appears a reading above 52 for the ISM employment index is consistent with an increase in the BLS data for manufacturing.

Although there is significant variability, the current level of 50.8 percent in November suggests further manufacturing job losses.

Ford: U.S. November Sales Flat

by Calculated Risk on 12/01/2009 12:02:00 PM

From MarketWatch: Ford U.S. Nov. sales flat at 123,167 units

Update: CNBC is reporting Ford Motor November US Sales Rise 8.6% on an Adjusted Basis

UPDATE2:

This is a comparison to Nov 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows total U.S. light vehicle sales (seasonally adjusted annual rate) from the BEA since Jan 2006.

Sales declined sharply in Oct 2008, and fell further in November. On a year-over-year basis light vehicle sales declined slightly in October (Blue labels and arrow), but the comparison is easier for November (red data label for November 2008).

So the Ford numbers seem disappointing.

Once all the reports are released, I'll post a graph of the estimated total November sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET.

ISM Manufacturing Index shows Slower Expansion in November

by Calculated Risk on 12/01/2009 10:30:00 AM

PMI at 53.6 in November, down from 55.7% in October.

From the Institute for Supply Management: November 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in November for the fourth consecutive month, and the overall economy grew for the seventh consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading above 50 shows expansion.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the fourth consecutive month in November. While the rate of growth slowed when compared to October, the signs are still encouraging for continuing growth as both new orders and production are still at very positive levels, and the Prices Index fell 10 points, signaling less inflationary pressure on manufacturers' costs. Overall, the recovery in manufacturing is continuing, but many are still struggling based on their comments."

...

Manufacturing growth decelerated in November as the PMI registered 53.6 percent, a decrease of 2.1 percentage points when compared to October's reading of 55.7 percent. This continues the recovery in the sector, but at a slower rate of growth. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

ISM's Employment Index registered 50.8 percent in November, which is 2.3 percentage points lower than the 53.1 percent reported in October. This is the second month of growth in manufacturing employment following 14 consecutive months of decline. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added

Construction Spending Flat in October

by Calculated Risk on 12/01/2009 10:00:00 AM

We started the year looking for two key construction spending stories: a likely bottom for residential construction spending, and the collapse in private non-residential construction.

It appears residential construction spending may have bottomed, although any growth in spending will probably be sluggish until the large overhang of existing inventory is reduced.

And the collapse in non-residential construction spending continues, and there will be further declines as projects are completed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending increased in October, and nonresidential spending continued to decline.

Private residential construction spending is now 63% below the peak of early 2006.

Private non-residential construction spending is 20.6% below the peak of last October.  The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 20.6% on a year-over-year basis.

Residential construction spending is still off 23.6% from a year ago, although the negative YoY change will get smaller going forward.

Here is the report from the Census Bureau: October 2009 Construction at $910.8 Billion Annual Rate

Treasury Guidance on Short Sales

by Calculated Risk on 12/01/2009 08:39:00 AM

UPDATE: Here is the document (pdf): Introduction of Home Affordable Foreclosure Alternatives – Short Sale and Deed-in-Lieu of Foreclosure

From Reuters: Treasury sets guidance to simplify "short sales" (ht Anthony)

Here are the basics of the Home Affordable Foreclosure Alternatives Program financial incentives for completing short sales or a deed-in-lieu transaction:

Dubai's Structured Debt

by Calculated Risk on 12/01/2009 12:07:00 AM

Ok, one more post on Dubai before all the U.S. economic news this week ...

A couple of articles from the NY Times: Dubai Crisis Tests Laws of Islamic Financing

Shariah-compliant investments prohibit lenders from earning interest, and effectively place lenders and borrowers into a form of partnership. Yet there are no consistent rules about who gets repaid first if a company defaults on such debt, said Zaher Barakat, a professor of Islamic finance at Cass Business School in London.And Andrew Ross Sorkin describes a recent trip to Dubai: A Financial Mirage in the Desert

One discussion was led by a British banker from Barclays who had moved to the region to create an entire Shariah-compliance team. He shared tips about various ways to create “structured products” that would pass muster with Muslim investors. (To me, the investments looked like bonds, walked like bonds and talked like bonds — but he never called them that.) Some of the bonds that Dubai World is in jeopardy of defaulting on, by the way, are Shariah-compliant sukuk. Just don’t call them bonds.Oh great, more "structured products".