by Calculated Risk on 8/27/2009 11:57:00 AM

Thursday, August 27, 2009

Report: Car Sales Slump 11% Below June Levels

From the Financial Times: ‘Cash-for-clunkers’ sales disappoint Detroit (ht James)

[S]igns are already emerging that overall sales will fall back sharply now that the incentives have expired.It now appears that sales in August were at about a 16 million SAAR (auto sales for August will be released next week).

...

[Edmunds.com] estimates that, based on visits to its websites, “purchase intent” is down 11 per cent from the average in June ...

excerpted with permission

This follows an 11.22 million SAAR in July. The Cash-for-clunkers program started on July 24th.

If sales in September are 11% below June - that would put sales at under 9 million SAAR - the lowest sales for this cycle, and perhaps at the lowest rate since the early '70s. Of course the program just ended, but it will be interesting to see how much Cash-for-Clunkers cannibalized future sales.

FDIC Q2 Banking Profile: 416 Problem Banks, $3.7 Billion Net Loss

by Calculated Risk on 8/27/2009 10:00:00 AM

The FDIC released the Q2 Quarterly Banking Profile today. The FDIC listed 416 banks with $299.8 billion in assets as “problem” banks in Q2, up from 305 banks with $220.0 billion in assets in Q1, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 391 problem banks - and will probably increase this week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of FDIC insured "problem" banks since 1990.

The 416 problem banks reported at the end of Q2 is the highest since 1993.

There has been some concern that the FDIC has been slow to add banks to the problem list - and a number of failed banks were apparently never on the official list. The second graph shows the assets of "problem" banks since 1990.

The second graph shows the assets of "problem" banks since 1990.

The assets of problem banks are the highest since 1993.

And the banking industry posted a net loss for the quarter:

Burdened by costs associated with rising levels of troubled loans and falling asset values, FDIC-insured commercial banks and savings institutions reported an aggregate net loss of $3.7 billion in the second quarter of 2009. Increased expenses for bad loans were chiefly responsible for the industry’s loss. Insured institutions added $66.9 billion in loan-loss provisions to their reserves during the quarter, an increase of $16.5 billion (32.8 percent) compared to the second quarter of 2008. Quarterly earnings were also adversely affected by writedowns of asset-backed commercial paper, and by higher assessments for deposit insurance.On the Deposit Insurance Fund:

On June 30, 2009, a special assessment was imposed on all insured banks and thrifts. For 8,106 institutions, with assets of $9.3 trillion, the special assessment was 5 basis points of each institution’s assets minus Tier 1 capital; 89 other institutions, with assets of $4.0 trillion, had their special assessment capped at 10 basis points of their second quarter assessment base.

The Deposit Insurance Fund (DIF) decreased by $2.6 billion (20.3 percent) during the second quarter to $10.4 billion (unaudited). Accrued assessment income from the regular and the special assessment increased the fund by $9.1 billion. Interest earned, combined with realized gains on securities and debt guarantee surcharges from the Temporary Liquidity Guarantee Program added $1.1 billion to the fund. Unrealized losses on available-for-sale securities combined with operating expenses reduced the fund by $1.3 billion.

The reduction in the DIF was primarily due to an $11.6 billion increase in loss provisions for bank failures. Twenty-four insured institutions with combined assets of $26.4 billion failed during the second quarter of 2009, the largest number of quarterly failures since the fourth quarter of 1992, when 42 insured institutions failed. For 2009 through the end of the second quarter, 45 insured institutions with combined assets of $35.9 billion failed at an estimated current cost to the DIF of $10.5 billion.

The DIF’s reserve ratio was 0.22 percent on June 30, 2009, down from 0.27 percent at March 31, 2009, and 1.01 percent one year ago. The June figure is the lowest reserve ratio for the combined bank and thrift insurance fund since March 31, 1993, when the reserve ratio was 0.06 percent.

Weekly Unemployment Claims: Still Very High

by Calculated Risk on 8/27/2009 08:30:00 AM

The DOL reports weekly unemployment insurance claims decreased to 570,000:

In the week ending Aug. 22, the advance figure for seasonally adjusted initial claims was 570,000, a decrease of 10,000 from the previous week's revised figure of 580,000. The 4-week moving average was 566,250, a decrease of 4,750 from the previous week's revised average of 571,000.

...

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 15 was 6,133,000, a decrease of 119,000 from the preceding week's revised level of 6,252,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 4,750 to 566,250, and is now 92,500 below the peak in April. It appears that initial weekly claims have peaked for this cycle.

The number of initial weekly claims is still very high (at 570,000), indicating significant weakness in the job market. The four-week average of initial weekly claims will probably have to fall below 400,000 before the total employment stops falling.

Report: Mortgage Delinquencies increase in July

by Calculated Risk on 8/27/2009 12:16:00 AM

From Reuters: U.S. mortgage delinquencies up in July: Equifax

Among U.S. homeowners with mortgages, a record 7.32 percent were at least 30 days late on payments in July, up from about 4.5 percent a year earlier and 7.23 percent in June, according to monthly data from the Equifax credit bureau.There numbers aren't directly comparable to the MBA quarterly numbers, but this shows that delinquencies are still rising.

Wednesday, August 26, 2009

New Hampshire: The Clunker State

by Calculated Risk on 8/26/2009 07:56:00 PM

From the DOT: Cash for Clunkers Stats

Number Submitted: 690,114This should push light vehicle sales to about 16 million (SAAR) in August. Of course the real question is what happens in September.

Dollar Value: $2,877.9M

Darn - Floyd Norris beat me to it, but my table is sortable.

Using the Census Bureau population estimates, here is a table of dollars per person.

New Hampshire is the "Clunker State" by 'Dollars per person'. What happened in D.C.? No one wanted a new car? (UPDATE: several people told me almost everyone in D.C. buys cars in Virginia or Maryland)

NOTE: Columns are sortable - click on column headers: State (includes territories), Clunker dollars, Population, Dollars per person.

FDIC Lowers Qualifications for Failed Bank Acquisitions

by Calculated Risk on 8/26/2009 05:48:00 PM

From Bloomberg: FDIC Sets Standards for Private-Equity Firms to Buy Shut Banks (ht Anthony)

The Federal Deposit Insurance Corp. approved guidelines for private-equity firms to buy failed banks ... agreeing to lower to 10 percent from the proposed 15 percent the Tier 1 capital ratio private-equity investors must maintain after buying a bank.From the FDIC: Attachment: Final Statement of Policy of Qualifications for Failed Bank Acquisitions

As a reminder, the deadline for Corus Bank bids is reported to be next week. So this is just in time.

Also, the Q2 FDIC Quarterly Banking Profile will probably be released tomorrow AM (including stats on the Deposit Insurance Fund and the number of problem banks at the end of Q2).

Misc: ARMs, Mortgage Fraud, End of Tax Credits, and more

by Calculated Risk on 8/26/2009 03:59:00 PM

From the NY Times: Adjustable Mortgages Loom as Threat to Housing Recovery

(ht Shnaps, Ann)

When Harvey Clavon took out an exotic mortgage to refinance his home in Santa Clarita, Calif., three years ago, he thought he knew what he was doing.What a surprise!

Mr. Clavon, 63, was planning to sell the home in a few years and retire to Palm Springs. So he got a loan called an option adjustable rate mortgage, or option ARM, which allowed him the option of paying less than the interest for the first five years.

On his annual salary of $100,000 as a television camera operator, he could afford the $2,200 initial mortgage payments. And he would sell the home before the mortgage reset.

...

Mr. Clavon made only minimum payments on his mortgage, his balance has risen to $680,000 from $618,000, on a house worth closer to $400,000.

And the article also has a quote from the Shnapster's friend Ted Jadlos on Option ARMs!

“Everyone’s been focused on subprime, but we’re more concerned about this,” said Todd Jadlos, managing director of LPS Applied Analytics ... “By the time subprime defaults had increased 200 percent, in June and July of 2007, option ARMs had gone up 400 percent. People just didn’t notice because the overall numbers weren’t as high.”And some more mortgage fraud news: Task Force Cracks Mortgage Fraud Case Involving 453 Homes

Ohio Attorney General Richard Cordray and Cuyahoga County Prosecutor Bill Mason today announced details of an 18-month investigation that led to indictments against 41 people and four companies. The defendants are alleged to have engaged in real estate transactions to purchase 453 homes with fraudulent loans totaling $44 million. ...Hey, almost 100 homes in this scheme are not in foreclosure!

The scheme involved using straw buyers to purchase homes, falsely claiming home improvements were performed on houses in order to refinance them, and then selling houses to unqualified buyers with the assistance of real estate agents, mortgage brokers and title companies.

Lenders were tricked into believing that the buyers were making at least a 10% down payment when they were not, that the buyers had assets when they did not, and that the properties were worth more than they actually were. [Defendants] defrauded lenders through loan application fraud, down payment fraud and loan distribution fraud. The defendants siphoned off more than $31 million in profits from their criminal enterprise. Eventually, 358 of the homes fell into foreclosure.

As tax breaks expire, home sales decline ... from Reuters: California tax credit expires, home permits sink

Homebuilding permits filed in California in July fell significantly from June as a state tax credit for buyers of new homes expired ...Just imagine what will happen when the $8K first-time home buyer tax credit expires.

The tax credit offered earlier this year pulled homebuyers from the sidelines back into the state's beleaguered market for new homes but they have retreated since the incentive lapsed last month.

"Our homebuilders reported a significant drop in traffic last month, largely due to the state closing the window on the homebuyer tax credit," said Robert Rivinius, president and chief executive of the California Building Industry Association.

He noted the state government stopped taking applications for the $10,000 new-home credit at the beginning of July.

"Activity stopped as quickly as it started, which is bad news for housing and the broader economy," Rivinius said.

emphasis added

And a preview for BFF: Sioux City Bank at Risk of Failing

Vantus Bank, based in Sioux City, is at risk of failing because of the recession and rising bad loans.

Federal regulators have told the bank, which has 13 locations in Iowa, that its plan to increase its capital was unacceptable. According to a filing with the U.S. Securities and Exchange Commission, it must be sold or liquidated by Sept. 30.

Truck Tonnage Index Increased 2.1 Percent in July

by Calculated Risk on 8/26/2009 02:15:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Rose 2.1 Percent in July Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index increased 2.1 percent in July. In June, SA tonnage fell 2.4 percent. July’s gain, which raised the SA index to 101.9 (2000=100), wasn’t large enough to completely offset the reduction in the previous month. The not seasonally adjusted (NSA) index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 106.3 in July, down 0.9 percent from June.Once again it appears the cliff diving is over, and the index is now moving sideways and "choppy".

Compared with July 2008, SA tonnage fell 10.4 percent, which was the best year-over-year showing since February 2009. June’s 13.6 percent contraction was the largest year-over-year decrease of the current cycle.

ATA Chief Economist Bob Costello said that truck tonnage will continue to be choppy in the months ahead, but that is not necessarily a bad thing. “It is not unusual for an economic indicator to become volatile before changing direction,” Costello noted. He is hopeful that truck tonnage has finally hit bottom as it has been bouncing around a seven-year low for the last few months. “While I am optimistic that the worst is behind us, I just don’t see anything on the economic horizon that suggests freight tonnage is about to rise significantly or consistently,” Costello said. “Still, even small gains are better than the February 2008 through April 2009 cumulative tonnage reduction of 15.5 percent.”

Fed's Lockhart: "slow recovery" and "protracted period of high unemployment"

by Calculated Risk on 8/26/2009 12:35:00 PM

From Atlanta Fed President Dennis Lockhart: The U.S. Economy and the Employment Challenge

On the economic outlook:

With respect to growth, my forecast envisions a return to positive but subdued gross domestic product (GDP) growth over the medium term weighed down by significant adjustments to our economy. Some of these adjustments are transitional in the sense that they impede the usual forces of recovery. Among these are the rewiring of the financial sector and the need for households to save more to repair their balance sheets.And on Commercial real estate:

Some of these adjustments, however, are more "structural" in nature. By this, I mean that the economy that emerges from this recession may not fully resemble the prerecession economy. In my view, it is unlikely that we will see a return of jobs lost in certain sectors, such as manufacturing. In a similar vein, the recession has been so deep in construction that a reallocation of workers is likely to happen—even if not permanent. ...

My forecast for a slow recovery implies a protracted period of high unemployment. And labor market weakness is a concern I hear about often as I travel around the Southeast.

I'm concerned that commercial real estate weakness poses a serious potential risk to the economic recovery and to the banking system. Commercial real estate loan exposure is heavily concentrated in banks and commercial mortgage-backed securities. Commercial real estate values—that is, collateral values for loans—are being revised down materially by the potent combination of increased vacancy, rent reductions, and appropriately higher capitalization rates. Further, there is a clear link between employment trends (positive and negative) and commercial real estate trends.On that note, here is a graph from a post in July:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions.

As Lockhart noted: "[T]here is a clear link between employment trends (positive and negative) and commercial real estate trends."

As the unemployment rate continues to rise over the next year, the office vacancy rate will probably rise too. Reis' forecast is for the office vacancy rate to peak at 18.2 percent in 2010, and for rents to continue to decline through 2011.

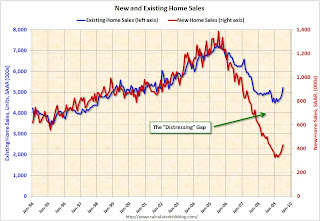

Distressing Gap: Ratio of Existing to New Home Sales

by Calculated Risk on 8/26/2009 11:18:00 AM

For graphs based on the new home sales report this morning, please see: New Home Sales Increase in July

According to the Q2 Campbell national survey of real estate agents, over 63% of sales in Q2 were distressed. The number of distressed sales has probably declined in Q3, but it is still very high. The July NAR survey shows "distressed homes accounted for 31 percent of transactions", but their survey is very limited. And even using the NAR numbers, distressed sales are running around 1.5 million this year.

All this distressed sales activity has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

This is an update including July new and existing home sales data. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows existing home sales (left axis) and new home sales (right axis) through July.

As I've noted before, I believe this gap was caused by distressed sales. Even with the recent rebound in new and existing home sales, the gap is still very wide. The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

The second graph shows the same information, but as a ratio for existing home sales divided by new home sales.

Although distressed sales will stay elevated for some time, eventually I expect this ratio to decline back to the previous ratio.

The ratio could decline because of a further increase in new home sales, or a decrease in existing home sales - or a combination of both. I expect the ratio will decline mostly from a decline in existing home sales as the first-time home buyer frenzy subsides, and as the foreclosure crisis moves into mid-to-high priced areas (with fewer cash flow investors).

From a longer term graph of the ratio, see my post last month.