by Calculated Risk on 7/01/2009 04:07:00 PM

Wednesday, July 01, 2009

California IOU Update

From the LA Times: Schwarzenegger orders third furlough day, proposes new cuts

Gov. Arnold Schwarzenegger this morning ordered state workers to take a third day off without pay each month ... If lawmakers and the governor do not agree on a plan to wipe out the deficit -- or at least part of it -- by the end of today, State Controller John Chiang will begin giving out IOUs in lieu of checks to pay debts owed by the state.Here are the FAQs on IOUs (known as Registered Warrants). A few points:

"We have one more day," Senate President Pro Tem Darrell Steinberg (D-Sacramento)

6. Will my financial institution honor a registered warrant?Most banks will probably accept warrants from established customers ...

Recipients of registered warrants should contact their financial institution to determine whether they will honor the registered warrant before the redemption date.

7. What happens if my financial institution will not accept the registered warrant?

You may decide to open an account at another financial institution that will accept registered warrants, or you will have to hold the warrant until it matures on October 1, 2009.

...

9. Who will receive registered warrants?

The State in July will issue registered warrants, or IOUs, for all other payments, including those to private businesses, local governments, taxpayers receiving income tax refunds and owners of unclaimed property.

General Motors June sales fell 33.6% YoY

by Calculated Risk on 7/01/2009 02:01:00 PM

From MarketWatch: General Motors U.S. June sales decline 33.6%

This is worse the the 29% drop in May.

Also: Toyota June U.S. sales down 32% to 131,654 units

And Chrysler June U.S. sales down 42% to 68,297 units

I'll have a summary for the month soon.

Report: As many as One in Five U.S. hotels may default

by Calculated Risk on 7/01/2009 12:59:00 PM

I've already posted most of the data in this article ... so I'll just excerpt a quote.

From Bloomberg: Hotel Loan Defaults Double as Recession Cuts Travel (ht mark, ghostfaceinvestah, brian)

As many as one in five U.S. hotel may default on their loans by the end of 2010 as the recession forces companies to spend less on travel and perks, according to Kenneth Rosen, an economist at the University of California.The hotel segment was the most overbuilt of all CRE - and that is saying something with all the excess retail space!

The value of hotel properties in default or foreclosure almost doubled to $17.3 billion in the second quarter through June 24 from $9 billion at the end of the first quarter, data compiled by Real Capital Analytics Inc. show. The New York-based research firm, which began tracking distressed commercial property in November, expects hotel defaults to increase by as much as $2 billion next quarter, said analyst Jessica Ruderman.

“Hotels without question will have the highest foreclosure rate of any commercial real-estate sector,” said Rosen ...

Ford June U.S. light vehicle sales down 11% YOY

by Calculated Risk on 7/01/2009 12:27:00 PM

From MarketWatch:

Ford June U.S. sales down 11% to 148,153 units

Ford to increase Q3 production to 485,000 vehicles

Volvo June U.S. sales down 0.6% to 7,042 units

Daimler June U.S. sales fell 26.5% to 16,271 vehicles.

MORE TO COME ...

Previous months:

Ford U.S. May sales fall 24.2%

Ford April U.S. vehicle sales off 31.3%

Ford U.S. March sales dropped 40.9%

February Ford sales were off 46.3% YoY

January off 42.1%

December off 32.4%

November off 31%

NAR: Pending Home Sales Index Increases Slightly

by Calculated Risk on 7/01/2009 10:49:00 AM

From the NAR: Pending Home Sales Record Fourth Straight Monthly Gain

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in May, increased 0.1 percent to 90.7 from an upwardly revised reading of 90.6 in April, and is 6.7 percent higher than May 2008 when it was 85.0. The last time there were four consecutive monthly gains was in October 2004.Yun is blaming the disconnect beteween pending and existing home sales on the change in apprasial rules, but there are probably other factors too - like rising mortgage rates, tighter lending standards, and the inability of homeowners to sell the current home.

...

Lawrence Yun, NAR chief economist, cautions that there could be delays in the number of contracts that go to closing. “Closed existing-home sales have improved but are coming in lower than expected because some contracts are delayed or falling through from the application of new appraisal rules for many transactions,” he said.

Constructon Spending Declines in May

by Calculated Risk on 7/01/2009 10:15:00 AM

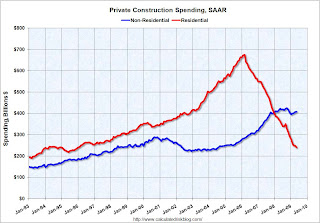

Private residential construction spending is 64.5% below the peak of early 2006.

Private non-residential construction spending is only off 4.1% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending fell further in May, and nonresidential spending was up a little (because of private spending on power), but will probably decline sharply over the next two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is off 3.3% on a year-over-year basis, and will turn strongly negative as projects are completed. Residential construction spending is still declining YoY, although the negative YoY change should be smaller going forward.

As I've noted before, these will probably be two key stories for late 2009: the collapse in private non-residential construction, and the probable bottom for residential construction spending. Both stories are still developing ...

From the Census Bureau: May 2009 Construction at $968.7 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $649.2 billion, 1.0 percent (±1.1%)* below the revised April estimate of $655.6 billion. Residential construction was at a seasonally adjusted annual rate of $240.2 billion in May, 3.4 percent (±1.3%) below the revised April estimate of $248.8 billion. Nonresidential construction was at a seasonally adjusted annual rate of $409.0 billion in May, 0.5 percent (±1.1%)* above the revised April estimate of $406.9 billion.

ISM Manufacturing Shows Contraction in June

by Calculated Risk on 7/01/2009 10:00:00 AM

From the Institute for Supply Management: June 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector failed to grow in June for the 17th consecutive month, while the overall economy grew for the second consecutive month following seven months of decline, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.As noted, any reading below 50 shows contraction, although the pace of contraction has slowed.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "Manufacturing continues to contract at a slower rate, but the trends in the indexes are encouraging as seven of 18 industries reported growth in June. Most encouraging is the gain in the Production Index, which is up 12.1 percentage points in the last two months to 52.5 percent. Aggressive inventory reduction continues and indications are that the de-stocking cycle is at or near the end in most industries, as the Customers' Inventories Index remained below 50 percent for the third consecutive month. The Prices Index was unchanged from May, indicating that the supply/demand balance is improving. Overall, a slow recovery for manufacturing is forming based on the current trends in the ISM data."

emphasis added

Employment: ADP, Challenger, Monster

by Calculated Risk on 7/01/2009 08:35:00 AM

ADP reports:

Nonfarm private employment decreased 473,000 from May to June 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®. The estimated change of employment from April to May was revised by 47,000, from a decline of 532,000 to a decline of 485,000.Note: the BLS reported a 338,000 decrease in nonfarm private employment in May, so once again ADP was not very useful in predicting the BLS number.

On the Challenger job-cut report from CNBC:

[P]lanned layoffs at U.S. firms fell for a fifth consecutive month in June, hitting the lowest since March 2008 ...And from Monster:

Planned job cuts announced by employers totaled 74,393 in June, down 33 percent from 111,182 in May, according to .... Challenger, Gray & Christmas.

"We typically see a decline in job cuts in the second quarter." [the report said]

...

It was the first time since last September that the monthly total was less than 100,000 and it was the lowest job-cut count since 53,579 job cuts were announced in March 2008.

It was also 9 percent lower than the same month a year ago, making it the first year-over-year decline since February 2008, Challenger added.

The Monster Employment Index slipped one point or one percent in June as online job opportunities fell modestly, largely in line with seasonal expectations. Year-over-year, the Index was down 28 percent ...The BLS reports tomorrow, and the consensus is for about 350,000 in reported job losses for June.

“While U.S. online job availability has remained largely flat since January, the annual pace improved during the second quarter, suggesting some expansion in underlying employer demand for workers,” said Jesse Harriott, senior vice president ... at Monster Worldwide. “Still, current levels of online job vacancies are at their lowest since January 2005, illustrating the extent to which hiring has slowed during this recession.”

MBA: Mortgage Refinance Applications Off 30%

by Calculated Risk on 7/01/2009 08:11:00 AM

The MBA reports:

The Market Composite Index, a measure of mortgage loan application volume, was 444.8, a decrease of 18.9 percent on a seasonally adjusted basis from 548.2 one week earlier.

...

The Refinance Index decreased 30.0 percent to 1482.2 from 2116.3 the previous week and the seasonally adjusted Purchase Index decreased 4.5 percent to 267.7 from 280.3 one week earlier. The Refinance Index is at its lowest level since November 2008.

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.34 percent from 5.44 percent ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 2002.

Note: The increase in 2007 was due to the method used to construct the index.

The Purchase index is still near recent lows, but the big story this week was the sharp decline in the Refinance index - probably because of the recent rise in borrowing costs.

Unemployment Forecast: Too Much "Hope"

by Calculated Risk on 7/01/2009 12:07:00 AM

From David Leonhardt at the NY Times: A Forecast With Hope Built In

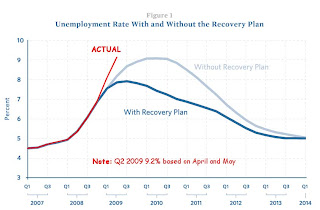

In the weeks just before President Obama took office, his economic advisers made a mistake. They got a little carried away with hope.Here is the January forecast with the actual data ...

... Without the stimulus, they saw the unemployment rate — then 7.2 percent — rising above 8 percent in 2009 and peaking at 9 percent next year. With the stimulus, the advisers said, unemployment would probably peak at 8 percent late this year.

We now know that this forecast was terribly optimistic.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph compares the actual quarterly unemployment rate (in red) with the Obama economic forecast from January 10th: The Job Impact of the American Recovery and Reinvestment Plan

There are two possible explanations that the administration was so wrong. ... The first explanation is that the economy has deteriorated because the stimulus package failed. ... The second answer is that the economy has deteriorated in spite of the stimulus.Very little of the stimulus has been spent so far, so it is premature to say it failed. However Romer recently was quoted in the Financial Times:

Ms Romer said stimulus spending was “going to ramp up strongly through the summer and the fall”.So we should see an impact in the 2nd half of 2009 ... and that starts now!

“We always knew we were not going to get all that much fiscal impact during the first five to six months. The big impact starts to hit from about now onwards,” she said.

Ms Romer said that stimulus money was being disbursed at almost exactly the rate forecast by the Office of Management and Budget. “It should make a material contribution to growth in the third quarter.”