by Calculated Risk on 4/01/2009 08:25:00 PM

Wednesday, April 01, 2009

Auto Sales: Ray of Sunshine?

In Looking for the Sun, I suggested there might be three areas to look for "rays of sunshine in a very dark season": housing starts, new home sales, and auto sales.

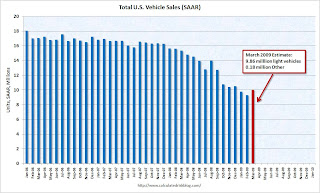

Just like for housing starts and new home sales, it is way too early to call a bottom for auto sales - but it does look like vehicle sales increased in March on a seasonally adjusted annual rate (SAAR) basis. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical vehicle sales from the BEA (blue) and an estimate for March (light vehicle sales of 9.86 million SAAR from AutoData Corp).

Note: this graph includes a small number of heavy vehicle sales to compare to the BEA.

From the WSJ: Auto Makers See a Ray of Hope

The annualized sales pace ... came in at 9.86 million vehicles, well below the 16 million or more the industry typically logged a few years ago, but up from February's pace of 9.12 million.Even if this is the bottom for auto sales (way too early to call), the pickup will probably be very sluggish - especially considering the grim unemployment news and continuing financial crisis.

"I believe we are in a bottoming process for the industry," Bob Carter, a group vice president at Toyota Motor Corp., said in a conference call. ...

Michael DiGiovanni, the top sales analyst at General Motors Corp., said he expects a "very, very gradual pickup" in vehicle sales in the second quarter. He cited "the first signs of brightening" in the market. ...

Moody's Warns of Worst Corporate Default Rate since WWII

by Calculated Risk on 4/01/2009 06:09:00 PM

From Reuters: Moody's downgraded $1.76 trln U.S. corp debt in Q1

... Moody's Investors Service downgrading an estimated $1.76 trillion of debt, a record high ...Hopefully the bank stress tests have all these defaults factored in ...

The downgrades included a record number to the lowest rating categories, signaling the approach of the worst defaults since at least World War Two ...

"The most prominent new driving force behind credit rating reductions would be deterioration of commercial real estate," [Moody's chief economist John Lonski] said. ...

Moody's has forecast that the U.S. default rate will peak around 14.5 percent in November.

emphasis added

Moody's: Record High Credit Card Charge-Offs

by Calculated Risk on 4/01/2009 05:57:00 PM

From Reuters: Credit card charge-offs hit record high -Moody's (ht Brad)

Credit card write-downs soared to record levels in February, representing an all-time high in the 20-year history of the Moody's Credit Card Index ....Moody's reported the charge-off rate at 5.59% in February 2008, and 4.51% in February 2007.

Credit card charge-offs, the write-down of uncollectable debt, advanced decisively to 8.82 percent in February, marking the sixth consecutive month of increases. The level, is more than 300 basis points higher than a year ago.

...

[Moody's] predicts the charge-off rate index will peak at about 10.5 percent in the first half of 2010, assuming a coincident unemployment rate peak at 10 percent.

Case Shiller House Prices Seasonal Pattern

by Calculated Risk on 4/01/2009 04:04:00 PM

First, the market graph from Doug ... Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. This graph shows the seasonal pattern for the Case-Shiller Composite 10 house price index.

This graph shows the seasonal pattern for the Case-Shiller Composite 10 house price index.

The percentage change is the month-to-month change annualized.

It is important to remember this clear seasonal pattern when looking at the Case-Shiller data.

Wile E. Coyote Indicator

by Calculated Risk on 4/01/2009 03:03:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Posted with permission.

Credit: Buzz Potamkin in Animation World Magazine

See: The Macro Economy's Impact on Animation: Will Wile E. Coyote Dodge the Anvil?

"Economists and commentators are increasingly citing Wile E. Coyote to explain the macro economy, with Nobel-laureate Paul Krugman first hoisting the anvil in 2007. Cartoon image courtesy of Warner Bros. Animation. Graphs courtesy of Project X."

Ford U.S. March sales fall 40.9%

by Calculated Risk on 4/01/2009 12:04:00 PM

Update2: Toyota sales off 36.6%. GM Sales off 47%. Chrysler off 39%. From MarketWatch:

Chrysler LLC on Wednesday reported a 39% drop in March U.S. sales to 101,001 cars and trucks from 166,386 a year earlier.Update: from MarketWatch: Ford U.S. March sales drop 40.9%

Ford Motor Co. said Wednesday that U.S. March sales fell 40.9% ... At the end of March, Ford said that Ford, Lincoln and Mercury inventories totaled 408,000 units, about 27% lower than a year ago.This is reported as Year-over-year (March 2009 vs. March 2008)

Last month (February) Ford sales were off 46.3% YoY

And in January Ford sales were off 42.1%

December: 32.4%

November: 31%

Ford's numbers will probably be better than GM or Chrysler!

Thornburg Mortgage to file BK

by Calculated Risk on 4/01/2009 11:50:00 AM

From Bloomberg: Thornburg Mortgage to File for Bankruptcy, Liquidate

Thornburg Mortgage Inc., the “jumbo” residential loan specialist battling a slump in home sales and the collapse of mortgage markets, plans to file for bankruptcy protection and shut down.Thornburg specialized in prime Jumbos.

...

Thornburg specialized in mortgages of more than $417,000, typically used to buy more expensive homes.

It was an early report of Thornburg's problems that prompted Tanta to famously exclaim: "We're all subprime now!"

Construction Spending Declines in February

by Calculated Risk on 4/01/2009 10:00:00 AM

Residential construction spending is 59.3% below the peak of early 2006.

Non-residential construction spending is 8.5% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now slightly negative on a year-over-year basis, and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: February 2009 Construction at $967.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $665.9 billion, 1.6 percent (±1.1%) below the revised January estimate of $676.9 billion. Residential construction was at a seasonally adjusted annual rate of $275.1 billion in February, 4.3 percent (±1.3%) below the revised January estimate of $287.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $390.7 billion in February, 0.3 percent (±1.1%)* above the revised January estimate of $389.5 billion.

Pending Home Sales Index

by Calculated Risk on 4/01/2009 09:59:00 AM

From the NAR: Gain Seen In Pending Home Sales, Housing Affordability Sets New Record

The Pending Home Sales Index, a forward-looking indicator based on contracts signed in February, rose 2.1 percent to 82.1 from a reading of 80.4 in January, but is 1.4 percent below February 2008 when it was 83.3.This suggests a possible slight increase in existing home sales from March to April (February was the most recent report).

Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the February report suggests existing home sales will increase slightly from March to April.

Note: Ignore all the affordability nonsense. That just tells you interest rates are low.

ADP: Private Sector Loses 742,000 Jobs

by Calculated Risk on 4/01/2009 09:06:00 AM

I don't have much confidence in the ADP report in predicting the BLS employment number, but this is pretty ugly ...

From ADP:

Nonfarm private employment decreased 742,000 from February to March 2009 on a seasonally adjusted basis, according to the ADP National Employment Report®.

...

March’s ADP Report estimates nonfarm private employment in the service-providing sector fell by 415,000. Employment in the goods-producing sector declined 327,000, the twenty-seventh consecutive monthly decline. Employment in the manufacturing sector declined 206,000, its thirty-seventh consecutive decline.

...

In March, construction employment dropped 118,000. This was its twenty-sixth consecutive monthly decline, and brings the total decline in construction jobs since the peak in January 2007 to 1,135,000.