by Calculated Risk on 4/01/2008 03:23:00 PM

Tuesday, April 01, 2008

Fed Releases New Mapping Tool for Alt-A and Subprime Loans

From the Federal Reserve:

The Federal Reserve System on Tuesday announced the availability of a set of dynamic maps and data that illustrate subprime and alt-A mortgage loan conditions across the United States.

The maps, which are maintained by the Federal Reserve Bank of New York, will display regional variation in the condition of securitized, owner-occupied subprime, and alt-A mortgage loans. The maps and data can be used to assist in the identification of existing and potential foreclosure hotspots. This may assist community groups, which can mobilize resources to bring financial counseling and other resources to at-risk homeowners. Policymakers can also use the maps and data to develop plans to lessen the direct and spillover impacts that delinquencies and foreclosures may have on local economies. Local governments may use the data and maps to prioritize the expenditure of their resources for these efforts.

To access the data visit: www.newyorkfed.org/mortgagemaps/. Monthly updates are planned.

The maps show the following information for subprime and alt-A loans for each state and most of the counties and zip codes in the United States:• Loans per 1,000 housing unitsAccompanying data tables report further statistics for states. The maps and data are drawn from the FirstAmerican CoreLogic, LoanPerformance Loan Level Data Set. For more details, see the website's technical appendices to the map and the data tables.

• Loans in foreclosure per 1,000 housing units

• Loans real estate owned (REO) per 1,000 housing units

• Share of loans that are adjustable rate mortgages (ARMs)

• Share of loans for which payments are current

• Share of loans that are 90-plus days delinquent

• Share of loans in foreclosure

• Median combined loan-to-value ratio (LTV) at origination

• Share of loans with low credit score (FICO) and high LTV at origination

• Share of loans with low- or no documentation

• Share of ARMs with initial reset in the next 12 months

• Share of loans with a late payment in the past 12 months

Additional mortgage foreclosure resources, including helpful information and links to agencies and organizations that may provide assistance to consumers experiencing difficulty making their mortgage payments, are available on the Board's website at: http://www.federalreserve.gov/pubs/foreclosure/default.htm

Normalized Construction Spending

by Calculated Risk on 4/01/2008 02:30:00 PM

Earlier this morning, I posted a couple of graphs on construction spending (see Construction Spending Declines in February). The key point was that non-residential construction spending appears to have peaked, and this appears to be the beginning of the non-residential construction slowdown!

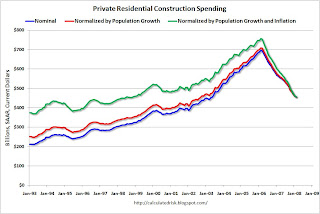

There were a couple of requests to see the first chart normalized by population. Yes, sometimes we do requests. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the nominal numbers in blue (seasonally adjusted annual rate) from the Census Bureau for private residential construction spending.

The red line is adjusting for population growth based on the monthly population number from the BEA (see line 32).

The green line is adjusting for inflation (using CPI from the BLS). We could use other inflation adjustments too (like the PCE deflator or CPI less shelter).

Clearly the inflation adjustment is more important than the population adjustment.

Another measure of new housing investment is Residential Investment (RI) as a percent of GDP. I expect RI as percent of GDP to bottom towards the end of 2008. (note: this says nothing about existing home prices - those will likely fall for some time).

The second graph shows the same three lines for private non-residential construction spending.

Once again, the inflation adjustment is more significant than the population adjustment.

It appears non-residential construction spending has peaked and will now probably decline throughout 2008.

New UBS Logo

by Calculated Risk on 4/01/2008 02:04:00 PM

Source: Jan-Martin Feddersen, Immobilienblasen who writes:

I think it is a good start to kick off the "Fools Day" with news from the the greatest fool UBS.(hat tip Dwight) Here is the actually UBS logo.

Treasury Agrees to Absorb any Losses to the Fed from Bear Stearns

by Calculated Risk on 4/01/2008 12:38:00 PM

Video from CNBC (hat tip idoc)

CNBC's Steve Liesman reports on a letter from Treasury Secretary Paulson to New York Fed President Tim Geithner. In the letter, Treasury agrees that the Fed can bill Treasury for any losses from the Bear Stearns deal.

Ford March U.S. sales off 14%

by Calculated Risk on 4/01/2008 12:29:00 PM

From MarketWatch: Ford March U.S. sales off 14% despite strength in small cars

Ford Motor Co. on Tuesday reported a 14.3% decline in March U.S. sales to 227,143 vehicles.The reported decline is in comparison to March 2007.

It appears the comparisons are getting worse; for February 2008, Ford reported that sales declined only 6.9% from a year earlier.

Construction Spending Declines in February

by Calculated Risk on 4/01/2008 10:00:00 AM

Spending declined in February for both residential and non-residential private construction. This is additional evidence that the non-residential slowdown is here.

From the Census Bureau: February 2008 Construction Spending at $1,121.6 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $826.6 billion, 0.5 percent below the revised January estimate of $831.2 billion.

Residential construction was at a seasonally adjusted annual rate of $456.9 billion in February, 0.9 percent below the revised January estimate of $461.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $369.7 billion in February, 0.1 percent below the revised January estimate of $370.1 billion.

Click on graph for larger image.

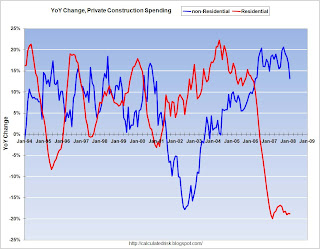

Click on graph for larger image. The graph shows private residential and nonresidential construction spending since 1993.

Over the last couple of years, as residential spending has declined, nonresidential has been very strong. This is additional evidence - along with the Fed's Loan Officer Survey and other data - that suggests the slowdown in nonresidential spending is here.

The second graph shows the year-over-year change in residential and non-residential private construction spending.

The second graph shows the year-over-year change in residential and non-residential private construction spending.From a year-over-year perspective, residential is off 19% and non-residential is still up 13%. However non-residential spending has now declined for three straight months, and will probably show a year-over-year decline by mid-summer.

Vintages, Revintages, and Defaults

by Tanta on 4/01/2008 08:12:00 AM

Our friend PJ at Housing Wire had a nice post up the other day about Michael Perry, CEO of IndyMac, and his startling announcement that IndyMac would be changing the way it collected and presented statistics on delinquent and defaulted loans. Of course I'd say it's a nice post; I contributed around two cents' worth to an earlier draft of PJ's. Self-serving motives of my own aside, though, PJ is making a very important point about how what we choose to measure--and how we define our measurements--influences what we perceive to be the risks of mortgage lending:

But if we’ve learned anything in this credit mess, it’s that all prepayments are not created equal — and that prepayments aren’t the only reason loans in a portfolio will run off.In my view--which I laid out a bit in our March newsletter, as you subscribers will know--the prepayment picture is also muddled if you use a very narrow definition of "default." If any loan that pays in full is treated as a simple "prepayment" unless it pays off via foreclosure or you actually took a principal loss on it (that is, it "settled for less" rather than "paying in full"), then you completely miss the problem of "revintaging" as well as missing the signs of the stress level on a pool or vintage or book of loans. That's because you treat a loan that refinances while it is delinquent, or a home that sells while the loan is delinquent, as the "same thing" as a non-distressed refi or sale. If you use a more sophisticated measure of "default" that many investors do use--one that counts loans on which you didn't take a loss, but that paid off out of a prior delinquency status--then you don't get so badly fooled by the "musical vintage" problem, because you can see it coming.

First off, there are prepayments that are voluntary, and those that aren’t. Think of it this way: a borrower that would have defaulted in 2006 refis into a new loan in 2006 and now defaults in 2008. That’s very different sort of prepayment than a creditworthy borrower deciding to refinance because they simply want a lower payment. The real problem with the 2006 and 2007 vintages, at the core, isn’t prepayments per se; it’s that the game of musical chairs finally stopped for those borrowers whose previous defaults had essentially been “revintaged.”

So the 2003-5 vintages end up looking great from a credit perspective, even if prepayment velocity is off the charts; analysts start making complex models that only look at the effect of prepayments in whatever static pool they’ve got, and everyone declares credit risk mostly irrelevant. In contrast, the 2006-7 vintages look horrible from a credit perspective, prepayments slow and become much more volatile, Wall Street takes a look at its models and realizes some important data was missing — and, of course, lender CEOs have to pen very public explanations explaining that prepayments are “screwing everything up.”

Not that taking the perspective of an investor in static pools of mortgages is always helpful: that does tend to lead to the mindset that a "prepayment" means a loan "goes away" and no longer needs to concern us. What distinguishes a "static pool" like an MBS from a dynamic book of business is that in the former, no new loans are ever added. MBS "run off" by definition. Newly-issued MBS will have new loans in them that were originated as refinances, but because we're now talking about a "different deal," there is no conceptual encouragement to see these "new" loans as the prepayments from an older pool. Even the new purchase-money loans in a new pool may represent a property that "defaulted" from an older pool.

Yet investors seem to be remarkably tolerant of a situation in which very little, if any, attention is paid to where these loans in these new pools came from. It's sort of credit risk as Groundhog Day: each pool issue is new again. Borrowers and properties have no history. Prepayment analysis is always forward-looking--attempting to model the future of this pool--rather than retrospective--attempting to account for how prepayments--voluntary and involuntary, distressed and non-distressed--generated the pool we're looking at today which has not yet experienced a "prepayment."

Perhaps a concrete example will help. Shnaps directed my attention to this one in yesterday's Chicago Tribune, largely because the example given doesn't make any sense. So it's an imperfect example; I'm going to have to "make up" a couple of details in order to illustrate my point. You may reflect on why we so often seem to have to do that when reading the newspapers. I'm after other fish to fry this morning:

Janice Lee fears she will lose her 1,400-square-foot Wilmette home next month.We do not know when Ms. Lee bought that home, or even if she borrowed money to buy it, although we have to suspect that she already had a first-lien mortgage on this loan when the HELOC series began. Otherwise we can make no sense of the payments indicated (which have to be combined first and second lien payments, or else they're payday loans.)

Lee, a former pharmaceutical representative from Minneapolis who owns Chinoiserie restaurant in Wilmette, found herself heading for trouble after she was diagnosed with lymphoma in 2003. To keep pace with her medical bills, Lee sought a $70,000 equity line on her home in 2004. Two years later, she sought a second line.

Nearly half of her $130,000 loan, or $60,000, went toward her mortgage and property taxes. But that pushed her monthly payments to $4,000 from $2,500 in two years.

In January 2007, she refinanced, pushing her monthly payments to more than $6,000, she said. She missed her first payment last March and received a foreclosure notice in June.

For the sake of example, then, I'll make up the idea that Ms. Lee bought the house in 2002 with a first-lien purchase-money loan. Why 2002? Well, cognoscenti of matters vintage will know that 2002 was once considered one of the cruddiest mortgage vintages ever to disgrace the earth. Heh. After 2005-2008, of course, old 2002 makes us all nostalgic for the "good old days." But that's kind of my point in building out this example.

So we have, in Ms. Lee's case, the following appearances in the following vintages:

2002: A new purchase-money first-lien loan

2004: A new cash-out HELOC second-lien loan

2006: A new cash-out HELOC second-lien loan that pays off the loan in the 2004 vintage

2007: A new cash-out first-lien loan (I think) that pays off both the 2002 loan and the 2006 loan and that is in FC. It was also, you note, an EPD (early payment delinquency), since it seems to have missed either its first or its second payment and was in FC by payment 5 or 6.

If you do a certain kind of simple-minded "vintage analysis" of the kind PJ is complaining about, you would get the following:

2002: A good vintage, since the loan never defaulted and paid in full

2004: A good vintage, for the same reason

2006: Ditto

2007: A very bad vintage

But what, really, about those earlier vintages was so "good"? Were these "good loans," or did we get lucky by having another lender around willing to "revintage" the loans via refinance? From hindsight, the lender in the earlier vintages looks like it got lucky, because someone else was holding this bag in 2007 when the music finally stopped (it's obligatory to mix metaphors in this context). At the time, of course, they might well have been complaining bitterly about prepayments erasing their yield on those pools (or their servicing income). In fact, they might have been so bitter about it that they developed these noxious "prepayment penalty" things to keep those apparently "good" loans in place. Yeah, that looks like a good idea now, doesn't it?

The Tribune article, of course, doesn't tell us whether Ms. Lee was ever delinquent on those earlier loans. I suspect she was, since it looks like she was paying real subprime interest rates on at least the last two, and that might well have been because her prior mortgage history wasn't good. If that's true, then the earlier vintages really dodged a bullet here: they escaped a loss on the loan only because a greater fool stepped in to refinance it.

Thus, as PJ notes, the problem with our most recent vintages: the greater fools got run over by a truck, and so loans aren't "moving" any longer. They stay where they are until they finally fail. It will undoubtedly take a long time until we get another vintage as ugly as 2007-2008, but that's not just because (we hope) it will take a while for memories to fail and lending standards to become as stupid as they have been. It's because the lack of an "exit" means that those vintages will be forced to "show" the real defaults.

It is also important to really notice the implications of a point PJ makes here: if you look not at individual pools of loans but at the entire outstanding "book" of subprime and Alt-A loans in the aggregate, you are going to see "rising" delinquency numbers even if "nothing gets worse" than it already is. That is because, until further notice, no or extremely few new subprime or Alt-A loans are being made. The whole "book" is in "run-off" mode. That means, if you use a "current balance" to calculate delinquency and default, the "current balance" just keeps getting smaller and smaller, because no new balances are added to it. The average loan age just keeps getting older, for the same reason. In other words, we really do, for once, have a "prepayment" situation in which liquidated loans just do "go away." You can think of lender REO inventory as exactly that: the old loan for the old owner "went away," but since there's no new buyer wanting a new loan, there is no new "loan vintage," just a nasty REO inventory in a kind of "limbo."

What Perry of IndyMac is up to, of course, is deciding to quit reporting "raw delinquencies" on current balances right at the time when that kind of statistic is going to just keep looking worse for a long time, and substituting an alternative kind of reporting that will look better. That doesn't mean that the alternative reporting is "false." It means, in the most generous case, that we're looking at the part of the cup that's half-full. But switching measurements (and universes of loans to be measured) at the beginning of the unwind is going to play havoc with our ability to understand history. Those of us not looking forward to being doomed to repeat it do care about that.

Deutsche Bank: $3.95 Billion in Write-Downs

by Calculated Risk on 4/01/2008 07:38:00 AM

From the WSJ: Deutsche Bank Faces Writedowns Of About $3.95 Billion

Germany's largest bank by market value issued a statement before market opening stating that "conditions have become significantly more challenging during the last few weeks."The write-downs were across the board - we are all subprime now - but perhaps even more concerning was the comment that "conditions have become significantly more challenging during the last few weeks". Ouch.

"Reflecting this environment," the Frankfurt-based bank expects around [$3.95 billion] in write-downs in the first quarter 2008 related to "leveraged loans and loan commitments, commercial real estate, and residential mortgage-backed securities (principally Alt-A)."

UBS: $19 Billion In Write-Downs, Chairman Resigns

by Calculated Risk on 4/01/2008 01:24:00 AM

From Bloomberg: UBS Seeks SF15 Billion Capital Increase, Has First-Quarter Loss

UBS AG ... will seek to raise 15 billion francs ($15.1 billion) in a capital increase after writing down $19 billion in debt securities.

Chairman Marcel Ospel will step down ...

Centex sells Lots for a loss

by Calculated Risk on 4/01/2008 01:06:00 AM

From Reuters: Centex sells 8,500 U.S. housing lots for a loss

Centex Corp ... sold a portfolio of real estate to a group of investment funds for $455 million, which represents a discount to the properties' $528 million book value.The tax refund made the deal work. The buyers paid $161 million, and the actual cost to Centex was higher than $528 million (these properties had already been written down significantly).

Dallas-based Centex said it sold 8,500 developed, partly developed and undeveloped lots in 11 states ... Most of the properties are in Nevada and California.

Centex said its proceeds include the $161 million purchase price and an anticipated $294 million tax refund.