by Calculated Risk on 9/03/2007 01:03:00 PM

Monday, September 03, 2007

Shiller on Housing

On Bloomberg Video: Shiller of Yale Says U.S. Home Prices May Fall `Substantially'. (hat tip Houston)Click image for video.

September 3 (Bloomberg) -- Robert Shiller, chief economist at MacroMarkets LLC and a professor at Yale University, talked with Bloomberg's Kathleen Hays on Sept. 1 about the outlook for the U.S. economy and housing prices. (Source: Bloomberg)

More Leamer

by Tanta on 9/03/2007 12:50:00 PM

This is another snippet from the Leamer paper CR discusses below, in which Dr. Leamer argues that if we had nothing but economists on our side, we'd never get rid of Voldemort:

We love our homes. We don’t love our investments in General Motors or IBM, and when the stock market sends us the daily message that share prices have plummeted, we reluctantly accept that unwelcome reality. Homes are different. We have a close personal relationship with our homes. When the market is hot, buyers stream by our front doors proclaiming that they love our homes even more than we do by offering prices beyond our wildest dreams. Charmed by that flattery, many of us sell our loved ones, confidant that we have turned our homes over to people who will treat them well. Thus rising prices and high sales volumes. When the market cools, however, only a few prospective buyers come to our front doors, and those prospective buyers bring a most unsettling message: “We know you love your home, but it isn’t worth nearly as much as you think.” That can be a deal-breaker for female owners, but the clincher for males is the fact that their idiot neighbor sold his home for $1 million just last year, and the male owner is not going to take a penny less than that. It doesn’t matter what the market thinks. This house is worth $1million. Period.No, I'm not here to point out that Leamer seems to have attended the Larry Summers School of Unwise Rhetoric About Genderalizations.

Housing hormones, both estrogen and testosterone, make owners very unwilling to sell into a weak market and that unwillingness tends to keep the prices of homes actually sold high while greatly reducing the volumes of homes sold. What we observe are not market prices but sellers’ prices.

If you don’t like this love story, another good one is that sellers look backward, remembering what they or their neighbors paid, but buyers look forward, wondering what the house might be worth in a couple of years. Positioned in time looking in different directions, when the market is rising, owners estimate the value less than prospective buyers, and a sale occurs, but when the market is falling, the owners remember the good old days of high prices, and the buyers are thinking about a better deal in a couple of months. Then there is no transaction, unless it is at the high sellers prices. A third story comes from the behavioral economics: It’s loss aversion.7 As long as I don’t sell my home, I can comfortably maintain that it is worth what I paid for it.

Of course, economists have no room in their models for love, hope, or the psychology of loss. . . .

I was actually going to observe that economists spend some time hanging out in a mortgage shop. You will learn everything you need to know about the effects of love, hope, and the psychology of loss on economic decisions.

More Papers from Jackson Hole Conference

by Calculated Risk on 9/03/2007 10:54:00 AM

Here are a couple more papers presented at the Jackson Hole conference. I'll be posting excerpts with comments from these papers during the week.

Housing and the Monetary Transmission Mechanism, by Frederic S. Mishkin, Fed Board of Governors.

Comments on Housing and the Monetary Transmission Mechanism, Professor James Hamilton, UC San Diego.

There was apparently quite an interesting discussion at the symposium of MEW (mortgage equity withdrawal) and the impact on consumer spending. Martin Feldstein argued that MEW has had an important impact on consumer spending. So did Professor John Muellbauer. Muellbauer presented a paper modeling the interaction between house prices, credit availability, and spending. Apparently Muellbauer found that the housing wealth effect has grown sharply in the US due to the recent period of easy credit.

I'll have more as soon as soon as the papers are available online at the Jackson Hole symposium site.

As an aside, Business Week mentioned us this week (see Blogspotting: Loan Smarts).

Sunday, September 02, 2007

Leamer on Housing and Macroeconomics

by Calculated Risk on 9/02/2007 09:05:00 PM

Here is the paper Professor Leamer (UCLA Anderson Forecast) presented at the Jackson Hole conference: Housing and the Business Cycle (Hat tip Cal). Leamer is one of the better economic forecasters, and he has an enjoyable writing style.

Leamer starts by noting that most academic macro economists typically ignore residential investment:

... if you look up “real estate” in the index to Mankiw’s(2007) best selling Principles of Macroeconomics, you will find real exchange rates, real GDP, real interest rates, real variables, and even reality, but no real estate. Under “housing” you will find a reference to the CPI and to rent control, but no reference to the business cycle. I have not been able to find any macroeconomic textbook that places real estate front and center, where it belongs.The joke is Mankiw couldn't forecast his way out of a paper bag. However many of the better private sector forecasters (like Leamer and Paul Kasriel at Northern Trust) know that residential investment is the best leading indicator for the U.S. economy. Leamer notes the residential investment is a small part of long run growth, but that the contribution of residential investment to "US recessions is huge!"

...

Likewise, the index to James H. Stock and Mark W. Watson’s edited volume, Business Cycles, Indicators and Forecasting, has no references to residential investment or to housing. Housing is treated with the same level of interest that housing starts has in the Index of Leading Indicators: one of many things that might predict a recession, about as interesting as x7 in the list x1, x2, x3, ..., x10.

...

Something’s wrong here. Housing is the most important sector in our economic recessions ...

Leamer also points out the common temporal pattern of an economic slowdown:

First homes, then cars, and last business equipment.Sound familiar? I've covered this many times, pointing out that business investment in equipment and software and structures lags residential investment. Read the paper, there is a tremendous amount of detail.

Leamer also has some data from the Great Depression:

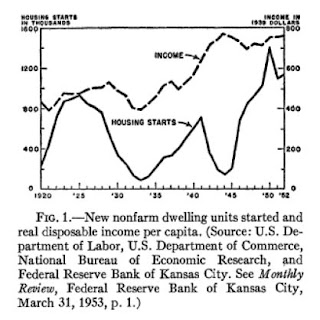

Click on graph for larger image.

Click on graph for larger image.The Great Depression: Housing Again!A little poke at Bernanke!

The housing starts data available from the Census Bureau begin in 1959 and leave us wondering what happened earlier, but in searching for references I ran across the image to the right of the earlier data in Ketchum(1954). Look at that: housing starts declined beginning in 1925! Industrial production didn’t begin its nosedive until July 1929 and the Dow Jones Average peaked in October 1929. How weird is that!

Problems in housing led the great depression by full three years. Without doing the hard work to confirm, it seems possible that the increase in the discount rate in 1928 was very hard on an already weakened housing sector, and set in motion the events that led to the Great Depression, dropping housing starts dramatically from over 900 thousand in 1925 to under 100 thousand in 1933. But, of course, I must defer to Bernanke’s(2000) Essays on the Great Depression, which does not emphasize housing.

But Leamer still doesn't expect a recession:

The historical record strongly suggests that in 2003 and 2004 we poured the foundation for a recession in 2007 or 2008 led by a collapse in housing we are currently experiencing. Only twice have we had this kind of housing collapse without a recession, in 1951 and in 1967, and both times the Department of Defense came to the rescue, because of the Korean War and the Vietnam War. We don’t want that kind of rescue this time, do we?So Leamer expects an extended period of sluggish growth. I disagree with Leamer somewhat: I think a recession (not severe) is likely. Of course Leamer notes "this is largely uncharted territory."

But don’t worry. This time we don’t need the DOD to save us. This time troubles in housing will stay in housing. It’s because manufacturing has done an “L” of a job. An official recession cannot occur without job loss, [and the] sectors with volatile employment are manufacturing and construction ...

Look at manufacturing. It’s V, V, V in every recession - a sharp drop in jobs and a sharp recovery. The 1990 recession was different. That was a U. But in the 2001 recession we got an L! [note: no recovery in jobs] Though this is largely uncharted territory, it doesn’t look like manufacturing is positioned to shed enough jobs to generate a recession. And without the job loss, expect the housing adjustment to be shallower but more long-lasting.

Bear Stearns Fund's "Qualified Investors"

by Tanta on 9/02/2007 09:16:00 AM

The redoubtable Gretchen Morgenson reports on the liquidation of the infamous Bear Stearns hedge funds. We discover that in 2005 at least one of the funds waived its normal $1MM limit to attract investors with as little as (ahem) $250,000 to invest. (It's still not clear to me what the total net worth requirement was for the investor putting only $250,000 into the fund.) Anyway, our anecdote without which we cannot live:

Ronald Greene, 79, a retiree in Northern California, is one investor watching the Bear Stearns case closely. Greene lost $280,000 in the Bear Stearns High Grade Structured Credit Strategies Fund and says he will join a suit that has been filed against the firm. He contends that Bear Stearns duped him with assurances that the fund's high-quality investments would protect holders against market and credit risks.I think I now understand why so many of my conversations with people during 2005 were at cross-purposes. I would never have guessed that anyone using the phrase "preservation of principal" would be thinking of hedge funds as the vehicle of choice.

Hedge funds are theoretically open only to institutional investors and extremely wealthy individuals, who are deemed savvy and well heeled enough to assess and weather complex risks. But documents from Greene's files show that Bear Stearns Asset Management allowed investments of $250,000 in its fund, considerably smaller than the typical $1 million minimum for many hedge funds.

On July 20, 2005, Greene received an e-mail message from his broker at a small regional firm, with the following header: "Bear Stearns High-Grade Structured Credit Strategies Fund will accept smaller investments this month on a limited basis." Noting that the fund was temporarily reopening on Aug. 1, 2005, the message said that for investors who "do not have $1,000,000 to invest, the fund will accept a limited number of clients this month for 500K and perhaps 250K."

The message went on to note the fund's stellar performance: up a cumulative 29.4 percent since its October 2003 inception, and no down months.

Greene, a former engineer, said he had invested in several hedge funds in recent years, aiming to preserve his principal. Most of the funds have worked out well, he said, producing slightly better-than-market returns with little volatility. He estimated that he had $600,000 to $800,000 invested in hedge funds.

He invested in the Bear Stearns fund in October 2005, and he said the fund appealed to him because its returns of about 1 percent a month did not seem to fall into the too-good-to-be-true category.

I have a question. Mr. Greene thought 1% a month didn't sound that unreasonable. By my back-of-the-envelope calculations that's 12% a year. From securities backed by home mortgages.

I conclude that Mr. Greene must hang out a lot with people who regularly pay 12% mortgage rates. This gave him the mistaken impression that the return on CDOs has something to do with just passing through interest payments, and not outrageous levels of gearing and risk concentrations.

Right. I know a lot of people who have nearly a million dollars invested in hedge funds whose friends all have the most expensive subprime mortgages ever originated (remember how high 12% was in 2005; that's a sub-sub-subprime.)

Please do not misunderstand me; I am not making excuses for Bear Stearns, nor am I suggesting that Mr. Greene deserves to lose his money. I am simply somewhat puzzled over our inability, now that the curtain has been drawn back on how all this worked, to ask these people how they thought investing in CDOs to "preserve principal" at 12% was going to work. There's trusting your broker--obviously that gets to be a problem--and then there's just plain old having some idea about what your broker is doing.

It begins to sound like Mr. Greene would have plunked his money down in the Tralfamadore Anti-Matter-Indexed Mystery Investment Vehicle (incorporated on Mars) if someone had said that the returns were "only" 1% a month. Of course it's understandable that Mr. Greene wanted 1% a month, because interest rates were so low that it was hard to find yield in instruments that involved other people paying interest . . .

Saturday, September 01, 2007

Jackson Hole: Quotes on Housing

by Calculated Risk on 9/01/2007 08:37:00 PM

Here are some articles and quotes from the Jackson Hole conference.

Professor John Taylor (of the Taylor rule fame) blames the housing bubble on the Fed. From Reuters: Ultra-low Fed rates stoked housing boom: Taylor (hat tip Kevin)

In rare public criticism of Alan Greenspan, former U.S. Undersecretary for International Affairs John Taylor said on Saturday that ultra-low Federal Reserve interest rates had stoked the U.S. housing boom and subsequent bust.And Reuters quotes economist Martin Feldstein: U.S. at risk of recession from housing (hat tip risk capital)

...

"A higher federal funds path would have avoided much of the housing boom," Taylor said, drawing on a model he designed to simulate housing activity if the Fed had raised rates instead of aggressively easing borrowing costs.

The weak housing market could topple the country into a full-blown recession and the Federal Reserve should slash interest rates aggressively, one of the country's most prominent economists warned on Saturday.And from MarketWatch: View from Jackson Hole is hazy and gloomy (hat tip FFDIC)

...

Feldstein, who was one of the front-runners for the top job at the Fed until Bernanke was picked for the post, saw three challenges to U.S. growth from housing: declining home prices; the subprime mortgage crisis; and weakening home equity withdrawal and refinancing.

Those three problems "point to a potentially serious decline in aggregate demand," he said. "The multiplier effect of home price declines and declines in consumer spending could push the economy into recession."

David Hale, an economist and a regular at the Jackson Hole conference, called the current environment "a crisis of information."

...

Mickey Levy, chief economist at Bank of America Corp. pointed out that the tone of the Jackson Hole conference was one of "uncertainty with risks to the downside."

"I am virtually certain [the Fed] will ease on Sept. 18," Levy said, adding that the move would be enough to keep the economy from going into recession.

But the risks of a recession are clearly higher than they were only one month ago, economists said.

Hatzius agreed there was a "significant risk" of recession, putting the odds at one in three. In addition, the economist said that the Fed would have more data by the time of its next meeting on Oct. 30 and 31, and that future moves would depend on the outlook.

...

Gramley, the former Fed governor, said that the odds of a recession are somewhere between 33% to 50%. "This is a severe problem which will have to be dealt with," he said.

The Economist: Heading for the rocks

by Calculated Risk on 9/01/2007 05:45:00 PM

The Economist has a free special report 'on the turmoil in the world's financial markets': Heading for the rocks (hat tip Mike)

The tremors in financial markets have gone far beyond their beginnings in the US subprime mortgage sector, and indeed far beyond the borders of the US. The full impact on the markets, and the repercussions on the global economy, remain unclear, but we can sketch out three broad scenarios:The full special report is here.

• Scenario 1. The Economist Intelligence Unit’s central forecast, to which we attach a probability of 60%, sees the impact being contained by timely monetary policy action, with only a modest effect on the global economy.

• Scenario 2. Our main risk scenario, with a 30% probability, envisages the US falling into recession, with substantial fallout in the rest of the world.

• Scenario 3. Should the US enter recession, another, darker scenario arises: that corrective action fails, and severe economic repercussions cascade from the US into the world economy with devastating effect. We attach only a 10% probability to this outcome, but the potential impact is so severe that it warrants careful consideration.

Since scenario 1 informs our regular output and Scenario 3 has a low probability, the bulk of the report focuses on scenario 2.

Saturday Rock Blogging

by Tanta on 9/01/2007 07:46:00 AM

Oh, man. Tanta's rockitorializing again.

Deal with it.

The thing I like best about the following video is how it provides a compelling visual metaphor for the hearts and minds of those who wish to convince themselves that business cycles are a secular morality play in which the Elect are rewarded and the Damned punished, and "we" is a meaningless pronoun because the only valid point of view is "I." In a time of war, no less.

The lyrics, of course, need no particular exegesis. At certain historical moments there is something quite aesthetically sufficient and necessary about stark and unsubtle metaphor.

Translation: yes, apparently we do sometimes need to be beaten over the head with it.

And it's still a great song, after all these years. There is a legend that the composer came up with the main rhythm while working on a piano with partially broken action. You find the music that a failing instrument will play. And then you play it.

CR, my friend, crank it up. After the week we've had, we deserve something with a better beat. Dance, dance, but try not to step on the cat. That's my motto and I'm sticking to it.

UCLA's Leamer: Some housing prices may decline 40%

by Calculated Risk on 9/01/2007 02:19:00 AM

From Bloomberg: Fed Gets `F' for Failures on Housing, Leamer Says

Federal Reserve policy makers underestimated the role that housing plays in triggering recessions and merit an `F' grade for their failure, said Ed Leamer, director of an economic forecasting group at UCLA.Leamer still thinks a recession is unlikely.

...

Housing is vulnerable to ``persistent'' trends that, once under way, are difficult to restrain, Leamer wrote. The Fed ought to have raised interest rates more aggressively to head off the ``bubble'' in home prices that grew from 2003 to 2005 and should have lowered rates by now, he said.

...

Leamer said in an interview today at Jackson Hole that some former ``hot markets,'' such as pockets of California, may see declines of 30 percent to 40 percent.

...

He added that there's ``very little possibility that a rate cut would make much of a difference'' at this point. ``Once the wave has peaked and is crashing, there is not much that can be done to quiet the waters.''