by Tanta on 8/02/2007 10:02:00 AM

Thursday, August 02, 2007

LEND Reports: Going Concern Problem

From Reuters:

In its delayed 2006 annual report filed with the U.S. Securities and Exchange Commission, Accredited said that because of adverse conditions in the subprime mortgage industry, it could not give assurance that it would continue to operate as a "going concern."

In Which Due Diligence Is Discovered

by Tanta on 8/02/2007 09:06:00 AM

From Reuters, via IHT, "Wall Street often shelved damaging subprime reports":

WASHINGTON: Investment banks that bundle and sell home mortgages often commissioned reports showing growing risks in subprime loans to less creditworthy borrowers but did not pass on much of the information to credit rating agencies or investors, according to some of those who prepared the reports. . . .Yeah, well, Keith, I gave up potted-plantdom and took to blogging. It doesn't pay as well, but it's less frustrating.

Several executives of due-diligence firms said they had reported a slide in loan quality to their investment bank clients but that those mortgages still had been bought up and passed on to investors.

"In some cases we felt that we were potted plants," said Keith Johnson, president of Clayton Holdings, a large due-diligence firm based in Connecticut.

Having been both in the third-party due diligence business as well as employed by mortgage originators on the sell side and mortgage conduits on the buy side, I'll confirm that yes, there's tons of information that falls under the general heading of "due diligence" that nobody paid any attention to. It isn't just the reports of outside firms like Clayton. Everybody in the chain has loan reviewers, Quality Control analysts, compliance officers, document custodians, and "new loan boarding" specialists at the servicing level whose job it is, day in and day out, to look at this stuff and report on problems in a very "granular" way. Quite often, when I was doing loan-level due diligence, I would have to use my sophisticated Sherlock Holmes-level razor-sharp mind to spot subtle, well-hidden clues of fraud, misrepresentation, or violation of underwriting guidelines.

At other times, I'd flip open the file to see, right on top, page after page of worksheets, printouts, and memos from everyone else who had handled the thing so far indicating some serious problems with it. Discovering what's wrong with these loans involved using the reading skills Miss Buttkicker taught me in the third grade. But the loans were still in the deal, even though three or four people before me had noticed something wrong.

This is the "repurchase" meltdown, folks. Having ignored their own people, the originators sold these things to Wall Street. Wall Street, having ignored the due diligence firms they hired to look at the stuff, went ahead and securitized it. When it started performing just like all the little potted plants said it would, more due diligence firms were hired--or rehired--to go through and find enough "misrepresentations" so that the loans could be shoved back to the originators. I'm guessing that the originators who are being punished the hardest with repurchase requests are the ones who were too stupid to pull all of those worksheets and printouts and memos from the files before passing them on.

As for all those sophisticated institutional investors who read those prospectuses and failed to notice that none of them includes a section on "Due Diligence Findings" for the pool? This little former aspidistra says "Hi!"

Wednesday, August 01, 2007

GM, Ford Chrysler July Sales Plunge

by Calculated Risk on 8/01/2007 05:05:00 PM

From CNNMoney: GM, Ford Chrysler see July sales plunge worse than expected, allowing import brands to outsell domestics for first time.

Sales plunged worse than expected at U.S. automakers in July ... Overall sales were weaker than expected for both domestics and imports, as total sales fell 12.3 percent.These weak sales number are probably a direct result of declining MEW. Although it appears MEW was still relatively strong in Q2, I expect equity extraction to decline significantly in the 2nd half of '07.

Experts and some automakers pointed to concerns about the housing markets and gasoline prices as weighing on American consumers who might have been considering a auto purchases.

...

Toyota Motor also posted a bigger than expected decline in sales, as it saw them drop 7.3 percent ... "The industry stumbled this month, on continued housing weakness," Jim Lentz, an executive vice president for [Toyota]'s U.S. sales unit said in a statement.

Fitch Downgrades

by Tanta on 8/01/2007 04:58:00 PM

Fitch downgraded a passel of subprime tranches today, which wasn't much of a surprise: these deals were on the Watch List announced in mid-July. The originators were mostly the usual suspects (Fremont, New Century, First Franklin, WMC). However, Fitch has started supplying some more information in its ratings announcements, to coincide with its updated surveillance methodology. I thought this bit was interesting (enough that I copied it into Excel so that the columns would display properly, you're welcome):

"BL" is "Break Loss," or the percentage loss the security could suffer before a write-down occurred for the tranche in question. So, for the average of all of the securities Fitch took rating action on today, the deal would have to take 37.75% in cumulative losses before a principal loss is taken by the AAA tranches. The BL takes into account subordination, overcollateralization, excess spread, the timing of actual and expected losses, prepayment speeds, and interest rate assumptions.

"LCR" is "Loss Coverage Ratio," or the BL divided by the expected lifetime losses for a given security. The Benchmark LCR here is specifically for seasoned securities (it is not identical to the benchmarks for new issues as it takes into account prepayments of the higher-rated classes). The benchmark LCR is the major factor in determining affirmation or downgrade of a given class.

Looking at just these averages, I'd be inclined to think that some of the affirmations just squeaked by in the B-rated tranches.

Alt-A: No Bid?

by Calculated Risk on 8/01/2007 01:40:00 PM

Yesterday I received an excerpt from a Wells Fargo notice to mortgage brokers suggesting their Alt-A programs were "discontinued until further notice":

"Due to the appetite and demand for this product in the secondary market, we are not able to obtain pricing from our investors."Now, on the Broker's Outpost (hat tip Cal):

Due to Current market conditions National City is making the following changes effective immediately:

All Expanded Criteria Products/Alt A - No New Registrations and No New Locks

Advance Q2 MEW Estimate

by Calculated Risk on 8/01/2007 12:20:00 PM

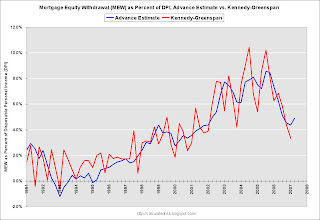

Based on the Q2 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $120 Billion or 4.9% of Disposable Personal Income (DPI). This would be an increase from the Q1 estimates, from the Fed's Dr. Kennedy, of $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

The actual Q2 data for MEW is released after the Flow of Funds report is available from the Fed (scheduled for Sept 17th for Q2). Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high (0.89) but there is substantial differences quarter to quarter. Also, there are some seasonal adjustment issues. This does suggest that MEW rebounded somewhat in Q2. We will have to wait until September to know for sure.

MEW will probably decline precipitously in the second half of 2007, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a slowdown in consumption expenditures is likely.

Here are the Kennedy-Greenspan estimates of home equity extraction for Q1 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. For Q1 2007, Dr. Kennedy calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

For Q1 2007, Dr. Kennedy calculated Net Equity Extraction as $84.0 Billion, or 3.4% of Disposable Personal Income (DPI).

This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

ADP Employment Report

by Calculated Risk on 8/01/2007 11:23:00 AM

Nonfarm private employment grew 48,000 from June to July of 2007 on a seasonally adjusted basis, according to the ADP National Employment Report TMSince changing their methodology, ADP has been pretty close to the BLS number (due Friday). The current consensus is for the BLS report to show 150K jobs, but that includes government jobs - ADP is for the private sector only.

More Viscous Cycle

by Tanta on 8/01/2007 09:51:00 AM

This is not going to be all Bloomberg all day. I hope.

Aug. 1 (Bloomberg) -- Railroads, chemical producers and insurance companies are blaming the worst U.S. housing slump in 16 years for their earnings woes.

Burlington Northern Santa Fe Corp., the second-biggest U.S. railroad, said lower shipments of housing products and lumber reduced second-quarter earnings. DuPont Co., the third-largest chemical maker, said slumping demand for kitchen and bathroom countertops was partly responsible for its profit drop. Genworth Financial Inc., the former insurance unit of General Electric Co., said earnings will be at the ``lower end'' of its forecast this year as mortgage-insurance claims increase.

``The subprime slime is oozing,'' said Gary Shilling, president of A. Gary Shilling & Co. in Springfield, New Jersey, who correctly predicted the recession in 2001. ``As home equity evaporates, that takes out the foundation of strong consumer spending growth, which has been the mainstay of the economy.''

MMI: Stabilizing

by Tanta on 8/01/2007 08:37:00 AM

So far this morning, the Muddled Metaphor Index is stabilizing. Colorfuls lead Cliches by 2-1. Analysts fear that current levels of unmixed metaphors may be supported by inability of fund managers to breathe deeply enough to utter multiple phrases; comments remain on Watch Negative until further notice.

My favorites so far today:

``There will be more pain,'' said Felix Stephen, a strategist who helps oversee the equivalent of $7.5 billion at Advance Asset Management Ltd. in Sydney. ``I'm giving it a couple of months at least. It's not the subprime issue that really matters, it is the first card to fall in the tower of cards in this situation.''

and

``There are still some more cockroaches to come out from under the fridge,'' said Chris Viol, a credit analyst at Citigroup Inc. in Sydney. ``We are getting a lot of questions about the big picture and the amount of contagion to investment grade credit.''As long as the cockroaches do not start laying their cards on the table, I think we may get out of this with our tentacles intact.

Moody's: Alt-A Rating Changes Effective Aug 1st

by Calculated Risk on 8/01/2007 01:05:00 AM

The earlier article on Moody's and Alt-A didn't mention the effective date. From Reuters: Moody's refines ratings methodology for Alt-A loans

Moody's Investors Service said on Tuesday it has refined its method for rating residential mortgage securitizations backed by Alt-A loans in response to rising delinquencies in pools of loans securitized in 2006.

The changes, which will go into effect on Aug. 1, address the poor performance of subprime-like loans, low and no equity loans, and low and no documentation loans which are present in certain Alt-A transactions, it said.