by Calculated Risk on 1/05/2007 12:15:00 AM

Friday, January 05, 2007

Housing Bust Gives Renters a Break

This is interesting. When the housing bust started a year ago, rents started to rise. But now it appears many frustrated homeowners are trying to rent their vacant homes, putting some downward pressure on rents.

From the WaPo: Cold Sales Give Renters a Break

As home sellers grew more frustrated with the slow local real estate market in recent months, they abandoned their for-sale signs and put their homes up for rent. That has increased choices and cooled prices for tenants in one of the tightest and most expensive parts of the country.Just this morning, Ivy Zelman of Credit Suisse wrote: Vacancy Sales Loom Large.

"This is the first sign that the cooling housing market is having an impact on the rental market," said Gregory H. Leisch, chief executive of Delta Associates ...

As competition for tenants intensified, apartment rents did not rise as sharply in the past three months of 2006 as they had earlier in the year, the report said.

"... we have not addressed the explosion of vacant listings and the implications on the housing market food chain, a factor that we and several of our private industry contacts believe deserves attention."

Click on graph for larger image.

Click on graph for larger image."The proportion of single family vacant homes for sale and for rent relative to total housing stock is at the highest level since at least 1993 (as far back as our data series goes). The recent surge in vacant units for sale, as the capitulation by distressed sellers accelerates, may provide a persistent headwind to the [housing] recovery."This WaPo story suggests that these vacancies might also provide a headwind for rents.

Wednesday, January 03, 2007

MEW's Impact on 2007

by Calculated Risk on 1/03/2007 08:45:00 PM

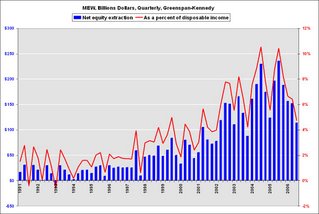

First, I'd like to clarify a previous post on Mortgage Equity Withdrawal's (MEW) impact on GDP. Click on graph for larger image.

Click on graph for larger image.

To construct this graph, I used the reported GDP for the previous year, and then removed 50% of the Greenspan-Kennedy MEW from GDP for the target year. The intention was to show how important MEW has been in recent years.

Note: the 50% is Greenspan estimate of MEW flowing to consumption of domestic goods and services.

From the questions I've received, I clearly didn't provide an adequate description of this chart. Or perhaps the presentation is misleading.

Let's use 2004 and 2005 as an example. In 2004, MEW was $754.2 Billion, and in 2005 MEW was $743.7 Billion (about the same). We could make two seemingly contradictory statements:

1) MEW contributed $372 Billion to GDP in 2005 (half of total MEW).

2) The change in MEW had no impact (positive or negative) on 2005 GDP growth, since MEW was the same in 2004 and 2005.

Both statements are correct, but since I presented the first statement in terms of the impact on GDP growth in the chart for each specific year, this was clearly confusing. To clarify further, let's look at 2007:

MEW's Impact on 2007 GDP

For 2006, my estimate of MEW is $521 Billion (first three quarters were $421 Billion). For 2007, I expect MEW to decline to around $300 Billion.

So, assuming Greenspan's 50% estimate is correct, what will be the drag on GDP in 2007?

Here is a simplified calculation: First, the change in MEW is $221 Billion ($521 Billion minus $300 Billion). So the estimated drag on consumption would be $110 Billion. If we assume 2006 GDP of $13.3 Trillion that would mean a drag of about 0.8% in 2007 due to the decline in MEW (see notes below).

Chart Caveats

Although the chart still makes perfect sense to me, it is clearly confusing to some (perhaps many) readers. If you use the chart, remember:

1) The MEW calculation ignores the impact of previous MEW on GDP. It is NOT cumulative. The calculation assumes MEW is a one time boost for each SPECIFIC year.

2) I'm using the Greenspan-Kennedy numbers provided by the Fed, but MEW is NOT an official statistic.

3) this chart assumes that 50% of MEW flows to domestic consumption. It is possible that more or less is used to pay off debt, for investment purposes, or flows to imports.

4) This chart also assumes that MEW flows to consumption in the year the MEW was extracted.

This will probably be the end of the above chart due to the confusion. I will be using this graph in the future to show the relative size of MEW. This graph is of the Greenspan-Kennedy MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

I will be using this graph in the future to show the relative size of MEW. This graph is of the Greenspan-Kennedy MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Sorry for any confusion.

CSBS State Mortgage Guidance Update

by Calculated Risk on 1/03/2007 06:25:00 PM

Twenty two states and the District of Columbia have now adopted the CSBS / AARMR Guidance on Nontraditional Mortgage Product Risks.

This may seem like a slow process, but the WaPo reports:

... states ... have moved quickly to warn state-regulated lenders about the hazards to consumers from nontraditional mortgages.The CSBS told me they expect all 50 states to adopt the guidance.

...

Mike Stevens, senior vice president for regulatory affairs at the Conference of State Bank Supervisors, ... said it was the fastest state-by-state regulatory rollout he had ever seen.

emphasis added

November Construction Spending

by Calculated Risk on 1/03/2007 02:21:00 PM

From the Census Bureau: November 2006 Construction at $1,184.1 Billion Annual Rate

There is some good news in this report - nonresidential construction increased in November.

Nonresidential construction was at a seasonally adjusted annual rate of $316.5 billion in November, 1.4 percent above the revised October estimate of $312.0 billion.Residential construction spending peaked in December 2005, and the typical pattern is for nonresidential construction to peak 3 to 5 quarters after residential construction. Last month I asked if nonresidential construction had peaked in August 2006 - the answer is: no.

The continued decline in residential construction spending was about as expected, and will continue at around this pace, at least through mid-2007, based on housing starts.

Residential construction was at a seasonally adjusted annual rate of $589.3 billion in November, 1.6 percent (±1.3%) below the revised October estimate of $599.0 billion.The Fed is watching nonresidential construction closely too. From the just released minutes of the Dec 12th FOMC meeting:

Business investment appeared to have decelerated recently, and surveys and orders data pointed to a relatively slow rise in equipment and software spending over the next few quarters. Incoming data on construction activity and employment also suggested that, following very rapid growth earlier in the year, increases in nonresidential construction spending could be moderating considerably.

MBA: Mortgage Applications Increase

by Calculated Risk on 1/03/2007 01:19:00 AM

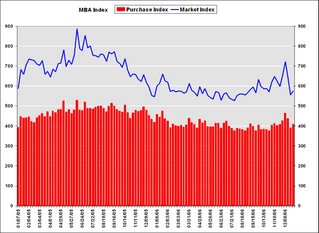

The Mortgage Bankers Association (MBA) reports: Mortgage Applications Increase Click on graph for larger image.

Click on graph for larger image.

The Market Composite Index, a measure of mortgage loan application volume, was 575.6, an increase of 3.6 percent on a seasonally adjusted basis from 555.8 one week earlier. On an unadjusted basis, the Index decreased 27.4 percent compared with the previous week and was up 6.9 percent compared with the same week one year earlier.Mortgage rates were mixed:

The Refinance Index increased by 2.2 percent to 1640.4 from 1604.6 the previous week and the seasonally adjusted Purchase Index increased by 4.3 percent to 406.9 from 390.2 one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.22 from 6.12 percent ...

The average contract interest rate for one-year ARMs decreased to 5.84 percent from 5.87 ...

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is down 1.1 percent to 424.4 from 429.3 for the Purchase Index.

The second graph shows the Purchase Index and the 4 and 12 week moving averages since January 2002. The four week moving average is down 1.1 percent to 424.4 from 429.3 for the Purchase Index.The refinance share of mortgage activity decreased to 48.1 percent of total applications from 48.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 20.4 from 23.1 percent of total applications from the previous week. The ARM share is at its lowest level since July 2003.

Tuesday, January 02, 2007

December Retail Sales "Anemic"

by Calculated Risk on 1/02/2007 09:48:00 PM

From Bloomberg: December Sales Look Anemic, According To Analysts

When the numbers are all tallied on Thursday most industry analysts and experts think this year's holiday-shopping period will be "anemic" -- the description most often used -- because shoppers held off on buying winter gear, procrastinated on holiday gift shopping and have yet to turn in gift cards.Just a note - the Census Bureau will release advanced monthly retail sales for December on January 12th.

...

The International Council of Shopping Centers is projecting that same-store sales, the industry's benchmark of growth measured by receipts rung up at stores open longer than a year, will rise at the low end of its 2.5% to 3.5% forecast.

Thomson Financial expects sales to rise 3% in December.

Wal-Mart Stores Inc. (WMT) , the world's largest retailer, said Saturday that its same-store sales are likely to be higher by 1.6%. That's above a flat to 1% rise the mass discounter forecast ahead of the month. However, it comes after Wal-Mart turned in its first sales decline in 10 years, down 0.1%, in November and may have come at the expense of profit margins.

2007 Economic Predictions

by Calculated Risk on 1/02/2007 06:30:00 PM

"The models say 'recession'; the mind says 'no way.' I'm going with the mind."

Edward Leamer, UCLA Anderson Forecast, December 7, 2006

Click on graph for larger image.

Click on graph for larger image.This graph shows the YoY change in New Home Sales from the Census Bureau. When the YoY change in New Home Sales falls about 20%, usually a recession will follow. The one exception for this data series was the mid '60s when the Vietnam buildup kept the economy out of recession.

Note: the New Home Sales data is smoothed using a three month centered average before calculating the YoY change. The Census Bureau data starts in 1963.

But will the housing bust be enough to take the general economy into recession?

“We're having a lot of problems assessing the impact of the housing market on consumers. We know that it's going to dampen consumer activity. We just don't know how much.”"How much" is the key question. I think the odds of a recession are at least a coin flip at this point, so unlike Professor Leamer, I'm going with the models. With that in mind, here are my predictions for oil prices, the trade deficit, and interest rates. For a long look at housing, see: Housing in 2007.

Peter Morici, economist with the University of Maryland, Dec 31, 2006

Oil Prices: Based on slowing U.S. and world economies, I expect oil prices to fall in 2007. Current the spot prices for WTI are just under $61 per barrel.

Trade Deficit: I expect the U.S. trade deficit to decline in 2007 from the 2006 record of approximately $770 Billion ($643 Billion for through October, 2006). This will be the first decline since 2001.

Economy: Recession. What can I say?

Interest Rates: I expect the Fed to start cutting rates sometime between March and August. I think they will be slow to recognize the downturn, just like in 1990. Still I expect the yield on the Ten Year to be higher by the end of 2007 (currently 4.71%).

Recognizing a recession is hard (almost as hard as predicting a recession correctly). Here are a few quotes from Fed Chairman Alan Greenspan (bear in mind that the recession started in July, 1990):

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].” Greenspan, July 1990I won't mind being wrong, and I hope everyone has a great 2007!

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.” Greenspan, August 1990

“... the economy has not yet slipped into recession.” Greenspan, October 1990

Mortgage Lenders Network stops loans

by Calculated Risk on 1/02/2007 06:17:00 PM

The rumors are true. From Reuters: Mortgage Lenders Network stops loans, sets layoffs

Mortgage Lenders Network USA, a large U.S. subprime lender, said it has stopped funding loans and accepting applications for loans, citing deteriorating conditions in the mortgage market, and has temporarily laid off about 80 percent of its 1,800 employees.And they just broke ground on their new campus:

...

Meanwhile, some lenders have been pinched by being forced to buy back loans they sold because of rising delinquencies, and as "warehouse" lenders pull credit lines, analysts said.

Unlike most subprime rivals, Mortgage Lenders increased its lending throughout 2006. It made $3.31 billion of subprime loans in the third quarter, ranking 15th nationwide, according to data from National Mortgage News.

The firm, however, said wholesale market conditions have "deteriorated dramatically" in the last two months.

MLN’s President & CEO Mitch Heffernan surveys the site of MLN’s new corporate headquarters located in Wallingford, CT. Construction is underway on the 305,000 square foot campus.

Lennar: No Sign of Housing Market Recovery

by Calculated Risk on 1/02/2007 10:51:00 AM

From CNNMoney: Lennar warns on earnings.

Lennar, one of the nation's largest home builders, warned that it will miss fourth quarter earnings forecasts and post a net loss as it writes down the value of some of its land and other assets.

Lennar (Charts) also said it has "not yet seen tangible evidence of a market recovery." ... The ongoing weakness in the home building market will cause Lennar to take a pretax impairment charges of $400 million to $500 million due to the revaluation of some of its assets.

Monday, January 01, 2007

More Views on Housing

by Calculated Risk on 1/01/2007 03:55:00 PM

From the Orange County Register Jon Lanser's, Eyeballs on Housing series, on the 2007 housing market:

"Nationally, I expect low levels of sales of both existing and new homes, aggressive pricing of new homes (e.g., a 10 percent decline in price), but very little erosion (2-5 percent) of sales prices of existing homes."

Professor Ed Leamer, Director UCLA Anderson Forecast

"Both sales and prices will be up from 2006. Sales should rise to our 10-year average of 40,100, which puts sales up 10 percent, and prices should rise 7 percent for homes and the 4 percent-5 percent range for condos."

Gary Watts, broker/economist on Orange County housing.