by Calculated Risk on 10/29/2009 08:30:00 AM

Thursday, October 29, 2009

BEA: GDP Increases at 3.5% Annual Rate in Q3

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.5 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is close to expectations, and GDP in Q4 will probably be in the same range with more inventory restocking and stimulus spending. But the question is: what happens in 2010?

...

The upturn in real GDP in the third quarter primarily reflected upturns in PCE, in private inventory investment, in exports, and in residential fixed investment and a smaller decrease in nonresidential fixed investment that were partly offset by an upturn in imports, a downturn in state and local government spending, and a deceleration in federal government spending.

...

Real personal consumption expenditures increased 3.4 percent in the third quarter, in contrast to a decrease of 0.9 percent in the second.

...

Real nonresidential fixed investment decreased 2.5 percent in the third quarter, compared with a decrease of 9.6 percent in the second. Nonresidential structures decreased 9.0 percent, compared with a decrease of 17.3 percent. Equipment and software increased 1.1 percent, in contrast to a decrease of 4.9 percent. Real residential fixed investment increased 23.4 percent, in contrast to a decrease of 23.3 percent.

I'll have some more on investment later ...

Sunday, October 18, 2009

Inventory Restocking and Q3 GDP

by Calculated Risk on 10/18/2009 02:43:00 PM

Professors Hamilton and Krugman have mentioned that Q3 GDP will probably be reasonably strong, see Hamilton's No L and Krugman's A smidgen of optimism. I agree.

But I don't think growth in Q3, or even in Q4, are the question. The key question is what happens in early 2010.

The following graph shows the contributions to GDP from changes in private inventories for several recessions. The blue shaded area is the last two quarters of each recession, and the light area is the first four quarters of each recovery. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The Red line is the median of the last 5 recessions - and indicates about a 2% contribution to GDP from changes in inventories, for each of the first two quarters coming out of a recession. But this boost is always transitory.

Following the 1969 recession, changes in inventory added 6.2% to GDP in the first quarter of recovery - and GDP increased at an 11.5% (SAAR) that quarter. No one is predicting a quarter like that. But a 1% to 2% contribution from changes in inventories is possible.

And Personal Consumption Expenditures (PCE) will be strong too.

The following graph shows real PCE through August (2005 dollars). Note that the y-axis doesn't start at zero to better show the change. The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

The July and August numbers suggest PCE will grow at about a 3.6% (annualized rate) in Q3, however retail sales suggest less growth in September (July and August were boosted by cash-for-clunkers). So maybe we will see 3% PCE growth in Q3, and that would mean a contribution to GDP of about 2%.

Add in positive contributions from net exports, an increase in residential investment (for the first time since Q4 2005), some increase in equipment and software investment - and Q3 should look pretty healthy. Yes, investment in non-residential structures will be ugly, but overall private investment will be positive (first time since Q3 2007).

However, I expect early 2010 to be a different story.

Although I expect solid GDP growth in Q3 (and probably OK in Q4), I think GDP growth in 2010 will be sluggish, with downside risks.

Saturday, August 01, 2009

Real Declines in GDP

by Calculated Risk on 8/01/2009 10:28:00 PM

An update: the following graph shows the decline in real GDP (quarterly) from the previous peak since 1947. GDP is now 3.9% below the recent peak. In terms of declines in real GDP, the current recession is the worst since quarterly records have been kept (starting in 1947).

Note: This includes the downward revisions to the previous quarters.

When the red line is at zero it indicates that that quarter is at an all time high in terms of real GDP.

It will be interesting to see how long it takes for real GDP to reach the pre-recession peak. With a a sluggish recovery, and assuming no more cliff diving, it could take until sometime in 2011.

Friday, July 31, 2009

The Investment Slump in Q2

by Calculated Risk on 7/31/2009 08:53:00 AM

The investment slump continued in Q2 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

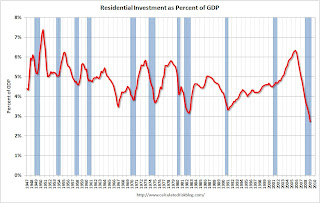

Residential investment (RI) has been declining for 14 consecutive quarters, and the decline in Q2 was still very large - a 29.3% annual rate in Q2.

This puts RI as a percent of GDP at 2.4%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are declining.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are declining.

Business investment in equipment and software was off 9.0% (annualized) and has declined for 6 consecutive quarters. Investment in non-residential structures was only off 8.9% (annualized) and will probably fall sharply over the next year or so.

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last three and a half years. The good news is the drag on GDP will probably end soon. The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

Residential investment (red) has been a huge drag on the economy for the last three and a half years. The good news is the drag on GDP will probably end soon. The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - declined in Q2. If there is a surprise it is how well nonresidential investment in structures held up in Q2 (although we could see this in the construction spending data). This investment will decline sharply soon as many major projects are completed, and few new projects are started.

In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - and I expect it to turn slightly positive in the second half of 2009.

Sunday, July 12, 2009

Selected GDP Forecasts

by Calculated Risk on 7/12/2009 01:59:00 PM

Professor Roubini thinks the economy will be in recession through the end of 2009, and that the recovery will be "shallow". More from Christian Menegatti at RGE Monitor:

The general consensus is that this recession will end sometime in the second half of 2009. While RGE Monitor expects more quarters of negative real GDP growth in 2009, we also expect the pace of contraction of economic activity to slow significantly. We forecast negative real GDP growth in Q2 2009 and Q3 2009, and for real GDP to remain flat in Q4. After the sharp contraction in economic activity in 2009, growth will reenter positive territory only in 2010, and then at a very sluggish rate, well below potential.Paul Kasriel at Northern Trust is a little more optimistic: When We Get “There”, Will We Know It?

Back in April, our forecast update commentary was entitled, “Are We There Yet?” The “there” referred to a resumption of real growth in the overall economy. Our answer in April was “no,” which also happens to be our answer in July. When will we get there? Our answer in April was the fourth quarter of this year, which also happens to be our answer now. Assuming we get there in the fourth quarter, would most households and businesses in America know it if they were not so informed by the media? Probably not. We anticipate another “jobless recovery,” which implies a relatively feeble one. We would not be surprised to hear terms early in 2010 such as “double dip.”I think Kasriel might be a little too optimistic about 2010.

Jan Hatzius at Goldman Sachs sees a little positive GDP growth starting in Q3, and a sluggish recovery (no link).

Here are the quarter by quarter real GDP (annualized) forecasts from Northern Trust and Goldman:

| Quarter | Northern Trust | Goldman Sachs |

|---|---|---|

| Q2 2009 | -2.2% | -1.0% |

| Q3 2009 | -2.1% | 1.0% |

| Q4 2009 | 2.3% | 1.0% |

| Q1 2010 | 1.2% | 1.5% |

| Q2 2010 | 2.4% | 1.5% |

| Q3 2010 | 2.4% | 2.0% |

| Q4 2010 | 3.3% | 2.0% |

I think the real GDP growth will turn slightly positive sometime in the 2nd half of this year, but my guess is 2010 will be barely positive, with the unemployment rate rising for most of 2010.

Saturday, July 11, 2009

Unemployment and GDP

by Calculated Risk on 7/11/2009 05:50:00 PM

The WSJ Real Time Economics blog mentioned Okun's law yesterday (a relationship between changes in GDP and unemployment): Job Losses Outpace GDP Decline (ht Bob_in_MA)

In a research note, [Alliance Bernstein economist Joseph] Carson says job losses in prior downturns have been roughly proportional to the decline in gross domestic product. But in the current recession, the proportion of jobs lost is running about a third greater than the drop in real GDP.

The correlation between GDP growth and unemployment is called Okun’s Law, after the late economist Arthur Okun who documented it in the 1960s. But the numerical relationship that Okun estimated – and other economists have since refined – has broken down. His original estimate suggested about a 3% decline in GDP for every 1% increase in unemployment. Before joining the Fed, Ben Bernanke, working with Andrew Abel, figured more recent suggested about a 2% decrease in output for every 1% increase in unemployment.

Click on graph for larger image.

Click on graph for larger image.This graph shows the quarterly change in real GDP (annualized) vs. the change in unemployment rate. The red markers are for 2008 and Q1 2009.

Usually the trend line is drawn as linear, but I made it a 2nd order polynomial here.

The red markers are above the trend line, but within the normal scatter.

For Q2 the unemployment rate increased 1.2% (from Q1, quarterly average), and the annualized real GDP change will probably be in the -1% to -2% range - so that is also above the trend (a larger than expected change in unemployment based on the change in real GDP).

Okun's law is just a general relationship, and the relationship appears to have changed over time (as mentioned in the WSJ).

Note: the graph shows the quarterly change in real GDP annualized (the way it is reported by the BEA each quarter). In the WSJ post, they mentioned "a 2% [or 3%] decrease in output for every 1% increase in unemployment". A 2% decrease in quarterly output would be reported by the BEA as over 8% annualized for the quarter.

Wednesday, June 10, 2009

Update: What is a Depression?

by Calculated Risk on 6/10/2009 08:50:00 PM

In early March it seemed like the "D" word was everywhere. That raised a question: What is a depression?

This is an update to that earlier post. Although there is no formal definition, most economists agree a depression is a prolonged slump with a 10% or more decline in real GDP.

In March I heard an analyst say that a 10% unemployment rate is a depression. But the unemployment rate peaked at 10.8% in 1982, and that period is not considered a depression.

Some people argue the duration of the economic slump defines a depression - and the current recession is already 18 months old (through May). That is longer than the recessions of '90/'91 and '01. The '73-'75 recession lasted 16 months peak to trough, and the early '80s recession (a double dip) was classified as a 6 month recession followed by a 16 month recession (22 months total). Those earlier periods weren't "depressions", so if duration is the key measure, the current recession probably still has a ways to go.

Here is a graph comparing the decline in real GDP for the current recession with other recessions since 1947. Depression is marked on the graph as -10%.

Q2 2009 is estimated at a -4.0% decline in real GDP (seasonally adjusted annual rate). This will push the cumulative decline (peak to trough) to about 4.2% from the peak of real GDP.

Note: Northern Trust is forecasting -3.6% real GDP (SAAR) in Q2, and Goldman Sachs is forecasting -3.0%. For the stress tests, the baseline scenario assumed -1.2% in Q2, and the "more adverse" scenarios assumed -4.3%.

Even though the current recession is already one of the worst since 1947, it is only about 42% of the way to a depression (assuming a weak Q2).

To reach a depression - assuming -4.0% in Q2 - the economy would have to decline at about a 5.8% annual rate each quarter for the next year.

Wednesday, April 29, 2009

The Investment Slump

by Calculated Risk on 4/29/2009 09:13:00 AM

The huge investment slump was the key story in Q1. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Residential investment (RI) has been declining for 13 consecutive quarters, and Q1 2009 was the worst quarter (in percentage terms) of the entire bust. Residential investment declined at a 38% annual rate in Q1.

This puts RI as a percent of GDP at 2.7%, by far the lowest level since WWII. The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

The second graph shows non-residential investment as a percent of GDP. All areas of investment are now cliff diving.

Business investment in equipment and software was off 33.8% (annualized), and investment in non-residential structures was off 44.2% (annualized).

The third graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures. The graph shows the rolling 4 quarters for each investment category.

This is important to follow because residential tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy. Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Residential investment (red) has been a huge drag on the economy for the last couple of years. The good news is the drag on GDP will probably be getting smaller going forward.

Even if there is no rebound in residential investment later this year, the drag will be less because there isn't much residential investment left! The bad news is any rebound in residential investment will probably be small because of the huge overhang of existing inventory.

As expected, nonresidential investment - both structures (blue), and equipment and software (green) - fell off a cliff. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

As always, residential investment is the most important investment area to follow - it is the best predictor of future economic activity.

GDP Declines 6.1% in Q1

by Calculated Risk on 4/29/2009 08:32:00 AM

From the BEA: Gross Domestic Product: First Quarter 2009 (Advance)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 6.1 percent in the first quarter of 2009 ...So PCE increased (as expected), but investment slumped sharply in all categories.

Real personal consumption expenditures increased 2.2 percent in the first quarter, in contrast to a decrease of 4.3 percent in the fourth. ...

Real nonresidential fixed investment decreased 37.9 percent in the first quarter ...

Nonresidential structures decreased 44.2 percent ...

Equipment and software decreased 33.8 percent ...

Real residential fixed investment decreased 38.0 percent ...

From Rex Nutting at MarketWatch: GDP falls 6.1% on record drop in investment

The two-quarter contraction is the worst in more than 60 years. The big story for the first quarter was in the business sector, where firms halted new investments, and shed workers and inventories at a dizzying pace ...For the stress tests, the baseline scenario for Q1 was minus 5.0%, and the more adverse scenario was minus 6.9%, so, before revisions, Q1 is between the two scenarios. More to come ...

Friday, March 27, 2009

Q1 GDP will be Ugly

by Calculated Risk on 3/27/2009 04:43:00 PM

First, a quick market update ...

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

On Q1 GDP:

Earlier today the BEA released the February Personal Income and Outlays report. This report suggests Personal Consumption Expenditures (PCE) will probably be slightly positive in Q1 (caveat: this is before the March releases and revisions).

Since PCE is almost 70% of GDP, does this mean GDP will be OK in Q1?

Nope.

I expect Q1 2009 GDP to be very negative, and possibly worse than in Q4 2008. Right now I'm looking at something like a 6% to 8% decline (annualized) in real GDP (there is significant uncertainty, especially with inventory and trade).

The problem is the 30% of non-PCE GDP, especially private fixed investment. There will probably be a significant inventory correction too, and some decline in local and state government spending. But it is private fixed investment that will cliff dive. This includes residential investment, non-residential investment in structures, and investment in equipment and software.

A little story ...

Imagine ACME widget company with a steadily growing sales volume (say 5% per year). In the first half of 2008 their sales were running at 100 widgets per year, but in the 2nd half sales fell to a 95 widget per year rate. Not too bad.

ACME's customers are telling the company that they expect to only buy 95 widgets this year, and 95 in 2010. Not good news, but still not too bad for ACME.

But this is a disaster for companies that manufacturer widget making equipment. ACME was steadily buying new widget making equipment over the years, but now they have all the equipment they need for the next two years or longer.

ACME sales fell 5%. But the widget equipment manufacturer's sales could fall to zero, except for replacements and repairs.

And this is what we will see in Q1 2009. Real investment in equipment and software has declined for four straight quarters, including a 28.1% decline (annualized) in Q4. And I expect another huge decline in Q1.

For non-residential investment in structures, the long awaited slump is here. I expect declining investment over a number of quarters (many of these projects are large and take a number of quarters to complete, so the decline in investment could be spread out over a couple of years). And once again, residential investment has declined sharply in Q1 too.

When you add it up, this looks like a significant investment slump in Q1.

Sunday, March 15, 2009

Hamilton: "What will recovery look like?"

by Calculated Risk on 3/15/2009 06:10:00 PM

Professor Hamilton provides a number of graphs on the temporal order of a recovery: What will recovery look like?

This adds to my post: Business Cycle: Temporal Order

Here is the table I provided of a simplified temporal order for emerging from a recession. The table shows when each area typically starts to recovery relative to the end of the recession.

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

And this graph from Professor Hamilton shows the average pattern for all the recessions since 1947.

And here is what the current recession looks like. The record slump in RI has changed the scale of the graph, but the order appears the same.

For recovery, we know what to watch: Residential Investment (RI) and PCE. The increasingly severe slump in CRE / non-residential investment in structures will be interesting, but that is a lagging indicator for the economy.

Unfortunately there are reasons that RI (excess supply) and PCE (too much debt) won't rebound quickly, but they are still the areas to watch.

And here is an excerpt from a research note by Jan Hatzius, Chief Economist at Goldman Sachs, sent out this afternoon:

"Although we still think real GDP will fall by about 7% annualized in Q1 and the labor market numbers remain awful, the good news is that the weakness is shifting from more leading to more lagging sectors."(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Saturday, March 14, 2009

Inventory Correction

by Calculated Risk on 3/14/2009 05:35:00 PM

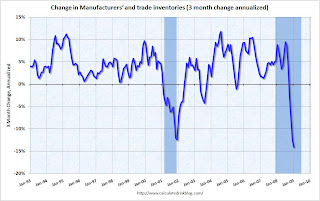

The recent data suggests there is a significant inventory correction in progress. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph is based on the Manufacturing and Trade Inventories and Sales report from the Census Bureau.

This shows the 3 month change (annualized) in manufacturers’ and trade inventories. The inventory correction was slow to start in this recession, but inventories are now declining sharply.

This change in inventories will probably have a significant impact on GDP for the next few quarters. This is common in a recession. The contribution of changes in inventory to GDP have been pretty wild at times - in the early '80s there were a few quarters where the change in inventory subtracted more than 5% from GDP (annualized) in just one quarter! Something like that could happen in Q1 or Q2 too - and this is difficult to predict - and that could contribute to a horrible GDP number in Q1.

This inventory correction is probably also impacting imports and could be part of the reason import traffic has fallen off a cliff (see LA Port Import Traffic Collapses in February)

The good news is a significant inventory correction will help with GDP later in the year. Even with some evidence of stabilization in personal consumption, I expect a horrible GDP number for Q1 due to this inventory correction and also because of the sharp decline in all categories of investment (especially non-residential investment).

Thursday, January 29, 2009

Q4 GDP Forecasts: Consensus 5.4% Decline

by Calculated Risk on 1/29/2009 11:44:00 PM

As a late night thread, here are some forecasts for Q4 GDP.

From the LA Times: Economy is going from bad to worse, reports show

Many economists think the economic output declined in the fourth quarter at an annual rate of 5% or more -- which would make it the worst quarter for the U.S. economy since 1982.From CNNMoney:

"It will be bad," said Nigel Gault, chief U.S. economist at IHS Global Insight, a forecasting firm in Lexington, Mass. He estimated that the economy shrank at a 5.3% annual rate in the three months that ended Dec. 31.

...

"It's going to confirm what we already know, and that is that we're in a severe recession," said Ben Herzon, senior economist with forecasting firm Macroeconomic Advisers in St. Louis, who expects the report to show a decline of 5.5%.

The gross domestic product is expected to have declined by an annual rate of 5.4% in the fourth quarter, according to a consensus of economist expectations from Briefing.com.Goldman Sachs most recent estimate is for real GDP to decline by 5.9%.

Northern Trust is forecasting a decline of 4.7%.

Looks like tomorrow will be interesting.

Thursday, October 30, 2008

Q3 GDP Declines 0.3%

by Calculated Risk on 10/30/2008 08:30:00 AM

From the BEA: GROSS DOMESTIC PRODUCT: THIRD QUARTER 2008 (ADVANCE)

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- decreased at an annual rate of 0.3 percent in the third quarter of 2008 ...PCE declined -3.1% (annualized). This is the first decline in consumer spending since 1991.

The decrease in real GDP in the third quarter primarily reflected negative contributions from personal consumption expenditures (PCE), residential fixed investment, and equipment and software that were largely offset by positive contributions from federal government spending, exports, private inventory investment, nonresidential structures, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

Private investment declined -1.9%. I'll have some graphs on investment shortly.

Friday, October 24, 2008

Fed Researchers on Predicting PCE

by Calculated Risk on 10/24/2008 06:29:00 PM

I've been using a two month method to predict PCE. This estimate suggests real PCE will decline by 2.4% in Q3.

Fed economists Riccardo DiCecio and Charles S. Gascon have used real time data to estimate PCE and check the reliability of this approach: Predicting Consumption: A Lesson in Real-Time Data (November 2008)

Whereas I used revised data for historical comparisons, the Fed economists only used data that was available for analysts at the time of the estimate (a much better test of the approach). The economists found that using the change in the second-month of each quarter (over the second-month of the previous quarter) was very reliable. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The chart plots the approximated (second-month) and actual growth rates of PCE since 1991 using real-time data: That is, the growth rates at each point on the chart are computed using only the data that would have been available to a researcher at the time of the estimate. The approximated measure for 2008:Q3 is –2.3 percent, suggesting the first decline in PCE since the fourth quarter of 1991.Since PCE accounts for almost 71% of GDP, this also suggests the change in real GDP in Q3 might be negative. This depends on exports, changes in inventories and government spending (investment will certainly be negative in Q3).

Friday, October 03, 2008

Goldman Sachs Forecasts "Deeper" Recession

by Calculated Risk on 10/03/2008 07:40:00 PM

From Rex Nutting at MarketWatch: More severe recession now forecast by Goldman Sachs

The U.S. recession will be "significantly deeper" than they previously thought, Goldman Sachs economists predicted Friday in a research note. ... The unemployment rate will likely rise to 8% by the end of next year from 6.1% currently.Goldman is now forecasting Q3 2008 real GDP growth at 0.0%, with PCE at minus 2.5% (annualized as reported by BEA). This is similar to my two month estimate for PCE, see Estimating PCE Growth for Q3 2008. Both PCE and investment will be negative in Q3, but net exports, private inventories and government spending will probably all show positive growth in Q3. So GDP may be close to zero.

A major change in the Goldman outlook is the increase in the unemployment rate to 8% in 2009 (their previous forecast was for unemployment reaching 7% in 2009).

One of the features of recent recessions is that the unemployment rate kept rising for 18 months to two years after the recession officially ended. This suggests that the peak unemployment rate (for this cycle) might not happen until 2011, even if the recession ends in late 2009 - scary. I'll have some more thoughts on unemployment soon.

Note that this is the headline unemployment number. Other measures of unemployment are much higher: See Krugman: The track record

Thursday, July 31, 2008

GDP and Investment

by Calculated Risk on 7/31/2008 10:09:00 AM

The BEA reported that GDP increased 1.9% in Q2 2008 at a seasonally adjusted annual rate (SAAR). But the underlying details - especially for investment - are weak.

Residential investment (RI) declined at a 15.6% (SAAR).

Investment in equipment and software declined 3.4% (SAAR).

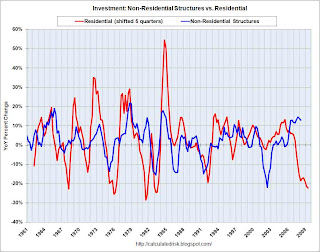

The lone bright spot for investment was non-residential investment in structures. Non-RI structure investment increased at a 14.4% SAAR. But all evidence suggests this investment is about to slow sharply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This first graph shows the typical relationship between residential investment and non-residential investment in structures. Note that residential investment is shifted 5 quarters into the future on the graph (non-residential investment usually follows residential by about 4 to 7 quarters).

The current non-residential boom has gone on a little longer than normal, probably for two reasons: 1) there was a slump in investment following the bursting of the tech bubble, and 2) loose lending standards kept non-residential investment lending strong until mid-year 2007, and it takes time to build non-residential structures.

All signs suggest that the bust is now here, and non-residential investment will probably be a drag on GDP for the next year or more. The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

The second graph shows non-residential investment as a percent of GDP. This shows the current boom is even greater than the boom in the late '90s.

Some of the current investment boom is energy related, and I'll break out the three key areas that will soon go bust - office buildings, multimerchandise shopping, and lodging - as soon as the underlying detail tables are available. The third graph shows residential investment (RI) as a percent of GDP.

The third graph shows residential investment (RI) as a percent of GDP.

RI as a percent of GDP is at 3.5%, just above the cycle lows in 1982 and 1991. It is possible that RI, as a percent of GDP, will bottom later this year (or possibly in early 2009) since inventory is finally declining (housing starts are now below housing sales).

When RI finally bottoms, the good news is RI will no longer be a drag on GDP, but the bad news is RI will probably not recovery quickly because of the huge overhang of inventory. Unfortunately, by the time RI bottoms, non-residential investment will probably have taken over as a significant drag on GDP - suggesting the recession will linger.

Investment is usually the key to the economy, and investment remains weak.

Wednesday, April 30, 2008

Q1 GDP Increases 0.6%

by Calculated Risk on 4/30/2008 08:51:00 AM

The Bureau of Economic Analysis reports that the U.S. economy grew at a 0.6% annual real rate in Q1 2006, mostly because of a buildup in inventories. Without the unwanted buildup in inventory, GDP would have been negative, suggesting the economy is in recession.

Consumer spending was up 1.0% at an annual rate, with services up 3.4% (the two month method predicted 1% PCE growth in Q1), and investment spending was off in all categories: residential investment off -26.7%, non-residential structures off -6.2%, and equipment and software investment off -0.7%. Click on graph for larger image.

Click on graph for larger image.

This graph shows residential investment (RI) as a percent of GDP since 1960. RI as a percent of GDP is now at 3.8%, still well above the investment lows in 1982 (3.15%) and 1991 (3.3%). RI will probably decline further over the next few quarters.

Perhaps more important for the economy is that investment in equipment and software, and investment in non-residential structures, both turned negative in Q1. This is important because business investment slumps are highly correlated with the beginning of a recession. The second graph shows non-residential investment in structures as a percent of GDP since 1960.

The second graph shows non-residential investment in structures as a percent of GDP since 1960.

Non-RI structure investment has finally turned negative, and will probably decline sharply during 2008. See CRE Bust: How Deep, How Fast?

More on investment later.

Thursday, April 17, 2008

Investment Matters

by Calculated Risk on 4/17/2008 02:19:00 PM

Recently many companies have announced plans to cut capital spending in 2008. This probably means non-residential fixed investments will decline in 2008, as compared to 2007.

This decline in investment is an important indicator for the economy, since changes in fixed investment correlate very well with GDP. The first graph shows the change in real GDP and Private Fixed Investment over the preceding four quarters through Q4 2007. (Source: BEA Table 1.1.1) (note these are year-over-year changes, not quarter-by-quarter).  Click on graph for larger image.

Click on graph for larger image.

The red line is the year-over-year change in fixed investment, and the blue line (scale on left axis) is the year-over-year change in GDP. Correlation is 79%.

Residential investment is the best indicator of a future recession, but that has been flashing a recession warning for some time. This is why I've been so focused lately on non-residential investment, especially on commercial real estate, to determine that the recession has started. (also consumer spending - but that is a different post). The second graph shows two components of private fixed investment: residential (shifted 5 quarters into the future) and nonresidential structures.

The second graph shows two components of private fixed investment: residential (shifted 5 quarters into the future) and nonresidential structures.

This graphs shows something very interesting: in general, residential investment leads nonresidential structure investment. There are periods when this observation doesn't hold - like '95 when residential investment fell and the growth of nonresidential structure investment remained strong.

Another interesting period was in 2001 when nonresidential structure investment fell significantly more than residential investment. Obviously the fall in nonresidential structure investment was related to the bursting of the stock market bubble.

However, the typical pattern is residential investment leads non-residential structure investment. The normal pattern would be for investment in non-residential structures to have turned negative now.

And based on construction spending, anecdotal stories, and the most recent Fed loan survey, it appears the non-residential structure investment bust is here.

Here is a graph based on the Fed senior loan officer survey in January: The January 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

Note: the April survey should be released in early May. Of particular interest is the record increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the record increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

This is strong evidence of an imminent slump in non-residential structure investment.

Wednesday, October 31, 2007

Q3 GDP Growth: 3.9 Percent

by Calculated Risk on 10/31/2007 09:25:00 AM

From the WSJ: GDP Grew 3.9% in Third Quarter On Exports, Consumer Spending

Gross domestic product rose at a seasonally adjusted 3.9% annual rate in the third quarter, the Commerce Department said Wednesday in its first estimate of growth for the July-September period. GDP climbed at a 3.8% pace in the second quarter and 0.6% in the first.Also ADP reports: ADP Numbers Show Job Market Improvement

ADP said nonfarm private employment increased 106,000 in October, following three months in which private-sector jobs grew by an average of 43,000 a month. Assuming public employment rose by 19,000 — the average monthly gain over the last year — the ADP numbers imply that Friday’s payroll report from the Labor Department will show an increase of 125,000 in total nonfarm employment.I'll have more on investment later.