by Calculated Risk on 4/20/2010 02:06:00 PM

Tuesday, April 20, 2010

DataQuick: California Notice of Default Filings Decline in Q1

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009, and for Q1 2010, in California from DataQuick.

Although the pace of filings has slowed, it is still very high by historical standards.

From Alejandro Lazo at the LA Times: California foreclosures drop 4.2% as lenders work with troubled borrowers

Across California, a total of 81,054 homes received a notice of default in the first quarter compared with 84,568 in the fourth quarter of 2009 and a record 135,431 in the first quarter of 2009.In terms of new NOD filings, the peak was probably in 2009. A few key points:

Thursday, April 15, 2010

RealtyTrac: March Foreclosure Activity Highest on Record

by Calculated Risk on 4/15/2010 08:54:00 AM

From RealtyTrac: Foreclosure Activity Increases 7 Percent in First Quarter

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for Q1 2010, which shows that foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 932,234 properties in the first quarter, a 7 percent increase from the previous quarter and a 16 percent increase from the first quarter of 2009. One in every 138 U.S. housing units received a foreclosure filing during the quarter.This is the highest monthly total - and highest quarterly total - since RealtyTrac started tracking foreclosures in 2005 (and that probably means this is the highest ever). Note that the initial stage filings (Notice of Default and Lis Pendens depending on the state) were flat with Q1 2009, but that later stage filings (of Trustee Sale and Notice of Foreclosure Sale and repossessions) surged:

Foreclosure filings were reported on 367,056 properties in March, an increase of nearly 19 percent from the previous month, an increase of nearly 8 percent from March 2009 and the highest monthly total since RealtyTrac began issuing its report in January 2005.

“Foreclosure activity in the first quarter of 2010 followed a very similar pattern to what we saw in the first quarter of 2009: a shallow trough in January and February followed by a substantial spike in March,” said James J. Saccacio, chief executive officer of RealtyTrac. “One difference, however, is that the increases were more tilted toward the final stage of foreclosure, with REOs increasing 9 percent on a quarterly basis in the first quarter of 2010 compared to a 13 percent quarterly decrease in REOs in the first quarter of 2009.

“This subtle shift in the numbers pushed REOs to the highest quarterly total we’ve ever seen in our report and may be further evidence that lenders are starting to make a dent in the backlog of distressed inventory that has built up over the last year as foreclosure prevention programs and processing delays slowed down the normal foreclosure timeline.”

Foreclosure auctions were scheduled for the first time on a total of 369,491 properties during the quarter, the highest quarterly total for scheduled auctions in the history of the report. Scheduled auctions increased 12 percent from the previous quarter and were up 21 percent from the first quarter of 2009.It appears that the banks are starting to clear out the foreclosure backlog.

Bank repossessions (REOs) also hit a record high for the report in the first quarter, with a total of 257,944 properties repossessed by the lender during the quarter — an increase of 9 percent from the previous quarter and an increase of 35 percent from the first quarter of 2009.

Thursday, April 08, 2010

Report: Distressed Home Sales Increasing

by Calculated Risk on 4/08/2010 02:33:00 PM

First American Corelogic released their first distressed sales report this morning: Distressed Sales Again on the Rise, Reaching 29% in January

First American CoreLogic today released its first monthly report on distressed sales activity. The report below indicates that distressed home sales – such as short sales and real estate owned (REO) sales – accounted for 29 percent of all sales in the U.S. in January: the highest level since April 2009. The peak occurred in January 2009 when distressed sales accounted for 32 percent of all sales transactions (Figure 1). After the peak in early 2009, the distressed sale share fell to 23 percent in July, before rising again in late 2009 and continuing into 2010.Here are a couple of graphs from the report:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Credit: First American Corelogic.

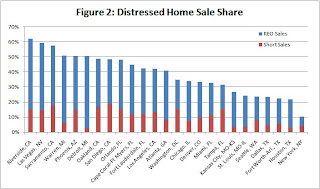

This graph shows the total percent of distressed sales broken down by REO and Short Sales. Notice that the percent short sales has increased significantly over the last year - that trend will probably continue.

The second graph shows the breakdown by certain metropolitan areas.

The second graph shows the breakdown by certain metropolitan areas. Among the largest 25 markets, Riverside, CA, had the largest percentage of distressed sales in January (62 percent), followed closely by Las Vegas (59 percent) and Sacramento (58 percent) (Figure 2). The top REO market was Detroit where the REO share was 48 percent, followed closely by Riverside (47 percent) and Las Vegas (45 percent). San Diego’s short sale share was 19 percent in January, making it the highest ranked short sale market, followed by Sacramento (18 percent) and Oakland (16 percent). Although the top 10 markets for foreclosures are all located in Florida, only two Florida markets, Orlando and Cape Coral, made the top 10 distressed sale list. The most likely reason: Florida is a judicial state where foreclosures process through the courts and take quite a bit longer than in California, Arizona or Nevada, where non‐judicial foreclosures are the norm.I've been following the Sacramento market as an example of a distressed market - and the Sacramento Association of REALTORS® reported that almost 69% of sales were distressed in January, with 24% short sales, and 45% REOs. The FACL data shows about 58% as distressed. The difference is probably in the methodology.

The exact numbers probably aren't as important as the trend - and this will be an interesting trend to follow in 2010.

Wednesday, April 07, 2010

Report: BofA to increase Foreclosures significantly in 2010

by Calculated Risk on 4/07/2010 09:42:00 PM

Irvine Renter at the Irvine Housing Blog writes: Bank of America to Increase Foreclosure Rate by 600% in 2010

[Irvine Renter] attended a local Building Industry Association conference on Friday 26 March 2010. The west coast manager of real estate owned, Senior Vice President Ken Gaitan, stated that Bank of America, which currently forecloses on 7,500 homes a month nationally, will increase that number to 45,000 homes per month by December of 2010.CR Note: I tried to verify these numbers with BofA without success. Irvine Renter clarified this for me today. Apparently Gaitan said that Bank of America anticipates the peak of foreclosure activity will occur in December 2010 and will top out at 45,000 units that month. Apparently BofA believes foreclosure activity will trend down in 2011. According to Irvine Renter, Gaitan said BofA expects about 300,000 total foreclosures in 2010. That is a significant increase from the current 7,500 per month pace.

After his surprising statement, two questioners from the audience asked questions to verify the numbers.

Bank of America is projecting a 600% increase in its already large number of monthly foreclosures.

This isn't unsubstantiated rumor; this comes straight from one of the most powerful men in Bank of America's OREO department (yes, that really is what they call it). It appears they have too many properties already.

Once again, BofA's media department told me they'd get back to me - but no word so far - so there numbers have not been verified.

CR note: OREO stands for "Other Real Estate Owned"

Tuesday, April 06, 2010

CNBC's Olick: Foreclosure "Pig in the python is showing its face"

by Calculated Risk on 4/06/2010 03:38:00 PM

From Diana Olick at CNBC: Foreclosures Are Rising

Yes, banks are ramping up loan modifications and ramping up short sales and ramping up deeds in lieu of foreclosure, but the plain fact is that as the systems are oiled, the loans are moving through faster, and the pig in the python is showing its face.The foreclosures are coming! The foreclosures are coming!

We won't get the [foreclosure] numbers until next week, but sources tell me they will likely be a new monthly record.

I don't think there is any question that foreclosures will pick up. And now is a good time to get properties on the market. As an example, Freddie Mac just announced an auction of homes: Freddie Mac, New Vista to Auction Hundreds of Homes on April 24 in Las Vegas, April 25 in California's Inland Empire Before Federal Homebuyer Tax Credit Expires

Freddie Mac (NYSE:FRE) and New Vista today announced plans to auction hundreds of HomeSteps® REO homes to individual homebuyers in Las Vegas on April 24, 2010 and in California’s Inland Empire on April 25, 2010 in support of the federal Neighborhood Stabilization Program (NSP) and to help more first time homebuyers and owner occupants purchase these homes. HomeSteps is the real estate sales unit of Freddie Mac and markets a nationwide selection of Freddie Mac-owned homes.

...

By scheduling these two auctions on April 24 and 25, bidders may still be able to qualify for the federal home purchase tax credit, which is set to expire on April 30, 2010. The tax credit offers eligible first time homebuyers up to $8,000 on qualifying homes.

Monday, March 15, 2010

2010: REOs or Short Sales?

by Calculated Risk on 3/15/2010 11:20:00 PM

Paul Jackson has a great post at HousingWire: Housing Recovery is Spelled R-E-O

[U]sing LPS data, for all loans more than 90 days in arrears, the average days delinquent is now at 272 days—up from 204 days in early 2008. For loans in foreclosure, the aging numbers are even more staggering: loans in this bucket average 410 days delinquent, up from 260 days delinquent in early 2008.Ahhh ... the "Squatter Stimulus Plan" - live mortgage free (but not worry free).

Ponder those numbers for just a second. On average, severely delinquent borrowers have gone more than 9 months without making a mortgage payment—and yet foreclosure has not yet started for them. For those borrowers who are in the foreclosure process, it’s been an average of 13.6 months—more than one full year—since they last made any payment on their mortgage.

But Paul thinks foreclosures (REOs) will be the answer, not short sales:

For some, short sales will be an important solution—but don’t kid yourself: the hype currently surrounding short sales and the HAFA program will prove to be short-lived ...He gives two main reasons for foreclosures over short sales: 1) 2nd liens, and 2) that HAFA has the same qualifications as HAMP. I agree that 2nd liens pose a serious problem, but on the qualifications, Paul writes:

The HAFA program, going into effect on April 5, is getting plenty of attention—and the program’s heart is in the right place. But most are forgetting that it’s an extension of HAMP, the government’s loan modification program that has seen tepid success at best thus far. A loan must first be HAMP-eligible in order for anyone (borrower, servicer, or investor) to qualify for the program’s various incentive payments for short sale or deed-in-lieu.But lets review the qualifications for HAFA:

Which means any of the guidelines applicable to the HAMP program—loan in default or default imminent, within UPB [CR: unpaid principal balance] guidelines, owner-occupied, and originated prior to 2009—still apply.

If we look at the HAMP program stats (see page 6), the median front end DTI (debt to income) for permanent mods was 45%, and the back end DTI was an astounding 76.4%! And these are the borrowers who made it to permanent status!The property is the borrower’s principal residence; The mortgage loan is a first lien mortgage originated on or before January 1, 2009; The mortgage is delinquent or default is reasonably foreseeable; The current unpaid principal balance is equal to or less than $729,7501; and The borrower’s total monthly mortgage payment (as defined in Supplemental Directive

09-01) exceeds 31 percent of the borrower’s gross income.

Many borrowers who meet the HAMP qualifications never even get a trial program because their DTI ratios are so high there is just no way they will make it to a permanent mod. The servicers turn them down on the spot. These are the borrowers eligible for the HAFA program right away - and looking at the HAMP DTI stats I suspect this is a much larger group of borrowers than will ever get a permanent mod. So, although I think REOs will play a key role, I think short sales will also be very important.

More on Short Sales at HousingWire:

As 2010 gears up to be the ‘Year of the Short Sale,’ Lenders Processing Service (LPS), the integrated technology provider, is jumping on opportunities such a situation offers by launching its own short sale service to clients.

In a report that may be considered numerical ammunition to the argument that short sales are heating up faster than modifications, Equator announced that it ushered along more than 125,000 short sale transactions, from November to February, since launching an automated short sale platform.Note: Yes, I predicted that 2010 would be the year of the short sale, although I think economist Tom Lawler was first.

Thursday, March 11, 2010

RealtyTrac: Foreclosure Activity Decreases Slightly

by Calculated Risk on 3/11/2010 04:26:00 AM

From RealtyTrac: U.S. Foreclosure Activity Decrease 2 Percent in February

[F]oreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 308,524 U.S. properties during the month, a decrease of 2 percent from the previous month but still 6 percent above the level reported in February 2009.Blame it on the snow!

...

Default notices (Notices of Default and Lis Pendens) were reported on a total of 106,208 U.S. properties during the month, an increase of 3 percent from the previous month but down 3 percent from February 2009. ...

Foreclosure auctions (Notices of Trustee’s Sale and Notices of Sheriff’s Sales) were scheduled for the first time on a total of 123,633 U.S. properties, a decrease of 1 percent from the previous month but still 16 percent higher than the level reported in February 2009. ...

Bank repossessions (REOs) were reported on a total of 78,683 U.S. properties during the month, a 10 percent decrease from the previous month but an increase of 6 percent from February 2009. ...

“This leveling of the foreclosure trend is not necessarily evidence that fewer homeowners are in distress and at risk for foreclosure, but rather that foreclosure prevention programs, legislation and other processing delays are in effect capping monthly foreclosure activity — albeit at a historically high level that will likely continue for an extended period." [said James J. Saccacio, chief executive officer of RealtyTrac.]

“In addition, severe winter weather appears to have temporarily slowed the processing of foreclosure records in some Northeastern and Mid-Atlantic states.”

Saturday, February 20, 2010

Study: Mods just Delay Foreclosures, 6.1 Million to Lose Homes

by Calculated Risk on 2/20/2010 07:46:00 AM

Jeff Collins, at the O.C. Register, has a Q&A with Wayne Yamano, vice president at John Burns Real Estate Consulting: Loan mods won’t halt foreclosures, study shows

Register: Your study says that five million of the 7.7 million delinquent homes will go through foreclosure or a “foreclosure-related procedure.” How is this likely to occur?Burns Consulting doesn't think there will be flood of homes hitting the market - they expect these homes will be lost over a few years - so in their view there will not be "another leg down in pricing".

Wayne: Most shadow inventory will get out onto the market as an REO or short sale. In any event, it results in the homeowner losing their home, and that home being added to the supply of homes available for sale.

Register: Do the remaining 2.7 million borrowers get their loan payments caught up?

Wayne: Of the 7.7 million delinquent homeowners, we actually think that only about 1.6 million will be able avoid losing their homes, and that the remaining 6.1 million will lose their homes. We say that there is 5 million units of shadow inventory because we estimate that about 1.1 million delinquent homeowners already have their homes listed for sale, and we would not classify those homes as “shadow.”

Register: When will this wave of foreclosures hit, and how will this shadow inventory affect home prices?

Wayne: We don’t believe that the shadow inventory will be dumped onto the market all at once. Although we don’t believe modification efforts will truly save a lot of homeowners from losing their homes, we do believe that these programs are effective in delaying foreclosures and pushing out the additional supply to later years.

Friday, February 19, 2010

Mortgage Delinquencies by Period

by Calculated Risk on 2/19/2010 12:11:00 PM

Much was made this morning about the decline in the 30 day delinquency "bucket" (percent of loans between 30 and 60 days delinquent). Hopefully this graph will put the problem in perspective ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Loans 30 days delinquent are still elevated, and still above the levels in 2007 - and at about the level of early 2008 - when prices were falling sharply.

The 60 day bucket also declined in Q4, but it is still above the levels of 2008.

As MBA Chief Economist Jay Brinkmann noted, the 90 day and 'in foreclosure' rates are at record levels. Obviously the lenders have been slow to start foreclosure proceedings - and the 90+ day delinquent bucket is now very full. And lenders have been slow to actually foreclose - and the 'in foreclosure' bucket is at record levels.

What impacts prices are distress sales; homes coming out of the 'in foreclosure' bucket without being cured. Since the lenders slowed foreclosures to a trickle, prices have stabilized or even increased slightly in some areas.

But these record levels of long term delinquencies are why Brinkmann cautioned about house prices. This morning he pointed out on the conference call that there are a record 4.5 million homes seriously delinquent or in foreclosure. The loans on some of these homes will be cured - perhaps by HAMP modifications of by other lender modification programs - but many of these homes will go to foreclosure or be sold as short sales putting pressure on house prices.

MBA Q4 National Delinquency Survey Conference Call

by Calculated Risk on 2/19/2010 11:17:00 AM

On the MBA conference call concerning the "Q4 2009 National Delinquency Survey", MBA Chief Economist Jay Brinkmann said this morning:

A few graphs ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the delinquency and foreclosure rates for all prime loans.

This is a record rate of prime loans in delinquency and foreclosure (tied with Q3 2009).

Prime loans account for over 75% of all loans.

"We're all subprime now!"

NOTE: Tanta first wrote this saying in 2007 in response to the 'contained to subprime' statements.

The second graph shows just fixed rate prime loans (about 66% of all loans).

The second graph shows just fixed rate prime loans (about 66% of all loans).This is a new record for prime fixed rate loans.

Note that even in the best of times (with rapidly rising home prices in 2005), just over 2% of prime FRMs were delinquent or in foreclosure. However the cure rate was much higher back then since a delinquent homeowner could just sell their home.

The third graph shows the delinquency and in foreclosure process rates for subprime loans.

The third graph shows the delinquency and in foreclosure process rates for subprime loans. Although the total has declined, about 40% of subprime loans are still delinquent or in foreclosure.

Much was made about the decline in 30 day delinquencies, and this is potentially "good" news. But 1) the level is still very high (3.31%), and 2) a decline happened in Q4 2007 too - and then the rate started rising again, and 3) this is probably related to the slight increase in house prices in many areas.

MBA: 14.05 Percent of Mortgage Loans in Foreclosure or Delinquent in Q4

by Calculated Risk on 2/19/2010 10:00:00 AM

The MBA reports 14.05 percent of mortgage loans were either one payment delinquent or in the foreclosure process in Q4 2009. This is a slight decrease from 14.11% (edit) in Q3 2009, and an increase from 13.5% in Q2 2009 (note: older data was revised).

From the MBA: Delinquencies, Foreclosure Starts Fall in Latest MBA National Delinquency Survey

The delinquency rate for mortgage loans on one-to-four unit residential properties fell to a seasonally adjusted rate of 9.47 percent of all loans outstanding as of the end of the fourth quarter of 2009, down 17 basis points from the third quarter of 2009, and up 159 basis points from one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The non-seasonally adjusted delinquency rate increased 50 basis points from 9.94 percent in the third quarter of 2009 to 10.44 percent this quarter.I'll have notes from the conference call and graphs soon.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the fourth quarter was 4.58 percent, an increase of 11 basis points from the third quarter of 2009 and 128 basis points from one year ago. The combined percentage of loans in foreclosure or at least one payment past due was 15.02 percent on a non-seasonally adjusted basis, the highest ever recorded in the MBA delinquency survey.

The percentage of loans on which foreclosure actions were started during the third quarter was 1.20 percent, down 22 basis points from last quarter and up 12 basis points from one year ago. The percentages of loans 90 days or more past due and loans in foreclosure set new record highs. The percentage of loans 30 days past due is still below the record set in the second quarter of 1985.

“We are likely seeing the beginning of the end of the unprecedented wave of mortgage delinquencies and foreclosures that started with the subprime defaults in early 2007, continued with the meltdown of the California and Florida housing markets due to overbuilding and the weak loan underwriting that supported that overbuilding, and culminated with a recession that saw 8.5 million people lose their jobs,” said Jay Brinkmann, MBA’s chief economist.

Thursday, February 11, 2010

RealtyTrac: Foreclosures Decline in January, Surge Expected over Next Few Months

by Calculated Risk on 2/11/2010 12:01:00 AM

Press Release: U.S. Foreclosure Activity Decreases 10 Percent in January

RealtyTrac® ... today released its January 2010 U.S. Foreclosure Market Report™, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 315,716 U.S. properties during the month, a decrease of nearly 10 percent from the previous month but still 15 percent above the level reported in January 2009. The report also shows one in every 409 U.S. housing units received a foreclosure filing in January.There probably was an increase in foreclosure activity in February, since many of the trial modifications have now ended. However I also think a key theme in 2010 will be short sales, and that might mean fewer foreclosures in 2010 than in 2009 - but still more distressed sales (just a different mix).

REO activity nationwide was down 5 percent from the previous month but still up 31 percent from January 2009; default notices were down 12 percent from the previous month but still up 4 percent from January 2009; and scheduled foreclosure auctions were down 11 percent from the previous month but still up 15 percent from January 2009.

“January foreclosure numbers are exhibiting a pattern very similar to a year ago: a double-digit percentage jump in December foreclosure activity followed by a 10 percent drop in January,” said James J. Saccacio, chief executive officer of RealtyTrac “If history repeats itself we will see a surge in the numbers over the next few months as lenders foreclose on delinquent loans where neither the existing loan modification programs or the new short sale and deed-in-lieu of foreclosure alternatives works.”

emphasis added

Tuesday, February 02, 2010

NYTimes: More Homeowners Just Walk Away

by Calculated Risk on 2/02/2010 09:03:00 PM

“We’re now at the point of maximum vulnerability. People’s emotional attachment to their property is melting into the air.”From David Streitfeld at the NY Times: No Aid or Rebound in Sight, More Homeowners Just Walk Away. A few excerpts:

Sam Khater, senior economist at First American CoreLogic.

New research suggests that when a home’s value falls below 75 percent of the amount owed on the mortgage, the owner starts to think hard about walking away, even if he or she has the money to keep paying.Streitfeld is referring to the recent negative equity report from First American CoreLogic, see: Negative Equity Report for Q3

...

The number of Americans who owed more than their homes were worth was virtually nil when the real estate collapse began in mid-2006, but by the third quarter of 2009, an estimated 4.5 million homeowners had reached the critical threshold, with their home’s value dropping below 75 percent of the mortgage balance.

Some excerpts from that report:

Nearly 10.7 million, or 23 percent, of all residential properties with mortgages were in negative equity as of September, 2009. An additional 2.3 million mortgages were approaching negative equity, meaning they had less than five percent equity. Together negative equity and near negative equity mortgages account for nearly 28 percent of all residential properties with a mortgage nationwide. The rise in negative equity is closely tied to increases in pre-foreclosure activity. At one end of the spectrum, borrowers with equity tend to have very low default rates. At the other end, investors tend to default on their mortgages once in negative equity more ruthlessly: their default rate is typically two to three percent higher than owner-occupied homes with similar degrees of negative equity. For the highest level of negative equity, investors and owners behave very similarly and default at similar rates (Figure 4). Strategic default on the part of the owner occupier becomes more likely at such high levels of negative equity.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

As Streitfeld noted, there are an estimated 4.5 million homeowners with more than 25% negative equity. According to the chart, maybe only 10% of them are currently in default. If, as First American CoreLogic senior economist Sam Khater said, "people's emotional attachment to their property is melting into the air", then we might see a surge in defaults by homeowners with negative equity.

And more from the NY Times:

In 2006, Benjamin Koellmann bought a condominium in Miami Beach. By his calculation, it will be about the year 2025 before he can sell his modest home for what he paid. Or maybe 2040.

Benjamin Koellmann paid $215,000 for his apartment in Miami Beach in 2006, but now units are selling in foreclosure for $90,000. “There is no financial sense in staying,” he said.

“People like me are beginning to feel like suckers,” Mr. Koellmann said. “Why not let it go in default and rent a better place for less?”

FHA to Pay Out Claims on 25% of 2007 and 2008 Loans

by Calculated Risk on 2/02/2010 08:36:00 AM

From Dina ElBoghdady and Dan Keating at the WaPo: Rising FHA default rate foreshadows a crush of foreclosures

The share of borrowers who are falling seriously behind on loans backed by the Federal Housing Administration jumped by more than a third in the past year ... About 9.1 percent of FHA borrowers had missed at least three payments as of December, up from 6.5 percent a year ago, the agency's figures show.Ouch.

... The problems are rooted in FHA mortgages made in 2007 and 2008. Those loans are now maturing into their worst years because failures most often occur two to three years after a mortgage is made.

... the FHA projects that it will pay out claims to lenders on one out of every four loans made in 2007 -- the worst rate in at least three decades. The claim rate should be nearly the same on the vastly larger volume of loans made in 2008.

Wednesday, January 27, 2010

DataQuick on California: Record Notices of Default filed in 2009

by Calculated Risk on 1/27/2010 03:54:00 PM

Click on graph for larger image in new window.

This graph shows the Notices of Default (NOD) by year through 2009 in California from DataQuick.

There were a record number of NODs filed in California last year, however the pace slowed in the 2nd half.

From DataQuick: Another Drop in California Mortgage Defaults

The number of California homes entering the foreclosure process declined again during fourth quarter 2009 amid signs that the worst may be over in hard-hit entry-level markets, while slowly spreading to more expensive neighborhoods. There are mixed signals for 2010: It's unclear how much of the drop in mortgage defaults is due to shifting market conditions, and how much is the result of changing foreclosure policies among lenders and loan servicers, a real estate information service reported.In terms of units, the peak of the foreclosure crisis may be over, but the mid-to-high end foreclosures are increasing - and the values of these properties is much higher than the low end starter properties. This suggests that prices may have bottomed in some low end areas, but we will see further price declines in many mid-to-high end areas.

A total of 84,568 Notices of Default ("NODs") were recorded at county recorder offices during the October-to-December period. That was down 24.3 percent from 111,689 for the prior quarter, and up 12.4 percent from 75,230 in fourth-quarter 2008, according to San Diego-based MDA DataQuick.

NODs reached an all-time high in first-quarter 2009 of 135,431, a number that was inflated by activity put off from the prior four months. In the second quarter of last year, NODs totaled 124,562. The low of recent years was in the third quarter of 2004 at 12,417, when housing market annual appreciation rates were around 20 percent.

"Clearly, many lenders and servicers have concluded that the traditional foreclosure process isn't necessarily the best way to process market distress, and that losses may be mitigated with so-called short sales or when loan terms are renegotiated with homeowners," said John Walsh, DataQuick president.

While many of the loans that went into default during fourth quarter 2009 were originated in early 2007, the median origination month for last quarter's defaulted loans was July 2006, the same month as during the prior three quarters. The median origination month during the last quarter of 2008 was June 2006. This means the foreclosure process has moved forward through one month of bad loans during the past 12 months.

"Mid 2006 was clearly the worst of the 'loans gone wild' period and it's taking a long time to work through them. We're also watching foreclosure activity start to move into more established mid-level and high-end neighborhoods. Homeowners there were able to make their payments longer than homeowners in entry-level neighborhoods, but because of the recession and job losses, that's changing. Foreclosure activity is a lagging indicator of distress," Walsh said.

The state's most affordable sub-markets, which represent 25 percent of the state's housing stock, accounted for 52.0 percent of all default activity a year ago. In fourth-quarter 2009 that fell to 34.9 percent. ...

emphasis added

Thursday, January 14, 2010

RealtyTrac: 2009 was Record Year for Foreclosure Filings

by Calculated Risk on 1/14/2010 12:43:00 AM

Press Release: RealtyTrac® year-end report shows record 2.8 million U.S. Properties with foreclosure filings in 2009 (ht Ann)

RealtyTrac® ... today released its Year-End 2009 Foreclosure Market Report™, which shows a total of 3,957,643 foreclosure filings — default notices, scheduled foreclosure auctions and bank repossessions — were reported on 2,824,674 U.S. properties in 2009, a 21 percent increase in total properties from 2008 and a 120 percent increase in total properties from 2007. The report also shows that 2.21 percent of all U.S. housing units (one in 45) received at least one foreclosure filing during the year, up from 1.84 percent in 2008, 1.03 percent in 2007 and 0.58 percent in 2006.AP is reporting that RealtyTrac expects 3 to 3.5 million foreclosures in 2010.

Foreclosure filings were reported on 349,519 U.S. properties in December, a 14 percent jump from the previous month and a 15 percent increase from December 2008 — when a similar monthly jump in foreclosure activity occurred. Despite the increase in December, foreclosure activity in the fourth quarter decreased 7 percent from the third quarter, although it was still up 18 percent from the fourth quarter of 2008.

“As bad as the 2009 numbers are, they probably would have been worse if not for legislative and industry-related delays in processing delinquent loans,” said James J. Saccacio, chief executive officer of RealtyTrac

emphasis added

There should be a pickup in foreclosure activity in February when the trial modifications end, however I think the themes in 2010 will be short sales (although NODs1 count as filings) and higher priced foreclosures (but fewer in that range) - so the total filings in 2010 might be a little lower than RealtyTrac expects - but it will definitely be a busy year.

1NODs: Notice of Default

Sunday, January 10, 2010

Update on "Foreclosureville, U.S.A."

by Calculated Risk on 1/10/2010 09:28:00 PM

Note: Here is a weekly summary and look ahead.

Evelyn Nieves at HuffingtonPost has an update on Stockton, CA: Stockton, California Is Foreclosureville, USA, Has One Of The Worst Foreclosure Rates In The United Sates. A short excerpt:

Stockton is a changed place. Whole neighborhoods have been decimated by the mortgage disaster. The tax base has shrunken. City services and municipal jobs have been cut. Unemployment hovers at about 16 percent. Economists predict it will take years for Stockton to recover from the housing bust.A long way from normal ...

...

Housing developments built for commuters have been hit the hardest, since they were the ones to attract newcomers fleeing the huge spike in prices closer to the Bay area. Those whose livelihoods depend on a healthy housing environment – real estate brokers, contractors, day laborers – are barely holding on here.

...

The heart of Foreclosureville, U.S.A. – the Stockton subdivision that had more bank repossessions than any other place in the country for much of the last two years – is starting to look like its old self again.

The "For Sale" signs that overwhelmed Weston Ranch are mostly gone, and the lawns where weeds grew like corn stalks are shorn.

Foreclosure businesses that sprang up, including one that spray-painted brown lawns green and another that offered a foreclosure bus tour, have folded. Every time a foreclosure hits the market, bargain hunters snap it up.

But looks are deceiving. In Weston Ranch, financial devastation struck like a natural disaster and the ground has not yet settled. Speculators are buying houses to rent out. On streets where everyone knew everyone, no one knows anyone.

Saturday, January 09, 2010

HAMP Loan Modifications and the Fifth Amendment

by Calculated Risk on 1/09/2010 02:21:00 PM

CR Note: This is a guest post from albrt.

CR sent along this story concerning a foreclosure case in California (ht Lyle). The homedebtor enjoyed some initial success arguing a non-judicial foreclosure was a violation of due process. As it happens I'm out of the country, so this will be a relatively short post.

The homedebtors are named Huxtable and Agnew. Interestingly, Agnew is also listed as the "lead attorney" for the plaintiffs. The plaintiffs defaulted in late 2007, and the bank began a non-judicial foreclosure process in late 2008. The plaintiffs filed suit in federal court to stop the foreclosure, naming as defendants Timothy Geithner, the FHFA the lender and the servicer. The plaintiffs were allegedly denied a HAMP modification, and they claim the government and the bank violated the plaintiffs' right to "due process under the Fifth Amendment for failing to create rules implementing HAMP that comport with due process."

The bank tried to have itself dismissed from the case because Fifth Amendment procedural due process applies to the government, not private companies. For whatever reason, this bank apparently considers itself a private company and not part of the federal government at this time. The judge refused to dismiss the case because the plaintiffs might be able to prove the government has "insinuated itself into a position of interdependence" with the bank. The phrase seems apt, felicitous even, and perchance in the fulness of time may prove to be widely applicable. But this is only a very preliminary decision, and the court will need to take a look at the relationship between this particular bank and the government.

The court may also need to consider whether the plaintiffs have any constitutionally protectable interest. The Fifth Amendment says, among other things, that no person may be "deprived of life, liberty, or property, without due process of law." A deeply underwater homedebtor facing a lawful non-judicial foreclosure process may not have much property interest in the home. It is possible to have a property interest in certain types of government benefits if the benefits are an entitlement explicitly created by law. It is not clear whether HAMP creates such an entitlement, and that may end up being the main issue in the case.

Due process was a mildly hot topic in the comments a few weeks ago, so I'll provide some additional thoughts on the subject next weekend. Please leave questions and suggestions in the comments here and I'll check back later.

The text of the Huxtable case is available at a foreclosure consultant site here, which also has a number of other foreclosure cases. I haven't been able to follow the comments while traveling, and I probably won't be able to monitor the comments for this short post, so sorry if I've overlooked a hat tip.

CR note: The opinion is interesting reading! This is a guest post from albrt.

Monday, December 21, 2009

OCC and OTS: Foreclosures, Delinquencies increase in Q3

by Calculated Risk on 12/21/2009 10:40:00 AM

From Jim Puzzanghera at the LA Times: Foreclosures for major sector of bank industry topped 1 million in third quarter, report says

The number of home foreclosures for a major sector of the banking industry topped 1 million for the first time in the third quarter of the year as struggles spread to homeowners with prime loans and modified mortgage payments, according to new data released today by ... the Office of the Comptroller of the Currency and the Office of Thrift Supervision.Here is the press release and report.

...

The report highlighted some troubling trends as ... Difficulties increased for holders of prime mortgages, with the percentage of those loans that were 60 days or more delinquent increasing to 3.2%, up almost 20% from the second quarter and more than double the rate of a year ago.

In addition, holders of mortgages whose payments had been lowered through government or private modification plans re-defaulted at high rates. More than half of all homeowners with modified loans fell 60 days or more behind in their payments within six months of the modification taking place.

Much of the report focuses on modifications and recidivism, but this report also shows how the foreclosure problem has moved to prime loans.

Click on graph for larger image.

Click on graph for larger image.This report covers about 65% of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now significantly more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

Overall, mortgage performance continued to decline as a result of continuing adverse economic conditions including rising unemployment and loss in home values. The percentage of current and performing mortgages fell to 87.2 percent of the servicing portfolio. Seriously delinquent mortgages loans 60 or more days past due and loans to delinquent bankrupt borrowers—rose to 6.2 percent of the servicing portfolio. Foreclosures in process increased to 3.2 percent, while new foreclosure actions remained steady for the third consecutive quarter at 369,209. Of particular note, delinquencies among prime mortgages, the largest category of mortgages, continued to climb. The percentage of prime mortgages that were seriously delinquent in the third quarter was 3.6 percent, up 19.6 percent from the second quarter and more than double the percentage of a year ago.

emphasis added

The second graph shows foreclosure activity.

Notice that foreclosure in process are increasing sharply, but completed foreclosures were only up slightly.

The next wave of completed foreclosures is about to break, but the size of the wave depends on the modification programs.

There was some good news on redefaults:

The percentage of modified loans 60 or more days delinquent or in process of foreclosure increased steadily in the months subsequent to modification (see Table 2 [see below]). Modifications made after the third quarter of 2008 appeared to perform relatively better than older vintages. The most recent modifications made in the second quarter of 2009 had the lowest percentage of mortgages (18.7 percent) that were 60 or more days delinquent three months subsequent to modification. This lower three-month re-default rate may be an early indicator of sustainability for loan modifications that reduce monthly payments.

For earlier modifications, the redefault rates was around 60% after 12 months, but the little bit of good news is "only" 18.7% of recent modifications have redefaulted with 3 months (this is lower than the previous modifications). I expect a large percentage of the homeowners to redefault eventually because the modification efforts still leave the homeowners with significant negative equity (they are more renters than owners).

For earlier modifications, the redefault rates was around 60% after 12 months, but the little bit of good news is "only" 18.7% of recent modifications have redefaulted with 3 months (this is lower than the previous modifications). I expect a large percentage of the homeowners to redefault eventually because the modification efforts still leave the homeowners with significant negative equity (they are more renters than owners).

Thursday, November 19, 2009

Mortgage Delinquencies and Foreclosures by Period Past Due

by Calculated Risk on 11/19/2009 03:49:00 PM

Click on graph for larger image in new window.

First, on the market ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Reader Yuri asked me if the number of 30 day delinquencies is decreasing. He was curious if the overall number of delinquencies is increasing because of the loan modifications and other actions that are limiting the outflow - but that that overall increase might be masking some improvement for the inflow of new delinquencies. This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

This graph shows the delinquencies by time period (30, 60, 90 day, and in foreclosure) for all loans.\

The percentage of 30 and 60 day delinquencies have decreased slightly. However the rates are still near record levels.

For the 30 day bucket, there were 3.57% percent delinquent - not much lower than the high in Q1 of 3.77%. For 60 days, the rate was 1.67% - also below the high in Q1.

Clearly most of the increase was in the 90 day and in foreclosure buckets. And that is why the modification programs are so important. The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

The second graph provides the same data for prime fixed rate mortgages. Both the 30 and 60 day buckets are still at record levels, although the rate of increase has slowed.

Since prime fixed rate mortgages account for about 2/3s of the mortgage market, a large portion of future foreclosures will probably be from these loans.