by Calculated Risk on 9/13/2011 09:00:00 AM

Tuesday, September 13, 2011

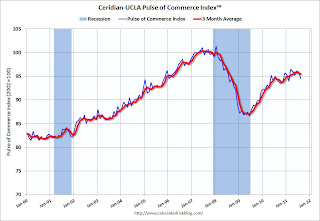

Ceridian-UCLA: Diesel Fuel index declined in August

This is the UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce Index Remains in Idle – Down 1.4 Percent in August

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), issued today by the UCLA Anderson School of Management and Ceridian Corporation fell 1.4 percent in August on a seasonally and workday adjusted basis, following a 0.2 percent decline in July.

“The August number supports the pattern of sluggish economic growth coming out of a recession, which is something that we’ve seen in the past. What we’re experiencing is the ‘new normal,’ where the U.S. economy will continue to stumble forward until a new growth engine is identified. Essentially, the economy is in need of an innovation burst.” [said Ed Leamer, chief economist for the Ceridian-UCLA Pulse of Commerce Index and director of the UCLA Anderson Forecast.]

“The PCI continues to prove its value in providing insight into the U.S. economy. While previously being flat, recent, seven-day-average diesel volumes have dropped by 2 percent from July 23 to August 19, excluding the holiday impact. However, the last week of August suggests some improvement.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the index since January 2000.

The weakness in the PCI over the last several months called for a zero percent change in the July Industrial Production – the initial release of 0.9% was stronger, although subject to revisions. Due to the continued weakness evident in the PCI, the forecast for August Industrial Production is a 0.26 percent decline when released on September 15.This index has declined for two consecutive months after increasing slightly earlier in the year. The little bit of good news was the reported improvement during the last week of August.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

Note: This index does appear to track Industrial Production over time (with plenty of noise).