by Calculated Risk on 3/17/2018 08:11:00 AM

Saturday, March 17, 2018

Schedule for Week of Mar 18, 2018

The key economic reports this week are February new home sales and existing home sales.

The FOMC meets this week and is expected to announce a 25bps increase in the Fed Funds rate.

No major economic releases scheduled.

No major economic releases scheduled.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, up from 5.38 million in January.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for 5.42 million SAAR, up from 5.38 million in January.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler will probably release his estimate on Monday. His preliminary estimate is 5.43 million SAAR for February.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 225 thousand initial claims, up from 226 thousand the previous week.

9:00 AM: FHFA House Price Index for January 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 ET AM: Durable Goods Orders for February from the Census Bureau. The consensus is for a 0.1.72% increase in durable goods orders.

10:00 AM: New Home Sales for February from the Census Bureau.

10:00 AM: New Home Sales for February from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the January sales rate.

The consensus is for 626 thousand SAAR, up from 593 thousand in January.

10:00 AM: State Employment and Unemployment (Monthly) for February 2018

Friday, March 16, 2018

Sacramento Housing in February: Sales up 10% YoY, Active Inventory up 17% YoY

by Calculated Risk on 3/16/2018 08:52:00 PM

From SacRealtor.org: Flat February: median sales price, sales volume stagnant

February closed with 1,131 sales, up just .2% from January’s 1,129 sales. Compared with one year ago (1,028), the current figure is a 10% increase. Of the 1,131 sales this month, 171 (15.1%) cash financing, 651 (57.6%) used conventional, 203 (17.9%) used FHA, 59 (5.2%) used VA and 47 (4.2%) used Other types of financing.CR Note: Inventory is still low, but now increasing year-over-year in Sacramento.

Active Listing Inventory increased 2.8% from 1,677 to 1,724. The Months of Inventory, however, remained at 1.5 Months. A year ago the Months of inventory was 1.4 and Active Listing Inventory stood at 1,469 listings (17.4% below the current figure).

The Average DOM (days on market) remained at 31 from month to month. The Median DOM dropped from 17 to 13.

“Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” 66.9% of all homes sold this month (757) were on the market for 30 days or less and 81.8% (925) of all homes sold in 60 days or less. Compare this to February 2016 where 78.8% of all homes sold (1,082) sold in 60 days or less.

emphasis added

The statistics for February are here.

Comments on February Housing Starts

by Calculated Risk on 3/16/2018 03:40:00 PM

Earlier: Housing Starts decreased to 1.236 Million Annual Rate in February

The housing starts report released this morning showed starts were down 7.0% in February compared to January, and starts were down 4.0% year-over-year compared to February 2017.

The decline in starts was due to the volatile multi-family sector. Single family starts were up 2.9% year.

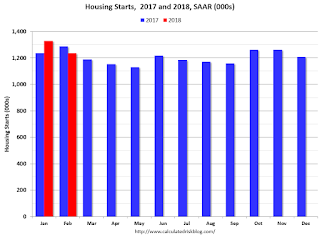

This first graph shows the month to month comparison between 2017 (blue) and 2017 (red).

Starts were down 4.0% in February compared to February 2017.

Note that February 2016 was a pretty strong month for housing starts, so this was a difficult comparison. The next three months will be easier.

Through two months, starts are up 1.6% year-to-date compared to the same period in 2017.

Single family starts were up 2.9% year-over-year, and also up 2.9% compared to January.

Multi-family starts were down 18.7% year-over-year, and down 26.1% compared to January (multi-family is volatile month-to-month).

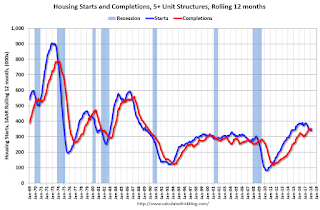

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - and completions have caught up to starts (more deliveries).

Completions lag starts by about 12 months, so completions will probably turn down in a year or so.

As I've been noting for a few years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

"CBO’s Projection of Labor Force Participation Rates"

by Calculated Risk on 3/16/2018 12:22:00 PM

CR Note: I've written extensively about the Labor Force Participation Rate (LFPR). This is a very detailed analysis and model from the CBO.

Here is the new paper from Joshua Montes at the Congressional Budget Office: CBO’s Projection of Labor Force Participation Rates

From the Conclusion:

This paper details CBO’s methodology for estimating and projecting labor force participation rates. CBO constructs a birth-year cohort model of the labor force participation rate that estimates labor force participation rates by age-sex-education-race subgroups. Using the estimated model to project rates over the next decade, CBO expects the overall rate to decline by 2.7 percentage points, reaching 60.1 percent by 2028.

Most (2.5 percentage points, or about 80 percent) of the 3.2 percentage-point decline since the 2007–2009 recession in the labor force participation rate for the population at least 16 years old is the result of aging. That decline continued a trend that began in the late 1990s and early 2000s as the early baby-boom cohorts began to turn 50 years old, the age at which individuals tend to start reducing their participation in the labor force. CBO projects that the continued aging of the population will further reduce the overall participation rate over the next 11 years by an additional 2.8 percentage points, as most baby boomers age into retirement.

Although aging is the primary driver of the falling labor force participation rate, it is not the only driver, as other structural factors are driving down some group-specific participation rates. First, the members of younger birth cohorts, who are replacing baby boomers in the labor force, have participated in the labor force at lower rates, and CBO projects that this trend will continue to weigh down the participation rate over the next decade. Second, the share of people receiving disability insurance benefits is generally projected to continue rising, and people who receive such benefits are less likely to participate in the labor force. Third, the marriage rate has declined and is projected to continue decreasing, especially among men, and unmarried men tend to participate in the labor force at lower rates than married men. Finally, elements of fiscal policy, including various provisions of the ACA, have increased effective marginal tax rates and reduced the incentive for individuals to supply labor in recent years. The effects of many of these structural factors have been concentrated among the less educated, contributing greatly to the decline in the participation rates of these groups.

Cyclical weakness was also an important factor weighing down the labor force participation rate over much of the previous decade, even as that rate has had much cyclical improvement in recent years. CBO’s estimates show that the drag on the overall participation rate from discouraged job seekers leaving the labor force was as much as 1.2 percentage points in 2014. Since then, many discouraged workers have reentered the labor force, and that cyclical weakness has diminished considerably. CBO estimates that the labor force participation rate remained only 0.4 percentage points below its potential rate in 2017, and that gap will close entirely in the coming years. Increases in populationwide educational attainment have helped boost the participation rate since 2007, on the other hand, as more of the population now holds a bachelor’s degree. CBO estimates that increases in educational attainment have increased the observed labor force participation rate by nearly a full percentage point over the past decade, all else being equal, highlighting the importance of modeling educational attainment in projections of the labor force participation rate. CBO projects these trends to continue over the next decade, boosting the participation rate by almost another full percentage point.

Although most of the decline in the overall labor force participation rate comes from the aging of the baby-boom generation, the decline in the prime-age labor force participation rate over the past decade is entirely unrelated to aging. Instead, other structural factors, including the declining propensity of successive cohorts to participate in the labor market, the increase in disability insurance incidence, the declining male marriage rate, and fiscal policy, have contributed most to the decline in that rate. The contribution of most of those factors to the declining prime-age labor force participation rate has been concentrated among the less educated. CBO expects the contribution of some of those factors to dissipate over the next decade—namely the declining male marriage rate and fiscal policy—whereas others will continue to weigh down the prime-age rate over the next decade.

Furthermore, CBO finds that the effects of the 2007–2009 recession reduced the prime-age labor force participation rate considerably and that lingering cyclical weakness from the aftermath of that recession still lowers that rate some. The agency estimates that cyclical weakness reduced the prime-age rate by as much as 1.3 percentage points in 2014 and 2015. Although the improving economy and labor market have pulled some discouraged prime-age workers back into the labor market, CBO estimates that the prime-age labor force participation rate was still 0.4 percentage points below its potential in 2017. As was the case for the overall participation rate, part of the decline in recent history of the prime-age rate has been offset by the evolving educational attainment distribution. Because individuals with higher levels of educational attainment participate at higher rates, the shift toward more education in the population results in higher rates of participation. The changing educational attainment distribution contributed to an increase in the prime-age potential labor force participation rate of more than a percentage point since the end of 2007. That increase, however, is not enough to offset the decline resulting from other variables. Over the next decade, as the downward pressure from other structural factors on the prime-age labor force participation rate is expected to dissipate, CBO projects that increases in educational attainment will fully offset downward pressure on that rate from those other factors. In addition to the upward pressure from continued increases in educational attainment, CBO expects further cyclical improvement to draw more individuals who had been discouraged from seeking work back into the labor market. As a result, CBO expects those factors to drive an increase in the observed prime-age labor force participation rate over the next decade, from 81.7 percent in 2017 to 82.1 percent in 2028.

Click on graph for larger image.

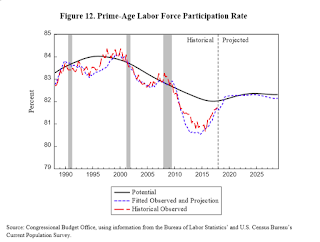

Click on graph for larger image.This graph from the CBO paper shows the CBO projections for the overall Labor Force Participation Rate (LFPR). After a few year of a relatively stable LFPR (as the economy recovered), the CBO expects the LFPR to begin declining again by 2020.

The CBO projection is the LFPR will decline to 61.5% in 2024, and to 60.1% in 2028.

The second graphs shows the CBO projection for the prime age LFPR (people aged 25 to 54).

From the CBO:

From the CBO: The potential prime-age labor force participation rate follows a pattern similar to that of the potential aggregate labor force participation rate over history: It increases through the 1980s and early 1990s, peaks in the middle of the 1990s, and then starts a continuous decline in the late 1990s that persists through about 2017. The magnitudes of the changes in rates giving rise to that pattern, though, are much smaller than the changes in the aggregate rate. In particular, the potential prime-age labor force participation rate fell by 2.0 percentage points over the past roughly two decades, from its peak of 84.0 percent in the middle of the 1990s to 82.0 percent by the end of 2017. However, that decline is entirely unrelated to aging. Interestingly, that downward trend stops over the projection period, when CBO expects that the net change in the potential prime-age participation rate will be slightly positive at about 0.3 percentage points.A key point: The overall LFPR declined from a high of just over 67% in the year 2000, to the current level of 63%. The CBO expects that the LFPR will start declining again, and will be close to 60% in 2028 (this is close to my earlier projections).

BLS: Job Openings Increased in January

by Calculated Risk on 3/16/2018 10:10:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings increased to 6.3 million on the last business day of January, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.6 million and 5.4 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.2 percent and 1.2 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits was little changed at 3.3 million in January. The quits rate was little changed at 2.2 percent. Over the month, the number of quits was little changed for total private and for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for January, the most recent employment report was for February.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings increased in January to 6.312 million from 5.667 in December.

The number of job openings (yellow) are up 15.9% year-over-year.

Quits are up 3.2% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at the highest level since this series started, and quits are increasing year-over-year. This is a strong report.

Industrial Production Increased 1.1% in February

by Calculated Risk on 3/16/2018 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production rose 1.1 percent in February following a decline of 0.3 percent in January. Manufacturing production increased 1.2 percent in February, its largest gain since October. Mining output jumped 4.3 percent, mostly reflecting strong gains in oil and gas extraction. The index for utilities fell 4.7 percent, as warmer-than-normal temperatures last month reduced the demand for heating. At 108.2 percent of its 2012 average, total industrial production in February was 4.4 percent higher than it was a year earlier. Capacity utilization for the industrial sector climbed 0.7 percentage point in February to 78.1 percent, its highest reading since January 2015 but still 1.7 percentage points below its long-run (1972–2017) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.1% is 1.7% below the average from 1972 to 2017 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 108.2. This is 24% above the recession low, and 3% above the pre-recession peak.

Housing Starts decreased to 1.236 Million Annual Rate in February

by Calculated Risk on 3/16/2018 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in February were at a seasonally adjusted annual rate of 1,236,000. This is 7.0 percent below the revised January estimate of 1,329,000 and is 4.0 percent below the February 2017 rate of 1,288,000. Single-family housing starts in February were at a rate of 902,000; this is 2.9 percent above the revised January figure of 877,000. The February rate for units in buildings with five units or more was 317,000.

Building Permits:

Privately-owned housing units authorized by building permits in February were at a seasonally adjusted annual rate of 1,298,000. This is 5.7 percent below the revised January rate of 1,377,000, but is 6.5 percent above the February 2017 rate of 1,219,000. Single-family authorizations in February were at a rate of 872,000; this is 0.6 percent below the revised January figure of 877,000. Authorizations of units in buildings with five units or more were at a rate of 385,000 in February.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased sharply in February compared to January. Multi-family starts were down 18.7% year-over-year in February.

Multi-family is volatile month-to-month, but has been mostly moving sideways the last few years.

Single-family starts (blue) increased in February, and are up 2.9% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in February were below expectations, mostly due to a sharp decrease in multi-family starts (the reverse of January). Starts for December and January were revised slightly.

I'll have more later ...

Thursday, March 15, 2018

Today on NPR Planet Money with Cardiff Garcia

by Calculated Risk on 3/15/2018 07:12:00 PM

Cardiff Garcia interviewed me at NPR Planet Money: Calculated Risk, Calculated Caution. This was related to my post two weeks ago: When the Story Changes, Be Alert. Thanks to Cardiff for having me on!

Friday:

• At 8:30 AM ET, Housing Starts for February. The consensus is for 1.284 million SAAR, down from 1.326 million SAAR.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.7%.

• At 10:00 AM, Job Openings and Labor Turnover Survey for January from the BLS. Jobs openings decreased in December to 5.811 million from 5.978 in November. The number of job openings were up 4.9% year-over-year, and Quits were up 5.6% year-over-year.

• Also at 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for March). The consensus is for a reading of 98.5, down from 99.7.

Lawler: "New Long-Term Population Projections Show Slower Growth than Previous Projections but Are Still Too High"

by Calculated Risk on 3/15/2018 04:22:00 PM

CR Note: A key takeaway from this excellent analysis by Tom Lawler is that annual household growth will be much lower than previously expected.

From housing economist Tom Lawler: Census: New Long-Term Population Projections Show Slower Growth than Previous Projections but Are Still Too High; Projections Overstate Growth in all Age Groups Save the Very Young and the Very Old

This week the Census Bureau released new projections of the US population, and to the surprise of no one reading this report the new projections show substantially slower population growth than the last set of projections, released at the end of 2014. Virtually all of the slower projected population growth stemmed from a sharp decline in projected net international migration. The new projections show average annual growth in the total US population from 2017 to 2020 (I’m only focusing on the short-term projections) of 2.355 million (compound annual growth rate (CAGR) of 0.72%), down by 271 thousand from the 2.626 million annual projected increase (CAGR of 0.80%) in the 2014 population projections. The latest projection shows average annual Net International Migration (NIM) from July 1, 2017 to July 1, 2020 of 1.006 million, compared to the unrealistically high 1.267 million per year in the 2014 projection. This reduced forecast for NIM reflected recent trends, and did not reflect any possible policy changes.

One of the biggest surprises to folks who follow various demographic data was the projection for deaths in the latest Census report. While data on deaths from the National Center for Health Statistics (NCHS) showed SIZABLE increases in US deaths and death rates over the past few years – with alarmingly increases in death rates for the 15-44 year old age groups – the latest Census projections showed almost no increase in projected US deaths from 7/1/2017 to 7/1/2020 (2.745 million per year in the latest projections vs. 2.721 in the 2014 projections). Provisional data from the NCHS show that US “age-adjusted” death rates continued to increase last year, and these provisional data suggest that US death on the 12 month period ending last June were a staggering 97 thousand higher than those shown in the latest projections.

Before analysts start plugging these new population projections – especially with respect to age – into their various models, they should look at the key assumptions about the components of change that drive these projections, which are deaths, births, and net international migration, to assess whether they seem “reasonable.: These assumptions are available by age and ethnicity in the “datasets” on the Census Population Projections website. With respect to deaths, it is quite clear that the latest Census population projections do not pass the “sniff test” for reasonableness.

Below is a table comparing the Census 2017 Population Projections’ (C2017) assumptions about deaths for selected age groups for the 12-month period ending June 30, 2017 compared to the National Center for Health Statistics tally of US deaths for 2016 (calendar year).

| Age Group | Census 2017 Projections 7/1/16-6/30/17 | NCHS 2016 (Calendar Year) | Difference |

|---|---|---|---|

| <1 | 39,741 | 23,161 | 16,580 |

| 1-4 | 8,482 | 4,045 | 4,437 |

| 5-9 | 2,422 | 2,490 | -68 |

| 10-14 | 2,883 | 3,013 | -130 |

| 15-24 | 23,543 | 32,575 | -9,032 |

| 25-34 | 43,981 | 57,616 | -13,635 |

| 35-44 | 62,599 | 77,792 | -15,193 |

| 45-54 | 151,976 | 173,516 | -21,540 |

| 55-64 | 330,420 | 366,445 | -36,025 |

| 65-74 | 493,422 | 512,080 | -18,658 |

| 75-84 | 619,610 | 636,916 | -17,306 |

| 85+ | 909,723 | 854,462 | 55,261 |

| N/A | 137 | -137 | |

| Total | 2,688,802 | 2,744,248 | -55,446 |

A few things jump out from this table. First, the Census 2017 Projections (C2017) show a massively larger (and unrealistically high) number of “new-born” infant deaths than that compiled by the NCHS. I pointed this out to Census analysts, and they are aware of this “issue.” (I actually sent the Population Division this table.). Second, the C2017 assumptions show a massively smaller number of deaths for the 15-84 year age groups combined than does the NCHS, with especially large % differences for the 15-44 year age groups. And finally, the C2017 assumptions show significantly more deaths for the very elderly than does the NCHS.

As I showed in an earlier report, death rates as compiled by the NCHS increased sharply in the 15-44 year old age groups over the past several years, and I have no clue why the C2017 projections do not incorporate this increase. Moreover, the C2017 projections assume that death rates for these age groups will decline from the “too low” 2017 levels over the forecast period.

If in fact death rates remain near recent levels – or even if they gradually reverted to 2014 levels – the number of deaths in these age groups would be massively higher than those shown in the C2017 projection, which the number of deaths of the very elderly (85+ years) would be lower (aggregate death would be higher).

What this means, of course, is that if one were to incorporate the higher “actual” death rates the US has recently experienced into population projections over the next several years, the result would be substantially lower projections in the size of the “working age” population and somewhat higher projection for the very elderly and very young.

To give one an idea of how important death rate assumptions are to the near-term population outlook, below is a table of what the C2017 population projections might be if death rates by age were similar to what was experienced. I kept the net immigration assumptions by age from C2017, though are issues with these as well (that’ll be later). I also show the population projections from C2014. (Note: the starting point for C2017 was “Vintage 2016,” and population estimates were revised upward slightly in “Vintage 2017,” which will also be subject to revision next year. Also, note population numbers are as of July 1.)

| Census 2014 Population Projections (000s) | ||||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | 2016-2020 | |

| Total | 323,996 | 326,626 | 329,256 | 331,884 | 334,503 | 10,508 |

| 0-14 | 61,037 | 61,176 | 61,314 | 61,435 | 61,577 | 539 |

| 15-24 | 43,613 | 43,352 | 43,202 | 43,125 | 43,107 | -506 |

| 25-34 | 44,865 | 45,490 | 46,018 | 46,561 | 46,890 | 2,025 |

| 35-44 | 40,578 | 40,930 | 41,477 | 42,035 | 42,628 | 2,050 |

| 45-54 | 42,864 | 42,443 | 41,860 | 41,239 | 40,842 | -2,022 |

| 55-64 | 41,619 | 42,180 | 42,619 | 42,931 | 43,019 | 1,401 |

| 65-74 | 28,747 | 29,825 | 30,743 | 31,860 | 33,075 | 4,328 |

| 75-84 | 14,267 | 14,739 | 15,461 | 16,083 | 16,639 | 2,373 |

| 85+ | 6,407 | 6,491 | 6,562 | 6,615 | 6,727 | 320 |

| 25-54 | 128,306 | 128,863 | 129,356 | 129,836 | 130,360 | 2,053 |

| Census 2017 Population Projections (000s) | ||||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | 2016-2020 | |

| Total | 323,128 | 325,489 | 327,849 | 330,205 | 332,555 | 9,427 |

| 0-14 | 60,975 | 61,071 | 61,162 | 61,235 | 61,325 | 350 |

| 15-24 | 43,511 | 43,222 | 43,051 | 42,962 | 42,938 | -573 |

| 25-34 | 44,677 | 45,253 | 45,727 | 46,216 | 46,491 | 1,814 |

| 35-44 | 40,470 | 40,781 | 41,286 | 41,802 | 42,352 | 1,882 |

| 45-54 | 42,787 | 42,329 | 41,710 | 41,051 | 40,615 | -2,172 |

| 55-64 | 41,463 | 42,002 | 42,421 | 42,714 | 42,783 | 1,319 |

| 65-74 | 28,630 | 29,668 | 30,547 | 31,620 | 32,789 | 4,159 |

| 75-84 | 14,234 | 14,697 | 15,406 | 16,015 | 16,561 | 2,328 |

| 85+ | 6,380 | 6,468 | 6,539 | 6,590 | 6,701 | 321 |

| 25-54 | 127,934 | 128,363 | 128,723 | 129,068 | 129,458 | 1,524 |

| Updated Projections Assuming 2016 NCHS Death Rates, C2017 NIM (000s) | ||||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | 2016-2020 | |

| Total | 323,128 | 325,438 | 327,703 | 329,920 | 332,090 | 8,962 |

| 0-14 | 60,975 | 61,091 | 61,202 | 61,294 | 61,402 | 427 |

| 15-24 | 43,511 | 43,213 | 43,034 | 42,938 | 42,907 | -604 |

| 25-34 | 44,677 | 45,239 | 45,699 | 46,173 | 46,431 | 1,754 |

| 35-44 | 40,470 | 40,766 | 41,256 | 41,755 | 42,287 | 1,817 |

| 45-54 | 42,787 | 42,309 | 41,666 | 40,981 | 40,520 | -2,267 |

| 55-64 | 41,463 | 41,967 | 42,342 | 42,585 | 42,594 | 1,131 |

| 65-74 | 28,630 | 29,649 | 30,492 | 31,540 | 32,669 | 4,039 |

| 75-84 | 14,234 | 14,681 | 15,380 | 15,959 | 16,455 | 2,222 |

| 85+ | 6,380 | 6,523 | 6,631 | 6,696 | 6,824 | 444 |

| 25-54 | 127,934 | 128,314 | 128,621 | 128,908 | 129,238 | 1,303 |

Census’ 2014 Projections, total population from 2016 to 2020 was forecast to rise by 10.508 million, compared to 9.427 million in the latest projection and 8.962 million if the latest projection held 2016 NCHS death rates constant. The so-called “prime-age” working population was project to rise by 2.053 million in C2014 Projections, compared to 1.524 million in the C2017 Projection and 1.303 million if the C2017 has assumed constant 2016 death rates.

| Annual Growth Rate, 25-54 Year Old Population | |||

|---|---|---|---|

| C2014 | C2017 | Adjusted C2017 * | |

| 2017 | 0.43% | 0.34% | 0.30% |

| 2018 | 0.38% | 0.28% | 0.24% |

| 2019 | 0.37% | 0.27% | 0.22% |

| 2020 | 0.40% | 0.30% | 0.26% |

| CAGR, 2016-2020 | 0.40% | 0.30% | 0.25% |

| *Assumes 2016 NCHS Death Rates | |||

Obviously, an updated population projection from those from 2014 produces slower projections for labor force growth, and significantly slower if one uses “realistic” growth rates. Similarly, household projections using 2014 projections are a LOT higher than those using updated assumptions and realistic death rates. E.g., from mid-2018 to mid-2020 a reasonable projection for annual household growth using the 2014 population projections of about 1.455 million. Using the “raw” 2017 projections would, using similar headship rates, produce an annual household growth forecast of about 1.345 million. Adjusting the 2017 projections for more realistic death rates, however, would (using same headship rates) result in an annual household growth forecast over the next two years of about 1.245 million, or about 210,000 a year less than one would get using the old C2014 projections.

I’ll have more on the topic of population projections later.

CoreLogic: "2.5 million Homes still in negative equity" at end of Q4 2017

by Calculated Risk on 3/15/2018 12:54:00 PM

From CoreLogic: Homeowner Equity Q4 2017

CoreLogic analysis shows U.S. homeowners with mortgages (roughly 63 percent of all properties) have seen their equity increase by a total of $908.4 billion since the fourth quarter 2016, an increase of 12.2 percent, year over year.CR Note: A year ago, in Q4 2016, there were 3.2 million properties with negative equity - now there are 2.5 million. A significant change.

In the fourth quarter 2017, the total number of mortgaged residential properties with negative equity decreased 1 percent from the third quarter 2017 to 2.5 million homes, or 4.9 percent of all mortgaged properties. Compared to the fourth quarter 2016, negative equity decreased 21percent from 3.2 million homes, or 6.3 percent of all mortgaged properties.

...

Negative equity peaked at 26 percent of mortgaged residential properties in the fourth quarter of 2009, based on the CoreLogic equity data analysis which began in the third quarter of 2009.

emphasis added