by Calculated Risk on 2/21/2018 04:57:00 PM

Wednesday, February 21, 2018

House Prices and Inventory

This will be an interesting year for housing. With the tax changes - and rising mortgage rates - a key question is: What will be the impact on housing?

The answer is no one knows for sure. For the possible impact of tax changes on housing, see: Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

It is difficult to measure demand directly, but inventory is fairly easy to track. Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

This graph below shows existing home months-of-supply (from the NAR) vs. the seasonally adjusted month-to-month price change in the Case-Shiller National Index (both since January 1999).

There is a clear relationship, and this is no surprise (but interesting to graph).

If months-of-supply is high, price decline. If months-of-supply is low, prices rise.

In the existing home sales report released this morning, the NAR reported months-of-supply at 3.4 months in January. Based on the historical relationship, months-of-supply could double before house prices started declining.

My current expectation is inventory will increase this year, and house price growth will slow a little.

FOMC Minutes: "Labor market continued to strengthen and that economic activity expanded at a solid rate"

by Calculated Risk on 2/21/2018 02:08:00 PM

Still on pace for 3 or 4 rate hikes in 2018, although few signs of "broad-based pickup in wage growth". Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, January 30-31, 2018:

In their discussion of the economic situation and the outlook, meeting participants agreed that information received since the FOMC met in December indicated that the labor market continued to strengthen and that economic activity expanded at a solid rate. Gains in employment, household spending, and business fixed investment were solid, and the unemployment rate stayed low. On a 12-month basis, both overall inflation and inflation for items other than food and energy continued to run below 2 percent. Market-based measures of inflation compensation increased in recent months but remained low; survey-based measures of longer-term inflation expectations were little changed, on balance.

Participants generally saw incoming information on economic activity and the labor market as consistent with continued above-trend economic growth and a further strengthening in labor market conditions, with the recent solid gains in household and business spending indicating substantial underlying economic momentum. They pointed to accommodative financial conditions, the recently enacted tax legislation, and an improved global economic outlook as factors likely to support economic growth over coming quarters. Participants expected that with further gradual adjustments in the stance of monetary policy, economic activity would expand at a moderate pace and labor market conditions would remain strong. Near-term risks to the economic outlook appeared roughly balanced. Inflation on a 12-month basis was expected to move up this year and to stabilize around the Committee's 2 percent objective over the medium term. However, participants judged that it was important to continue to monitor inflation developments closely.

During their discussion of labor market conditions, participants expressed a range of views about recent wage developments. While some participants heard more reports of wage pressures from their business contacts over the intermeeting period, participants generally noted few signs of a broad-based pickup in wage growth in available data. With regard to how firms might use part of their tax savings to boost compensation, a few participants suggested that such a boost could be in the form of onetime bonuses or variable pay rather than a permanent increase in wage structures. It was noted that the pace of wage gains might not increase appreciably if productivity growth remains low. That said, a number of participants judged that the continued tightening in labor markets was likely to translate into faster wage increases at some point.

emphasis added

A Few Comments on January Existing Home Sales

by Calculated Risk on 2/21/2018 12:45:00 PM

Earlier: NAR: "Existing-Home Sales Slip 3.2 Percent in January"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in January. The consensus was for sales of 5.65 million SAAR in December. Lawler estimated 5.48 million, and the NAR reported 5.38 million.

"Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.48 million in January, down 1.6% from December’s preliminary estimate and down 3.7% from last January’s seasonally-adjusted pace."2) Inventory is still very low and falling year-over-year (down 9.5% year-over-year in January). More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases. This was the 32nd consecutive month with a year-over-year decline in inventory.

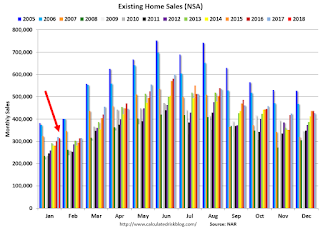

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Click on graph for larger image.

Click on graph for larger image.Sales NSA in January (313,000, red column) were below sales in January 2017 (319,000, NSA).

Sales NSA will also be low seasonally in February.

We will probably have to wait until March - at the earliest - to draw any conclusions about the impact of the new tax law on home sales.

AIA: "Architecture billings continue growth into 2018"

by Calculated Risk on 2/21/2018 10:47:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings continue growth into 2018

2018 started on a strong note for architecture firms, as the Architecture Billings Index (ABI) saw its highest January score since 2007. The American Institute of Architects (AIA) reported the January ABI score was 54.7, up from a score of 52.8 in the previous month. This score reflects an increase in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). The new projects inquiry index was 61.1, down from a reading of 62.0 the previous month, while the new design contracts index increased slightly from 53.4 to 53.9.

“Healthy conditions continue across all sectors and regions except the Northeast, where firm billings softened for the second consecutive month,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “With strong billings and healthy growth in new projects to start the year, firms remain generally optimistic about business conditions for the next several months.”

...

• Regional averages: West (56.2), South (55.3), Midwest (54.8), Northeast (47.3)

• Sector index breakdown: multi-family residential (56.0), commercial / industrial (53.3), institutional (52.5), mixed practice (50.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.7 in January, up from 52.8 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018.

NAR: "Existing-Home Sales Slip 3.2 Percent in January"

by Calculated Risk on 2/21/2018 10:16:00 AM

From the NAR: Existing-Home Sales Slip 3.2 Percent in January

Existing-home sales slumped for the second consecutive month in January and experienced their largest decline on an annual basis in over three years, according to the National Association of Realtors®. All major regions saw monthly and annual sales declines last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, sank 3.2 percent in January to a seasonally adjusted annual rate of 5.38 million from a downwardly revised 5.56 million in December 2017. After last month’s decline, sales are 4.8 percent below a year ago (largest annual decline since August 2014 at 5.5 percent) and at their slowest pace since last September (5.37 million).

...

Total housing inventory at the end of January rose 4.1 percent to 1.52 million existing homes available for sale, but is still 9.5 percent lower than a year ago (1.68 million) and has fallen year-over-year for 32 consecutive months. Unsold inventory is at a 3.4-month supply at the current sales pace (3.6 months a year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (5.38 million SAAR) were 3.2% lower than last month, and were 4.8% below the January 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.52 million in January from 1.46 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.52 million in January from 1.46 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 9.5% year-over-year in January compared to January 2017.

Inventory decreased 9.5% year-over-year in January compared to January 2017. Months of supply was at 3.4 months in January.

As expected by CR readers, sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/21/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 6.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 16, 2018.

... The Refinance Index decreased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 6 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since January 2014, 4.64 percent, from 4.57 percent, with points increasing to 0.61 from 0.59 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, February 20, 2018

Wednesday: Existing Home Sales, FOMC Minutes

by Calculated Risk on 2/20/2018 05:38:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unable to Extend Last Week's Gains

Mortgage rates moved back up today after ending last week on a positive note. Improvements in rates have been uncommon so far in 2018. In fact, we haven't seen more than 2 consecutive days without a move higher. In that sense, today keeps the prevailing trend intact. If there's a saving grace, it's that rates didn't quite rise back above last week's highs. [30YR FIXED - 4.625%]Wednesday:

emphasis added

• At 7:00 AM ET,The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 10:00 AM, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.65 million SAAR, up from 5.57 million in December. Housing economist Tom Lawler expects the NAR to report sales of 5.48 million SAAR for January. Take the under!

• During the day, The AIA's Architecture Billings Index for January (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes, Meeting of January 30-31, 2018

Q1 GDP Forecasts

by Calculated Risk on 2/20/2018 04:03:00 PM

It is early, but here are few Q1 GDP forecast.

From Merrill Lynch:

The weak retail sales data sliced 0.3pp from our 1Q estimate to 2.0%, while 4Q 2017 dropped to 2.5% from 2.7%.And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 3.2 percent on February 16, unchanged from February 14.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q1 stands at 3.1%.CR Note: It looks likely that GDP will be 2% to low 3% range again in Q1.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 2/20/2018 02:12:00 PM

Note: This is mostly a repeat of a June 2017 post with updated statistics and graph, and one new quote.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

Update: And from White House chief economic advisor Gary Cohn on December 20, 2017:

"I think there is a lot more momentum in the stock market. ... "The stock market is reflecting the reality of what's going in the business environment today," said Cohn, director of the National Economic Council. "There is going to be a continuation [of the] rally in the equity markets based on real underlying fundamentals of the U.S. economy ... as well as companies having more earnings power because of lower tax rates."For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Click on graph for larger image.

Click on graph for larger image.Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 20.2% under Mr. Trump - compared to up 37.4% under Mr. Obama for the same number of market days.

Chemical Activity Barometer Increased in February

by Calculated Risk on 2/20/2018 11:17:00 AM

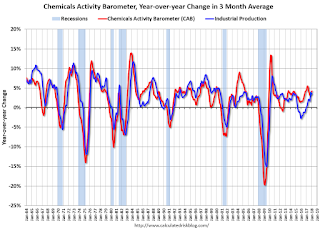

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Industrial Activity Signals Further Gains in U.S. Economy

he Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.5 percent in February on a three-month moving average (3MMA) basis, its fifth such solid gain following the 2017 hurricanes. On an unadjusted basis, growth was just 0.1 percent. The CAB is up 4.2 percent on a 3MMA compared to a year earlier.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

The year-over-year increase in the CAB has been solid over the last year, suggesting further gains in industrial production in 2018.