by Calculated Risk on 8/21/2017 11:55:00 AM

Monday, August 21, 2017

Existing Home Sales: Take the Under on Thursday

The NAR is scheduled to report July Existing Home Sales on Thursday, August 24th at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.57 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.38 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.52 million SAAR in June.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for over 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 145 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | --- |

| 1NAR initially reported before revisions. | |||

Chicago Fed "Index Points to Growth near Historical Trend in July"

by Calculated Risk on 8/21/2017 09:50:00 AM

From the Chicago Fed: Index Points to Growth near Historical Trend in July

The Chicago Fed National Activity Index (CFNAI) moved down to –0.01 in July from +0.16 in June. Three of the four broad categories of indicators that make up the index decreased from June, and three of the four categories made negative contributions to the index in July. The index’s three-month moving average, CFNAI-MA3, moved down to –0.05 in July from +0.09 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in July (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, August 20, 2017

Sunday Night Futures

by Calculated Risk on 8/20/2017 08:59:00 PM

Weekend:

• Schedule for Week of Aug 20, 2017

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 futures are up 2, and DOW futures are up 32 (fair value).

Oil prices were mixed over the last week with WTI futures at $48.48 per barrel and Brent at $52.66 per barrel. A year ago, WTI was at $47, and Brent was at $48 - so oil prices are up slightly year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.32 per gallon - a year ago prices were at $2.16 per gallon - so gasoline prices are up 16 cents per gallon year-over-year.

Update: For Fun, Stock Market as Barometer of Policy Success

by Calculated Risk on 8/20/2017 08:11:00 AM

Note: This is a repeat of a June post with updated statistics and graph.

There are a number of observers who think the stock market is the key barometer of policy success. My view is there are many measures of success - and that the economy needs to work well for a majority of the people - not just stock investors.

However, for example, Treasury Secretary Steven Mnuchin was on CNBC on Feb 22, 2017, and was asked if the stock market rally was a vote of confidence in the new administration, he replied: "Absolutely, this is a mark-to-market business, and you see what the market thinks."

And Larry Kudlow wrote in 2007: A Stock Market Vote of Confidence for Bush: "I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Note: Kudlow's comments were made a few months before the market started selling off in the Great Recession. For more on Kudlow, see: Larry Kudlow is usually wrong

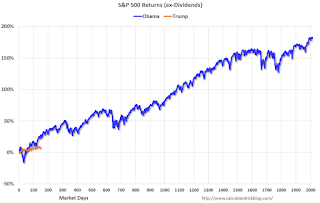

For fun, here is a graph comparing S&P500 returns (ex-dividends) under Presidents Trump and Obama:

Blue is for Mr. Obama, Orange is for Mr. Trump.

At this point, the S&P500 is up 6.8% under Mr. Trump compared to up 22.9% under Mr. Obama for the same number of market days.

Saturday, August 19, 2017

Schedule for Week of Aug 20, 2017

by Calculated Risk on 8/19/2017 08:09:00 AM

The key economic reports this week are New and Existing Home sales for July.

Fed Chair Janet Yellen will speak at the Jackson Hole Economic Symposium on Friday.

8:30 AM ET: Chicago Fed National Activity Index for July. This is a composite index of other data.

9:00 AM ET: FHFA House Price Index for June 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for August.

10:00 AM, Expected: Q2 MBA National Delinquency Survey.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM ET: New Home Sales for July from the Census Bureau.

10:00 AM ET: New Home Sales for July from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the May sales rate.

The consensus is for 610 thousand SAAR, unchanged from 610 thousand in June.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 236 thousand initial claims, up from 232 thousand the previous week.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.52 million in June.

10:00 AM: Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for 5.57 million SAAR, up from 5.52 million in June.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.38 million SAAR for July.

Three days (Thursday, Friday and Saturday): The 2017 Jackson Hole Economic Symposium, "Fostering a Dynamic Global Economy, will take place Aug. 24-26, 2017. (The program will be available at 6 p.m., MT, Aug. 24, 2017)."

11:00 AM: the Kansas City Fed manufacturing survey for August.

8:30 AM: Durable Goods Orders for July from the Census Bureau. The consensus is for a 5.7% decrease in durable goods orders.

10:00 AM, Speech by Fed Chair Janet L. Yellen, Financial Stability, At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming

Friday, August 18, 2017

Oil Rigs "Rigs counts are now off the peak"

by Calculated Risk on 8/18/2017 05:03:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Aug 18, 2017:

• Rigs counts are now off the peak

• Total US oil rigs were down 5 to 763

• Horizontal oil rigs were down 4 at 650

...

• Expect rigs counts to roll off for the next three months or so, with oil prices languishing in the $46-49 range typically.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Sacramento Housing in July: Sales up Slightly YoY, Active Inventory down 18% YoY

by Calculated Risk on 8/18/2017 02:57:00 PM

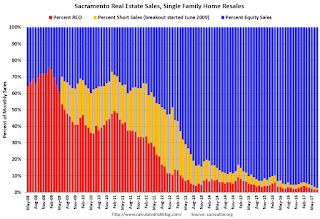

During the recession, I started following the Sacramento market to look for changes in the mix of houses sold (equity, REOs, and short sales). For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In July, total sales were up 0.7% from July 2016, and conventional equity sales were up 5.0% compared to the same month last year.

In July, 2.4% of all resales were distressed sales. This was down from 3.2% last month, and down from 4.9% in July 2016.

The percentage of REOs was at 1.3%, and the percentage of short sales was 1.1%.

Sacramento Realtor Press Release: July sees decrease in sales volume; inventory, price increase

July ended with a 10.4% decrease in sales, down from 1,824 to 1,634. Compared with 2016, current number is .7% higher than the 1,622 sales for that month. Equity sales for the month reached a high point, accounting for 97.2% (1,588) of the sales this month. REO/bank‐owned and Short Sales made up the difference with 22 sales (1.3%) and 18 sales (1.1%) for the month, respectively.Here are the statistics.

...

The decrease in sales for the month and increase in active listings raises the Months of Inventory, which showed a 25% increase from 1.2 Months to 1.5 Months. A year ago the Months of inventory was 1.7. Total Active Listing Inventory increased 13.8% from 2,105 to 2,395. This current figure is down 14.5% from the 2,801 listings of July last year.

The Average DOM (days on market) remained at 18 from June to July.

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes decreased 14.5% year-over-year (YoY) in June. This was the 27th consecutive monthly YoY decrease in inventory in Sacramento.

Cash buyers accounted for 13.8% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory.

Lawler: Early Read on Existing Home Sales in July

by Calculated Risk on 8/18/2017 11:57:00 AM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.38 million in July, down 2.5% from June’s preliminary pace and up 0.9% from last July’s seasonally adjusted pace.

On the inventory front, local realtor/MLS data suggest that the YOY decline in active listings last month was slightly less than in June, and I forecast that the NAR’s existing home inventory estimate for July will be 1.98 million, up 1.0% from June’s preliminary estimate and down 6.2% from last July’s estimate.

Finally, local realtor/MLS data suggest that the NAR’s estimate of the median exiting home sales price last month was up 6.1% from a year earlier.

CR Note: The NAR is scheduled to release existing home sales for July on Thursday, August 24th. The early consensus forecast is for sales of 5.56 million SAAR (take the under!).

BLS: Unemployment Rates Unchanged in 46 states in July, Two States at New Series Lows

by Calculated Risk on 8/18/2017 10:13:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were higher in July in 3 states, lower in 1 state, and stable in 46 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Twenty-seven states had jobless rate decreases from a year earlier and 23 states and the District had little or no change. The national unemployment rate, 4.3 percent, was little changed from June but was 0.6 percentage point lower than in July 2016.

...

North Dakota and Colorado had the lowest unemployment rates in July, 2.2 percent and 2.4 percent, respectively. The rates in North Dakota (2.2 percent) and Tennessee (3.4 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.0 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are well below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement. The yellow squares are the lowest unemployment rate per state since 1976.

Ten states have reached new all time lows since the end of the 2007 recession. These ten states are: Arkansas, California, Colorado, Maine, Mississippi, North Dakota, Oregon, Tennessee, Washington, and Wisconsin.

The states are ranked by the highest current unemployment rate. Alaska, at 7.0%, had the highest state unemployment rate.

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

The second graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).Currently one state has an unemployment rate at or above 7% (light blue); Only two states and D.C. are at or above 6% (dark blue). The states are Alaska (7.0%) and New Mexico (6.3%). D.C. is at 6.4%.

Thursday, August 17, 2017

Mortgage Rates Fall below 4%, Lowest since November 2016

by Calculated Risk on 8/17/2017 07:22:00 PM

From Matthew Graham at Mortgage News Daily: Trump Administration Drama Pushing Rates Even Lower

Mortgage rates fell yesterday in response to a tweet about Trump disbanding his councils of CEOs. Twitter was in play again today. This time around it was Gary Cohn, Trump's economic advisor. Rather, it was rumors of Cohn's departure that sent financial markets into a tail-spin. Terror attacks in Spain may have played a supporting role. The net effect was heavy losses for stocks and solid gains for bonds. When bonds improve, rates fall.

Mortgage lenders continue to be slow to pass along the gains in bond markets in general, but they're certainly passing them along. Multiple lenders issued positive reprices in the afternoon as bond markets rallied. Conventional 30yr fixed rates are increasingly being quoted at 3.875% as opposed to 4.0% on top tier scenarios. On average, rates are the lowest since November 2017--something we've been able to say for the 2nd straight day, and several times over the past few weeks.