by Calculated Risk on 8/17/2017 08:32:00 AM

Thursday, August 17, 2017

Weekly Initial Unemployment Claims decrease to 232,000

The DOL reported:

In the week ending August 12, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 12,000 from the previous week's unrevised level of 244,000. The 4-week moving average was 240,500, a decrease of 500 from the previous week's unrevised average of 241,000The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 240,500.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, August 16, 2017

Thursday: Unemployment Claims, Industrial Production, Philly Fed Mfg

by Calculated Risk on 8/16/2017 07:33:00 PM

Personal Note: Sometimes we must not remain silent. I found Mr. Trump's comments on Saturday disgraceful. His comments on Monday were more appropriate, and better late than never. However Mr. Trump's comments yesterday were despicable. Unfortunately, this isn't a surprise. Here is what I wrote last May: Off-Topic: A Comment on Litmus Test Moments

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, down from 244 thousand the previous week.

• Also at 8:30 AM, Philly Fed manufacturing survey for August. The consensus is for a reading of 17.0, down from 19.5.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 76.7%.

NY Fed: "Household Borrowing Grows Modestly; Credit Card Delinquencies Rise"

by Calculated Risk on 8/16/2017 02:53:00 PM

From the NY Fed: Household Borrowing Grows Modestly; Credit Card Delinquencies Rise

The CMD’s latest Quarterly Report on Household Debt and Credit reveals that total household debt rose by $114 billion (0.9 percent) to $12.84 trillion in the second quarter of 2017. There were modest increases in mortgage, auto, and credit card debt (increasing by 0.7 percent, 2 percent, and 2.6 percent respectively), no change to student loan debt, and a decline in home equity lines of credit (which fell by 0.9 percent). Flows of credit card balances into both early and serious delinquencies climbed for the third straight quarter—a trend not seen since 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances increased in the second quarter of 2017, for the 12th consecutive quarter, and are now $164 billion higher than the previous (2008Q3) peak of $12.68 trillion. As of June 30, 2017, total household indebtedness was $12.84 trillion, a $114 billion (0.9%) increase from the first quarter of 2017. Overall household debt is now 15.1% above the 2013Q2 trough.

Mortgage balances, the largest component of household debt, increased again during the first quarter. Mortgage balances shown on consumer credit reports on June 30 stood at $8.69 trillion, an increase of $64 billion from the first quarter of 2017. Balances on home equity lines of credit (HELOC) were roughly flat, and now stand at $452 billion. Non-housing balances were up in the second quarter. Auto loans grew by $23 billion and credit card balances increased by $20 billion, while student loan balances were roughly flat.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate was mostly unchanged in Q2. From the NY Fed:

Aggregate delinquency rates were flat in the second quarter of 2017. As of June 30, 4.8% of outstanding debt was in some stage of delinquency. Of the $612 billion of debt that is delinquent, $411 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Early delinquency flows deteriorated somewhat in the second quarter from a year ago, although they have improved markedly since the recession. Student loans, auto loans, and mortgages all saw modest increases in their early delinquency flows, while delinquency flows on credit card balances ticked up notably in the second quarter.There is much more in the report.

FOMC Minutes: Balance Sheet Normalization "Relatively soon"

by Calculated Risk on 8/16/2017 02:10:00 PM

From the Fed: Minutes of the Federal Open Market Committee, July 25-26, 2017. Excerpts:

Participants also discussed the appropriate time to implement the plan for reducing the Federal Reserve's securities holdings that was announced in June in the Committee's postmeeting statement and its Addendum to the Policy Normalization Principles and Plans. Participants generally agreed that, in light of their current assessment of economic conditions and the outlook, it was appropriate to signal that implementation of the program likely would begin relatively soon, absent significant adverse developments in the economy or in financial markets. Many noted that the program was expected to contribute only modestly to the reduction in policy accommodation. Several reiterated that, once the program was under way, further adjustments to the stance of monetary policy in response to economic developments would be centered on changes in the target range for the federal funds rate. Although several participants were prepared to announce a starting date for the program at the current meeting, most preferred to defer that decision until an upcoming meeting while accumulating additional information on the economic outlook and developments potentially affecting financial markets.

...

Participants discussed the softness in inflation in recent months. Many participants noted that much of the recent decline in inflation had probably reflected idiosyncratic factors. Nonetheless, PCE price inflation on a 12‑month basis would likely continue to be held down over the second half of the year by the effects of those factors, and the monthly readings might be depressed by possible residual seasonality in measured PCE inflation. Still, most participants indicated that they expected inflation to pick up over the next couple of years from its current low level and to stabilize around the Committee's 2 percent objective over the medium term. Many participants, however, saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside. Participants agreed that a fall in longer-term inflation expectations would be undesirable, but they differed in their assessments of whether inflation expectations were well anchored. One participant pointed to the stability of a number of measures of inflation expectations in recent months, but a few others suggested that continuing low inflation expectations may have been a factor putting downward pressure on inflation or that inflation expectations might need to be bolstered in order to ensure their consistency with the Committee's longer-term inflation objective.

emphasis added

Comments on July Housing Starts

by Calculated Risk on 8/16/2017 10:44:00 AM

Earlier: Housing Starts decreased to 1.155 Million Annual Rate in July

The housing starts report released this morning showed starts were down 4.8% in July compared to June, and were down 5.6% year-over-year compared to July 2016. This was a weak report and was below the consensus forecast.

Note that multi-family starts are volatile month-to-month, and has seen wild swings over the last year.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were down 4.8% in July 2017 compared to July 2016, and starts are up only 2.4% year-to-date.

Note that single family starts are up 8.6% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess is starts will increase around 3% to 7% in 2017.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - but completions have been catching up (more deliveries).

Completions lag starts by about 12 months.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts probably peaked in June 2015 (at 510 thousand SAAR).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few years of increasing single family starts and completions.

Housing Starts decreased to 1.155 Million Annual Rate in July

by Calculated Risk on 8/16/2017 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,155,000. This is 4.8 percent below the revised June estimate of 1,213,000 and is 5.6 percent below the July 2016 rate of 1,223,000. Single-family housing starts in July were at a rate of 856,000; this is 0.5 percent below the revised June figure of 860,000. The July rate for units in buildings with five units or more was 287,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,223,000. This is 4.1 percent below the revised June rate of 1,275,000, but is 4.1 percent above the July 2016 rate of 1,175,000. Single-family authorizations in July were at a rate of 811,000; this is unchanged from the revised June figure of 811,000. Authorizations of units in buildings with five units or more were at a rate of 377,000 in July.

emphasis added

Click on graph for larger image.

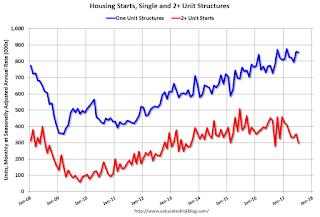

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July compared to June. Multi-family starts are down 35% year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving sideways over the last few years.

Single-family starts (blue) increased in July, and are up 10.9% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in July were below expectations, however starts for May and June combined were revised up slightly. I'll have more later ...

MBA: Mortgage Applications Increase Slightly in Latest Weekly Survey

by Calculated Risk on 8/16/2017 07:00:00 AM

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 11, 2017.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.12 percent, from 4.14 percent, with points remaining unchanged at 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, August 15, 2017

Wednesday: Housing Starts, FOMC Minutes

by Calculated Risk on 8/15/2017 05:48:00 PM

Two notes from Tim Duy at Fed Watch. First a few excerpts from: Retail Sales, Dudley, Wages

[Duy write] 5.) But - and I think this is important - financial conditions continue to easy despite rate hikes:And from Duy: Don't Add To The Fire

[Dudley said] Now the reason why I think you’d want to continue to gradually remove monetary policy accommodation, even with inflation somewhat below target, is that 1) monetary policy is still accommodative, so the level of short-term rates is pretty low, and 2) and this is probably even more important, financial conditions have been easing rather than tightening. So despite the fact that we’ve raised short-term interest rates, financial conditions are easier today than they were a year ago.[Duy] Overall, Dudley continues to adhere to what amounts to the Fed's median forecast, and that means he thinks another rate hike this year is solidly in play.

The stock market’s up, credit spreads have narrowed, the dollar has weakened, and those have more than offset the effects of somewhat higher short-term rates and the very modest increases that we’ve seen in longer-term yields.

I have no qualms with the criticism that the Fed's is excessively focused on inflation or, more accurately, possibly working with a broken model of inflation. That's fair game.Wednesday:

What I find disturbing and quite frankly irresponsible is the use of "deep state" language to describe the Fed. This is the language used by the far right to discredit and undermine faith in our government institutions. For the left to adopt the same language adds to the fire already burning.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for July. The consensus is for 1.225 million SAAR, up from the June rate of 1.215 million.

• At 2:00 PM, FOMC Minutes for the Meeting of 25 - 26, 2017

Earlier for the NY Fed: Manufacturing Activity "grew strongly" in August

by Calculated Risk on 8/15/2017 12:54:00 PM

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity grew strongly in New York State, according to firms responding to the August 2017 Empire State Manufacturing Survey. The headline general business conditions index climbed fifteen points to 25.2, its highest level in nearly three years. The new orders index rose seven points to 20.6 and the shipments index edged up to 12.4, pointing to solid gains in orders and shipments. ...This was well above the consensus forecast of a reading of 10.0.

...

After retreating for the preceding three months, the index for number of employees increased two points to 6.2, pointing to a modest rise in employment levels, and the average workweek index advanced to 10.9, indicating that the average workweek lengthened. ...

Indexes assessing the six-month outlook suggested that firms were quite optimistic about future conditions. The index for future business conditions rose ten points to 45.2, and the index for future new orders moved up eight points to 41.3. Employment was expected to increase modestly, though the average workweek was expected to decline slightly.

emphasis added

NAHB: Builder Confidence increased to 68 in August

by Calculated Risk on 8/15/2017 10:16:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in August, up from 64 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Springs Back with Four-Point August Jump

Builder confidence in the market for newly-built single-family homes rose four points in August to a level of 68 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Our members are encouraged by rising demand in the new-home market,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “This is due to ongoing job and economic growth, attractive mortgage rates, and growing consumer confidence.”

“The fact that builder confidence has returned to the healthy levels we saw this spring is consistent with our forecast for a gradual strengthening in the housing market,” said NAHB Chief Economist Robert Dietz. “GDP growth improved in the second quarter, which helped sustain housing demand. However, builders continue to face supply-side challenges, such as lot and labor shortages and rising building material costs.”

...

All three HMI components posted gains in August. The component gauging current sales conditions rose four points to 74 while the index charting sales expectations in the next six months jumped five points to 78. Meanwhile, the component measuring buyer traffic increased a single point to 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 48. The West, South and Midwest all remained unchanged at 75, 67 and 66, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast - a solid reading.