by Calculated Risk on 8/16/2017 07:00:00 AM

Wednesday, August 16, 2017

MBA: Mortgage Applications Increase Slightly in Latest Weekly Survey

From the MBA: Mortgage Applications Slightly Increase in Latest MBA Weekly Survey

Mortgage applications increased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 11, 2017.

... The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.12 percent, from 4.14 percent, with points remaining unchanged at 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, August 15, 2017

Wednesday: Housing Starts, FOMC Minutes

by Calculated Risk on 8/15/2017 05:48:00 PM

Two notes from Tim Duy at Fed Watch. First a few excerpts from: Retail Sales, Dudley, Wages

[Duy write] 5.) But - and I think this is important - financial conditions continue to easy despite rate hikes:And from Duy: Don't Add To The Fire

[Dudley said] Now the reason why I think you’d want to continue to gradually remove monetary policy accommodation, even with inflation somewhat below target, is that 1) monetary policy is still accommodative, so the level of short-term rates is pretty low, and 2) and this is probably even more important, financial conditions have been easing rather than tightening. So despite the fact that we’ve raised short-term interest rates, financial conditions are easier today than they were a year ago.[Duy] Overall, Dudley continues to adhere to what amounts to the Fed's median forecast, and that means he thinks another rate hike this year is solidly in play.

The stock market’s up, credit spreads have narrowed, the dollar has weakened, and those have more than offset the effects of somewhat higher short-term rates and the very modest increases that we’ve seen in longer-term yields.

I have no qualms with the criticism that the Fed's is excessively focused on inflation or, more accurately, possibly working with a broken model of inflation. That's fair game.Wednesday:

What I find disturbing and quite frankly irresponsible is the use of "deep state" language to describe the Fed. This is the language used by the far right to discredit and undermine faith in our government institutions. For the left to adopt the same language adds to the fire already burning.

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for July. The consensus is for 1.225 million SAAR, up from the June rate of 1.215 million.

• At 2:00 PM, FOMC Minutes for the Meeting of 25 - 26, 2017

Earlier for the NY Fed: Manufacturing Activity "grew strongly" in August

by Calculated Risk on 8/15/2017 12:54:00 PM

Earlier from the NY Fed: Empire State Manufacturing Survey

Business activity grew strongly in New York State, according to firms responding to the August 2017 Empire State Manufacturing Survey. The headline general business conditions index climbed fifteen points to 25.2, its highest level in nearly three years. The new orders index rose seven points to 20.6 and the shipments index edged up to 12.4, pointing to solid gains in orders and shipments. ...This was well above the consensus forecast of a reading of 10.0.

...

After retreating for the preceding three months, the index for number of employees increased two points to 6.2, pointing to a modest rise in employment levels, and the average workweek index advanced to 10.9, indicating that the average workweek lengthened. ...

Indexes assessing the six-month outlook suggested that firms were quite optimistic about future conditions. The index for future business conditions rose ten points to 45.2, and the index for future new orders moved up eight points to 41.3. Employment was expected to increase modestly, though the average workweek was expected to decline slightly.

emphasis added

NAHB: Builder Confidence increased to 68 in August

by Calculated Risk on 8/15/2017 10:16:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in August, up from 64 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Springs Back with Four-Point August Jump

Builder confidence in the market for newly-built single-family homes rose four points in August to a level of 68 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI).

“Our members are encouraged by rising demand in the new-home market,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “This is due to ongoing job and economic growth, attractive mortgage rates, and growing consumer confidence.”

“The fact that builder confidence has returned to the healthy levels we saw this spring is consistent with our forecast for a gradual strengthening in the housing market,” said NAHB Chief Economist Robert Dietz. “GDP growth improved in the second quarter, which helped sustain housing demand. However, builders continue to face supply-side challenges, such as lot and labor shortages and rising building material costs.”

...

All three HMI components posted gains in August. The component gauging current sales conditions rose four points to 74 while the index charting sales expectations in the next six months jumped five points to 78. Meanwhile, the component measuring buyer traffic increased a single point to 49.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose one point to 48. The West, South and Midwest all remained unchanged at 75, 67 and 66, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast - a solid reading.

Retail Sales increased 0.6% in July

by Calculated Risk on 8/15/2017 08:40:00 AM

On a monthly basis, retail sales increased 0.6 percent from June to July (seasonally adjusted), and sales were up 4.2 percent from July 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $478.9 billion, an increase of 0.6 percent from the previous month, and 4.2 percent above July 2016. ... The May 2017 to June 2017 percent change was revised from down 0.2 percent to up 0.3 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.3% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.3% on a YoY basis.The increase in July was above expectations, and sales in May and June were revised up. A solid report.

Note: Amazon Prime day boosted retail sales in July.

Monday, August 14, 2017

Tuesday: Retail Sales, Empire State Mfg, Homebuilder Survey

by Calculated Risk on 8/14/2017 06:47:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Up Slightly From Long-Term Lows

Mortgage rates rose moderately today as weekend news headlines suggested some measure of de-escalation of nuclear tensions between the US and North Korea. To be sure, the news wasn't resoundingly conciliatory, but investors took solace in it nonetheless.Tuesday:

...

In the afternoon, comments from NY Fed President Dudley (one of the 3 most important voices at the Fed) kept pressure on rates, which seemed willing to recover in the late morning hours. Dudley affirmed investors' assumptions about upcoming Fed policy changes. Because these changes are net-negative for bond markets, they put upward pressure on rates. [30YR FIXED - 4.00%]

• At 8:30 AM ET, Retail sales for July will be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 10.0, up from 9.8.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 65, up from 64 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.4% increase in inventories.

LA area Port Traffic increased in July

by Calculated Risk on 8/14/2017 12:55:00 PM

From the Port of Long Beach: Port of Long Beach Sees Busiest Month Ever

Surging cargo volume in July set a record for the best month in the Port of Long Beach’s 106-year history, surpassing the previous high mark set in August 2015 for the number of containers moved across its docks.Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

With total volume of 720,312 twenty-foot-equivalent units (TEUs) in July, cargo traffic has increased for five consecutive months in Long Beach, and in six of the first seven months of 2017. Volume is up 6.4 percent for the calendar year compared to 2016.

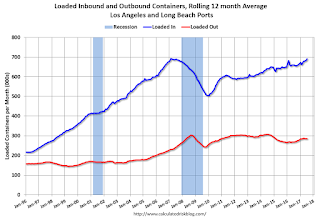

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 1.2% compared to the rolling 12 months ending in June. Outbound traffic was up 0.2% compared to the rolling 12 months ending in June.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. In general imports have been increasing, and exports are moving sideways.

Phoenix Real Estate in July: Sales up 3%, Inventory down 9% YoY

by Calculated Risk on 8/14/2017 09:28:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in July were up 3.0% year-over-year.

2) Active inventory is now down 8.9% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the ninth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (2.5% through May or 6.2% annual rate).

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| Jul-16 | 7,775 | -1.8% | 1,534 | 19.7% | 23,695 | 3.3% |

| Jul-17 | 8,010 | 3.0% | 1,541 | 19.2% | 21,590 | -8.9% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Sunday, August 13, 2017

Sunday Night Futures

by Calculated Risk on 8/13/2017 07:45:00 PM

Weekend:

• Schedule for Week of Aug 13, 2017

• The Housing Bottom and Comparing Housing Recoveries

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 futures are up 7, and DOW futures are up 65 (fair value).

Oil prices were down over the last week with WTI futures at $48.84 per barrel and Brent at $52.09 per barrel. A year ago, WTI was at $46, and Brent was at $47 - so oil prices are up about 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.34 per gallon - a year ago prices were at $2.13 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

The Housing Bottom and Comparing Housing Recoveries

by Calculated Risk on 8/13/2017 08:21:00 AM

In early 2012 I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Here is an update to that graph.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the most recent housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

In 2012, I argued that the current housing recovery would continue to be sluggish relative to previous housing recoveries. I suggested there were several reasons for this. From my 2012 post:

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.That was correct, and the recovery continued to be sluggish.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.For the first several years, the current recovery (red) under performed previous recoveries.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

In 2012 I wrote:

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).The current recovery (red) started slowly, but is still ongoing!