by Calculated Risk on 5/23/2017 08:18:00 PM

Tuesday, May 23, 2017

Wednesday: Existing Home Sales, FOMC Minutes and More

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for March 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.67 million SAAR, down from 5.71 million in March. Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million SAAR for April.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Minutes for the Meeting of May 2 - 3, 2017

Chemical Activity Barometer increases in May

by Calculated Risk on 5/23/2017 05:41:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Chemical Activity Barometer Remains Strong but Hints at Slowing Pace of Economic Growth and Business Activity Into 2018

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), rose 0.4 percent in May, following a downward revision of 0.1 percent for April. Compared to a year earlier, the CAB is up 5.0 percent year-over-year, a modest slowing that still suggests continued growth through year-end 2017. All data is measured on a three-month moving average (3MMA).

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

Richmond Fed: Regional Manufacturing Activity Mostly Unchanged in May

by Calculated Risk on 5/23/2017 02:39:00 PM

Earlier from the Richmond Fed: Manufacturing Firms were Somewhat Less Upbeat about Activity in May Compared to Prior Months

Manufacturers in the Fifth District were somewhat less upbeat in May than in the prior three months, according to the latest survey by the Federal Reserve Bank of Richmond. The index for shipments and the index for new orders decreased notably, with the shipments index falling to slightly below 0. The index for employment was relatively flat, but the decline in the other two indexes resulted in a decline in the composite index from 20 in April to 1 in May. The majority of firms continued to report higher wages, but more firms reported a decline in the average workweek than reported an increase. ...Based on the regional surveys released so far, it appears manufacturing growth slowed in May. The ISM index will probably show slower growth this month.

emphasis added

A few Comments on April New Home Sales

by Calculated Risk on 5/23/2017 12:26:00 PM

New home sales for April were reported at 569,000 on a seasonally adjusted annual rate basis (SAAR). This was well below the consensus forecast, however the three previous months combined were revised up significantly. Overall this was a decent report.

Sales were only up 0.5% year-over-year in April.

Earlier: New Home Sales decrease to 569,000 Annual Rate in April.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 0.5% year-over-year in April.

For the first four months of 2017, new home sales are up 11.3% compared to the same period in 2016.

This was a strong year-over-year increase through April, however sales were weak in Q1 2016, so this was also an easy comparison.

New Home Sales decrease to 569,000 Annual Rate in April

by Calculated Risk on 5/23/2017 10:24:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 569 thousand.

The previous three months combined were revised up significantly.

"Sales of new single-family houses in April 2017 were at a seasonally adjusted annual rate of 569,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 11.4 percent below the revised March rate of 642,000, but is 0.5 percent above the April 2016 estimate of 566,000."

emphasis added

Click on graph for larger image.

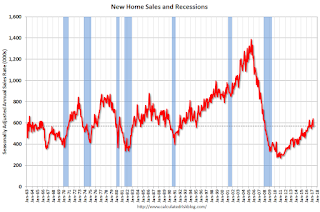

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 5.7 months.

The months of supply increased in April to 5.7 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April was 268,000. This represents a supply of 5.7 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2017 (red column), 54 thousand new homes were sold (NSA). Last year, 55 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was below expectations of 604,000 sales SAAR, however the previous months were revised up. I'll have more later today.

Monday, May 22, 2017

Tuesday: New Home Sales

by Calculated Risk on 5/22/2017 07:09:00 PM

From Matthew Graham at Mortgage News Daily: Low and Sideways, Mortgage Rates Play Waiting Game

Mortgage rates were slightly higher for the 3rd straight day, continuing a modest bounce back from the year's lowest rates last Wednesday. ...Tuesday:

While the general movement in rates has been slightly higher, it hasn't lifted rates much above 2017's lows. Especially when considered next to anything before last Wednesday, recent rate offerings have been low and the trend has been sideways. Most lenders continue to offer conventional 30yr fixed rates of 4.0% on top tier scenarios. The only difference from Friday would be marginally higher upfront costs, but several lenders are effectively "unchanged."

emphasis added

• At 8:30 AM ET, New Home Sales for April from the Census Bureau. The consensus is for a decrease in sales to 604 thousand Seasonally Adjusted Annual Rate (SAAR) in April from 621 thousand in March.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for May.

Merrill: "Revising down our inflation forecasts"

by Calculated Risk on 5/22/2017 11:25:00 AM

A few excerpts from a Merrill Lynch research note: Revising down our inflation forecasts

After two consecutive disappointing CPI reports, it is clear that inflation is now set for a slower finish this year. After refreshing our models, we now see core CPI inflation ending the year at 1.9% 4Q/4Q, down from our prior forecast of 2.3% and slowing from 2.2% 4Q/4Q 2016 growth. The downgrade largely reflects transitory weakness from wireless telephone services that should revert next year, allowing for core CPI to accelerate back to 2.2% by the end of 2018.

We are also revising our core PCE inflation forecasts. Assuming we see a sluggish 0.1% mom reading in April, the trajectory for core PCE will be knocked lower as the % yoy clip drops to 1.5%. As a result, we take down our 4Q/4Q 2017 core PCE estimate to 1.7% yoy from 1.9%. That said, we continue to expect core PCE to hit 2% by the end of 2018, reaching the Fed’s target.

The main takeaway from these forecast changes is that inflation is still set to move higher, but it is happening later.

Chicago Fed "Increased Economic Growth in April"

by Calculated Risk on 5/22/2017 08:55:00 AM

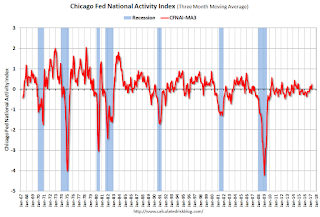

From the Chicago Fed: Chicago Fed National Activity Index Points to Increased Economic Growth in April

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) rose to +0.49 in April from +0.07 in March. Two of the four broad categories of indicators that make up the index increased from March, and only one category made a negative contribution to the index in April. The index’s three-month moving average, CFNAI-MA3, increased to +0.23 in April from a neutral reading in March.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was above the historical trend in April (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, May 21, 2017

Sunday Night Futures

by Calculated Risk on 5/21/2017 08:09:00 PM

Weekend:

• Schedule for Week of May 21, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for April. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures: S&P futures are up 3, and DOW futures are up 19(fair value).

Oil prices were up over the last week with WTI futures at $50.73 per barrel and Brent at $53.61 per barrel. A year ago, WTI was at $48, and Brent was at $49 - so oil prices are up about 5% to 8% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.36 per gallon - a year ago prices were at $2.29 per gallon - so gasoline prices are up about 7 cents a gallon year-over-year.

Existing Home Sales: Take the Under

by Calculated Risk on 5/21/2017 02:15:00 PM

The NAR will report April Existing Home Sales on Wednesday, May 24th at 10:00 AM ET.

The consensus, according to Bloomberg, is that the NAR will report sales of 5.67 million. Housing economist Tom Lawler estimates the NAR will report sales of 5.56 million on a seasonally adjusted annual rate (SAAR) basis, down from 5.71 million SAAR in March.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 7 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last seven years, the consensus average miss was 150 thousand, and Lawler's average miss was 70 thousand.

Many analysts now change their "forecast" after Lawler's estimate is posted, so the consensus has improved a little recently!

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | --- |

| 1NAR initially reported before revisions. | |||