by Calculated Risk on 4/26/2017 07:00:00 AM

Wednesday, April 26, 2017

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Surve

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 21, 2017.

... The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index increased 0.1 percent compared with the previous week and was 0.4 percent higher than the same week one year ago.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to its lowest level since November 2016, 4.20 percent, from 4.22 percent, with points increasing to 0.37 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity increased last week as rates declined, but remains low - and will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up slightly year-over-year.

Tuesday, April 25, 2017

Zillow Forecast: "The national Case-Shiller index is projected to climb 5.9 percent year-over-year in March"

by Calculated Risk on 4/25/2017 08:39:00 PM

The Case-Shiller house price indexes for February were released this morning. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Svenja Gudell at Zillow: March Case-Shiller Forecast: The Home Price Party Rages On

Home prices are expected to continue to climb in March, but the pace of month-over-month growth is expected to slow, according to Zillow’s March Case-Shiller forecast.The year-over-year change for the Case-Shiller national index will probably increase in March.

The national Case-Shiller index is projected to climb 5.9 percent year-over-year in March, following a 5.8 percent gain in February. Month-to-month, the national index is expected to be up a seasonally adjusted 0.3 percent in March, following a 0.4 percent monthly gain in February.

Annual growth in the smaller 10- and 20-city indices is also expected to slow slightly: The 10-city forecast is for a 5.1 percent gain in annual growth for March, following 5.2 percent annual growth in February. And the 20-city index is projected to gain 5.7 percent in March, below its 5.9 percent annual gain in February.

The 10-city index is forecast to climb a seasonally adjusted 0.7 percent in March from February, following 0.6 percent monthly growth between January and February. Growth in the 20-city index is expected to hold steady on a seasonally adjusted, month-over-month basis, rising 0.7 percent in March as it did in February.

Zillow’s March Case-Shiller forecast is shown below. These forecasts are based on today’s February Case-Shiller data release and the March 2017 Zillow Home Value Index. The March S&P CoreLogic Case-Shiller Indices will not be officially released until Tuesday, May 30.

Real House Prices and Price-to-Rent Ratio in February

by Calculated Risk on 4/25/2017 05:09:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.8% year-over-year in February

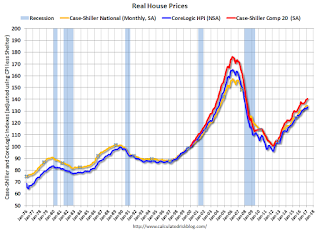

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.1% above the previous bubble peak. However, in real terms, the National index (SA) is still about 14.4% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In February, the index was up 5.8% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $280,000 today adjusted for inflation (40%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels, and the CoreLogic index (NSA) is back to September 2005.

Real House Prices

In real terms, the National index is back to April 2004 levels, the Composite 20 index is back to December 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, the Composite 20 index is back to August 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 / early 2004 - and the price-to-rent ratio maybe moving a little more sideways now.

Chemical Activity Barometer increases in April

by Calculated Risk on 4/25/2017 02:41:00 PM

Note: This appears to be a leading indicator for industrial production.

From the American Chemistry Council: Economic Indicator Marks Strong Opening to Second Quarter; Up More Than Five Percent Over Last Year

The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), marked the second quarter by posting a robust 5.6 percent year-over-year gain, suggesting continued growth through year-end 2017.

The barometer posted a 0.4 percent gain in April, following three successive months of upward revisions to the monthly data. All data is measured on a three-month moving average (3MMA). On an unadjusted basis the CAB climbed 0.2 percent in April.

...

Applying the CAB back to 1912, it has been shown to provide a lead of two to fourteen months, with an average lead of eight months at cycle peaks as determined by the National Bureau of Economic Research. The median lead was also eight months. At business cycle troughs, the CAB leads by one to seven months, with an average lead of four months. The median lead was three months. The CAB is rebased to the average lead (in months) of an average 100 in the base year (the year 2012 was used) of a reference time series. The latter is the Federal Reserve’s Industrial Production Index.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change in the 3-month moving average for the Chemical Activity Barometer compared to Industrial Production. It does appear that CAB (red) generally leads Industrial Production (blue).

CAB has increased solidly over the last several months, and this suggests an increase in Industrial Production in 2017.

A few Comments on March New Home Sales

by Calculated Risk on 4/25/2017 11:59:00 AM

New home sales for March were reported at 621,000 on a seasonally adjusted annual rate basis (SAAR). This was well above the consensus forecast, and the three previous months combined were revised up significantly. This was a strong report.

Sales were up 15.6% year-over-year in March. However, January, February and March were the weakest months last year on a seasonally adjusted annual rate basis - so this was an easy comparison.

So far the increase in mortgage rates has not negatively impacted new home sales.

Earlier: New Home Sales increase to 621,000 Annual Rate in March.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were up 15.6% year-over-year in March.

For the first three months of 2017, new home sales are up 12.0% compared to the same period in 2016.

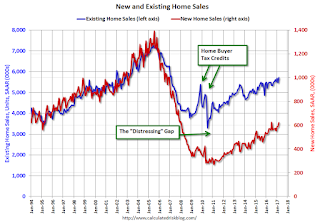

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales increase to 621,000 Annual Rate in March

by Calculated Risk on 4/25/2017 10:16:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 621 thousand.

The previous three months combined were revised up significantly.

"Sales of new single-family houses in March 2017 were at a seasonally adjusted annual rate of 621,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.8 percent above the revised February rate of 587,000 and is 15.6 percent above the March 2016 estimate of 537,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still fairly low historically.

The second graph shows New Home Months of Supply.

The months of supply declined in March to 5.2 months.

The months of supply declined in March to 5.2 months. The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of March was 268,000. This represents a supply of 5.2 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In March 2017 (red column), 58 thousand new homes were sold (NSA). Last year, 50 thousand homes were sold in March.

The all time high for March was 127 thousand in 2005, and the all time low for March was 28 thousand in 2011.

This was above expectations of 584,000 sales SAAR. I'll have more later today.

Case-Shiller: National House Price Index increased 5.8% year-over-year in February

by Calculated Risk on 4/25/2017 09:17:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3 month average of December, January and February prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: S&P Corelogic Case-Shiller National Home Price NSA Index Sets Fourth Consecutive All-Time High

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.8% annual gain in February, up from 5.6% last month and setting a 32-month high. The 10-City Composite posted a 5.2% annual increase, up from 5.0% the previous month. The 20-City Composite reported a year-over-year gain of 5.9%, up from 5.7% in January.

Seattle, Portland, and Dallas reported the highest year-over-year gains among the 20 cities. In February, Seattle led the way with a 12.2% year-over-year price increase, followed by Portland with 9.7%. Dallas replaced Denver in the top three with an 8.8% increase. Fifteen cities reported greater price increases in the year ending February 2017 versus the year ending January 2017

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.2% in February. The 10-City Composite posted a 0.3% increase, and the 20-City Composite reported a 0.4% increase in February. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase. The 10-City Composite posted a 0.6% increase and the 20-City Composite reported a 0.7% month-over-month increase. Sixteen of 20 cities reported increases in February before seasonal adjustment; after seasonal adjustment, 19 cities saw prices rise

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 7.2% from the peak, and up 0.6% in February (SA).

The Composite 20 index is off 4.8% from the peak, and up 0.7% (SA) in February.

The National index is 2.1% above the bubble peak (SA), and up 0.4% (SA) in February. The National index is up 38.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.1% compared to February 2016. The Composite 20 SA is up 5.8% year-over-year.

The National index SA is up 5.7% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, April 24, 2017

Tuesday: New Home Sales, Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 4/24/2017 08:03:00 PM

From Bloomberg: Trump Said to Plan 20% Tariff on Canadian Softwood Lumber

U.S. President Donald Trump said Monday he would impose a 20 percent tariff on Canadian softwood lumber, according to a White House official and two people present when he made the comment at a reception for conservative journalists.This would negatively impact homebuilders.

Tuesday:

• At 9:00 AM ET, FHFA House Price Index for February 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

• Also at 9:00 AM, S&P/Case-Shiller House Price Index for February. Although this is the February report, it is really a 3 month average of December, January and February prices. The consensus is for a 5.8% year-over-year increase in the Comp 20 index for February.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for a decrease in sales to 584 thousand Seasonally Adjusted Annual Rate (SAAR) in March from 592 thousand in February.

• Also at 10:00 AM, Richmond Fed Survey of Manufacturing Activity for April.

U.S. Demographics: Largest 5-year cohorts, and Ten most Common Ages in 2016

by Calculated Risk on 4/24/2017 02:28:00 PM

Three year ago, I wrote: Census Bureau: Largest 5-year Population Cohort is now the "20 to 24" Age Group.

Last year I followed up with Largest 5-year Population Cohorts are now "20 to 24" and "25 to 29" and

U.S. Demographics: Ten most common ages in 2010, 2015, 2020, and 2030.

Note: For the impact on housing, also see: Demographics: Renting vs. Owning

Last week the Census Bureau released the population estimates for 2016, and I've updated the table from the previous post (replacing 2015 with 2016 data).

The table below shows the top 11 cohorts by size for 2010, 2016 (released this month), and Census Bureau projections for 2020 and 2030.

By the year 2020, 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

There will be plenty of "gray hairs" walking around in 2020 and 2030, but the key for the economy is the population in the prime working age group is now increasing.

This is very positive for housing and the economy.

| Population: Largest 5-Year Cohorts by Year | ||||

|---|---|---|---|---|

| Largest Cohorts | 2010 | 2016 | 2020 | 2030 |

| 1 | 45 to 49 years | 25 to 29 years | 25 to 29 years | 35 to 39 years |

| 2 | 50 to 54 years | 20 to 24 years | 30 to 34 years | 40 to 44 years |

| 3 | 15 to 19 years | 55 to 59 years | 35 to 39 years | 30 to 34 years |

| 4 | 20 to 24 years | 50 to 54 years | Under 5 years | 25 to 29 years |

| 5 | 25 to 29 years | 30 to 34 years | 55 to 59 years | 5 to 9 years |

| 6 | 40 to 44 years | 15 to 19 years | 20 to 24 years | 10 to 14 years |

| 7 | 10 to 14 years | 45 to 49 years | 5 to 9 years | Under 5 years |

| 8 | 5 to 9 years | 35 to 39 years | 60 to 64 years | 15 to 19 years |

| 9 | Under 5 years | 10 to 14 years | 15 to 19 years | 20 to 24 years |

| 10 | 35 to 39 years | 5 to 9 years | 10 to 14 years | 45 to 49 years |

| 11 | 30 to 34 years | Under 5 years | 50 to 54 years | 50 to 54 years |

Click on graph for larger image.

This graph, based on the 2016 population estimate, shows the U.S. population by age in July 2016 according to the Census Bureau.

Note that the largest age groups are all in their mid-20s.

And below is a table showing the ten most common ages in 2010, 2016, 2020, and 2030 (projections are from the Census Bureau).

Note the younger baby boom generation dominated in 2010. By 2016 the millennials are taking over. And by 2020, the boomers are off the list.

My view is this is positive for both housing and the economy, especially in the 2020s.

| Population: Most Common Ages by Year | ||||

|---|---|---|---|---|

| 2010 | 2016 | 2020 | 2030 | |

| 1 | 50 | 25 | 29 | 39 |

| 2 | 49 | 26 | 30 | 40 |

| 3 | 20 | 24 | 28 | 38 |

| 4 | 19 | 27 | 27 | 37 |

| 5 | 47 | 23 | 31 | 36 |

| 6 | 46 | 56 | 26 | 35 |

| 7 | 48 | 55 | 32 | 41 |

| 8 | 51 | 22 | 25 | 30 |

| 9 | 18 | 52 | 35 | 34 |

| 10 | 52 | 28 | 34 | 33 |

Merrill: "Fed to take a breather"

by Calculated Risk on 4/24/2017 12:54:00 PM

The consensus view is that the Fed will hike two more times this year (probably in June and September), and then announce a changed to the balance sheet policy at the December FOMC meeting (slow down reinvestment). Merrill Lynch economists think that the Fed will move slower.

A few excerpts from a Merrill Lynch note today: Fed to take a breather

Two more hikes ... then balance sheet

Fed officials have been preparing the market for a change to the balance sheet policy. This is consistent with the Fed’s larger communication strategy – slowly hint at policy changes and test the market reaction. ... In our view, the Fed is still prioritizing interest rate normalization over the balance sheet. Moreover, we think that the Fed would like to bring rates to at least a range of 1.25 – 1.50% (two more hikes) before shrinking the balance sheet. We believe it is a tall order for the Fed to deliver two more hikes and change the balance sheet policy before yearend, leaving us to argue that balance sheet reduction is a story for early 2018.

June is a close call

Our expectation has been for the Fed to skip the June meeting and hike in September and December ... our central scenario is as follows. June: the data are not quite strong enough to pull the trigger and the Fed hints at a later date for changing the balance sheet policy. September: the Fed hikes and offers more details on the reinvestment policy. December: another hike and a formal plan for the balance sheet is released. March: they announce the change to balance sheet policy in the statement, effective April [2018]